If you get dropped from a Medicare Advantage plan, you’re automatically re-enrolled in Original Medicare (Parts A and B). If you want to buy a new Advantage plan, you’ll have to wait until the next enrollment period. Medicare Part D

Medicare Part D

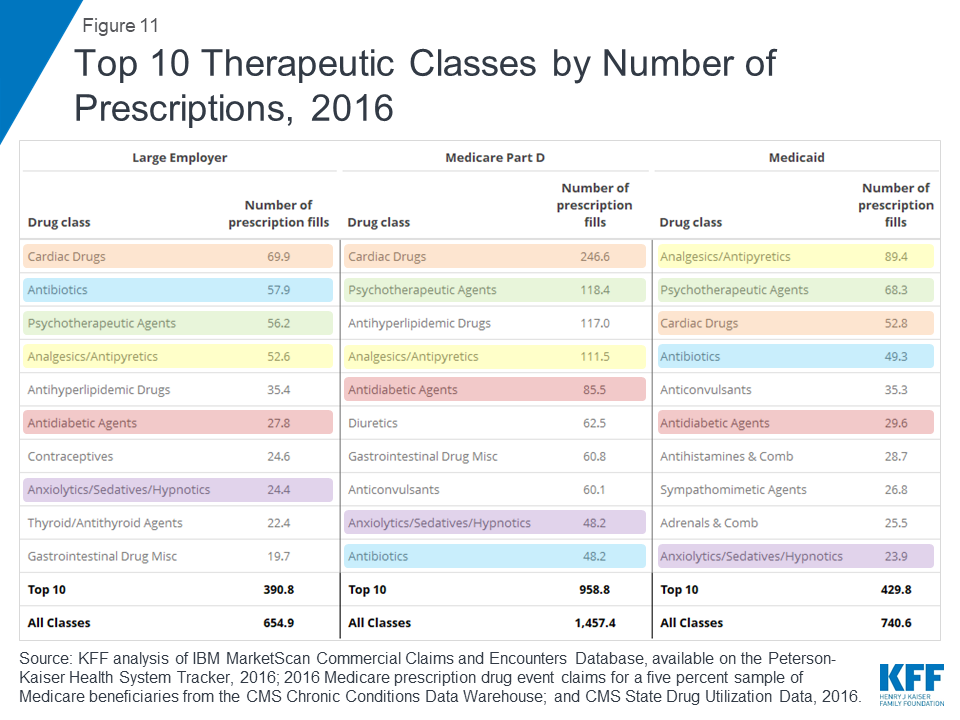

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

What would happen if I drop Medicare coverage?

- You get health benefits from a new job. You can opt out of Part B after being enrolled in it if your situation changes and you begin getting health coverage ...

- You become eligible for TRICARE or VA drug coverage. ...

- You move out of the United States. ...

- You decide you just want out of your plan. ...

How to reinstate Medicare coverage?

- Review information currently on file.

- Upload your supporting documents.

- Electronically sign and submit your revalidation online.

Can your Medicare coverage be taken away?

Reasons your Medicare benefits could be taken away. Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability; You fail to pay your plan premiums; You move outside your plan’s coverage area; Your plan is discontinued

How do I Change my Medicare coverage?

To ensure correct payment of your Medicare claims, you should:

- Respond to Medicare Secondary Claim Development Questionnaire letters in a timely manner.

- Tell the BCRC about any changes in your health insurance due to you, your spouse, or a family member’s current employment or coverage changes. ...

- Tell your doctor and other health care providers if you have coverage in addition to Medicare.

Can Medicare cancel my coverage?

If you do not pay your premium by the 25th day of that month, your Medicare coverage may be terminated. For other types of Medicare plans such as Medicare Advantage, Medicare Part D or Medicare Supplement Insurance, the protocol for termination may vary by carrier.

What happens if you don't pick a Medicare plan?

If you don't switch to another plan, your current coverage will continue into next year — without any need to inform Medicare or your plan. However, your current plan may have different costs and benefits next year.

Can a person decline Medicare Part A?

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and won't cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so.

What happens if I disenroll from Medicare Part A?

To disenroll after turning 65, you are required to pay back all of the money received from Social Security as well as any Medicare benefits paid. You can re-enroll at any time by calling Social Security at 1-800-772-1213 or visiting your local SSA office.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do you have to pick a Medicare plan every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Can I collect Social Security and not have Medicare?

Yes, many people receive Social Security without signing up for Medicare. Most people aren't eligible for Medicare until they turn 65. As you can start collecting Social Security retirement benefits at 62, individuals may have Social Security without Medicare for several years.

Can you cancel Medicare coverage at any time?

Canceling your Medicare Supplement insurance plan and getting a new one. You may want to cancel your Medicare Supplement insurance plan because you want to switch to a different plan. You can cancel the plan anytime as long as you notify your health insurance company in writing.

What is the penalty for canceling Medicare Part B?

Your Part B premium penalty is 20% of the standard premium, and you'll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

Can Medicare be reinstated?

A member may also ask to get their coverage back through reinstatement under Medicare's “Good Cause” policy, if the member can show a good reason for not paying the premiums within the grace period, like an emergency or unexpected situation that kept a member from paying their premium on time.

Why won't my Medicare Advantage plan drop me?

Loss of coverage. Eligibility. Special Needs Plans. Finding new coverage. Takeaway. A Medicare Advantage plan can’t drop you because of a health condition or disease. Your plan may drop you, though, if you fail to pay your premiums within a specified grace period. You might also lose your plan if it’s no longer offered by the insurance company, ...

When will Medicare leave?

It will let you know that your plan is leaving Medicare in January of the next calendar year and will give you information about your options for coverage.

What is Medicare Advantage?

Medicare Advantage plans vary, but most include coverage for prescription drugs, as well as vision and dental care. Medicare Advantage plans are guaranteed issue. This means you’re guaranteed acceptance into the plan, provided you live in the plan’s service area and are eligible for original Medicare.

What happens if you miss Medicare open enrollment?

If you miss both your special enrollment window and open enrollment, your coverage will continue automatically through original Medicare. Because your Medicare Advantage plan will no longer be active, you won’t be able to enroll in a new Advantage plan during Medicare Advantage open enrollment.

What happens if you don't pay your Medicare premiums?

For example, if you don’t pay your premiums within the plan’s grace period for nonpayment, you can be dropped. Your plan can also drop you if it’ll no longer be offered in your area or through Medicare. Read on to learn more about why Medicare Advantage plans may end your coverage, how to find a new plan, and more.

What is a D SNP?

D-SNPs are designed to help individuals who have very low incomes and other issues receive optimum support and medical care.

When will Medicare Advantage be available for ESRD?

The new law allows individuals with ESRD to be eligible for Medicare Advantage plans, starting January 1, 2021. If you also qualify for an SNP, though, you might still prefer the coverage this type of plan provides.

What happens if you lose Medigap?

An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens:

Can insurance drop you?

This means your insurance company can't drop you unless one of these happens: You stop paying your premiums. You weren't truthful on the Medigap policy application. The insurance company becomes bankrupt or insolvent. If you bought your Medigap policy before 1992, it might not be guaranteed renewable.

What happens if Medicare Supplement is discontinued?

If your Medicare Supplement Insurance plan is discontinued, you should be granted enrollment in a new plan under guaranteed issue rights, which means no medical underwriting would be used in your application process.

Why did Medicare take away my benefits?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan’s coverage area. Your plan is discontinued.

What happens if you lose Medicare Part A?

This means that if you lose Medicare Part A or Part B because of failing to pay plan premiums, you may also lose your private Medicare plan coverage. Be sure to contact your plan carrier for more information.

Why is Medicare not being offered?

There are a variety of reasons why a Medicare plan might cease being offered, and all of them could mean that your private coverage is taken away. Low-performing Medicare Advantage or Medicare Part D plans may be discontinued by the Centers for Medicare and Medicaid Services (CMS). A private insurer may decide to restructure their plan offerings ...

How to contact a licensed insurance agent?

Call a licensed insurance agent today at. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week to get started with a free, no-obligation plan quote. Every five minutes, we help someone enroll in a plan. 1 And we can help you too.

What happens if you don't pay Medicare?

If you do not pay by the deadline indicated on the Second Notice, you will receive a Delinquent Notice.

Can Medicare take away your coverage?

Some Medicare Advantage plans could also potentially take away your coverage if you engage in “disruptive behavior.”. The definition of disruptive behavior could vary depending on your plan provider, but it generally means engaging in any type of behavior that impairs the insurers ability to arrange for or provide care for you or other plan members.

Why You Could Potentially Lose Medicare Benefits

First, there are multiple reasons why you might lose Medicare coverage, most of which are your responsibility.

Termination for Nonpayment

Most plans allow a grace period, which they’ll specify before payment is deemed outstanding. This period usually happens around two months after the due date. If you haven’t paid your premiums by the end of the grace period, your plan could be terminated. If you think your plan was wrongly removed, you may appeal the decision.

Medicare Advantage (Part C) Termination

If you get dropped from a Medicare Advantage plan, you’re automatically re-enrolled in Original Medicare (Parts A and B). If you want to buy a new Advantage plan, you’ll have to wait until the next enrollment period.

Medicare Part D Termination

If you get “Extra Help,” and your prescription drug coverage plan is cut off, Medicare will send you a Reassignment Notice. You should receive this via mail in October. The notice says that you’ll be reassigned to a new Part D plan for the following year. You can decide to join a new program on your own after comparing your insurance options.

Medigap Termination

Medicare Supplement (Medigap) plans can drop you if you don’t pay premiums, provide false info on your application, and if the carrier goes bankrupt. What’s unique about Medigap policies is that they’re guaranteed renewable .

Has Your Plan Been Terminated? We Can Help

If your Medicare coverage has been terminated and you’re not sure how to regain it, don’t fear. We want to answer any questions and help you find a new plan. Contact Trusted Senior Specialists today.

How long do you have to apply for Medigap after you leave Medicare?

You have up to 123 days after your Medicare Advantage plan benefits actually end to apply for a guaranteed issue Medigap policy.

What happens if my MA plan stops?

If Your MA Plan Stops Providing Benefits in Your Area. If your MA plan stops providing benefits in your area at the end of the year, you have the right — regardless of age or health condition — to join another MA plan if one is available where you live, or to return to Original Medicare and join a Part D plan. ...

When is open enrollment for MA?

Note that this SEP gives you another chance to enroll in an MA or Part D plan in addition to the Annual Election Period, also known as Open Enrollment, from October 15 through December 7, when you can switch, enroll in or disenroll from MA and Part D plans.

When do MA plans have to change?

MA plans must get permission from the Centers for Medicare and Medicaid Services (CMS) before making any changes, and notify their members by early October of changes effective January 1 of the following year. MA plans are required to provide all Medicare-covered services.

Can Medicare Advantage change benefits?

At the beginning of each calendar year, Medicare Advantage (MA) plans can make changes to their benefits, premiums, copayments and geographic service areas. They must notify their members every fall of the changes they intend to make the following year. They can add or drop benefits, change premiums and copayments, ...

When are MA plans effective?

Any plan changes made before December 31 are effective January 1. Plan changes made after December 31 are effective the first day of the following month. If you switch to a new MA plan, make sure your doctor, the medical group that provides your care and your local hospital are all in the new MA plan network and plan to stay in it.

Do MA plans have to be covered by Medicare?

MA plans are required to provide all Medicare-covered services. They are not required to offer additional benefits, remain in business in certain areas, or continue their contracts with certain doctors or hospitals.

How much is the average prescription drug premium for 2020?

While the premiums vary for prescription coverage, the average for 2020 is about $42.

How much is Medicare Part B?

The standard monthly premium for Part B this year is $144.60, which is what most Medicare beneficiaries pay. (Part A, which is for hospital coverage, typically comes with no premium.) The surcharge for higher earners ranges from $57.80 to $347, depending on income.

How many people are on medicare?

Roughly 62 million people are on Medicare, the majority of whom are age 65 or older. In addition to premiums for certain parts of the program, beneficiaries pay deductibles and other out-of-pocket costs. Amid one of the worst public-health crises in history, a record number of Americans are without health insurance. John Fedele.

How many Medicare beneficiaries have experienced income loss?

More than a third (37% ) of Medicare recipients have experienced income loss due to the coronavirus crisis, according to a recent survey from ehealth.com. Younger beneficiaries are more likely to have suffered: 40% of respondents age 65 to 70 said they have experienced an income loss, compared with 30% of those age 80 or older.

Why are Social Security offices closed?

However, local Social Security offices are closed because of the coronavirus pandemic, and there are long waits to get through on the phone, said Patricia Barry, author of “Medicare for Dummies.”. The alternative is to appeal via an online form you can download and mail in.

Does Part D insurance automatically cover prescription drugs?

Help for Part D prescription drug coverage also is typically automatic if you qualify for one of the programs. Johnson recommends that beneficiaries who are struggling to pay their Medicare costs reach out to their state health insurance assistance program, or SHIP, as options can vary from state to state.

Can I pay Part B out of pocket?

On the Money. Depending on which program you qualify for, your Part B (outpatient care coverage) premiums could be paid, as well as other out-of-pocket costs such as deductibles, coinsurance and copayments. Help for Part D prescription drug coverage also is typically automatic if you qualify for one of the programs.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.

How long is the grace period for Part C and D?

All Part C and D plans must have a grace period that’s at least two months in length, and some plans have a longer grace period. If you fail to make a premium payment, your plan must send you a written notice of non-payment and tell you when your grace period ends.

When is Medicare Part B due?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.