Social Security and Medicare are two separate programs administered by the government, but funded by individuals and their employers. The government does not contribute any funds into the programs. In order to qualify for each of these programs an individual must have worked and contributed for a minimum amount of terms.

Where does the money for Medicare come from?

A SUMMARY OF THE 2021 ANNUAL SOCIAL SECURITY AND MEDICARE TRUST FUND REPORTS This year’s reports reflect the Trustees’ estimates of the effects of the COVID-19 pandemic and the ensuing recession. These events have had significant effects on the finances of both the Social Security and Medi-care programs.

How is Medicare Part B funded?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed Other sources, like these: Income taxes paid on Social Security benefits

What does the Treasury Department do with Social Security funds?

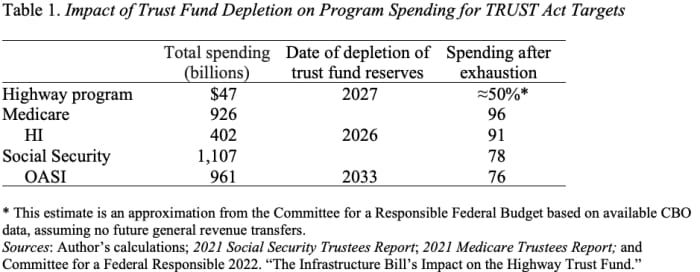

Federal government’s unified budget. In the latter context, Social Security and Medicare together accounted for 41 percent of total federal expendi-tures in fiscal year 2019. The unified budget includes current trust fund operations. Consequently, any drawdown of trust fund balances, as well as general fund transfers into Medicare’s SMI fund, increases financial pressure on the …

How is the Medicare trust fund Fund funded?

workers and people already dependent on program benefits. Social Security and Medicare together accounted for 45 percent of Fed-eral program expenditures (excluding net interest on the debt) in fiscal year 2018. The unified budget reflects current trust fund operations. Con-sequently, even when there are positive trust fund balances, any draw-

How are Social Security and Medicare funded?

Funding for Social Security and Medicare Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income).

What tax funds the Social Security and Medicare programs?

As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming out of my check? An estimated 171 million workers are covered under Social Security. FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

What fund is Social Security paid from?

The Social Security trust funds are financial accounts in the U.S. Treasury. There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits.

Who pays for Social Security and Medicare?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

Does federal taxes include Social Security and Medicare?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.Jan 13, 2022

How much money did the US collect in Social Security and Medicare taxes?

The quick answer is into the government's massive retirement fund for American workers. How massive is it? Since its inception, FICA has collected more than $20 trillion for Social Security and Medicare. Congress enacted FICA in 1935.Dec 6, 2021

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19648.LETTER TO THE NATION'S FIRST SOCIAL SECURITY BENEFICIARY INFORMING HER OF INCREASED BENEFITS--SEPTEMBER 6, 196515 more rows

Did Congress borrow money from Social Security?

The fact is that Congress, despite borrowing $2.9 trillion from Social Security, hasn't pilfered or misappropriated a red cent from the program. Regardless of whether Social Security was presented as a unified budget under Lyndon B.Feb 4, 2019

Can Social Security funds be invested?

The Social Security trust funds are invested entirely in U.S. Treasury securities. Like the Treasury bills, notes, and bonds purchased by private investors around the world, the Treasury securities that the trust funds hold are backed by the full faith and credit of the U.S. government.Sep 28, 2021

Is Medicare funded by the federal government?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

How much money is in the Social Security fund?

$2.91 trillionA 2020 annual surplus of $10.9 billion increased the asset reserves of the combined OASDI trust funds to $2.91 trillion at the end of the year. This amount is equal to 253 percent of the estimated annual expenditures for 2021....Summary: Actuarial Status of the Social Security Trust Funds.2020 report2021 reportAmount at beginning of report year (in billions)$2,897$2,90829 more rows

Is Medicare fully funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicaid in healthcare?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. programs offered by each state.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Does Medicare cover prescription drugs?

Optional benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare. Other sources, like interest earned on the trust fund investments.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What are some examples of SNF?

Examples of SNF care include physical therapy or intravenous injections that can only be given by a registered nurse or doctor. , home health care. Health care services and supplies a doctor decides you may get in your home under a plan of care established by your doctor.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

What is Medicare Part A?

The Medicare program helps pay for health care services for the aged, disabled, and individuals with end-stage renal disease. It has two sepa-rate trust funds, the Hospital Insurance (HI) Trust Fund and the Supple-mentary Medical Insurance (SMI) Trust Fund. HI, otherwise known as Medicare Part A, helps pay for inpatient hospital services, skilled nursing facility and home health services following hospital stays, and hospice care. The SMI Trust Fund consists of separate accounts for Medicare Part B and Part D. Part B helps pay for physician, outpatient hospital, home health, and other services for individuals who have voluntarily enrolled. Part D provides subsidized access to drug insurance coverage on a voluntary basis for all beneficiaries, as well as premium and cost-sharing subsidies for low-income enrollees.

How does Social Security work?

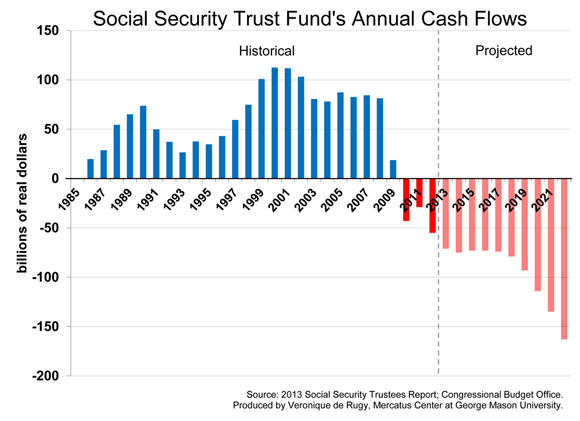

The Social Security program provides workers and their families with retirement, disability, and survivors insurance benefits. Workers earn these benefits by paying into the system during their working years. Over the program’s 84-year history, it has collected roughly $21.9 trillion and paid out $19.0 trillion, leaving asset reserves of $2.9 trillion at the end of 2018 in its two trust funds.