Full Answer

What are the phases of Medicare Part D?

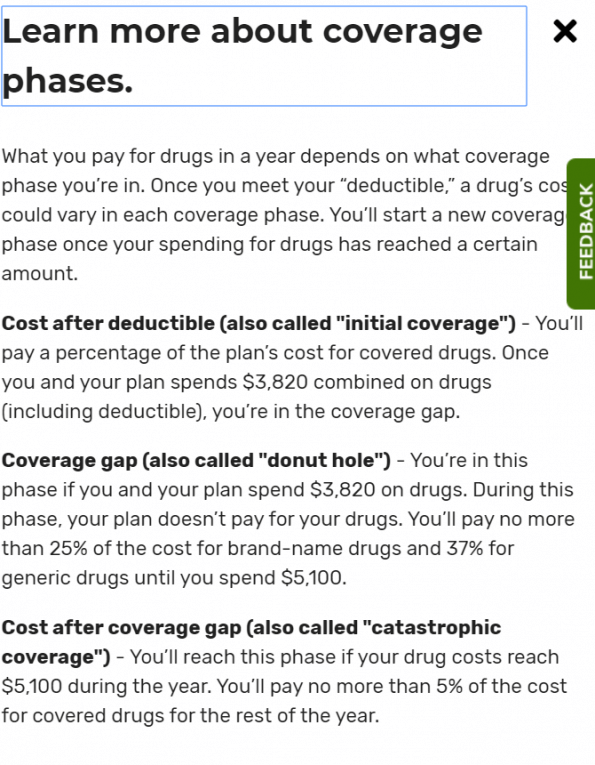

Medicare Part D Coverage Phases: How does Part D work? 1 Annual Deductible – The First stage of Medicare Part D Coverage Phases. 2 Initial Coverage: Copayments and coinsurance. 3 Donut Hole (Coverage Gap) Once the total costs of prescriptions (paid by you and your plan)... 4 Catastrophic Coverage. Catastrophic Coverage is the last stage...

What is the catastrophic phase of Medicare Part D drug coverage?

The catastrophic phase is the last phase of Medicare Part D drug coverage. You reach it when you’ve spent your way through the donut hole phase. When you get to the catastrophic phase, Medicare is supposed to pay the bulk of your drug costs. By then, your healthcare expenses have reached more than $6,550 in 2021.

What is Medicare Part D Tier 2?

Medicare Part D Tier 2: Tier 2 includes non-preferred generic drugs, which refers to higher-cost generic drugs. It costs more than tier 1 in copays.

How does Medicare Part D prescription drug coverage work?

Quite possibly the most confusing part of Medicare is Part D prescription drug coverage. There are 4 phases of Part D, meaning if you have enough drug costs, you could experience 4 different prices for your medications throughout a full calendar year. It can be incredibly frustrating. But we’re here to simplify this as much as possible.

What are the four phases of Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.

How many stages do Part D plans have?

four different phasesThere are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

How many stages do Medicare Part D plans have?

four different phasesYour Medicare Part D costs for prescription drugs may change during the year. This is because Part D coverage has four different phases.

What is Stage 3 of Medicare Part D?

Stage 3—Coverage Gap Most Medicare drug plans have a Coverage Gap (also called the “donut hole”). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the Coverage Gap, and it doesn't apply to members who get Extra Help to pay for their Part D costs.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

Is there still a donut hole in Medicare Part D?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people with Medicare won't pay anything once they pass the Initial Coverage Period spending threshold.

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How do you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How many stages are there in Medicare Part D?

There are four Medicare Part D stages. Depending on your drug costs, you may not reach all four in a given year. However, it’s still vital to know what to expect in case your prescription drug needs increase over time.

How much does Medicare Part D cost?

There is no out-of-pocket maximum for Medicare Part D, but once you hit catastrophic coverage, your out-of-pocket costs drop significantly. Generally, you’ll pay a a minimum of $9.20 for brand-name medication and $3.70 for generic drugs, or 5% of retail costs, whichever is higher.

What is the Medicare deductible for 2021?

In 2021 the deductible limit for Medicare Part D is $445.

How long does Medicare coverage last?

The initial coverage period lasts until you hit $4,130 in total drug costs, which includes both the amount you have paid during the year and the amount your plan paid. Depending on your medical needs, you may not hit the limit, but if you do, you enter the coverage gap known as the Medicare donut hole.

What is the donut hole in Medicare?

Once you hit the Medicare Part D initial coverage limit, you enter a gap in coverage known as the donut hole. In the past, you had to pay a significant amount of your drug costs during this gap. The coverage gap for all drugs essentially closed in 2020, meaning your share of costs in the “donut hole” is limited to 25% of the drug cost (both brand-name and generic).

When do I get Medicare?

For most Americans, enrollment in Medicare is automatic around the time you turn 65. If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you will automatically start receiving Medicare benefits on the first day of the month you turn 65. But what if you’re still working, or you don’t want to sign up for Medicare right away? Is it mandatory to go on Medicare when you turn 65? This page will help you understand your options. Do You Automatically Get Medicare When You Turn 65? If you are already receiving Social Security retirement benefits, you will automatically get Medicare at age 65 if you qualify for premium-free Medicare Part A. If you have to buy Medicare Part A, you will need to sign up manually online or by contacting your local Social Security office. You’ll know if you were automatically enrolled because you’ll receive a “Welcome to Medicare” package in the mail. This package includes details about Medicare Part A and Part B, along with your Medicare card. It will also help you answer the question, “How much will I have to pay for Medicare when I turn 65?” If you are uncertain or have questions about your Medicare eligility, you can contact Social Security direction, either via phone, online or visiting a local SSA office. You have the option to reject Medicare Part B if you don’t want it. However, if you change your mind and enroll later, you may have to pay a late enrollment penalty. What Happens If You Don't Sign Up For Medicare At 65? Do you have to sign up for Medicare when you turn 65? Unless you are covered by an employer group or union health insurance plan, if you don’t and enroll later, you will have to pay higher premiums. So while you don’t “have” to sign up, it will likely cost you more if you delay. If you’re not automatically enrolled and you also decide not to enroll for Medicare during your initial enrollment period near your 65th birthday, you won’t have coverage. If you change your mind, you will need to manually enroll in Medicare Part A and Part B by contacting your local Social Security office. And you may have to pay higher premiums if you didn’t enroll when you were first eligible. Again, unless you were covered by your employer or union group coverage. If you qualify for premium-free Medicare Part A, you can enroll in that coverage anytime. However, for Medicare Part B, you can only enroll during specific enrollment periods. The General Enrollment Period (GEP) for Medicare occurs every January - March 31 and is an opportunity for individuals to apply for Medicare Part A or B if not automatically enrolled in Medicare or missed their Initial Enrollment Period. Enrollments during the GEP are effective July 1. If you don’t get Part B when you are first eligible, you could have to pay a late enrollment penalty. Do You Have To Sign Up For Medicare At 65 If You Are Still Working? If you have medical coverage under a group health insurance plan offered by an employer or a spouse’s employer, you generally do not have to sign up for Medicare at age 65. You are able to delay your enrollment until your group coverage ends, without paying a penalty. Medicare gives you a special enrollment period that lasts eight months after the group coverage ends. The exception is for employers with less than 20 employees, so check with your employer or Social Security because if you don’t enroll in medicare, your employer might pay less or not at all. You can also sign up for Medicare Parts A and B while you’re still working, if you choose to. As long as you were previously covered by a group health insurance plan, you won’t have to pay a penalty. If you have Medicare Part B and return to work after the age of 65, you can drop Part B, as long as you have coverage under your employer’s group plan. When the group plan coverage ends, you can sign up for Part B again without paying a penalty. Understanding Your Medicare Option Knowing exactly when to enroll in Medicare can be confusing, especially if you’re still working or not receiving retirement benefits. Also, it’s important to understand all of your options and decide whether Original Medicare is right for you or if you want a different plan. The best way to find out is to talk to a licensed insurance agent. Contact us to find and compare plans today!

When to review Medicare Part D deductible?

Make sure you review the Medicare Part D deductible when you compare plans each year so you can choose the plan that’s best for your needs.

How many stages of Medicare Part D are there?

UPDATED Nov. 27, 2020. There are four Medicare Part D coverage phases (stages). The numbers below are for the year 2021.

How to contact Medicare for prescription drug?

If you are considering a Medicare Prescription Drug Plan, let us help you. Contact us with your Medicare Questions, or give us a call at 877-657-7477, and you will be connected to a licensed agent/broker.

What is initial coverage?

Initial Coverage: Copayments and coinsurance. During the Initial Coverage you pay for each covered drug a copayment/coinsurance (defined by the plan), and the plan pays its share. The typical coinsurance is 25%, i.e., you are paying 25% of the drug costs, but the insurance company pays the rest. The initial coverage continues until ...

What will be the discount for prescriptions in 2021?

In 2021, during the donut hole, you’ll get the following discounts on your prescriptions: 75% of the price of the plan-covered brand drugs and 75% of the generic plan-covered medicines.

What is catastrophic coverage?

Catastrophic Coverage is the last stage of Medicare Part D Coverage Phases. Once you’ve spent $6,550 out-of-pocket during the year of the Medicare Part D plan, the coverage gap ends, and catastrophic coverage begins.

How many phases of Medicare are there?

Quite possibly the most confusing part of Medicare is Part D prescription drug coverage. There are 4 phases of Part D coverage, meaning if you have enough drug costs, you could experience 4 different prices for your medications throughout a full calendar year. It can be incredibly frustrating.

What is the 2021 coverage gap?

Coverage Gap (Donut Hole): Once your gross drug costs reach $4,130 in 2021, you will enter the Coverage Gap (a.k.a. Donut Hole). This is where you will pay 25% of a drug’s full retail “gross” cost. For some drugs (like generics), the cost might not change much. For other drugs (like brand names), the cost could go up substantially ...

What is the deductible phase of Medicare?

The Deductible Phase. Medicare Part D costs may change during the year. The reason being, Part D coverage has four different phases. The first up – Part D deductible phase. You’re responsible for prescription costs until you meet the Part D deductible. After you reach your deductible amount, Part D will then cover the cost of your medications.

What is the Part D fee?

The fee is called the Part D income-related monthly adjustment amount. The government assists people who need help paying for Part D. Depending on where you live, more assistance may be available from state or federal agencies. You must meet income and asset requirements to qualify.

How much discount is given for generic drugs?

That leaves only 25% of the cost up to you, making prescriptions still affordable. Likewise, there’s a 63% discount for generic drugs; the beneficiary is responsible for the remaining 37% of the cost.

What is Part D insurance?

Once your deductible is met, Part D helps cover the costs of your prescriptions. Beneficiaries are responsible for the costs of any co-payments or co-insurance; meanwhile, your plan will pay its’ share of the cost. The length of your initial coverage phase depends on drug costs and the benefits your plan offers.

How much does a Part D plan cost?

Although deductible expenses will vary between plans, no plan may exceed $445; and some cost $0.

Can you change your Part D plan during AEP?

Once enrolled, if satisfied with your Part D plan changes, the renewal is automatic the following year. Beneficiaries may need to change drug plans during the AEP due to changes in medication needs, and switch to a program that is more suitable for them.

Can you buy a smaller amount of pills with Part D?

For instance, a Part D plan may limit you to buying a smaller amount of pills in each purchase. Insurers often require doctors to ask before ordering certain high-cost medicines. The insurance company could require you to try a less expensive drug before covering a more costly drug.

How many phases are there in Part D?

There are 4 phases to costs within the Part D program.

When does the Medicare benefit change?

Benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1 of each year.

What is cost sharing in insurance?

Cost-Sharing: In this phase, you and the drug plan are splitting the cost of your drugs. You are paying either a fixed amount, or a percentage of the retail costs. That amount is based on which tier your drug falls into. You remain in the cost-sharing phase until your annual drug costs (retail costs, not what you have paid out of pocket) hit the coverage gap threshold and you enter phase three.

What is catastrophic coverage?

Catastrophic Coverage: Once you get out of the coverage gap, you automatically get catastrophic coverage. With catastrophic coverage, you only pay a small coinsurance amount or copayment for covered drugs for the rest of the year. The drug plan assumes the largest amount of the cost for your prescriptions.

What are the stages of Medicare Part D?

This includes the deductible, your initial coverage, the coverage gap (formerly referred to as the donut hole) and catastrophic coverage. We will discuss these stages are impact by your TROOP (True Out-Of-Pocket Expense). Then last, but not least I will touch on Low Income Subsidy options that can be used to help relieve the financial burden of prescription drugs and Part D premiums for those who qualify. If you are having difficulty paying for your prescriptions, this will be very important for you.

How many tiers are there in Medicare Part D?

Most Part D plans have five tiers with tier one being the lowest cost, most common prescriptions. On my Medicare Part D shopper (linked below) you can easily see if your Part D plan exempts any tiers from the deductible. Exempting tiers one, two is the most common.

What is the maximum Medicare deductible for 2021?

They can charge the maximum. They can charge less than the maximum or have no deductible at all. For 2021 the maximum Medicare Part D deductible is $445. I would suspect the amount of the deductible will continue to increase a little each year.

What is the maximum deductible for Medicare Part D?

Each year Medicare sets a maximum deductible that a Medicare Part D plan can charge. They can charge the maximum. They can charge less than the maximum or have no deductible at all. For 2021 the maximum Medicare Part D deductible is $445. I would suspect the amount of the deductible will continue to increase a little each year.

How much does Medicare pay for catastrophic coverage?

In this stage Medicare will typically pay the greater of 95% of your prescription drug costs or $3.70 for a generic prescription or $9.20 for a brand name prescription. If you have a $10,000 prescription, Medicare will $9,500 you will pay $500.

What is the limit for Medicare 2021?

That is stage two – your Initial Coverage which ends when your total costs reach a pre-set limit. That limit for 2021 is $4,130. When your total costs reach $4,130 you exit Stage Two and enter Stage Three.

Is Medicare a perfect system?

Medicare is not a perfect Health Care system. It’s complex and full of potholes. Your responsibility is to try to understand it as best you can and to re-shop your Part D prescription drug plan every year during the Annual Election Period. Even if you like your current plan. Your current plan can and will change each year. If you fail to shop your plan or if you make a mistake because of what you don’t understand, you can end up paying much more than you should for your prescriptions.

How much does Medicare Part D cost?

The government says the average monthly amount is $33.06, or $396.72 annually. In practice, premiums vary a lot from plan to plan.

What is the catastrophic phase of Medicare?

The catastrophic phase is the last phase of Medicare Part D drug coverage. You reach it when you’ve spent your way through the donut hole phase. When you get to the catastrophic phase, Medicare is supposed to pay the bulk of your drug costs.

What can you do to manage your Part D costs?

Check available pharmacies. Sometimes just changing pharmacies to a “preferred” one in your insurer’s network can lower a drug’s price. Use GoodRX to compare prices and look for coupons that could save you money on your medications. Sometimes checking competitors or switching to a mail-order pharmacy can make a big difference.

What is the state health insurance assistance program?

Contact the State Health Insurance Assistance Program. It’s a nonprofit network of trained, unbiased benefits counselors who provide free guidance on Medicare issues. A SHIP counselor can help you with Part D questions.

When will Part D prices be reset?

Part D prescription plan prices are reset annually. You begin paying the new rates in January. In addition to the premium, there are four stages of pricing. Here’s how the four stages are expected to break down in 2022:

Is there a cap on Part D prescription drug coverage?

There is no cap on the cost of Part D prescription drug coverage.

Does Medicare Part D have a cap on out of pocket costs?

No. Medicare Part D has never capped out-of-pocket costs. Even when you reach catastrophic coverage, your 5% coinsurance lasts the rest of the year.

What are the tiers of Medicare Part D?

The Medicare Part D tiers refer to how drugs are organized in a formulary. They include both generic and brand name drugs, covered for different prices. Most commonly there are tiers 1-5, with 1 covering the lowest-cost drugs and 5 covering the most expensive specialty medications.

Which tier of Medicare does a drug need?

Which tier your drug needs depends on the formulary of your Medicare Part D plan. Every Medicare Prescription Drug Plan is required to have a list of covered drugs called a formulary. You can find out the drug Tier for each of your covered drugs by checking the plan’s formulary.

What is Tier 1 Medicare?

Tier 1 is the least expensive of the Medicare Part D tiers, and includes the lower-cost preferred generic drugs. Preferred drugs means a certain set of types of medications that have been approved by the insurance company to be in this low-cost grouping. Generic refers to non-name brand versions of each type of drug.

Does Medicare Part D cost more than tier 1?

Medicare Part D tiers 1 and 2 are often set up to exempt you from paying a deductible, whereas with drugs in the higher tiers you may have to pay the full drug cost until you meet the deductible, then pay a copay/coinsurance.