Your healthcare provider can’t waive or discount your deductible because that would violate the rules of your health plan. But they may be willing to allow you to pay the deductible you owe over time. Be honest and explain your situation upfront to your healthcare provider or hospital billing department.

Full Answer

Do Medicare Advantage plans have a deductible?

Medicare Advantage plans provide the same benefits as Medicare Part A and Part B in one plan and serve as an alternative way to get Original Medicare coverage. Medicare Advantage plans may have their own deductible, but you will not be responsible for the Medicare Part B deductible if you are enrolled in a Medicare Advantage plan.

What happens when you pay a Medicare deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). . The type of health care services you need and how often you get them.

What happens if you don’t pay Medicare premiums?

For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

Can My Medicare Advantage plan Drop Me due to a condition?

If you currently have a Medicare Advantage plan, you might be concerned that a change in circumstances could cause the plan to drop you and leave you without coverage. The good news is that Medicare Advantage can’t drop you due to a health condition or disease.

What happens if you don't have enough money to pay for Medicare?

Medicaid and Medicare coverage assistance You might be able to get assistance from your state to help pay for medical care–even if you have Medicare coverage. Depending upon your income, you may be eligible for Medicaid.

Do you have to meet a deductible on Medicare?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments. What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What does the deductible mean in Medicare Advantage plans?

A deductible is the amount you must pay before your plan begins to pay. Some Medicare Advantage plans have separate deductibles for medical care and prescription drugs. If your Medicare Advantage plan has a network, only in-network care may apply towards the deductible.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

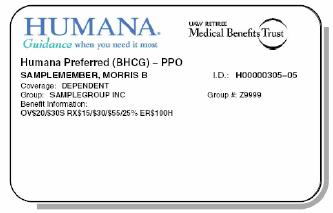

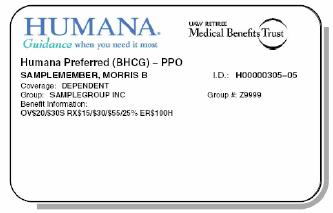

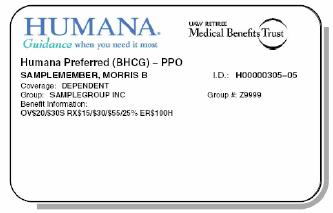

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What does out-of-pocket mean with Medicare Advantage plans?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits.

What is the 2022 deductible for Medicare?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare deductible for 2020?

In 2020, the Medicare Part B deductible is $198 per year.

What was the Medicare deductible for 2019?

In 2019, the Medicare Part B deductible is $185 per year.

What counts toward the Medicare Part B deductible?

Basically, any service or item that is covered by Part B counts toward your Part B deductible.

What happens once you reach the deductible?

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and i...

Is there a way to avoid paying the Medicare Part B deductible?

There are two ways you may be able to avoid having to pay the Medicare Part B deductible: Medicare Supplement Insurance or a Medicare Advantage plan.

What are Medicare Savings Programs?

Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limit...

How do I apply for Medicare Savings Programs?

Eligibility for MSPs is determined by your state Medicaid office, as the funding for MSPs comes from the Medicaid program. Medicaid is jointly run...

Do you have to apply for an MSP during Medicare's annual election period?

No. You can apply for MSP assistance anytime. As noted above, you’ll do this through your state’s Medicaid office, which accepts applications year-...

Is there financial help for Medicare Part D coverage?

Medicare offers “Extra Help” for Medicare enrollees who can’t afford their Part D prescription drug coverage. If you’re a single person earning les...

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

What will happen if I don't pay my Part B premium?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment. That second bill will be due by the 25th of the following month – in this case, April 25.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

What is a good cause for Medicare?

The regulations define “good cause” as circumstances under which “ failure to pay premiums within the initial grace period was due to circumstances for which the individual had no control, or which the individual could not reasonably have been expected to foresee .” In general, this is going to be determined on a case-by-case basis, so you’ll want to reach out to Medicare as soon as possible to explain the situation. And any past-due premiums must also be paid in order to have the coverage reinstated.

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

How much would Medicare pay if you met the Part B deductible?

Medicare would then pay the remaining $64.

What is the Medicare Part A deductible for 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period .

What counts toward the Medicare Part B deductible?

Basically, any service or item that is covered by Part B counts toward your Part B deductible.

What happens once you reach the deductible?

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and items for the remainder of the year.

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

What percentage of Medicare coinsurance is 20 percent?

A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent. It’s worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

What is extra help for Medicare?

Medicare offers “ Extra Help ” for Medicare enrollees who can’t afford their Part D prescription drug coverage. In 2020, if you’re a single person earning less than $1,615 per month ($2,175 for a couple), with financial resources that don’t exceed $14,610 ($29,160 for a couple), you may be eligible for “Extra Help.”.

What are Medicare Savings Programs?

Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets. There are four different types of MSPs, and they provide varying benefits. Two of the MSPs only help to pay Medicare Part B premiums (but not Part A premiums or Medicare cost sharing), and one MSP helps disabled working individuals pay their Part A premiums.

What is QMB in Medicare?

Qualified Medicare Beneficiary Program (QMB). Helps to pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. This is the most robust MSP, and has the lowest income limits for eligibility. A single person can qualify in 2021 with an income of up to $1,094 per month ($1,472/month for a couple).

Is Medicare a dual program?

Medicare-Medicaid dual eligibility. People who are eligible for MSPs are covered by Medicare, but receive assistance with premiums (and in some cases, cost-sharing) from the Medicaid program. But some low-income Medicare enrollees are eligible for full Medicaid benefits, in addition to Medicare. About 20 percent of Medicare beneficiaries are dually ...

Does MSP pay Medicare?

Two of the MSPs only help to pay Medicare Part B premiums (but not Part A premiums or Medicare cost sharing), and one MSP helps disabled working individuals pay their Part A premiums.

Does Medicare cover nursing home care?

Medicare does not cover custodial long-term care, but Medicaid does, if the person has a low income and few assets. The majority of the people living in American nursing homes are covered by Medicaid (virtually all of them are also covered by Medicare).

Do you have to apply for an MSP during Medicare's annual election period?

No. You can apply for MSP assistance anytime. As noted above, you’ll do this through your state’s Medicaid office, which accepts applications year-round.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

Who accepts Medicare?

who accepts. assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What happens if you don't pay your Medicare premiums?

For example, if you don’t pay your premiums within the plan’s grace period for nonpayment, you can be dropped. Your plan can also drop you if it’ll no longer be offered in your area or through Medicare. Read on to learn more about why Medicare Advantage plans may end your coverage, how to find a new plan, and more.

Why won't my Medicare Advantage plan drop me?

Loss of coverage. Eligibility. Special Needs Plans. Finding new coverage. Takeaway. A Medicare Advantage plan can’t drop you because of a health condition or disease. Your plan may drop you, though, if you fail to pay your premiums within a specified grace period. You might also lose your plan if it’s no longer offered by the insurance company, ...

What happens if my Medicare Advantage plan changes?

If your Medicare Advantage plan changes, you will be given the opportunity to enroll in a new plan or go back to original Medicare.

What is Medicare Advantage?

Medicare Advantage plans vary, but most include coverage for prescription drugs, as well as vision and dental care. Medicare Advantage plans are guaranteed issue. This means you’re guaranteed acceptance into the plan, provided you live in the plan’s service area and are eligible for original Medicare.

When will Medicare Advantage be available for ESRD?

The new law allows individuals with ESRD to be eligible for Medicare Advantage plans, starting January 1, 2021. If you also qualify for an SNP, though, you might still prefer the coverage this type of plan provides.

When will Medicare leave?

It will let you know that your plan is leaving Medicare in January of the next calendar year and will give you information about your options for coverage.

When does Medicare open enrollment start?

This takes place from January 1 through March 31 each year for people with an active Medicare Advantage plan.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is a Medicare deductible?

A Medicare deductible is the amount you must pay for health care services (excluding premiums) before your coverage begins to kick in.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month. 1

How often is Medicare paid?

Premiums exist for each part of Medicare. Premiums are typically paid monthly, but in some cases, they may be paid quarterly or yearly.

What to do if you can't afford to pay a percentage of your bill?

If you can’t afford to pay even a percentage of your full bill immediately, try asking for a 25% discount if you make a large down payment now. A less aggressive strategy is to ask if the provider will charge you the discounted fee that Medicare or Medicaid pays.

Why are medical bills not paid?

It’s not a personal failure, however; it’s a common affliction. In the U.S. some people are not paying their medical bills because they literally can't afford them.

What to say when paying 30%?

On its website, Medical Billing Advocates of America recommends starting by asking for an aggressive discount for immediate payment, saying something like, “If I pay you 30% right now, will you write off the rest ?” This strategy can work because your provider will save time and money if it doesn’t have to pursue payment from you for months or years.

Why is it important to review medical bills?

Because medical bills often contain costly mistakes, it may be a good idea to review them carefully.

What is a medical billing advocate?

Medical billing advocates are insurance agents, nurses, lawyers, and healthcare administrators who can help decipher and lower your bills. They’ll look for errors, negotiate bills, and appeal excessive charges. Expect to pay an advocate around 30% of the amount by which your bill is reduced.

Why are people not paying their medical bills?

In the U.S. some people are not paying their medical bills because they literally can't afford them. According to a 2019 report from T he Journal of General Internal Medicine, About 137.1 million U.S. adults faced financial hardship due to medical bills.

How to respond to medical debt?

People commonly respond to medical debt by delaying vacations, major household purchases, cutting back on household expenses, working more, borrowing from friends and family, and tapping retirement or college savings accounts. If you’re faced with medical debt you can’t pay, try these tips for reducing what you owe so you can minimize ...