Medicare covers roughly 64 million older and disabled people. When the Social Security trust fund

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

What's happening to the Medicare trust fund?

Most of those who watch Medicare finances agree that the larger problem right now is how much money is being collected for the trust fund. That money largely comes from the 1.45% payroll tax paid by employees and employers. With so many people out of work because of pandemic-related shutdowns, cash flowing in has dropped dramatically.

Is Medicare going “broke?

It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026. However, that does not mean Medicare is healthy.

When will the part a trust fund run out of money?

The Committee for a Responsible Federal Budget, a nonpartisan group of budget experts focused on fiscal policy, estimates that the pandemic will cause the Part A trust fund to be unable to pay all of its bills starting in late 2023 or early 2024. "But we're still very close," said Marc Goldwein, the group's senior vice president.

What happens when Medicare runs out of money?

This matters because when spending exceeds income and the assets are fully depleted, Medicare will not have sufficient funds to pay hospitals and other providers for all Part A benefits that are provided in a given year.

What is the source of Medicare trust funds?

Why is the Department of Justice filing suit against Medicare?

How many years of Medicare payroll tax is free?

What is the CMS?

How much is Medicare payroll tax?

What is HI trust fund?

How long will a 65 year old live on Medicare?

See more

About this website

What happens when Medicare runs out of funds?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Is the Medicare trust fund running out?

Medicare's insurance trust fund that pays hospitals is expected to run out of money in 2026, the same projection as last year, according to a new report from Medicare's board of trustees.

Is Medicare financially stable?

The Medicare Hospital Insurance (HI) Trust Fund, which pays for Medicare beneficiaries' hospital bills and other services, is projected to become insolvent in 2024 — less than three years away.

How does Medicare trust fund work?

The Medicare trust fund finances health services for beneficiaries of Medicare, a government insurance program for the elderly, the disabled, and people with qualifying health conditions specified by Congress. The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

How long will the Medicare trust fund last?

2026A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026. At the time, the trustees cautioned that their calculations did not include the potential impact of COVID-19.

Is Medicare about to collapse?

The Congressional Budget Office now projects that the Medicare program will be effectively bankrupt in 2021, and its continuing growth will increasingly burden the federal budget, sinking the nation deeper into debt.

Is Medicare in a state of crisis?

Medicare is on track to become insolvent by 2024 unless actions are taken.

What will happen to Medicare in the future?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

What is the average cost of Medicare per person?

Medicare's total per-enrollee spending rose from $11,902 in 2010 to $14,151 in 2019. This included spending on Part D, which began covering people in 2006 (and average Part D spending rose from $1,808 in 2010 to $2,168 in 2019). These amounts come from p. 188 of the Medicare Trustees Report for 2020.

What are the 2 Medicare trust funds?

The Medicare trust fund comprises two separate funds. The hospital insurance trust fund is financed mainly through payroll taxes on earnings and income taxes on Social Security benefits. The Supplemental Medical Insurance trust fund is financed by general tax revenue and premiums paid by enrollees.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What does the Medicare trust fund invest in?

Hospital Insurance (HI) Trust Fund Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Medicare Will Run Out of Money in 2026, Trustees Forecast

What to Know. Medicare will become insolvent in 2026, three years earlier than previously forecast, according to the government report; The report also says Social Security will become insolvent ...

Key Medicare Fund Will Be Insolvent in Just Five Years

Medicare. Key Medicare Fund Will Be Insolvent in Just Five Years The health program won't be able to pay all of its bills starting in 2026, according to a new Trustees report.

Medicare Part A Funds to Run Out in 2026 | Kiplinger

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That’s the same year as predicted in 2020, according to a summary of the ...

One Medicare Trust Fund May Run Dry By As Early As 2022, Analysts Warn ...

Funding is shrinking for Medicare's Part A trust fund, which pays for hospitalization and in-patient care. The funding largely comes from a 1.45% payroll tax paid by employees and employers.

THE FACTS

The Medicare program is already at risk for today’s seniors, its trustees warn, and its Hospital Insurance (HI) Trust Fund is projected to be depleted by 2026 under current law.

THE TRUTH

Today, our health care system is working together to expand access to care without putting additional strain on the Medicare program seniors depend upon. The federal government just enacted the largest expansion of affordable coverage in more than a decade, and most uninsured Americans are eligible for free or subsidized health coverage.

What is the longer term outlook for Medicare financing and trust fund solvency?

Over the longer term, Medicare faces financial pressures associated with higher health care costs and an aging population. To sustain Medicare for the long run, policymakers may consider adopting broader changes to the program that could include both reductions in payments to providers and plans or reductions in benefits, and additional revenues, such as payroll tax increases or new sources of tax revenue. Consideration of such changes would likely involve careful deliberations about the effects on federal expenditures, the Medicare program’s finances, and beneficiaries, health care providers, and taxpayers.

When will the HI trust fund be depleted?

To give a recent example of how such factors play into solvency projections, in January 2020, prior to the outbreak of the COVID-19 pandemic, CBO projected that the HI trust fund would be depleted in 2025.

How is Medicare financed?

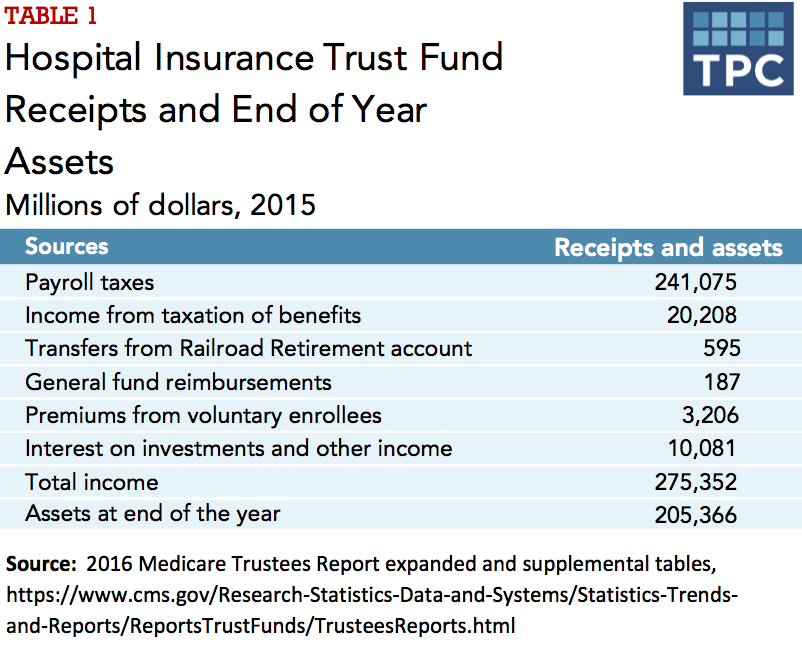

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

When is the HI trust fund projected to be depleted, and what happens if there is a shortfall?

Each year, Medicare’s actuaries provide an estimate of the year when the HI trust fund asset level is projected to be fully depleted. In the 2020 Medicare Trustees report, the actuaries projected that assets in the Part A trust fund will be depleted in 2026, just five years from now (Figure 3). A more recent projection from the Congressional Budget Office also estimated depletion of the HI trust fund in 2026.

What is the hospital insurance trust fund?

The Hospital Insurance trust fund provides financing for only one part of Medicare, and therefore represents only one part of Medicare’s financial picture. While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund. The revenues for Medicare Parts B and D are determined annually to meet expected spending obligations, meaning that the SMI trust fund does not face a funding shortfall, in contrast to the HI trust fund. But higher projected spending for benefits covered under Part B and Part D will increase the amount of general revenue funding and beneficiary premiums required to cover costs for these parts of the program in the future.

How much is the HI trust fund in 2021?

For example, in 2021, the Medicare actuaries estimated that the HI trust fund would begin the year with $185 billion in assets, but because spending is estimated to exceed revenue by $15 billion this year, the trust fund is expected to end the year with $170 billion in assets (Figure 2). By 2025, assets in the trust fund at the beginning of the year will have decreased to $73 billion, and with $50 billion more in spending than in revenues that year, assets will drop to $23 billion by the end of 2025. And by 2026, the $23 billion in assets in the HI trust fund at the start of the year is projected to be insufficient to cover the shortfall between projected spending and revenues, leading to a deficit of $31 billion by the end of that year.

How much would Medicare increase over 75 years?

Over a longer 75-year timeframe, the Medicare Trustees estimated that it would take an increase of 0.76% of taxable payroll over the 75-year period, or a 16% reduction in benefits each year over the next 75 years, to bring the HI trust fund into balance.

How does a trust fund get into trouble?

There are two ways the trust fund can get into trouble: Either the money flowing in is too little, or the payments going out for care are too much. Most of those who watch Medicare finances agree that the larger problem right now is how much money is being collected for the trust fund.

What would happen if a trust fund went insolvent?

It is important to remember that the fund becoming "insolvent" is not the same as being "bankrupt." Insolvent means the Trust Fund would still have money flowing in, but not enough to pay for all the care Medicare patients will consume.

When will Medicare run dry?

One Medicare Trust Fund May Run Dry By As Early As 2022, Analysts Warn : Shots - Health News With millions of people out of work because of the coronavirus pandemic, fewer payroll taxes are coming in to help keep Medicare's trust fund intact.

How much money was given to hospitals in the Cares Act?

At least $60 billion of the funding provided as part of the CARES Act to help hospitals weather the pandemic came not from the general treasury, but from the Trust Fund itself. That money in " accelerated and advance payments " is supposed to be paid back, via a reduction in future payments.

When will the Part A fund be unable to pay its bills?

The Committee for a Responsible Federal Budget, a nonpartisan group of budget experts focused on fiscal policy, estimates that the pandemic will cause the Part A trust fund to be unable to pay all of its bills starting in late 2023 or early 2024.

When will the trust fund become insolvent?

Given even a conservative estimate of how many workers and businesses would not be contributing payroll taxes that finance Part A spending, he said, the trust fund could become insolvent as early as 2022 or 2023.

Is Medicare Part B insolvent?

(Medicare Part B, which pays physicians and other outpatient costs, is funded by beneficiary premiums and general tax funding, so it cannot technically become insolvent.)

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

When will Medicare insolvency happen?

Insolvency projections for the Medicare Hospital Insurance Trust Fund have varied over the years, with current estimates projecting insolvency in 2026.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

What is the foundation of financial security for older Americans?

With the insolvency clock ticking, the Biden administration and Congress will need to act soon. Medicare, along with Social Security, is the foundation of financial security for older Americans.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

When will the Congressional Budget Office deplete?

Last September, the Congressional Budget Office (CBO) forecast depletion in 2024. In February 2021, the CBO pushed back that date to 2026 due to improved prospects for stronger economic growth and higher employment rates.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

What is Medicare report?

The report is an annual exercise designed to review the health of the nation’s biggest health insurance program. It looks in detail at each of Medicare’s pieces, including Part A inpatient hospital insurance; Part B coverage for outpatient hospital care, physician services, and the like; Part C Medicare Advantage plans; and Part D drug insurance.

Will Medicare costs increase in the next 75 years?

So we face what the economists like to call an asymmetric risk: It is possible that future Medicare costs will grow more slowly than predicted, but it is more likely that they’ll be significantly higher than the trustees forecast .

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How many years of Medicare payroll tax is free?

Premiums are free for people who have contributed 40 quarters (10 years) or more in Medicare payroll taxes over their lifetime. They have already paid their fair share into the system, and their hard work even earns premium-free coverage for their spouse. 3

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

What is HI trust fund?

The Medicare HI trust fund supports Medicare Part A. This part of Medicare pays for inpatient hospital care as well as hospice. For people who are discharged from the hospital, it also covers short-term stays in skilled nursing facilities or, as an alternative for people who choose not to go to a facility, it covers home healthcare services.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.