How much does Medicare Part D cost?

52 rows · Nov 18, 2021 · As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. ...

Can you use GoodRx if you have Medicare Part D?

Feb 09, 2022 · The Medicare part D premium 2022 depends on the plan you choose. As of now, the monthly premium costs range from $7 to $99. But remember that you may need to pay extra if you fall under the higher-income category. This income-related monthly adjustment amount (Part D IRMAA) goes to Medicare.

How much does a part D cost?

Part B deductible—$233 per year. Medicare Advantage Plans (Part C) & Medicare Drug Plans (Part D) Premiums. Visit Medicare.gov/plan-compare to get plan premiums. You can also call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. You can also call the plan or your State Health Insurance Assistance Program (SHIP).

Why do you need Part D?

Jul 06, 2021 · Medicare Part D premiums vary depending on the choice of plan. People can go to Medicare.gov and search for a Medicare plan to find out more about estimated costs. However, a base premium applies to Medicare Part D, as well as to Medicare Advantage. For 2020, this premium is $32.74. For 2019, the Medicare Part D premium was $33.19.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost for Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

Do Medicare Part D premiums increase with age?

Everyone pays the same amount for their monthly premium. With an Issue-Age Rated plan, your premium is based on your age when you purchase, or are issued, the policy. Generally, premiums cost less when you are younger. Premiums for these types of policies do not increase with age.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Does Medicare Part D have copays?

No type of Medicare drug coverage may have a deductible more than $445 in 2021. Some plans don't charge a deductible. You pay copayments or coinsurance for your prescription drugs after you pay the deductible. You pay your share, and your plan pays its share for covered drugs.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Introduction

If you are retiring soon, the rising cost of prescription drugs may be one of your major concerns. However, there is good news. If you opt to enroll in a Medicare Part D plan, you don’t have to pay the entire cost of your prescription drugs. A private insurer will shoulder a portion of your drug expenses.

What is a Medicare Part D plan?

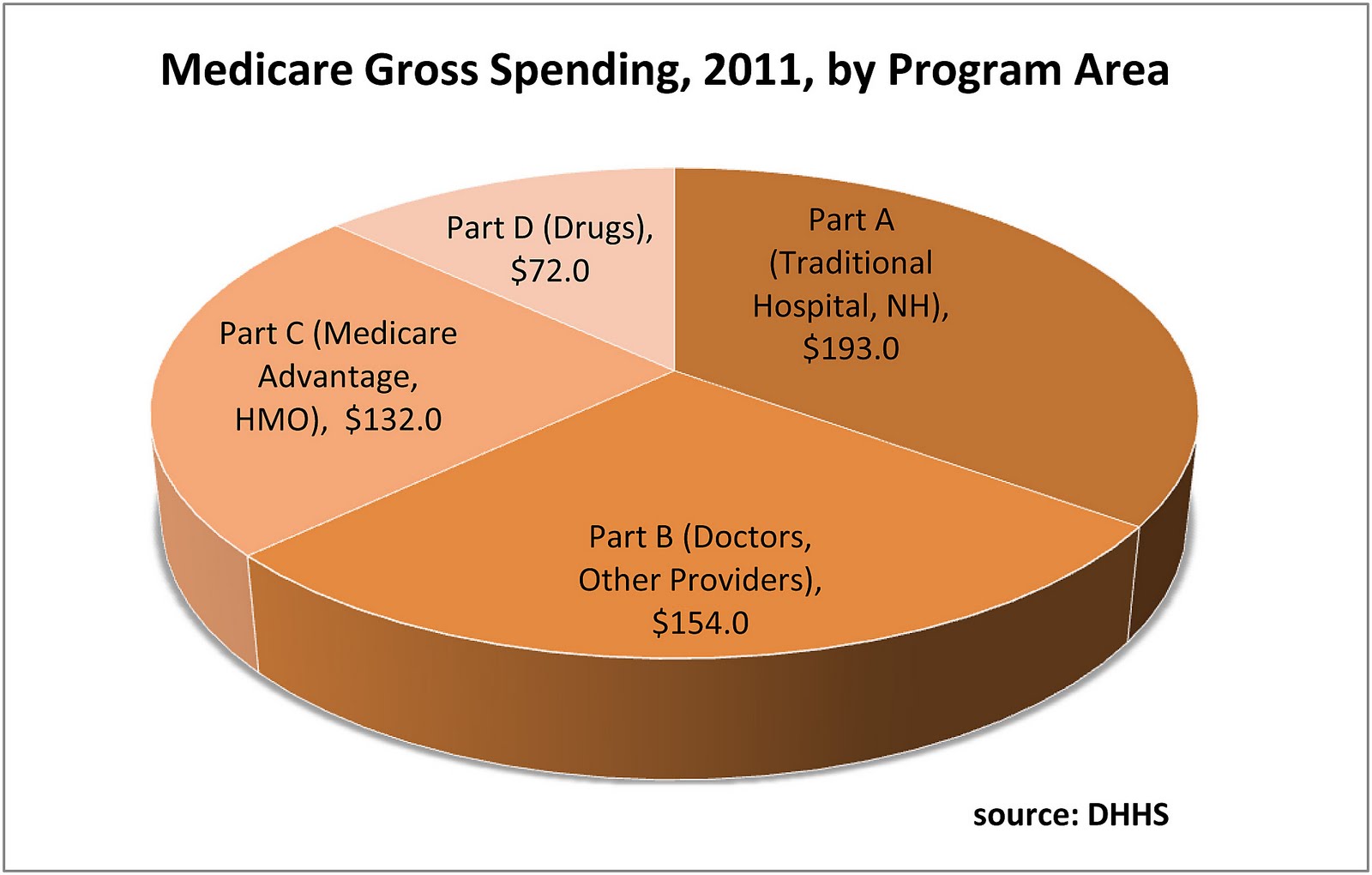

Most people over the age of 65 have Medicare Part A (hospital insurance) and Part B (medical insurance). However, neither parts cover prescription drugs.

What do Medicare Part D plans cost?

The cost of Medicare Part D depends on factors like your income, enrollment date, the type of prescription drugs (brand-name or generic), and the pharmacy (in-network or preferred). These variables are used in computing your monthly premiums.

How do you buy a Medicare Part D plan?

Since you are now aware of Medicare Part D costs, you are ready to look for a Part D plan that is right for you.

What are some guidelines in finding the right Medicare Part D plan?

Here are some helpful tips in finding a suitable Medicare Part D plan:

Final Words on Medicare Part D Costs

When you decide to get a Medicare Part D plan, it is advisable to balance your future medical needs with the Medicare Part D cost. If you are not satisfied with your current plan, remember that you can shift to another Part D plan on the next available enrollment period.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

When is open enrollment for insulin?

Find a plan that offers this savings on insulin in your state. You can join during Open Enrollment (October 15 – December 7, 2020). Note. If your drug costs are higher than what you paid last year, talk to your doctor.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

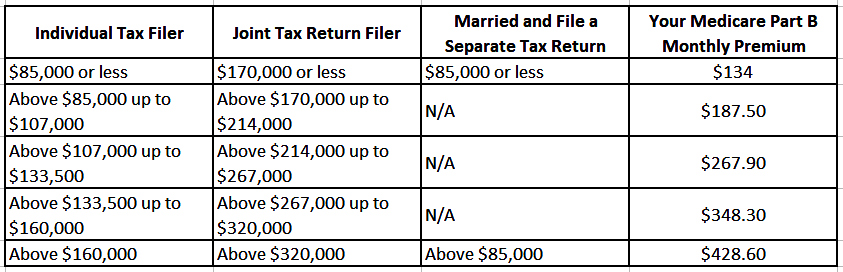

What is the IRMAA for 2020?

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan; this is called the Part D income-related monthly adjust amount (IRMAA). For 2020, this amount is based on the recipient’s tax filing status for 2018.

What is the penalty for not having insurance for 10 months?

If you are without coverage for a full 10 months, you would multiply 10 by $0.3274, which would make your penalty payment $3.27.

:max_bytes(150000):strip_icc()/medicare-part-d-costs-4589863_FINAL-a334073127ad461fbd5457a7d74d1e6c.png)