How are Social Security and Medicare funded?

Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income). The Social Security tax rate is higher, but there’s an upper income limit above which Social Security taxes are not levied.

Are Social Security and Medicare available to all Americans?

Both Social Security and Medicare are available regardless of income, so benefits are provided to wealthy Americans as well as those with lower incomes. That’s in contrast with Medicaid, which is only available to low-income Americans.

Does social security pay for Medicare enrollment?

However, the Social Security Administration (SSA) that manages Social Security benefits also handles enrollment for Medicare. The SSA determines the amount a person pays for their Medicare premium.

Where does the money for Medicare come from?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury.

How will Social Security and Medicare be funded?

How Are Social Security and Medicare Financed? For OASDI and HI, the major source of financing is payroll taxes on earnings paid by employees and their employers. Self-employed workers pay the equivalent of the combined employer and employee tax rates.

What taxes fund the Social Security and Medicare programs?

As you work and pay FICA taxes, you earn credits for Social Security benefits.How much is coming out of my check?6.2%1.45%FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.Think about FICA like this...SocialSecurity.gov.More items...

Who contributes to Social Security and Medicare?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Where does Medicare funding come from?

The Medicare program is primarily funded through a combination of payroll taxes, general revenues and premiums paid by beneficiaries. Other sources of revenues include taxes on Social Security benefits, payments from states and interest on payments and investments.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Who administers funds for Medicare?

The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

Who funds Social Security?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

Do federal employees pay into Social Security?

All federal employees hired in 1984 or later pay Social Security taxes. This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees. They all pay the same amount of Social Security taxes as people working in the private sector.

What percentage of your paycheck goes to Medicare?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

Is Medicare paid for by the government?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How does Medicare get paid for?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Who controls Medicare?

the Centers for Medicare & Medicaid ServicesMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

How is Medicare paid?

Medicare’s Supplementary Medicare Insurance (SMI) is paid by an authorization of Congress (ie: paid by general tax revenues in annual budgets). The amount of payroll taxes withheld for Medicare is 1.45% for employees and 1.45% for employers.

How much is Social Security tax?

Social Security. The Social Security Administration or SSA tax is 12.4% of one’s income (up to $132,900 in wages for 2019) if self-employed. For all employees, 6.2% is paid by the employer, and another 6.2% is taken out of one’s paycheck from the employee in the form of pay roll taxes.

How much is Medicare payroll tax?

The amount of payroll taxes withheld for Medicare is 1.45% for employees and 1.45% for employers. So if you earn say $50,000 a year, that’s $725 ($60.42 per month) in extra payroll taxes an employee and employer each pay annually.

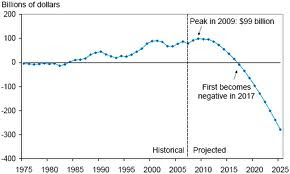

How much did Social Security contribute to the deficit?

Social Security contributed $73 Billion to the U.S. deficit just in 2014. Social Security is expected to add to the U.S. deficit every year, due mostly in part to the increased retiring of Baby Boomers. Medicare. Medicare composes 15% of the U.S. Budget (2018).

Is Social Security money taxable?

The SSA then invests the money in U.S. Treasuries in a trust fund. SSA then pays out money each year as taxable benefits. Social Security has remained an ‘off-budget’ item since 1990 and is funded no matter what tax revenues the federal government has.

Does Congress get paychecks?

Despite millions being unemployed, Congress is guaranteed to get their paychecks and their healthcare and build their retirement benefits at taxpayer’s expense. This inaction by Congress led to President Trump’s Executive Orders (EO’s) for economic relief for Americans.

Is the funding for EO's unlimited?

The funding for these EO’s are not unlimited. The funding for all this is limited to EXISTING funds and by PRIOR Congressional Acts. “the president is ready to extend enhanced federal unemployment benefits unilaterally, using unspent money from the $2 trillion CARES Act, and to renew the moratorium on evictions.”.

What is tax money for Social Security?

Tax money pays for Social Security benefits. During a person’s working life, they pay taxes into Social Security, which is then used to pay benefits. The benefits are provided for a person who meets one of the following criteria: has retired. is a survivor of a person who died.

When does Medicare start if you get Social Security?

A person’s 7-month IEP starts 3 months before the month they turn 65, includes the birthday month, and the following 3 months.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much Medicare premium for 2020?

For a person who has paid less than 40 quarters the premiums in 2020 are as follows: The premium for a person who paid for 30–39 quarters is $252.

How is Medicare Part A calculated?

The premium for original Medicare Part A is a fixed amount and is calculated on how many years a person paid Medicare taxes. The premium for Medicare Part B depends on a person’s income for the previous two years. When a person is getting Social Security benefits, the Medicare monthly premium is automatically deducted from the benefits.

How old do you have to be to get Social Security?

Age is not a factor in eligibility for Social Security benefits, and a person may apply for benefits when they are 62 years old, although they may not then get their full benefit amount. In general, a total of 40 credits is needed to qualify for benefits. That amount of credits represents 10 years of work.

Is Medicare a federal program?

While both Social Security and Medicare are federal government programs, they provide different support. Medicare is healthcare insurance while financial support is covered by Social Security. Although the two programs are separate, there are some places where they work together. In this article, we discuss Medicare and Social Security, ...

What is Medicare Supplement?

Medicare Supplement (Medigap) is an optional add-on that pays for the “gaps” in Parts A and B, such as deductibles, coinsurance, and excess charges. Recipients customize their coverage by choosing either Original Medicare (Parts A and B) or Medicare Advantage.

What percentage of your income is Social Security?

Along with income taxes, you’ll see the following amounts on your pay stub as a percentage of your income: Social Security: 6.2%. Medicare: 1.45% for most, 2.35% for incomes of $200,000 or more. Your employer will also contribute to Medicare, but that won’t affect your paycheck. 3.

What is disability income insurance?

Disability income insurance. Like Social Security disability benefits, this insurance pays out if you become disabled and can’t work. Your Social Security benefits won’t be affected by any additional disability coverage you have. But look your policy over carefully.

How old do you have to be to get Social Security?

The amount also depends on your age when you begin receiving your Social Security checks. Full Social Security retirement age is between 65 and 67, depending on when you were born. 1. You can receive benefits as early as 62, but the amount could be 25% to 30% lower.

What age do you have to be to get Medicare?

Medicare: You must be 65 or older. Social Security: Qualification age is a moving target. You can begin taking partial benefits at age 62, but your checks could be 25% or 30% lower.1 The full qualification age is between 65 and 67, depending on when you were born. Full Social Security retirement benefits.

What is Part B insurance?

Part B covers routine medical services such as doctor visits, lab testing, preventative care, and durable medical equipment (DME). Part C (Medicare Advantage) is an alternative way of receiving both Parts A and B all in one plan. Many plans also cover prescription drugs.

Is Social Security the same as Medicare?

Social Security provides monthly income checks, while Medicare provides health insurance. Although they are two separate programs with different benefits, they have similar funding methods, eligibility requirements, and enrollment steps. Together, they can provide you with the benefits you need while you’re not working.

How are Social Security and Medicare funded?

Funding for Social Security and Medicare. Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income).

When did Medicare start?

Medicare, enacted in 1965, is also a government-run program for older Americans, designed to provide health insurance coverage for anyone 65 or older who has worked – and paid Medicare taxes – for at least ten years. (You can purchase Medicare coverage if the work history is less than ten years, and coverage can also be obtained based on ...

What is Medicare payroll tax?

Together, Medicare and Social Security payroll taxes are known as FICA taxes (Federal Insurance Contributions Act taxes). Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing ...

What is the Medicare eligibility age?

Congressman Paul Ryan has proposed various Medicare reforms in budget proposals over the last few years, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryan’s proposals have failed to gain bipartisan support, but have been quite popular with Republicans. Similar proposals have been advanced ...

When do you qualify for Medicare?

Beneficiaries qualify for Medicare when they turn 65, with a seven-month enrollment window that straddles the month they turn 65. But there’s significantly more flexibility in terms of eligibility for Social Security.

Who is responsible for Medicare eligibility?

But some of the confusion stems from the fact that the Social Security Administration (SSA) is responsible for determining eligibility for Medicare and handling many of the program’s administrative functions, including enrollment. The SSA also handles the administration of Social Security benefits.

When was Social Security enacted?

Social Security, which was enacted in 1935 , is a government-run income benefit for retirees who have worked – and paid Social Security taxes – for at least ten years. Social Security also provides spousal and survivor benefits, and people under 65 are eligible for benefits if they’re disabled.

How much money has Social Security taken in?

Treasury. Throughout its history, Social Security generally has taken in more money than it paid out, generating a reserve that totaled $2.9 trillion at the end of 2019.

What percentage of Medicare income goes to trust funds?

FICA and SECA taxes also are set aside for Medicare. Payroll taxes amounting to 2.9 percent of earnings go into separate trust funds that subsidize the federal health-care program for older and disabled people. Updated February 11, 2021.

How much is FICA tax?

In 2019, those taxes — called FICA for people with wage-earning jobs and SECA for the self-employed — brought in nearly $945 billion, accounting for 89 percent of Social Security's revenue, according to the 2020 annual report from Social Security's board of trustees.

What percentage of Social Security will be paid in 2021?

In 2021, 12.4 percent of income up to $142,800 goes into the Social Security pot. Job holders and their employers split the contribution at 6.2 percent each; self-employed people pay both shares. That money goes into two Social Security trust funds, called Old-Age and Survivors Insurance and Disability Insurance.

Will Social Security be depleted by 2035?

The latest trustees’ report projects that the reserve will be depleted by 2035. That does not mean Social Security is going “broke,” as the situation sometimes is described. If reserves are exhausted, the Social Security programs will continue to pay benefits out of their annual tax revenue.

Is Social Security a savings plan?

Keep in mind. Social Security is not a savings plan. What you pay into the system does not go into an account for your retirement. Workers in each generation finance Social Security payments for their retired elders and other beneficiaries. Down the road, their benefits will be paid for in turn by younger workers.