Understanding what Medicaid considers to be income is vital to a discussion on how Medicaid counts income. The following are all counted towards the income limit: Social Security benefits, Veteran’s benefits, alimony, employment wages, pension payments, dividends from bonds and stocks, interest payments, IRA distributions, and estate income.

How does Medicare determine your income?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

Are Medicare costs based on your income?

The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Although Medicare eligibility has nothing to do with income, your premiums may be higher or lower depending on what you claim on your taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits.

Who Has to Pay the Medicare Surcharge?

Higher-income beneficiaries face the IRMAA surcharge. In this case, "high earner" refers to anyone who claimed an income greater than $91,000 per year (filing individually OR married filing separately) or $182,000 per year (married filing jointly).

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government (i.e. the Medicare program) paying the remaining 75 percent.

The Medicare Part D Premium

Original Medicare (Parts A and B) does not include prescription drug coverage. These benefits are available via a Medicare Part D prescription drug plan.

How Does Social Security Determine Whether You Pay Extra?

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What Does Modified Adjusted Gross Income Include?

According to Investopedia, your modified adjusted gross income is "your household's adjusted gross income with any tax-exempt interest income and certain deductions added back."

What If Your Income Went Down?

Income levels often fluctuate due to life-changing events, particularly once we retire. If one of the following applies to you AND it caused a permanent reduction in income, inform Social Security. (Temporary changes do not qualify as "life-changing events.")

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

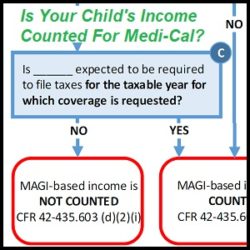

What is a household in the marketplace?

For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents, including those who don’t need coverage. The Marketplace counts estimated income of all household members. Learn more about who’s counted in a Marketplace household.

Can you use federal taxable wages on a pay stub?

Notes. Federal Taxable Wages (from your job) Yes. If your pay stub lists “federal taxable wages,” use that. If not, use “gross income” and subtract the amounts your employer takes out of your pay for child care, health insurance, and retirement plans. Tips.

Do you have to report health insurance changes to the marketplace?

Report income changes to the Marketplace. Once you have Marketplace health insurance, it’s very important to report any income changes as soon as possible. If you don’t report these changes, you could miss out on savings or wind up having to pay money back when you file your federal tax return for the year.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.

How is income counted for senior married applicants?

The way income is counted varies based on the program for which one is applying and the state in which one resides. In many states, married applicants applying for nursing home Medicaid or a Medicaid waiver are considered as single applicants. This means each spouse is able to have income up to the income limit. In this case, the “name on the check” rule is followed. This means that whichever spouse’s name is on the check is considered to own the income, and it will be counted towards that spouse’s income eligibility.

What is the income limit for Medicaid in 2021?

In 2021, the income limit for long-term care (nursing home Medicaid and home and community-based services Medicaid waivers) in most, but not all states, for a single applicant is $2,382 / month, which equates to $28,584 per year . For regular Medicaid, often called Aged, Blind and Disabled (ABD) Medicaid ...

What documents do you need to apply for medicaid?

Medicaid applicants generally have to provide documentation of their monthly income (earned and unearned) with their Medicaid application. Examples include copies of dividend checks, social security check or award letter, pay stubs, alimony checks, and VA benefits check or award letter.

How much is the Medicaid limit for nursing homes in 2021?

As of 2021, the individual income limit for nursing home Medicaid and Medicaid waivers in most states is $2,382 / month, which equates to $28,854 per year.

How much is the poverty level in 2021?

As mentioned previously, this income limit varies based on the state in which one lives. Generally, most states use 100% of the Federal Poverty Level for a household of two (as of 2021, $1,452 / month) or the SSI Federal Benefit Rate for couples (as of 2021, $1,191 / month). Married applicants over the income limit can still qualify for Medicaid.

How much is the SSI income limit for 2021?

The income limit varies by state, but in most states, either 100% of the SSI Federal Benefit Rate for couples ($1,191 / month in 2021) or 100% of the Federal Poverty Level for a household of two ($1,452 / month in 2021) is used. In order to protect the community spouse from having little to no income, and hence, becoming impoverished, ...

Is the income of a non-applicant spouse considered income?

Therefore, any income of the non-applicant spouse ( often called the community spouse or well spouse) is considered their income, and it will not be counted towards the applicant spouse’s (commonly called the institutionalized spouse) income limit.

How much is Medicare Part B?

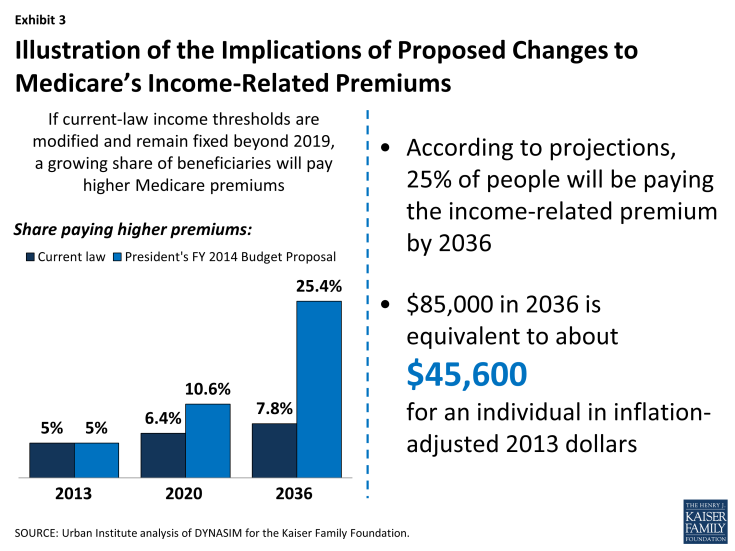

As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly. As income levels continue to rise above either $85,000 or $170,000, there is an increase in premium payments for Part B.

What other sources of income count as income?

These forms of income may include capital gains, revenue from a rental property or residual payments for previous works.

Is Social Security income taxed?

In simple cases, Social Security benefits are not taxed and are not counted as income by the Internal Revenue Service (IRS). This means that if Social Security payments are the only means by which an individual subsides, he or she does not need to report the payments as income, and these payments should not effect eligibility for medical benefit ...