Medicare Supplement Plan F Coverage is Comprehensive

- Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible.

- It covers all of the 20% that Medicare Part B normally leaves for you to pay.

- Medicare Plan F covers all Part B excess charges. ...

- Choose any doctor – from over 900,000 physicians in the United States.

- No referrals required! ...

- Guaranteed renewable. ...

What is covered by Medicare Part F?

... Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don’t.

What services are covered by Medicare Part?

- Medically necessary part-time or intermittent skilled nursing care

- Physical therapy, speech therapy, and a continuing need for occupational therapy

- Medical social services

- Part-time or intermittent home health aide services

What is covered under each part of Medicare?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers. Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care.

Does plan F cover Medicare deductible?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover. This means zero out-of-pocket for you at the doctor’s office.

Does Medicare Part F cover prescriptions?

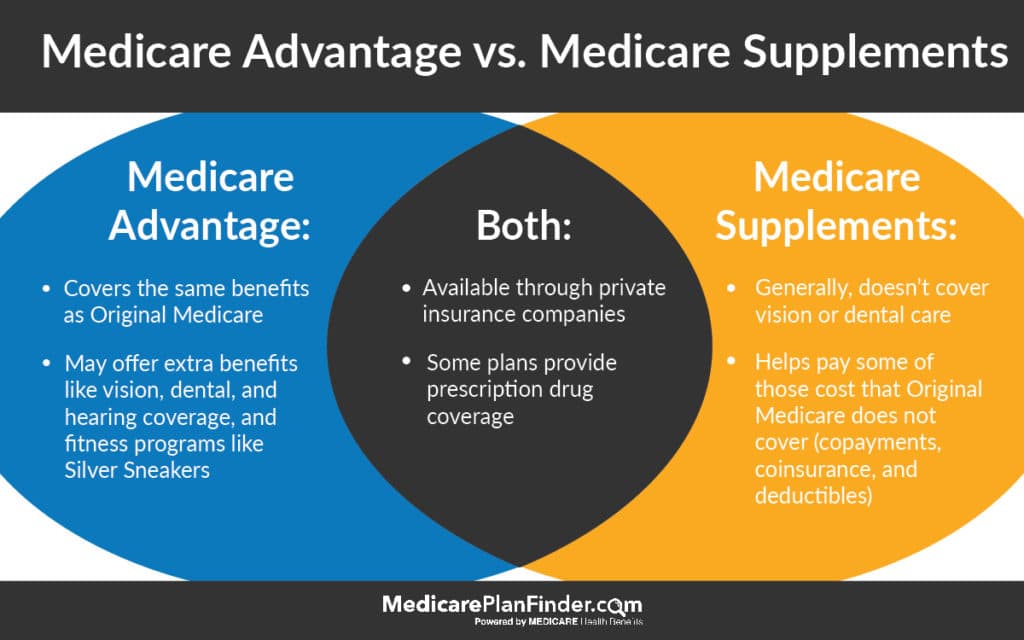

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What is the difference between Part C and Part F Medicare?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

What is the average cost of Medicare Part F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is there a deductible for Medicare Part F?

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns.

What is the premium for plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more.

What does Medicare Supplement Plan F cover?

MedSup Plan F pays for 100% of the following: Medicare Part A deductible. Medicare Part B deductible. Part A coinsurance and hospital costs up to a...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if the...

How does Medicare Part F compare to other MedSup plans?

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are th...

What Does Plan F Cover at My Doctor’S Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like: 1. Your annual physicals, well-woman exams and vaccines 2...

What Does Plan F Cover at The Hospital?

Medicare Part A covers inpatient hospital services, skilled nursing, blood transfusions and home health services that occur in the hospital. Medica...

What’S Not Covered by Plan F?

The only things Plan F does NOT cover would be those things that Medicare itself also does not cover, such as: 1. Acupuncture, acupressure and othe...

Does Medicare Plan F Cover Prescriptions?

Medicare decides what is covered and what is not. Medicare Part B covers injectable or infusion drugs given in a clinical setting. If Medicare pays...

Am I Guaranteed to Be Approved For Plan F?

Not always. You will get ONE open enrollment window to choose your first Medicare supplement without health underwriting. This window starts on Par...

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha...

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare pay for Supplement Plan F?

Then your Medicare Supplement Plan F will pay the remaining amount that Medicare does not cover.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

What is Medicare Plan F?

These can include deductibles, copayments, and coinsurance. Medicare Plan F is a Medigap policy. These policies help people pay some of the extra expenses of Medicare Part A and Part B. Together, Medicare Part A and Part B are called Original Medicare. Part A covers hospital expenses, and Part B covers other medical expenses.

How to enroll in Medicare Plan F?

To enroll in Medicare Plan F, a person must determine whether they are eligible and whether it is available in their area. They can use the Medicare Plan Finder or contact the State Health Insurance Assistance Program (SHIP) or State Insurance Department.

What is a Part B excess charge?

Part B excess charge. skilled nursing facility coinsurance. blood (first 3 pints) foreign travel — 80% of expenses up to the plan limit. Medicare sets a limit for allowable charges for services or procedures. In some states, a doctor can charge 15% more than Medicare allows. This cost is a Part B excess charge.

How much does Medicare cost if you have worked for 10 years?

If a person has worked and paid Medicare taxes for between 7.5 and 10 years, the premium is $252 per month.

When will everyone be eligible for Medicare Plan F?

A person may not qualify for a Medigap policy after the Open Enrollment Period. Before January 1, 2020, everyone was eligible for Medicare Plan F.

Is Medicare Plan F deductible higher?

If more benefits become added to the policy, its cost may be higher. Some states offer high deductible Medicare Plan F policies. People can use the Medicare Plan Finder to find the average cost of Medicare Plan F policies in their zip code.

Does Medicare plan F have the same benefits?

Private insurance companies offer the insurance plans. All Medicare Plan F plans offer the same benefits, but not all plans cost the same amount. Each insurance company can set its premiums and may provide more benefits. Not all insurance companies offer Medigap policies in every state.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

Does Medicare Plan F cover outpatient deductible?

Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. It covers all of the 20% that Medicare Part B normally leaves for you to pay. Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

Is Medicare Plan F higher for males or females?

With most carriers, the Medicare Plan F cost for males will be slightly higher than females. Tobacco users of course will often have a higher Medigap Plan F cost than non-tobacco users. There are also a number of companies who offer household discounts for their Medicare Supplement policies.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

How many Medicare Supplement Plans are there?

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

What is covered by Plan F?

The extensive coverage of Plan F includes the following: 100% of the deductibles for Parts A and B. 100% of the Part A coinsurance. Hospital expenses up to an extra 365 days after a person uses all available Medicare benefits. 100% of the copayment or coinsurance for Part A hospice care. 100% of the copayment or coinsurance for Part B.

How much is a Plan F deductible?

Plan F offers a high deductible version of the policy where an individual pays the deductible amount of $2,370 before the Medigap benefits take effect. They must also pay a $250 deductible for emergency healthcare costs they encounter when traveling in foreign countries.

What is the deductible for Medicare in 2021?

Some states offer a high-deductible version of Plan F. This means a person must first pay all Medicare costs up to $2,370, which is the deductible in 2021. Similar to other Medigap plans, Plan F does not cover prescription drugs or extra benefits, such as dental and vision.

What is Plan F for travel?

80% of foreign travel emergency healthcare costs up to the plan limits. In addition, Plan F covers 100% of Part B excess charges. These expenses refer to the amounts providers charge that are higher than Medicare-approved costs. Some states offer a high-deductible version of Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Which Medigap plan is the most closely resembled?

Plan G is the option that most closely resembles Plan F. Before buying a Medigap plan, a person may wish to take a careful look at the differences in their coverage, as insurance companies may offer the same plans but with different pricing.

When will Medicare and Medicaid costs be updated in 2021?

We last updated the costs on this page on October 13, 2020.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.