If you don't buy a policy right away, the plan can use medical underwriting to decide whether to accept your application. The plan will look at your age, gender, and pre-existing conditions and can charge you higher premiums, restrict coverage, or even reject your application.

Full Answer

What happens if you don’t act during the Medicare supplement enrollment period?

If you don’t act within the enrollment period, when you finally come calling supplemental plans can charge you higher prices or deny you outright, depending on which type of supplemental coverage you want. So, whether it’s a Medicare Supplement plan or Medicare Advantage coverage, you need to act in a timely way.

Can I have Medicare without supplemental insurance?

If you’re thinking about having basic Medicare without any supplemental coverage, experts have a message for you: Don’t. With deductibles, copays, coinsurance and — this is a biggie — no out-of-pocket maximum, the program has a variety of costs that make having no backup insurance a huge financial risk.

Are Medicare supplement plans worth it?

But are Medicare Supplement plans worth it? YES. Because we have many options for covering the gaps, there is no need to run around without supplemental coverage.

What happens if you don’t pay your drug plan premiums?

Keep in mind that if you’re disenrolled due to a failure to pay your premiums, you may be required to make good on your outstanding premiums before getting back on the plan you once had. Furthermore, if you go without drug plan coverage for 63 days or more, you may be liable for a Part D late enrollment penalty once you sign up for a new plan.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What happens if you don't choose a Medicare plan?

If you don't switch to another plan, your current coverage will continue into next year — without any need to inform Medicare or your plan. However, your current plan may have different costs and benefits next year.

What is the purpose of a Medicare Supplement policy?

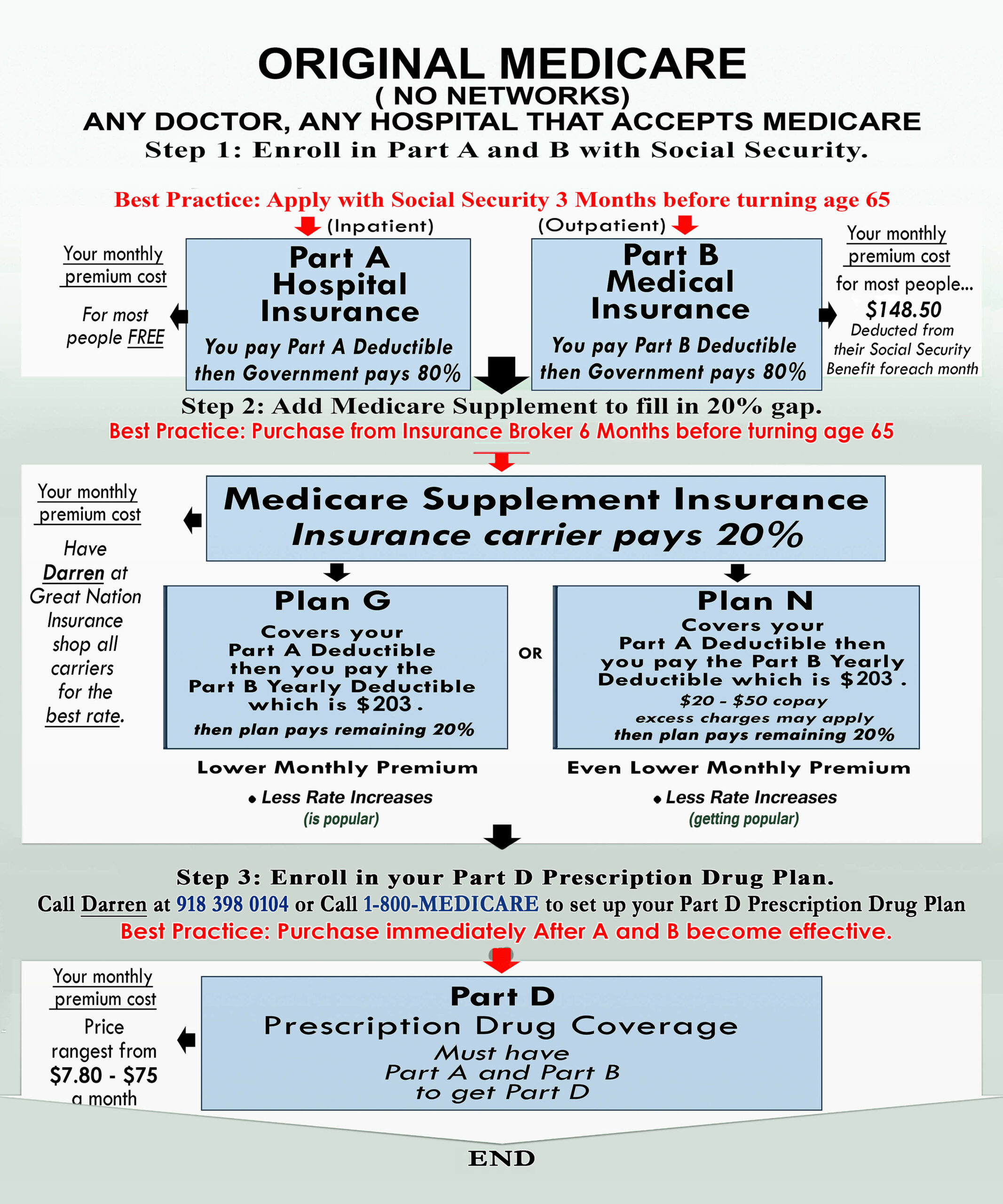

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

Why do some Medicare plans have no premium?

$0 Medicare Advantage plans aren't totally free Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What is the difference between Medicare Advantage and Medicare supplement?

Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What does a Medicare Supplement plan cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What are $0 premium plans?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage.

What is the cheapest Medicare plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately). 1 Typically, Medigap is applied to Medicare-covered services as secondary coverage.

What happens if you don't get Medigap?

If you don’t purchase Medigap during the open enrollment period or another federal or state-guaranteed issue period and have a preexisting condition, you may be denied coverage or charged higher premiums.

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Why does Medigap increase my rate?

Even if an insurer offers you a policy after Medigap open enrollment ends, it may increase your rate due to health issues and attach waiting periods for coverage for preexisting conditions.

What is a Medigap plan?

Medigap is a plan that helps cover the “gaps” in your Original Medicare coverage, while Medicare Advantage facilitates delivery of your Part A and Part B benefits. In general, compared to Medicare Advantage, Medigap plans feature: 17

How long do you have to buy back a Medigap policy?

If you drop your Medigap plan because you enrolled in Medicare Advantage, you have special rights to buy back a Medigap policy if you’re unhappy with the MA plan: You have 12 months from enrolling in the MA plan to buy back the same Medigap policy if you switch back to Original Medicare. If that policy is no longer available, you can purchase another one.

How long does Medicare Part B coverage last?

Medigap coverage is best purchased during your once-per-lifetime Medigap open enrollment period—it starts the first month you have Medicare Part B and are at least 65 years old and lasts for six months.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

How long can you enroll in Medigap without health questions?

In a couple of states of like California and Oregon, there is an annual 30-day period when you can enroll in a Medigap plan without health questions, but ONLY if you already have a Medigap plan and are switching to an equal or lesser plan. It does NOT apply to people who want to switch from no coverage or Medicare Advantage coverage over to Medigap coverage. That kind of switch generally requires you to complete a full application with health questions.

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

How much does Medicare pay for ER visits?

Then Part B Medicare only pay 80% of approved services. This means you are responsible for paying 20% of all your doctor visits, your ER visits, blood tests, X-rays, surgeries, durable medical equipment and even high-priced things like chemotherapy.

Is Medicare Advantage a good plan?

For those who may find that the premium for a Medigap plan does not fit within their budget, a Medicare Advantage Plan is a good alternative. In fact, these plans were specifically created to provide Medicare beneficiaries like yourself with an alternative to Original Medicare + Medigap.

Is Medicare Supplement optional?

Medicare supplement plans are optional but could save you big $$$ on doctor bills.

How to sign up for Medigap?

What If I Don’t Sign up for a Medigap Plan on time? 1 You’ll have to answer a set of health questions on the application 2 You will go through Medical Underwriting (they will check your medical history) 3 You might have to take a physical (this varies by insurance provider) 4 If you have a preexisting condition you may be turned down for Medigap coverage 5 If you are accepted, you may pay a higher monthly premium, called Standard Medigap plan 6 If you need services during this time you are without Medigap, you will be responsible for the gaps in Medicare coverage which could costs thousands of dollars in out-of-pocket costs each year

Do you have to answer health questions on the application?

You’ll have to answer a set of health questions on the application

Does Senior65 sell your information?

Senior65 believes in your privacy. We will not sell your personal information. This is a solicitation for insurance.

Does Medicare Advantage have an open enrollment period?

No, Medigap open enrollment only happens within 6 months of your Part B effective date. Medicare Advantage (which is very different) has an annual open enrollment but Medigap does not. If you let the 6 months pass, you have missed your Medigap open enrollment period and will be subject to the above list of bullet points. There is a Medigap Special Enrollment Period that offers guaranteed insurance for certain people who have unique situations such as their Medicare Advantage company is no longer operating.

What happens if you don't act on Medicare Supplement?

If you don’t act within the enrollment period, when you finally come calling supplemental plans can charge you higher prices or deny you outright, depending on which type of supplemental coverage you want. So, whether it’s a Medicare Supplement plan or Medicare Advantage coverage, you need to act in a timely way.

How long does Medicare Supplement last?

Your Medicare Supplement deadline is its Open Enrollment Period. Your initial OEP only lasts for six months, starting from the 1st day of the month when you’re both 65 and you join Medicare Part B. If you buy a supplement under those circumstances and during that first OEP, insurers can never deny you coverage or increase the price of your plan due to your pre-existing medical conditions, provided you maintain continuous health insurance coverage.

What If You Miss the Deadline for Medigap?

Otherwise, if you don’t act within those two situations, you face new rules. You still have the right to purchase a Medigap policy at the lowest possible rate, but only if you qualify for a Special Enrollment Period. Fortunately, there are many ways to qualify for special enrollment

What Are the Deadlines for Medicare Advantage (Part C)?

When you first become eligible for Original Medicare, you’re granted a seven-month Initial Enrollment Period to sign up for Medicare Advantage instead. Medicare Advantage plans are privately-run options that replicate Original Medicare coverage ( Parts A & B) and often offer extras like prescription coverage and gym memberships. Your IEP begins three months before the month that you turn 65, and lasts for three months after the month you turn 65 .

What If You Missed the Deadline for Medicare Advantage?

If you missed your IEP, you can still enroll in a Medicare Advantage plan during its Annual Election Period (AEP), which lasts from October 15 to December 7 every year.

How long does it take to sign up for Medicare Advantage?

When you first become eligible for Original Medicare, you’re granted a seven-month Initial Enrollment Period to sign up for Medicare Advantage instead.

How long can you be covered after retirement?

If you delay because you are still being covered at work, you can still be OK. Once you retire after 65, you have a “guaranteed issue right” for up to 63 days after the termination of your previous coverage.

What happens if you lose Medigap?

An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens:

Can insurance drop you?

This means your insurance company can't drop you unless one of these happens: You stop paying your premiums. You weren't truthful on the Medigap policy application. The insurance company becomes bankrupt or insolvent. If you bought your Medigap policy before 1992, it might not be guaranteed renewable.

Can you renew a Medigap policy?

If you bought your Medigap policy before 1992, it might not be guaranteed renewable. This means the Medigap insurance company can refuse to renew the Medigap policy. But, the insurance company must get the state's approval to cancel your Medigap policy. If this happens, you have the right to buy another Medigap policy.

How many people have no extra Medicare?

They also limit what you’ll pay out of pocket each year. Yet about 19%, or 6.1 million, who stick with basic Medicare have no extra coverage, according to a 2018 study from the Henry J. Kaiser Family Foundation. That’s risky, experts say.

What is Supplemental Coverage?

Supplemental coverage among beneficiaries with basic Medicare. In that situation, unless you have some type of employer-sponsored insurance or you get extra coverage from Medicaid, the option for mitigating your out-of-pocket costs is a Medigap policy.

How much does a 65 year old pay for medicare?

A 65-year-old male will pay anywhere from $126 to $464 monthly for a Medigap policy, according to the American Association for Medicare Supplement Insurance. For 65-year-old women, the range is $118 to $464.

What to do if you can't afford a Medigap?

CFP Carolyn McClanahan said if you can’t afford a Medigap policy, you should consider an Advantage Plan to help gird against endless medical bills. If you can find one with no premium, you’ll at least get protection from its out-of-pocket maximum — even if you have to use in-network doctors and other health facilities to avoid paying more.

How much is a Part B deductible?

That’s risky, experts say. While Part A is free for most beneficiaries, it comes with a $1,364 deductible per benefit period. And although Part B comes with a low $185 per-year deductible, you typically pay 20% of the remainder for most doctor services — including while you’re a hospital inpatient — as well as outpatient therapy and durable medical equipment such as wheelchairs or walkers.

Is there an out of pocket maximum for a backup insurance policy?

With deductibles, copays, coinsurance and — this is a biggie — no out-of-pocket maximum, the program has a variety of costs that make having no backup insurance a huge financial risk.

Does Medicare cover Part B deductible?

It’s worth noting that beginning Jan. 1, 2020, Medigap plans that are newly sold won’t be allowed to cover the Part B deductible.

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

What will happen if I don't pay my Part B premium?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment. That second bill will be due by the 25th of the following month – in this case, April 25.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

What is a good cause for Medicare?

The regulations define “good cause” as circumstances under which “ failure to pay premiums within the initial grace period was due to circumstances for which the individual had no control, or which the individual could not reasonably have been expected to foresee .” In general, this is going to be determined on a case-by-case basis, so you’ll want to reach out to Medicare as soon as possible to explain the situation. And any past-due premiums must also be paid in order to have the coverage reinstated.

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.