This money comes from the Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed

How do the Social Security trust funds really work?

You can collect on your current spouse’s record if:

- You’ve been married for at least a year.

- Your spouse is already taking their benefits.

- You’re at least 62, or you’re caring for a child who’s under 16 or disabled.

Can Social Security benefits go to a trust fund?

Those securities are issued to the trust funds both when cash from tax income is deposited and when interest is paid on the invested reserves. When Social Security benefits are paid, trust fund securities are redeemed for the cash to pay beneficiaries.

Does the Social Security Trust Fund really exist?

Whether you favor cutting Social Security may depend on how you view the Social Security trust funds, which currently contain $2.5 trillion for retirement benefits. That's $2.5 trillion that, according to some people, don't actually exist. Here's the back story.

Why is Social Security running out of money?

- The program pays benefits which were not intended to be paid from the program.

- The FICA taxes are not sufficient enough to support even the benefits intended in the original program.

- The funds are being “invested” in extremely low yielding investments.

- Mismanagement.

Is Social Security a US Treasury?

The Social Security trust funds are financial accounts in the U.S. Treasury.

Is Medicare funded by Social Security?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare.

Who funds the Social Security system?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

Who funds Medicare in the US?

the U.S. TreasuryMedicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.

Where does Medicare get its money?

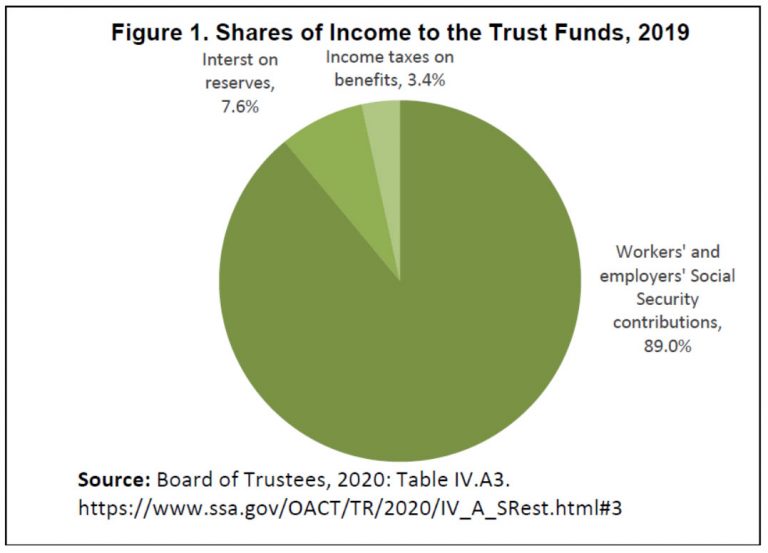

How is Medicare financed? Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

How is the Medicare trust fund funded?

The Medicare trust fund finances health services for beneficiaries of Medicare, a government insurance program for the elderly, the disabled, and people with qualifying health conditions specified by Congress. The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

How much money has the government borrowed from Social Security?

The total amount borrowed was $17.5 billion.

Has the government borrowed from Social Security?

Myth #5: The government raids Social Security to pay for other programs. The facts: The two trust funds that pay out Social Security benefits — one for retirees and their survivors, the other for people with disabilities — have never been part of the federal government's general fund.

Does the federal government fund Medicare?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover.

Is Original Medicare federally funded?

Original Medicare is provided by the federal government and covers inpatient and home health care (Part A), as well as medically necessary services (Part B). Seniors can also choose Medicare Advantage plans through approved private insurance companies.

Who controls Medicare premiums?

The State of California participates in a buy-in agreement with the Centers for Medicare and Medicaid Services (CMS), whereby Medi-Cal automatically pays Medicare Part B premiums for all Medi-Cal beneficiaries who have Medicare Part B entitlement as reported by Social Security Administration (SSA).

What is a Social Security trust fund?

The Social Security trust funds are financial accounts in the U.S. Treasury. There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits. Social Security taxes and other income are deposited in ...

What is the purpose of trust funds?

The only purposes for which these trust funds can be used are to pay benefits and program administrative costs.

Summary

According to the annual reports of the Social Security and Medicare trustees, the financial outlook for the two programs is not favorable.

Purpose of Trust Funds

Social Security and Medicare are programs created by federal laws and operated by agencies of the federal government. The taxes and premiums the public pays to support them and the benefits they provide to their recipients flow into and out of the U.S. Treasury.

Measures of Financial Soundness

The trustees of the two programs report annually on the financial status of their various trust funds. Although they use a number of measures, the media and general public typically place emphasis on trust fund exhaustion dates and long-range summary measures of financial status, such as the test of long-range close actuarial balance.

Budget Impact of the Programs

At times, the operations of trust funds are seen as measuring the effect that Social Security and Medicare have on the federal budget and the Treasury.

Resources Required to Pay for Social Security and Medicare

Trust fund assessments are intended to convey the adequacy of the financing arrangements established for the programs. In other words, the trustees reports evaluate whether and for how long the programs would be able to pay benefits with the spending authority Congress has given them.

Assessing the Economic Impacts

From an economic perspective, the gaps between what the government receives and spends for Social Security and Medicare can only be filled by increased borrowing, higher taxes, reduced spending, or some combination thereof. This total gap is composed of two parts.

Endnotes

1. Significant being defined here as having an average income shortfall of 5 percent or larger for the following 75 years.

What is a trust fund for Social Security?

The Social Security Trust Fund is an account managed by the United States Treasury that takes in Social Security payroll taxes from workers and their employers and pays out benefits to Social Security recipients. It invests in securities that are backed by the full faith and credit of the U.S. government.

What is the OASI trust fund?

The OASI Trust Fund is used to pay benefits to retired workers and their families, as well as to the families of deceased workers. The DI Trust Fund covers benefits to disabled workers and their families. Otherwise, the two funds work similarly. 1. When workers and employers pay more money into the Social Security system than it needs ...

What is the interest rate on trust funds in 2020?

In 2020, the trust funds earned an average interest rate of 0.990% on their securities compared to 2.219% in 2019. This rate, however, can vary from month to month. In 2020, it declined from 2% in January to a mere 0.625% in April, probably influenced by the economic downturn caused by the COVID-19 pandemic.

When was the interest rate on special issues set?

The interest rate on the special issues is set by a formula established in 1960 through amendments to the Social Security Act. 7 It is roughly the same as the average yield on marketable Treasury securities that are at least four years from maturity.

When will the trust fund be depleted?

By the most recent estimates, that means that unless Congress takes action to address the problem, the trust fund will be depleted by the year 2035. 11.

Does Social Security have a surplus?

Key Takeaways. The Social Security Trust Fund receives payroll taxes, pays out benefits, and invests any surplus in special government securities. Those securities earn interest and are backed by the full faith and credit of the U.S. government. The trust fund is expected to stop running a surplus in 2021, at which time it probably will need ...

Is Social Security a pay as you go system?

Social Security is a pay-as-you-go system, with taxes on current workers paying for the benefits owed to retired workers and others. For many years, the income Social Security received from payroll taxes was more than sufficient to cover the benefits it was paying out. Over time, the Social Security Trust Fund accumulated a reserve that, at the end of 2019, totaled nearly $2.9 trillion. 17

Contents

Summary

- According to the annual reports of the Social Security and Medicare trustees, the financial outlook for the two programs is not favorable. Under the central forecasts reported for the past 17 years under both Republican and Democratic Administrations, both programs face significant long-range financing problems arising in large measure from the aging of the population and the unre…

Purpose of Trust Funds

- Social Security and Medicare are programs created by federal laws and operated by agencies of the federal government. The taxes and premiums the public pays to support them and the benefits they provide to their recipients flow into and out of the U.S. Treasury. The U.S. Treasury Department tracks their financial flows through accounts that by law ...

Measures of Financial Soundness

- The trustees of the two programs report annually on the financial status of their various trust funds. Although they use a number of measures, the media and general public typically place emphasis on trust fund exhaustion dates and long-range summary measures of financial status, such as the test of long-range close actuarial balance. This summary estimate measures wheth…

Budget Impact of The Programs

- At times, the operations of trust funds are seen as measuring the effect that Social Security and Medicare have on the federal budget and the Treasury. If the trust funds show an excess of income over outgo, some read this to indicate that the programs are having a favorable effect on the budget and vice versa if trust fund outgo exceeds trust fund income. The receipts and expen…

Resources Required to Pay For Social Security and Medicare

- Trust fund assessments are intended to convey the adequacy of the financing arrangements established for the programs. In other words, the trustees reports evaluate whether and for how long the programs would be able to pay benefits with the spending authority Congress has given them. But those assessments are not intended to indicate the programs budgetary and economi…

Assessing The Economic Impacts

- From an economic perspective, the gaps between what the government receives and spends for Social Security and Medicare can only be filled by increased borrowing, higher taxes, reduced spending, or some combination thereof. This total gap is composed of two parts. The gap between what a trust fund receives and spends is known as a trust fund deficit. For a trust fund …

Endnotes

- 1.Significant being defined here as having an average income shortfall of 5 percent or larger for the following 75 years. 2.It has been postulated that excess Social Security and Medicare receipts give the government more money than it otherwise would receive, and as such, they are a substitute for government borrowing from the public. There is, however, no way of tracing the us…