- Cigna: Best Medicare Part D Plan overall. Cigna-HealthSpring is a well-priced and reliable option, making it our top pick in this best Medicare Part D plans.

- AARP Medicare Rx: Best Medicare Part D plan for seniors. ...

- Humana Medicare Rx: Best Medicare Part D Plan for home delivery. ...

- SilverScript: Best Medicare Part D plan for 24/7 advice. SilverScript is a Medicare Part D plan specialist, and this, together with being part of the CVS family of companies, ...

- WellCare Health Plans Medicare: Good choice of plans. WellCare Health is a government-sponsored healthcare plan specialist, and so is a great resource for weighing up which Medicare Part D ...

Full Answer

What are the best health insurance plans for seniors?

Jan 07, 2021 · What Is the Best Medicare Plan for Seniors? Original Medicare. Original Medicare consists of Medicare parts A and B. For many Americans, this covers most necessary medical expenses. However, ... Medicare Advantage. Medicare Part D. Medigap.

What is the best medical insurance for seniors?

Oct 16, 2020 · Original Medicare, also known as Traditional Medicare is a fee-for-service health plan that consists of two parts, Medicare Part A (hospital insurance) and Part B (medical insurance). This is a popular plan for seniors because it …

What is the best medical plan for seniors?

What Is the Best Medicare Plan for Seniors in 2022? Medicare Part A. Part A covers hospital services, including emergency room visits, inpatient care, and outpatient services. It covers limited home ... Medicare Part B. Medicare Part C (Medicare Advantage) Medicare Part D. Medigap.

What are the best insurance companies for Medicare?

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Which is better a Medigap policy or Medicare Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Who is the best Medicare provider?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Feb 25, 2022

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Can you switch from a Medicare Advantage plan to a Medigap plan?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

What is the best Medicare plan?

The best Medicare plan is one that covers all your necessary medical and financial needs. There are advantages and disadvantages to each Medicare plan option, ranging from cost-effectiveness to provider limitations, and more.

What to consider when choosing a Medicare plan?

Here are some important things to consider when choosing the best Medicare plan for you: The type of coverage you already have.

What is Medicare Part D?

Medicare Part D. Part D offers additional prescription drug coverage for any medications that aren’t included under original Medicare. A Medicare Advantage plan can take the place of Part D. If you don’t want Medicare Advantage, Part D is a great alternative.

Is Medigap a private insurance?

Medigap is a supplemental private insurance option that can help pay for Medicare costs, such as deductibles, copays, and coinsurance. Medigap isn’t necessarily an alternative to Medicare Advantage but rather, a cost-effective alternative for those who choose not to enroll in Medicare Advantage.

Does Medicare cover vision?

Original Medicare consists of Medicare parts A and B. For many Americans, this covers most necessary medical expenses. However, original Medicare doesn’t cover prescription drugs, vision, dental, or other services.

How to choose a health insurance plan?

Now that you have an understanding of all the plans available to you, it’s time to choose the right plan. Here are some things you should consider when choosing a plan: 1 How much coverage do you already have? If your spouse has coverage from their employer or if you have veteran benefits you may need less additional coverage than you think. 2 What are your needs? When choosing your plan, be mindful of your needs such as chronic conditions and medical expenses you may have in the future. 3 Do you need prescription drugs? Along the lines of accessing your needs think about the prescription drugs that you need or will need in the future. 4 Do you travel? If you’re a frequent traveler you may want to pick a plan that offers medical coverage overseas. 5 What is your budget? Finally, you need to determine how much you can afford to pay for Medicare.

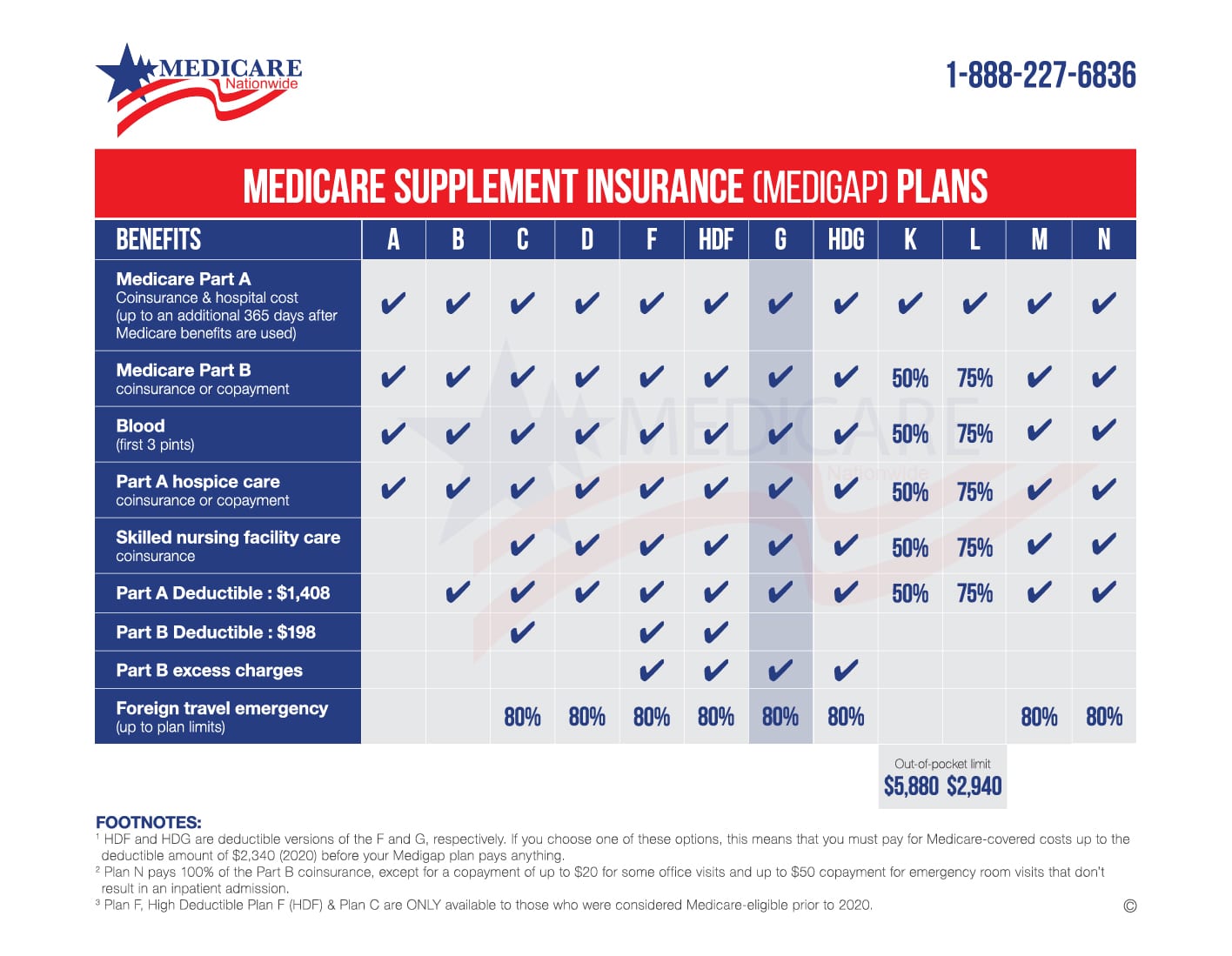

What is Medicare Supplement Insurance?

Medigap is Medicare Supplement Insurance that is designed to fill in the gaps in Original Medicare and is sold by private companies. Medigap can help pay for some of the remaining costs such as copayments, coinsurance, and deductibles.

What is Medicare Part A?

In short, Medicare Part A covers a variety of hospital services including inpatient care in a hospital. But that’s not all, Part A also covers hospice care, short-term skilled nursing facility care, some home health care, and nursing home care.

Who is Clarissa from ActiveBeat?

Clarissa is the Junior Managing Editor of ActiveBeat. She aspires to live a healthy lifestyle by staying active and eating foods that nourish her body, but she isn't afraid to indulge in a little chocolate here and there! Clarissa loves cooking, being outdoors, and spending time with her dog. In her free time, you'll find her relaxing in her hammock or curled up on the couch reading a book.

What is Medicare Advantage?

Most Medicare Advantage plans are either HMO or PPO plans, both of which have some provider limitations. Other plan offers may also come with additional provider limitations. State-specific coverage. Medicare Advantage plans cover you within the state you enrolled, typically the state you live in.

What are the disadvantages of Medicare Advantage?

Unlike original Medicare, the additional costs of an Advantage plan include in-network, out-of-network, and prescription drug deductibles, copays, and coinsurance. Provider limitations.

How much is Medicare Part B in 2021?

The monthly premium for Medicare Part B starts as low as $148.50 in 2021. If you receive Social Security payments, your monthly Medicare costs can be automatically deducted. Provider freedom. With original Medicare, you can visit any provider that accepts Medicare, including specialists.

Does Medicare Advantage save money?

Cost-effective. Medicare Advantage can help save you money. ResearchTrusted Source suggests that those enrolled in Advantage plans can save more money on certain healthcare services. In addition, all Part C plans have an out-of-pocket maximum.

What is standardized coverage?

Standardized coverage. When you enroll in a Part D plan, each plan must follow a set amount of coverage defined by Medicare. No matter how much your medications cost, you can rest assured that your plan will cover a set amount.

Does Medicare Part D cover prescription drugs?

The prescription drugs covered under Medicare Part D vary by plan. This means that you’ll need to find a plan that specifically covers your medications. In some cases, you may need to make compromises. Coverage rules. There are some prescription restrictions under Part D coverage rules.

Is Medigap a private insurance?

It is a supplemental private insurance option which can help pay for Medicare costs i.e deductibles, copays, and coinsurance. Medigap isn’t necessarily an alternative to Medicare Advantage. It is a cost-effective alternative for those who choose not to enroll in Medicare Advantage.