Does AARP offer the best Medicare supplemental insurance?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your...

How does Medicare work with AARP?

- Great name recognition — seniors trust AARP

- A+ Better Business Bureau rating for both AARP and UnitedHealthcare

- In 2019, UnitedHealthcare was ranked the “World’s Most Admired Company” in the Insurance and Managed Care category by Fortune magazine

- Offers the most popular Medicare Supplements: F, G, and N

What is the best AARP Medicare supplement plan?

What Does AARP Medicare Supplement Plan G Cover?

- Plans C and F are not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

- Plans F and G also offer a high deductible plan which has an annual deductible of $2,370 in 2021. ...

- Plan K has an out-of-pocket yearly limit of $6,220 in 2021. ...

Does AARP offer health insurance for under 65?

The AARP offers comprehensive and complementary quality health insurance plans for members aged 50 to 64. Basic first level health insurance and specially selected individual health insurance plans that provide high quality AARP health insurance under 65 coverage for customers and their families.

What is Medigap insurance?

A: Medigap is private insurance that covers out-of-pocket expenses in the Original Medicare program. (If you are under age 65 and have Medicare due to disability, see the next Q&A in this section, because the rules are different for your situation.) — Read Full Answer.

Does Medicare cover all medical expenses?

A: Medicare does not cover all your health care costs. It requires you to pay premiums, deductibles and copays, which vary according to the type of Medicare coverage you choose and, in some cases, your income. — Read Full Answer. Q: I want to be sure I understand the Part D “doughnut hole” or coverage gap.

Does Medicare sell Medicare Advantage plans?

Medicare doesn’t sell the Advantage plan directly to the customers. To buy one for yourself, you need to go to a private insurance company that has been allowed to sell Medicare Advantage plans. From those many private insurers, one of the prominent names is AARP. The Medicare Complete plan by AARP offers coverage for those medical expenses that had been always heavy in your pocket. Seniors can avail a lot more benefits from one single plan rather than purchasing multiple types.

Does AARP cover hospice?

Almost every AARP Medicare Complete plan will provide coverage for Medicare Part A (excluding the hospice care) and Medicare Part B. Even if you are in an unexpected medical emergency like ER room or ambulance service, the AARP Medicare Advantage plan will cover you for that as well. Any medical service that comes under urgently needed will get coverage by the plans. It is better that you ask from the doctors or medical staff at any healthcare facility that whether they honor the Medicare Advantage plan by AARP or not. There is no shame to ask, as it is your right as a patient.

What are the extra benefits of a dental plan?

Extra benefits like limited dental, vision and hearing are often included. Premiums are sometimes required but many plans are offered with a $0 premium. Plans generally require cost-sharing in the form of deductibles, co-payments and coinsurance.

Is Medicare Complete a PPO?

Plan benefits and premiums can vary County-to-County. Medicare Complete may be available as a PPO, HMO or HMO-POS plan. It may or may not include Part D coverage. Plans are good for one calendar year and must be renewed (if available) for the following year. You must adhere to strict enrollment period requirements.

Is vision covered by Medicare?

Some services such as routine dental, vision and hearing are not covered. You will be required to pay a deductibles and co-payments. You must pay premiums for your Part B coverage. Medicare Part D requires a separate premium. There is not an annual maximum out-of-pocket amount.

Does Medicare complete mean you are no longer in Medicare?

Enrolling in Medicare Complete does not mean you are no longer in Medicare. You must have Medicare Part A and Part B to qualify. You must also continue to pay your Part B premiums.

Is there an out of pocket maximum for Medicare?

There is not an annual maximum out-of-pocket amount. Medicare is considered a fee-for-service plan and you are able to choose any provider that accepts Medicare assignment. This means that if you require a specialist in another State you have the freedom to use them as long as they accept Medicare assignment.

Is it risky to insure yourself with original Medicare?

Original Medicare. Choosing to insure yourself with original Medicare by itself can be a risky business. Original Medicare was never intended to cover 100% of expenses associated with your health care.

How much is Medicare Part B coinsurance?

For Part B services, most MedicareComplete plans require coinsurance payments, usually a flat-rate amount of $15 to $25, rather than the Original Medicare Part B deductible of 20 percent.

What is Medicare Advantage Plan?

Medicare Advantage Plans are substitutes for Original Medicare coverage and were authorized by Congress to shift some of Medicare's cost burden to private insurance companies. Medicare participants who enroll in a Medicare Advantage Plan are covered directly by the private insurance company offering it, to which Medicare pays a premium.

What is an HMO insurance?

Health maintenance organization. In an HMO, the insurance company covers the charges only for health care providers in the network; if you go out-of-network for service, those charges won't be covered at all. Preferred provider organization.

Can you turn down Medicare Advantage?

These plans are "guaranteed issue" -- that is, you cannot be turned down for Medicare Advantage or MA-PD coverage, unless you have end-stage renal disease. 00:00. 00:04 08:24.

Is a PPO the same as a POS plan?

Point of service. A POS plan works the same as a PPO, with the important exception that if your in-network primary physician refers you to an out-of-network specialist, the insurance company will cover that specialist at the higher in-network rate.

What is the GRP number for Medicare Supplement Plan?

Policy form No. GRP 79171 GPS-1 (G-36000-4). You must be an AARP member to enroll in an AARP Medicare Supplement Plan. In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

What is a dual SNP?

Dual Special Needs (D-SNP) Plans. Dual Special Needs Plans (D-SNPs) are for people who have both Medicare and Medicaid. They offer many extra benefits and features beyond Original Medicare. People who are eligible can get a Dual Complete plan for a $0 plan premium.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

Does AARP pay royalty fees?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, ...

Who pays royalty fees to AARP?

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products.

What is Medicare Advantage?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies. Plans usually charge monthly premiums (in addition to the Part B premium), ...

When can Medicare Advantage plans change?

Medicare Advantage plans can change their costs (premiums, deductibles, copays) every calendar year. To be sure of getting your best deal, you can compare plans in your area during the Open Enrollment period (Oct. 15 to Dec. 7) and, if you want, switch to another one for the following year.

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How many Medigap plans does United Healthcare offer?

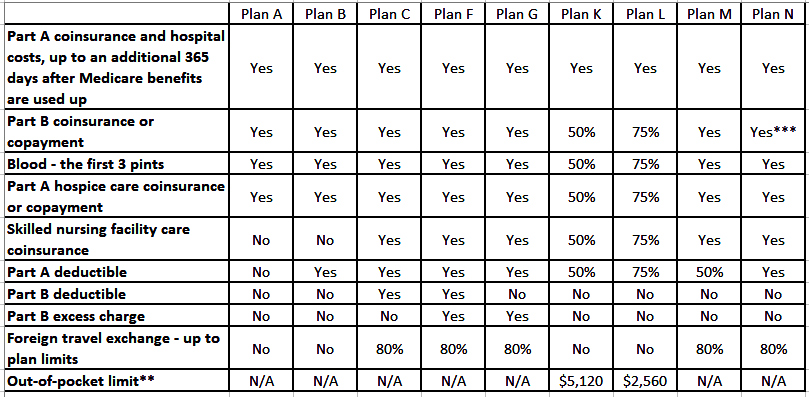

AARP members can choose from 8 standardized Medigap plans offered through United Healthcare. These plans are A, B, C, F, G, K, L, and N. Although all 50 states have at least one of these plans, people may not find all 8 plans offered in their state. A person can use this online tool to find a plan in their state.

How many AARP plans are there?

The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles. The plans vary in coverage and cost. Each state has at least one AARP Medigap plan available, although people may not find all eight plans in their location.

What is the process of underwriting for Medigap?

Insurance companies use a process called medical underwriting to decide if they will accept an application for Medigap and to determine the cost. During open enrollment, a person with health issues can enroll in any Medigap policy in their state for the same price as someone in good health.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What are the three systems of insurance?

The three systems include: community rated, where everyone who has the policy pays the same premium, regardless of their age. issue-age rated, where the premium is based on a person’s age when they first get a policy, but does not increase because of age.

What is dual eligibility?

Dual Eligibility. If you qualify for both Medicare and Medicaid, you are considered "dual eligible.". Sometimes the two programs can work together to cover most of your health care costs. Individuals who are dual eligible can often qualify for special kinds of Medicare plans.

What is a federal health insurance program?

A federal health insurance program for people who are: 65 or older. Under 65 with certain disabilities. Of any age and have End Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also called Lou Gehrig's Disease)

Can you be dual eligible for Medicare?

If you qualify for both Medicare and Medicaid, you are considered "dual eligible.". Sometimes the two programs can work together to cover most of your health care costs. Individuals who are dual eligible can often qualify for special kinds of Medicare plans. One such example is a Dual Special Needs Plan (D-SNP).

Does each state have its own medicaid program?

Each state creates its own Medicaid program, but has to follow federal guidelines, like the required and optional benefits they include. Some of the benefits Medicaid programs have to include are: