Every person who receives a paycheck is paying a Medicare tax. If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What kind of Medicare do you get in New York?

About Medicare in New York Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B, to plans offered by Medicare-approved insurance companies such as Medicare Advantage, Medicare Part D (prescription coverage), and Medicare Supplement insurance plans.

Is Medicare Part A and Part B available in New York?

Not every plan offered by health insurance companies in New York will be available in each county. Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are available in any state in the U.S.

What does Medicare mean on my paycheck?

What Does Medicare Mean on my Paycheck? When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

How do Medicare savings programs work in New York?

Medicare Savings Programs in New York: Programs in New York can assist beneficiaries in paying for things like their monthly premiums. Usually in order to qualify, your income and assets must be lower than a government-set limit.

How much is Medicare tax in NY?

1.45%The Medicare portion of FICA is 1.45% for wages up to 200,000 and 2.35% for wages above $200,000.

Is Medicare taken out of every paycheck?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What payroll taxes are taken out of Medicare and Social Security?

If you have more than one employer and you earn more than that amount, you'll receive an adjustment of any overpaid Social Security taxes on your return. The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%.

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How is Medicare tax withheld calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Why is Medicare taken out of paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

How much tax is deducted from a paycheck in NY weekly?

Overview of New York TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

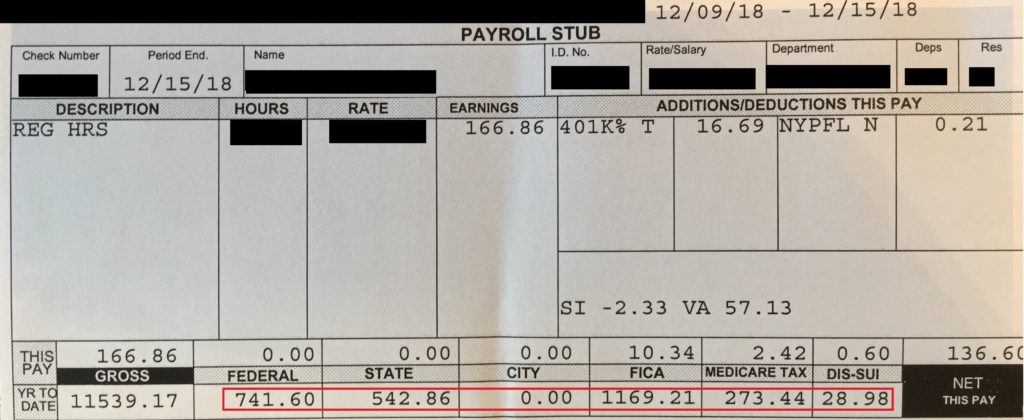

How do I calculate Medicare wages from my paystub?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What percent of taxes are taken out of paycheck?

Overview of California TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

What percentage of tax is withheld from my paycheck?

FICA Taxes - Who Pays What? Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

About Medicare in New York

Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B, to plans...

Types of Medicare Coverage in New York

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are...

Local Resources For Medicare in New York

Medicare Savings Programs in New York: Programs in New York can assist beneficiaries in paying for things like their monthly premiums. Usually in o...

How to Apply For Medicare in New York

To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re genera...

What Does Medicare Mean On My Paycheck

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

If An Employee Is Exempt From Paying Social Security And Medicare Taxes Are They Responsible For Telling Their Employer

Your employer should determine if you need to pay FICA taxes. But if you already know that youre exempt, then it may be a good idea to bring it up with your employer. That way, they can get the appropriate paperwork to prove exemption status.

The Additional Medicare Tax

The Additional Hospital Insurance Tax, more commonly referred to as the Additional Medicare Tax, is provided for by the Affordable Care Act . It became effective on November 29, 2013.

What Do You Pay For Medicare Drug Coverage

Youll want to consider additional coverage for medications if you dont already have coverage of equal value. You do this to avoid the Part D late enrollment penalty. You can buy a Medicare Part D plan while keeping Parts A and B or a Medicare Advantage plan instead.

Social Security And Medicare Tax 2019

Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare.

Do Medigap Costs Come Out Of My Social Security Check

Medigap premiums are paid directly to the private insurance carrier that provides the plan. In other words, you cannot deduct your Medigap premiums from your Social Security check.

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

What is the income tax rate in New York?

New York’s income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350. Taxpayers in New York City have ...

How much is Yonkers tax?

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

What is the FICA tax rate?

FICA taxes are Social Security and Medicare taxes, and they are withheld at rates of 6.2% and 1.45% of your salary, respectively.

Does NYC have a progressive tax system?

If you live in New York City, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. That’s because NYC imposes an additional local income tax. New York State’s progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level ...

How long do you have to be a resident of New York to qualify for Medicare?

How to apply for Medicare in New York. To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re generally eligible when you are 65 or older, but you may qualify under 65 through disability or having certain conditions. You’ll be enrolled automatically as soon as ...

How many Medicare Supplement plans are there?

Medicare Supplement, also called Medigap, features up to 10 plans, each with a letter designation (A, B, C, D, F, G, K, L, M, N). Plan benefits within each letter category do not change, no matter where the plan is purchased;

What is Medicare Part A and Part B?

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are available in any state in the U.S. Medicare Advantage, Part C, refers to plans offered by private health insurance companies with Medicare’s approval.

Does New York have Medicare?

About Medicare in New York. Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B , to plans offered by Medicare-ap proved insurance companies such as Medicare Advantage, Medicare Part D (prescription coverage), and Medicare Supplement insurance plans.

Does Medicare Part B cover vision?

These plans must cover at least what Original Medicare , Part A and Part B does, but can also include additional benefits, like vision, dental, and prescription drug coverage. You continue paying your monthly Medicare Part B premium when you’re enrolled in a Medicare Advantage plan along with any premium charged by the Medicare Advantage plan chosen.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How to coordinate Medicare with NYShip?

To coordinate Medicare with your NYSHIP benefits, you should make sure that you: Contact the Social Security Administration (SSA) to enroll in Medicare three months before your birthday month. Visit https://www.ssa.gov/onlineservices or call 1-800-772-1213. Enroll in Medicare Parts A and B (be sure not to decline Part B).

When did Medicare start mailing new cards?

New Medicare ID numbers and cards. New Medicare cards began mailing to all Medicare enrollees in April 2018. Your new card will have a unique ID that does not use your Social Security number. This will help protect your identity. For more information on the new cards, please visit http://go.medicare.gov/newcard.

How to get reimbursed for IRMAA?

To be reimbursed for IRMAA, you must complete the IRMAA Reimbursement Request application and submit it to the Employee Benefits Division along with proofs of payment of your Medicare Part B premium. Please refer to the IRMAA Reimbursement Application instructions for more information.

What is Medicare for disabled?

Medicare is a health insurance program administered by the federal government to individuals over age 65 or who are eligible due to disability. The section below includes a video, FAQs, publications, contact information and links to important resources about Medicare.

Does NYSHIP pay for Medicare Part B?

Medicare Part B Premium Reimbursement. When Medicare is primary to NYSHIP coverage, NYSHIP reimburses you for the standard Medicare Part B premium you pay to SSA, excluding any penalty you may pay for late enrollment. Q.

Is Medicare reimbursement automatic?

Reimbursement is not automatic for any enrollee or covered dependent who is under age 65 and is eligible for Medicare due to disability, ESRD, or ALS. You must notify the Employee Benefits Division in writing and provide a photocopy of your (or your dependent's) Medicare card to begin the reimbursement in these cases.

Who collects sales tax?

Sales taxes are taken while the sale is in process. It is collected by the retailer and then passed on to the government itself. Depending on the law and whereabouts of the business, the business in question will need to pay taxes to the given law authorities if it has a nexus there.

What is federal income tax?

Federal income tax is deducted by the Internal Revenue Service ( IRS) annual ly, and it’s one of the government’s largest sources of income. The IRS tax individuals, corporations, trusts, and other legal entities. It consists of the taxpayer’s employment earnings or capital gains. Federal income tax is used for a variety of expenses.

What is gross income?

Gross income is the total amount of money you earn, weekly, monthly, or yearly. The gross income for an individual consists of pensions, interest, dividends, and rental income. When it comes to individual gross income, it is part of an income tax return. After certain deductions and exemptions, it becomes adjusted gross income ...

Do you have to pay taxes if you are outside of New York?

However, if an employer is outside of New York State, who doesn’t have an office or transact business from within New York State, then they are not required to deduct any taxes from employees who reside in New York State. In the case of the out-of-state employer agreeing to deduct the employee’s income taxes, the employer is subject to New York State withholding requirements.

Does an out-of-state employer have to withhold taxes?

In the case of the out-of-state employer agreeing to deduct the employee ’s income taxes, the employer is subject to New York State withholding requirements. Every employer is required to withhold taxes for: New York State residents earning wages, even when earned and performed outside of their residential area.

Is the minimum wage in New York increasing?

Unlike the rest of the countries’ federal minimum wage, New York State introduced a statewide $15 per hour minimum wage plan. The state had plans to increase the minimum wage ever since 2016, making it so that the minimum wage would be increasing every year until it is $15 per hour statewide. The Commissioner of Labor will publish ...

Is gross income taxable?

After certain deductions and exemptions, it becomes adjusted gross income and then taxable income. When it comes to businesses, the gross income, or the gross profit, includes the company’s gross revenue but does not include all other additional business costs.

How do I apply for medicare?

You may apply for Medicare by calling the Social Security Administration at 1-800-772-1213 or by applying on-line at: https://www.ssa.gov/medicare/. You may be required to submit proof that you have applied for Medicare. Proof can be: Your award or denial letter from the Social Security Administration, OR.

What languages are eligible for Medicare?

You Must Apply for Medicare. This document is also available in the following languages: Spanish, Russian, Italian, Korean, Chinese, Haitian Creole. If you are turning 65 within the next 3 months or you are 65 years of age or older, you may be entitled to additional medical benefits through the Medicare program.

Can medicaid pay for premiums?

If so, then the Medicaid program can pay or reimburse your Medicare premiums. If the Medicaid program can pay your premiums, you will be required to apply for Medicare as a condition of Medicaid eligibility. You may apply for Medicare by calling the Social Security Administration at 1-800-772-1213 or by applying on-line at: ...

Is Medicare a federal program?

Medicare is a federal health insurance program for people over 65 and for certain people with disabilities regardless of income. When a person has both Medicare and Medicaid, Medicare pays first and Medicaid pays second. You are required to apply for Medicare if:

Who administers Medicare Part D?

The New York State Department of Civil Service shall administer the Medicare Part D Drug Subsidy on behalf of each Participating Agency in the New York State Health Insurance Program (NYSHIP). The Department shall provide to each employer its RDS based upon the actual utilization of each employer’s qualified enrollees using the enrollment information provided by the employer. In order to effect this distribution, the Department and the employer must have executed the Medicare Part D Drug Subsidy Agreement Form.

What is Medicare for ALS?

Medicare is a federal health insurance program for people age 65 or older, certain disabled people, and for people with end stage renal disease (kidney failure) or ALS (amyotrophic lateral sclerosis). It is administered by the U.S. Department of Health and Human Services through the Centers for Medicare and Medicaid Services (CMS). Local Social Security Administration offices provide information about the program and take applications for Medicare coverage. Various health insurance companies provide Medicare insurance. These companies contract with CMS to pay Medicare claims.

Does Medicare require a duplicate?

If a Participating Agency has documentation that an employee or dependent who is eligible for Medicare coverage is receiving Medicare reimbursement from another source (e.g., a public agency or private employer), the Participating Agency is not required to provide a duplicate Medicare reimbursement.

Can you get Medicare if you are 65?

If a NYSHIP enrollee or dependent under age 65 is eligible for Medicare primary coverage due to disability, this status must be entered into NYBEAS or for agencies without access, contact the Employee Benefits Division. NYBEAS will automatically update Medicare status for non-active employees and their dependents who turn age 65.

Does Medicare pay for inpatient care?

NYSHIP requires enrollees and their dependents to have Medicare Part A in effect as soon as they become eligible. There is usually no cost for Part A.

Does Empire Plan offer no drugs?

Participating Agency may elect to offer a no-drug Empire Plan option to enrollees who have been approved for the LIS at a reduced premium. If the Participating Agency elects to offer this option, it will be the agency’s responsibility to obtain a copy of the LIS approval from their enrollees and a letter from the enrollee requesting the no -drug Empire Plan option. The Participating Agency must provide this documentation to the Employee Benefits Division which will verify eligibility for the lower cost, no-drug Empire Plan option.

What is the most widely used program in New York?

The most broadly used program in New York that helps caregivers receive payment for caring for a loved one is CDPAP. First, we will discuss how this program works, followed by its eligibility requirements. CDPAP is a Medicaid program that stands for Consumer-Directed Personal Assistance Program. Consumer-directed means that the beneficiary of the program can direct or chose from whom they receive personal care assistance. As such, family members including the adult children or friends can be hired to provide personal care. Spouses, however, are prohibited from being hired.

Does New York have paid family leave?

New York is one of just five states, plus the District of Columbi a, to have created a Paid Family Leave Benefits Law (PFLBL). In short, this law allows relatives to take time off from their job to care for a family member. They continue to receive a percentage of their salary while doing so.