If you cannot afford Medicare, and you are low income, you can apply for a reduction in your costs through one of several different programs through Medicare or Medicaid. These programs help pay for deductibles, copays, coinsurance, and Medicare premiums. Your income determines the level of help that you can qualify for.

Full Answer

What if I Can’t afford Medicare’s Premiums?

Is there help for me if I can’t afford Medicare’s premiums? Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets. Reviewed by our health policy panel .

What happens if I don’t pay my second Medicare bill?

If your second bill remains unpaid by its due date, you’ll receive a delinquency notice from Medicare. At that point, you’ll need to send in the total overdue amount by the 25th of the following month to avoid losing coverage.

Do you qualify for help paying for Medicare?

You may qualify for certain government and private programs that offer help paying for some of the out-of-pocket costs associated with Medicare. Take a look at some of these programs and find out if you're eligible.

Can I enroll in Medicare if I’m on a lower fixed income?

You can enroll in original Medicare or Medicare Advantage even if you’re on a lower fixed income. Financial assistance programs and cost-reducing strategies will help you. Here are six ways to keep your health plan without breaking your budget.

How can I get my Medicare payments lowered?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How can I avoid paying $144 for Medicare?

Four ways to save money on your Medicare Part B premiumsSign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

How much money can you make and not have to pay for Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What does Part B give back mean?

The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Why is my Medicare bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Does Medicare look at your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Does everyone have to pay for Medicare?

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check.

What are Medicare Savings Programs?

Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limit...

How do I apply for Medicare Savings Programs?

Eligibility for MSPs is determined by your state Medicaid office, as the funding for MSPs comes from the Medicaid program. Medicaid is jointly run...

Do you have to apply for an MSP during Medicare's annual election period?

No. You can apply for MSP assistance anytime. As noted above, you’ll do this through your state’s Medicaid office, which accepts applications year-...

Is there financial help for Medicare Part D coverage?

Medicare offers “Extra Help” for Medicare enrollees who can’t afford their Part D prescription drug coverage. If you’re a single person earning les...

What is the number to call for Medicare?

1-800-557-6059 | TTY 711, 24/7. These programs include: Medicare Savings Programs. Extra Help. Medicaid. Programs of All-Inclusive Care for the Elderly (PACE) Take a look at some of these programs and find out if you’re eligible.

How many types of Medicare savings programs are there?

There are four types of Medicare Savings Programs, each with its own qualifications and benefits. All help cover Medicare premiums and the associated out-of-pocket costs.

What are the programs that help pay for out-of-pocket expenses?

Medicare Extra Help, Medicare Savings Programs, Medicaid and PACE. You may qualify for certain government and private programs that offer help paying for some of the out-of-pocket costs associated with Medicare. Take a look at some of these programs and find out if you're eligible. Original Medicare (Part A and Part B) helps make healthcare more ...

How old do you have to be to qualify for a PACE?

To qualify for PACE, you must: Be at least 55 years old. Live in a PACE service area.

What is medicaid for?

Medicaid is a government assistance program available to those with limited incomes. It can be used alongside Medicare to help pay for health care expenses that aren’t covered by Original Medicare, such as personal and nursing home care services. Medicaid eligibility requirements vary by state.

What is Supplemental Security Income?

Supplemental Security Income. This federal program offers cash benefits to seniors and disabled adults and children. The benefits can be used to pay for basic living expenses. You must meet certain income restrictions to qualify.

Is Medicare out of pocket?

However, there are still out-of-pocket costs associated with Medicare, such as premiums, deductibles, coinsurance and more. You may qualify for certain government and private programs that offer help paying for these costs.

How much does prescription benefit cover in 2021?

As of April 1, 2021, if you are 65 or older, your countable income must be less than $5,367/month (for an individual) or $7,258/month (for a couple). If you are under age 65 ...

What are the resources for Medicare?

Your income and resources must be low enough to use these programs. Resources are things you own, like savings accounts, jewelry, a boat, stock, etc.

What is the Social Security Extra Help Program?

The Social Security Administration offers the Extra Help program to help pay for some Medicare Part D costs. Extra Help can help pay premiums, deductibles, coinsurance, and copayments. In 2021, your "countable income" must be less than $19,320/year (for an individual) or $26,130/year (for a couple with no other dependents). ...

How much is the MassHealth Part A premium in 2021?

If you have a Part A premium, MassHealth may help pay your premium also. As of March 2021, if you are single, your “countable income” must be less than $1,771/month and the things you own must be worth less than $15,940.

When is the best time to buy a Medigap policy?

The best time to buy a Medigap policy is during the 6-month period that begins when you are 65 and first enroll in Part B.

Does MassHealth pay for Medicare?

If you get MassHealth, it will pay your Part B premium and your Medicare prescription drug coverage, Medicare Part D. You may also be able to get help paying out-of-pocket co-payments to doctors and hospitals. If you have a Part A premium, MassHealth may help pay your premium also.

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.

Where is Medicare available?

Medicare financial assistance is available to those with limited incomes and resources living in the U.S. territories of Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. Territory programs may vary.

What is Medicaid for Medicare?

Medicaid is a federal and state program that helps reduce the costs associated with health care that are usually not covered by Original Medicare, such as nursing home care and personal care services. It is for those with limited income and resources.

What is extra help for medicaid?

If you qualify for Medicare cost assistance in your state, you automatically qualify for the Extra Help program, which helps pay for prescription drug coverage under Medicare Part D.

What are some programs that help reduce the cost of health care?

Medicare Savings Programs. Programs of All-inclusive Care for the Elderly. Pharmaceutical Assistance Program.

What does an orange Medicare notice mean?

An Extra Help “Notice of Award” from Social Security. An orange Medicare notice that says your co-payment amount will change next year. A Supplemental Security Income (SSI) award letter as proof you have SSI.

What is a bill from a nursing home?

A bill from an institution (such as a nursing home) or a copy of a state document showing Medicaid paid for your stay for a month or more. A print-out from the state Medicaid system showing that you lived in the institution for a month or more and Medicaid paid for it.

Can I get QI if I qualify for medicaid?

You cannot access QI benefits if you qualify for Medicaid. Qualified Disabled and Working Individuals (QDWI) Program. The QDWI program reduces the cost of Medicare Part A premiums. In 2017, the monthly income limit is $4,105 for individuals and $5,499 for married couples.

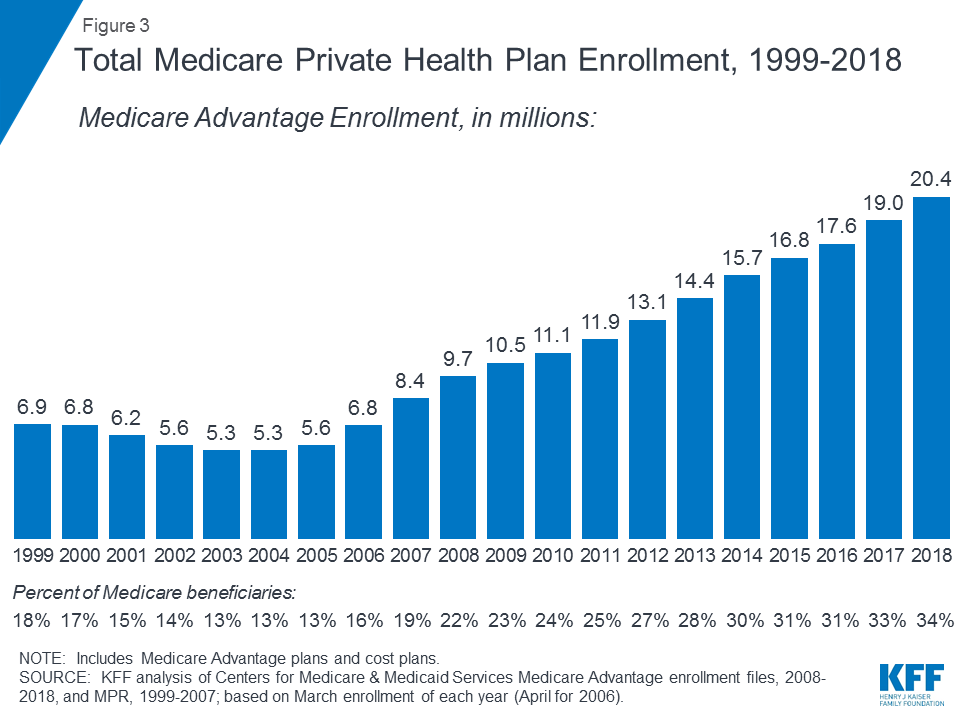

What to do if your Medicare plan is too expensive?

If your original Medicare plan is too pricey, consider looking at other plans through Medicare Part C , also known as Medicare Advantage. Advantage plans are held to the same regulations as traditional Medicare plans, but they’re sold through private insurers.

What is extra help for Medicare?

Anyone who has Medicare and also has limited financial resources may qualify for a program called Extra Help. This program assists with costs related to Part D (prescription drug coverage) or any prescription drug costs, including premiums, deductibles and co-payments. Eligibility is determined by income, and you have access to the plan from all 50 states. The Extra Help program can be used in conjunction with other Medicare Savings Programs. With an estimated value of $4,000, you may find this option especially beneficial if you need a lot of medication.

How to contact Medicare for seniors?

1-800-810-1437. While Medicare was initially designed to provide a means of healthcare that was affordable and accessible to seniors, it can still prove to be a financial burden to some, especially those who are on a low fixed income. If you or someone you love is struggling to keep up with premiums, cover out-of-pocket costs or simply afford ...

How much is Extra Help?

The Extra Help program can be used in conjunction with other Medicare Savings Programs. With an estimated value of $4,000, you may find this option especially beneficial if you need a lot of medication.

What to do if you can't switch to generics?

If you can’t switch to generics, find out if there’s an alternative medication that could work just as well but cost less. Don’t be hesitant to bring up finances with your doctor when it comes to medication. You can work together to find a compromise between getting the drugs that you need and sticking to your budget.

Does Medicare cover Medicare Part B?

Generally, Medicaid would cover your Medicare Part B costs and Part D prescription drug coverage.

Can I qualify for extra help for prescription drug costs?

However, you would still qualify for Extra Help to offset prescription drug costs. Qualified Individual (QI) Program: If you don’t qualify for the first two options, then you may be able to enroll in a QI program.

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

When is Medicare Part B due?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

When does Medicare start?

Keep track of your payments. Medicare eligibility begins at 65, whereas full retirement age for Social Security doesn’t start until 66, 67, or somewhere in between, depending on your year of birth.

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.