Medicare Supplement insurance, also known as Med-Supp or Medigap, was created by the federal government and is regulated by state Insurance Departments. It is offered by private insurance companies to cover some of the out-of-pocket costs not covered by Original Medicare. Why do I need a Medicare Supplement insurance policy?

Full Answer

What is a Medicare supplement plan F?

The Medicare Supplement High Deductible Plan F deductible is $2,490 for the 2022 calendar year. So to receive 100% coverage for all Medicare-covered services, you must first pay $2,490 out-of-pocket. While this deductible may seem high compared to the Medigap plans without a high deductible – for which you just need to pay the standard ...

What is a Medicare supplement plan?

· As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. Part A hospice care copayment or coinsurance costs.

Why is Medicare supplement plan F so expensive?

· Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage. However, Medicare Plan F was discontinued as of Jan. 1, 2020.

Do Medicare supplement plans cover out-of-pocket costs?

· Medicare Supplement Plan A is the most basic of the standardized, lettered Medicare Supplement plans. It usually includes only those benefits listed above. From there, the benefits in the 10 standard Medicare Supplement plans vary a bit more. Some pay all or part of your Medicare Part A and/or Part B deductibles, your Part A skilled nursing ...

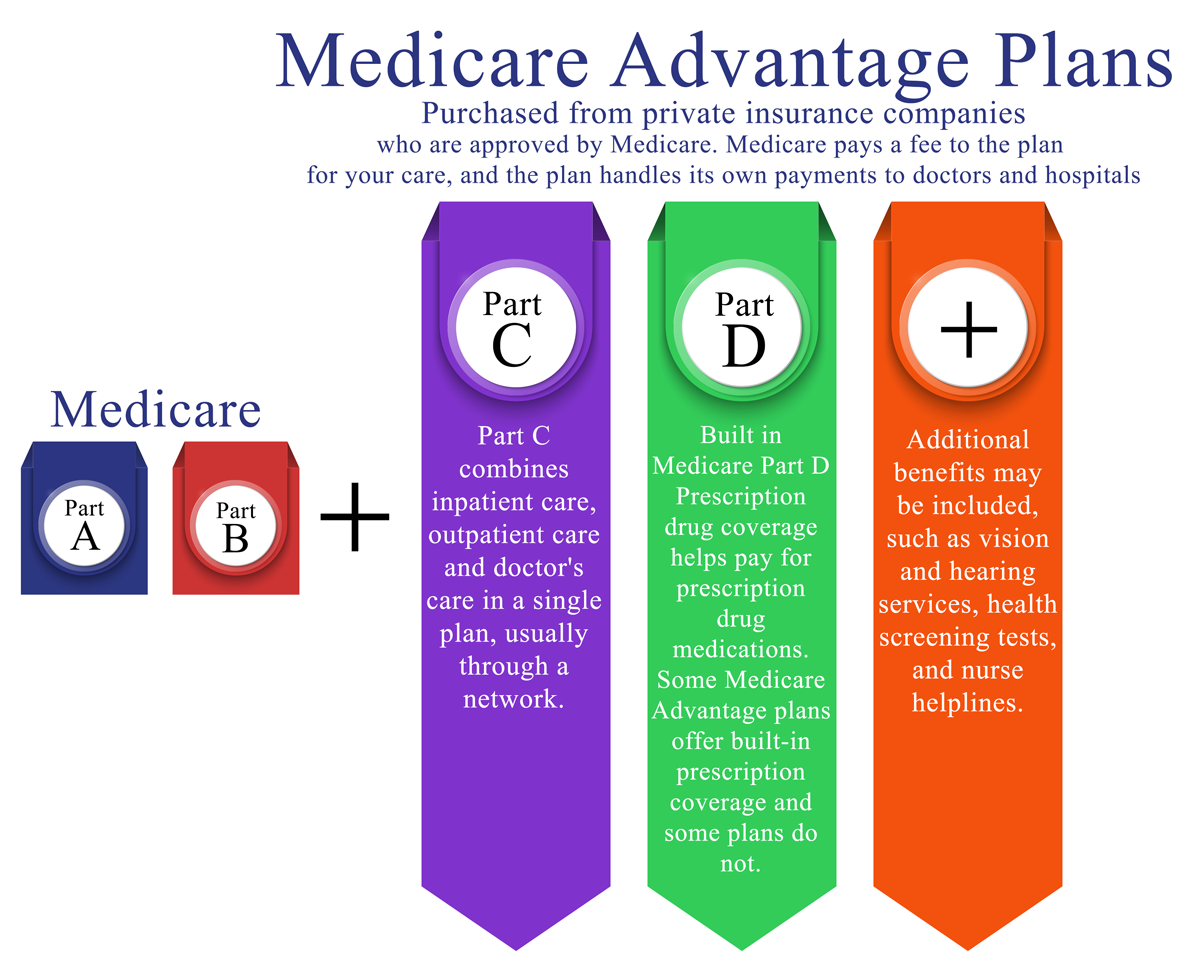

What is the difference between Medicare Advantage and supplemental?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Which states have non standardized Medicare Supplement plans?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is Medicare supplement plan MW?

Medicare Supplement (Medigap) Plan M is an insurance policy that works secondary to Original Medicare and helps you control those costs. Medigap Plan M is one of the ten standardized Medicare Supplement plans available.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the difference between Medigap and Medicare?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.

Can you have two Medicare supplement plans?

A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

Can I switch from Plan F to Plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.

Do Medicare Supplement Plans vary by state?

Although most states offer the same 10 Medicare Supplement insurance plans, the specific plans available in your location may vary, since insurance companies aren't required to sell every plan.

Does Medigap cover out of state?

In many cases, you can stay with your current Medicare Supplement (Medigap) plan even if you're moving out of state as long as you stay enrolled in Original Medicare. Medigap benefits can be used to cover costs from any provider that accepts Medicare, regardless of the state.

Is Medicare coverage different in different states?

Medicare Part A and Medicare Part B together are known as “original Medicare.” Original Medicare has a set standard for costs and coverage nationwide. That means your coverage will be the same no matter what state you live in, and you can use it in any state you visit.

Are Medigap plans accepted everywhere?

The short answer is “No.” Not all doctors accept Medicare supplement (Medigap) plans. However, if a doctor accepts Medicare (your primary coverage), they will accept your Medigap plan, regardless of the type of Medigap plan you're enrolled in.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

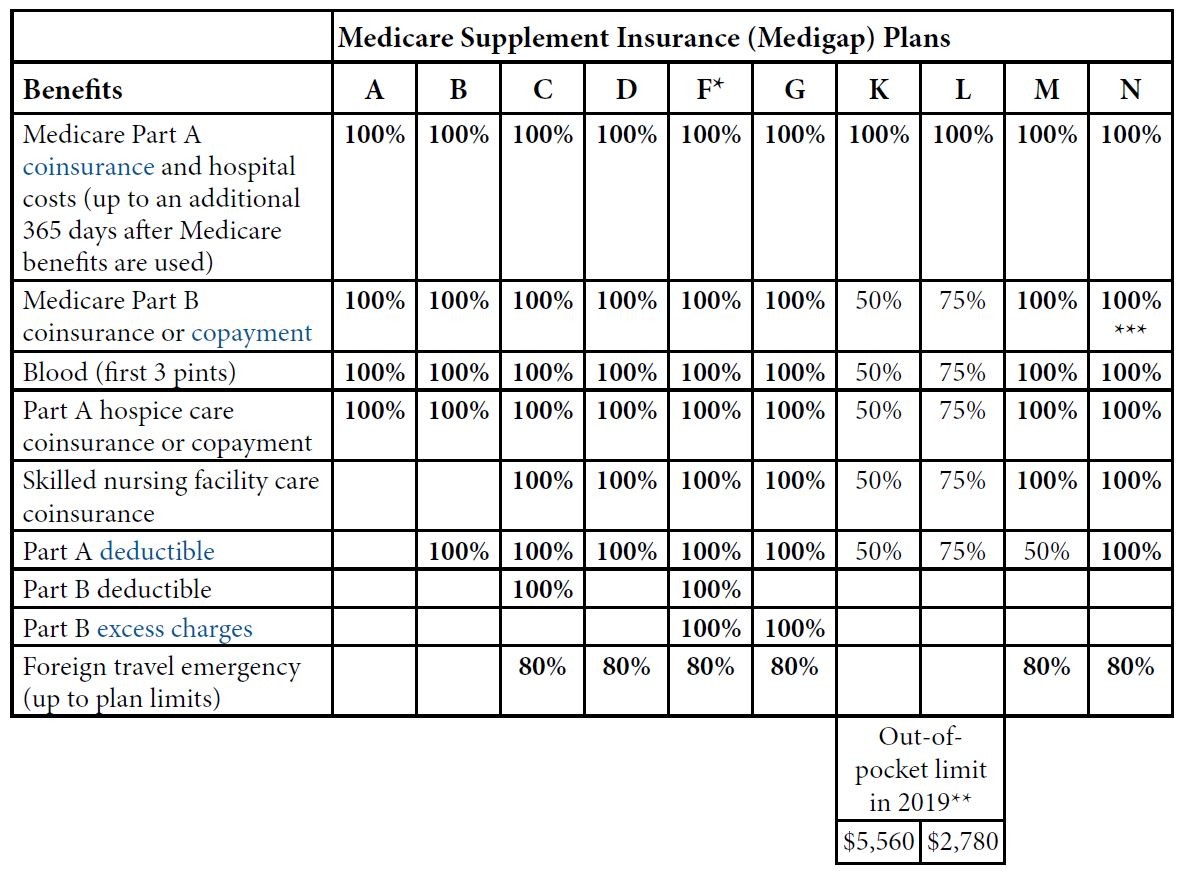

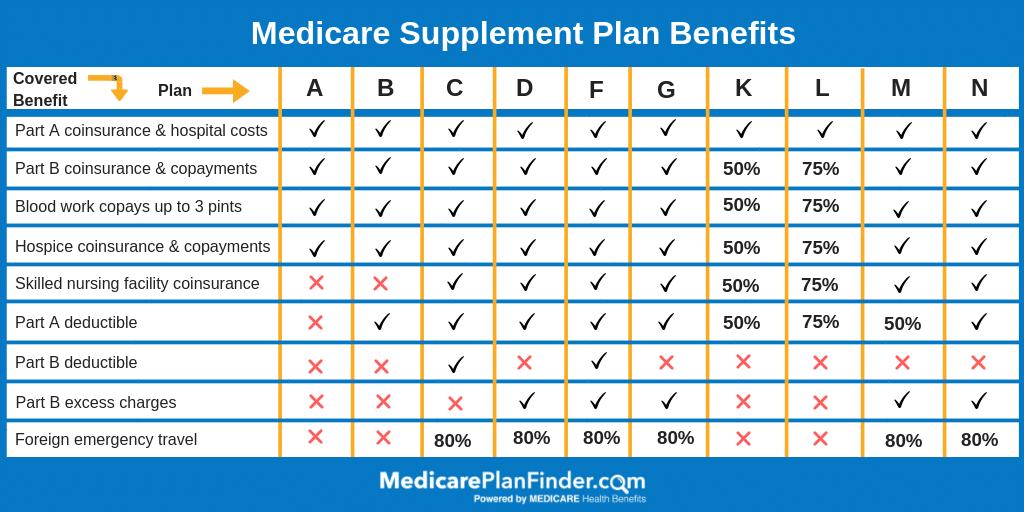

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

Which states have standardized Medicare Supplement Plans?

Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement plans. Medicare Supplement Plan F isn’t available in those states. Here’s an overview of what Medicare ...

Does Medicare Supplement Plan F have a high deductible?

Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan. Medicare Supplement Plan F also has a high-deductible version.

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

Is Medicare Supplement Plan A the same as Medicare Part A?

Please note that Medicare Supplement Plan A is not the same as Medicare Part A. There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Additional Documentation Requests

Noridian Healthcare Solutions, the current SMRC, will send requests to providers and suppliers for additional documentation on claims selected for medical review.

Overpayments

Noridian Healthcare Solutions will notify CMS of any identified improper payments and noncompliance with documentation requests. The Medicare Administrative Contractor (MAC) may initiate claim adjustments and/or overpayment recoupment actions through the standard recovery process.

Questions

If you have questions about the overpayment recovery process or appeal rights, find and contact your MAC using the review contractor directory. For more details on the SMRC program, contact Noridian Healthcare Solutions at 1-833-860-4133, or visit Noridian Healthcare Solutions’ SMRC website at https://www.noridiansmrc.com/.

Can you claim spousal benefits before FRA?

If you claimed your retirement or spousal benefit before FRA, you are still eligible for the maximum survivors benefit if you are FRA or older when you apply for the survivors benefit.

Does OPM pay Social Security?

Yes. For certain FERS employees who retire and are entitled to immediate annuity before age 62, OPM pays “retiree annuity supplement” that substitutes for Social Security part of FERS. It is paid only until age 62, regardless of when retiree applies for Social Security.