Does AARP offer the best Medicare supplemental insurance?

Dec 04, 2021 · Hospital Services for Medicare Part A: Plan K pays only 50% (or $778) of the $1,556 Part A deductible. It pays up to $97.25, instead of $194.50, per day for days 21 to 100 for care at a skilled nursing facility. It pays only 50% of the cost of the first three pints of blood if you need a transfusion.

What are the top 5 Medicare supplement plans?

Sep 07, 2021 · The most popular Medigap plans are Plan F, Plan G, and Plan N. High-Deductible versions of Plan F and Plan G are also available. Plan F Plan F is the most comprehensive Medigap plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medigap Plan F pays the rest.

Who has the best Medicare supplement plans?

Feb 05, 2021 · What is the most popular AARP Medicare Supplement plan? When it comes to Medicare Supplement Insurance coverage, one plan option is considered the most popular. In fact, two-thirds of Medicare enrollees who purchase a Medigap plan opt for Plan F. Discover the benefits of Medigap Plan F and why this policy is so popular among baby boomers.

How to choose the best Medicare supplement plans?

Feb 03, 2022 · Plan F is the only Medigap plan to provide coverage of all nine Medigap benefit areas. This includes everything found in Plan C along with coverage of Medicare Part B excess charges. Plan G Plan G is among the most comprehensive Medigap plans. Plan G provides all of the same benefits as Plan F except for the Medicare Part B deductible. Plan K

What Medicare Supplement is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most popular Medicare plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options. Medicare Supplement Insurance is popular.Oct 6, 2021

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is Humana star rating?

Humana increased the number of contracts that received a 5-star rating on CMS's 5-star rating system from one contract in 2021 to four contracts in 2022, the most in the company's history, including HMO plans in Florida, Louisiana, Tennessee and Kentucky covering approximately 527,000 members.Oct 8, 2021

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.Nov 11, 2020

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

What is the most comprehensive Medigap plan?

Plan F is the most comprehensive Medigap plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medigap Plan F pays the rest. This leaves beneficiaries with $0 out-of-pocket expenses. Enrollees pay a monthly premium, but they don’t need to pay deductibles or copays.

What is an excellent choice for those who: Frequent doctors’ office and hospitals.

An excellent choice for those who: Frequent doctors’ office and hospitals. Live in a state that allows excess charges (if your state allows excess charges, it doesn’t mean your doctor charges them) Often travel outside the United States.

How to reduce hospital costs?

A wise option for those who: 1 Prefer predictable out-of-pocket hospital costs and rate increases 2 Reside in a state that allows excess charges 3 Enjoy traveling outside of the United States

Which states do not allow excess charges?

This will not be a concern for you if live in a state that does not allow excess charges. The states that prohibit Part B excess charges are as follows: Connecticut , Massachusetts , Minnesota , New York , Ohio , Pennsylvania , Rhode Island, and Vermont.

Is Plan G a high deductible?

Enjoy traveling outside of the United States. A high-deductible version of Plan G became available this year. It is a replacement for High De ductible Plan F. High Deductible Plan F provides identical benefits to standard Plan F (as well as a higher deductible that the beneficiary must pay in exchange for the lower premium).

Who is Lindsay Malzone?

Lindsay Malzone. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Plan G the most popular Medigap plan?

In the past, Plan F was the most popular of the Medigap plans. Now that it’s no longer available to newly eligible beneficiaries, Plan G is gaining popularity. It also makes more financial sense to many beneficiaries.

What is the most popular AARP Medicare Supplement plan?

When it comes to Medicare Supplement Insurance coverage, one plan option is considered the most popular. In fact, two-thirds of Medicare enrollees who purchase a Medigap plan opt for Plan F. Discover the benefits of Medigap Plan F and why this policy is so popular among baby boomers.

Is Blue Cross Blue Shield better than UnitedHealthcare?

And the Overall Winner in the BCBS UHC Battle is… The overall winner in this rapid fire showdown between Blue Cross Blue Shield and United Healthcare would have to be United Healthcare. UHC takes the gold over BCBS because of its true nationwide network.

Is Cobra cheaper than individual insurance?

COBRA may still be less expensive than other individual health coverage plans. It is important to compare it to coverage the former employee might be eligible for under the Affordable Care Act, especially if they qualify for a subsidy. The employer’s human resources department can provide precise details of the cost.

Is it worth it to get Cobra insurance?

One good reason to decline COBRA is if you can’t afford the monthly cost: Your coverage will be canceled if you don’t pay the premiums, period. An Affordable Care Act plan or spouse’s employer plan may be your best bet for affordable premiums. On the other hand, COBRA might be worth a little higher monthly cost.

How do you figure out what Cobra will cost?

COBRA is costly as it is calculated by adding what your employer has been contributing toward your premiums to what you’ve been paying in premiums, and then adding the service charge on top of that.

Is Cobra cheaper than Obamacare?

The cost of COBRA insurance depends on the health insurance plan you had under your employer. COBRA costs an average of $h. An Obamacare plan of similar quality costs $h—but 94% of people on HealthSherpa qualify for government subsidies, bringing the average cost down to $h.

How do I get Cobra?

Leave a company with 20 or more employees, or have your hours reduced. Private sector and state or local government employers with 20 or more employees offer COBRA continuation coverage.

What is AARP for seniors?

AARP is a nonprofit organization that works to serve the interests of people age 50 and over. AARP was founded in 1958 by Dr. Ethel Percy Andrus on three primary principles: To promote independence, dignity and purpose for older persons. To enhance the quality of life for older persons.

How many AARP plans are there in 2021?

AARP Medicare Supplement Availability. There are 8 AARP Medicare Supplement plans offered by UnitedHealthcare in 2021. Depending on where you live, you may be able to find one of the following Medigap plans: Plan A.

What is Plan L?

Plan L provides coverage for 75 percent of the costs for the Medicare Part A deductible, Part B coinsurance, hospice care coinsurance, skilled nursing facility coinsurance and the first three pints of blood.

What is a Medigap Plan A?

Medigap Plan A provides full coverage of Medicare Part A and Part B coinsurance costs, hospice care coinsurance and the first three pints of blood needed for a transfusion. Plan B. Plan B provides all of the same coverage as Plan A and also includes coverage of the Medicare Part A deductible. Plan C.

How much is AARP insurance in 2021?

You must be an AARP member and continue to pay your AARP dues. In 2021, the standard yearly price of AARP membership is $16 for your first year.

What is the difference between Plan G and Plan K?

Plan G provides all of the same benefits as Plan F except for the Medicare Part B deductible. Plan K provides coverage for 50 percent of the costs for the Medicare Part A deductible, Part B coinsurance, hospice care coinsurance, skilled nursing facility coinsurance and the first three pints of blood.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is the most comprehensive Medicare Supplement plan?

All carriers who offer Medicare Supplement plans are required to offer at least Plan A, so that will be an option for you no matter where you live. Plans C and F are the most comprehensive plans, but they are only available to beneficiaries who were eligible for Medicare prior to January 1, 2020.

What is Medicare Supplement Plan?

A Medicare Supplement plan helps you cover costs such as deductibles, coinsurance, copays, and extended hospital care. iStock. AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country.

What percentage of Medicare does Plan K cover?

To offset this coverage, Plans K and L don’t cover any Medicare services at 100 percent. Plan K covers some benefits at 50 percent, and Plan L covers some benefits at 75 percent. Your travel plans can also help you narrow down your choice of Medicare Supplement plans.

How much does it cost to enroll in AARP?

Luckily, that’s simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful attention to your enrollment period.

When is the best time to join Medicare Supplement?

The best time to join a Medicare Supplement plan — AARP or otherwise — is during your Initial Enrollment Period (IEP). During this time, you are guaranteed to be accepted into a Medicare Supplement plan, regardless of any health problems.

Does AARP pay royalty fees?

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer — UnitedHealthcare pays AARP royalty fees for the use of its name . In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy.

Is AARP the least expensive insurance?

Must be an AARP member to purchase. Plans aren’t the least expensive, but they are competitive in some areas. Often a better deal for beneficiaries who manage health conditions. Note: Some low ratings are due to customer service issues, but many of them are coverage complaints.

Popular Medigap Plans: Plan F vs. Plan G vs. Plan N vs. Plan C

While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans.

Is Medigap Plan F the Best?

There are several reasons why consumers choose certain Medigap plan options over others.

Plan G and Plan N Likely to be the Most Popular Plan Going Forward

Because Plan F and Plan C are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 2020, Plan G is now the Medigap plan option that covers more Medicare costs than any other Medigap plan available to new Medicare beneficiaries.

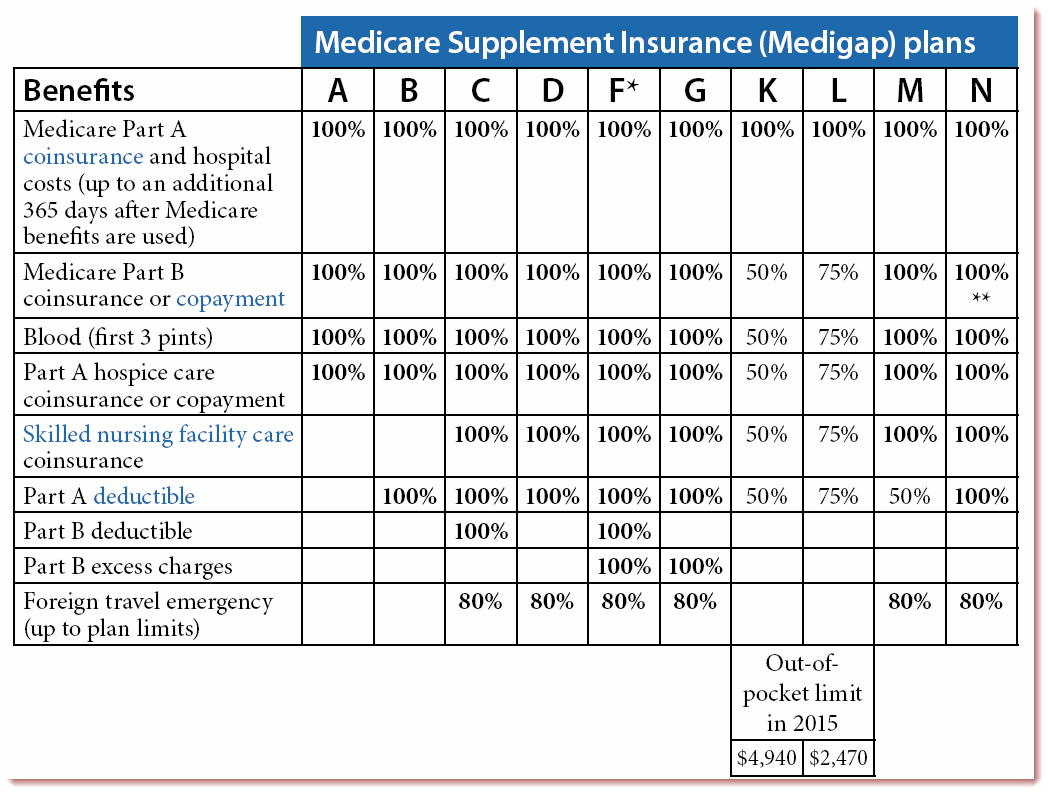

What Do the Most Medicare Supplement Plans Cover?

The chart below shows which benefits are covered by each of the 10 standardized Medicare Supplement Insurance plans available in most states. Take note of how Plan F and Plan G coverage compares to other plans, particularly plans like Plan A and Plan B.

What Do the Most Popular Medicare Supplement Plans Cost?

Although first-dollar coverage Medigap plans are the most popular, some beneficiaries may choose other plans based on their premiums and costs that they cover.

How Do Medicare Supplement Companies Determine Plan Costs?

Medicare Supplement Insurance companies can charge different premiums for policies depending on a number of factors, including age and location.

Why Should I Compare Medicare Supplement Plans?

Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

What is the most popular Medicare plan?

Plan F, Plan G, and Plan N are the most popular plans because they ensure predictable out-of-pocket Medicare costs. No matter which of these plans you choose, you know how much you’ll pay when you receive healthcare. The Medicare Plan Finder is a great resource for comparing plans in your area.

What is the most comprehensive Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is best suited for: 1 People who first became eligible for Medicare before January 1, 2020 2 People who don’t want to pay any out-of-pocket costs for covered healthcare services 3 People who see providers that don’t accept assignment and are billed for Part B excess charges

What is the most surprising thing about Medicare?

What’s the most surprising thing about Original Medicare? Most enrollees say it’s the unpredictable out-of-pocket costs. Medicare deductibles, coinsurance, and copayment costs can wreak havoc on a carefully planned budget. That’s why over 40 percent of people enrolled in Original Medicare buy a Medicare Supplement plan.

What is Plan N?

Plan N is a value-priced plan with comprehensive benefits. It covers 100 percent of your out-of-pocket costs under Part A and Part B, except for the Part B deductible and Part B excess charges. The one catch with Plan N is that you pay a small copayment each time you see a doctor or visit the emergency room.

What is the cost of Plan F?

Plan F is also available in a high-deductible option. With the high-deductible plan, you pay the first $2,340 (in 2020) of your out-of-pocket costs, then your plan covers 100 percent of your share for covered Medicare services.

When is Vermont Medicare Supplement Plan F best suited for?

Vermont. Medicare Supplement Plan F is best suited for: People who first became eligible for Medicare before January 1, 2020. People who don’t want to pay any out-of-pocket costs for covered healthcare services. People who see providers that don’t accept assignment and are billed for Part B excess charges.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.