If you or a spouse contribute to Medicare taxes while working a minimum of 40 quarters in the U.S., then Part A is free. Beneficiaries that only contributed 30-39 quarters; your premium would be $274. Those with fewer than 30 quarters of contributions would pay the full premium, which is $499.

Is there such a thing as free Medicare?

Luckily, there are quite a few, so it’s likely that you will find a solution that's right for you. Is Medicare ever free? By and large, Medicare is not considered free.

Who is eligible for premium-free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the income limit to receive Medicare?

There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

Can I get Medicare premium assistance if I have minimal income?

If you have a minimal income, you may be eligible for Medicare premium assistance. Medicare is a healthcare program available to all Americans aged 65 and above, regardless of their financial situation. However, your income can have an impact on the amount you pay for insurance.

At what income do you have to pay for Medicare?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeWhat income is used to determine Medicare premiums? Your modified adjusted gross income as reported 2 years ago on your IRS tax returns are what is used to determine your Medicare Part B premium. You also may see modified adjusted gross income as MAGI.

Does everyone get Medicare Part A for free?

coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A. The health care items or services covered under a health insurance plan.

How can I avoid paying Medicare premiums?

Four ways to save money on your Medicare Part B premiumsSign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

Is my Medicare premium based on my income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

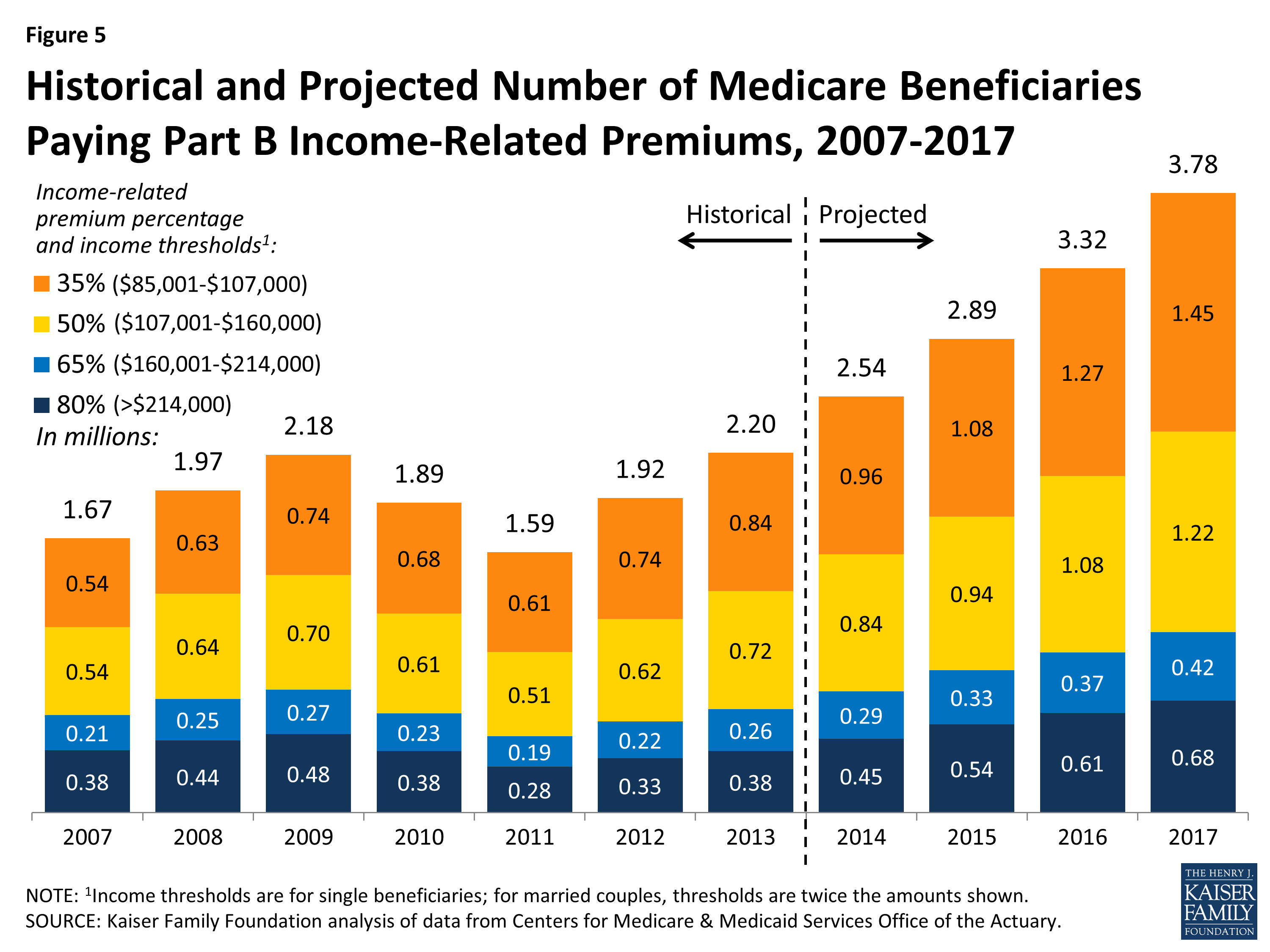

Do high income earners pay more for Medicare?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Does everyone automatically get Medicare at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I know if I have to pay for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

What is the minimum income for a married couple in 2020?

Your income must be no more than the federal poverty level to be eligible for this program, which was an annual income of $12,760 for a single person and an annual income of $17,240 for a married couple in 2020.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

Is there a higher income limit for Medicaid in Hawaii?

The income limits are higher in Alaska and Hawaii for all programs. Furthermore, even if your income is slightly above the cap, you may be eligible for these programs if it comes from a job and benefits. If you believe you may qualify for Medicaid, contact the Medicaid office in your state.

How much is the premium for a 30-39 quarter?

Beneficiaries that only contributed 30-39 quarters; your premium would be $252. Those with fewer than 30 quarters of contributions would pay the full premium, which is $458.

What is the Social Security premium for 2021?

For 2021, the standard monthly premium is $148.50. Premiums reflect income. Therefore, if you’re in a higher income bracket, you will pay more for coverage. Social Security determines Part B premium cost on AGI from the last two years before enrolling.

Is Medicare free in 2021?

Updated on April 5, 2021. Many people believe Medicare is free once they age in at 65. Some people are under the impression their payroll taxes will ultimately pay for Medicare costs in full. This is not entirely true, and for some, this news can be very stressful and worrisome. If Medicare is in your near future, ...

Is Part D free?

As you could imagine, this could get very costly. Part D isn’t free; but, with a policy, some generics are $0. You can think of your Part D plan as a pharmacy card that allows you to get your prescription medications by only paying a co-payment instead of the full retail price.

Do you have to pay Part C premiums?

Yes, some Part C plans don’t require a monthly premium, but that doesn’t make them entirely free. You will still need to pay your Part B premium. These plans are tricky. They may offset the zero-dollar premiums by requiring higher copayments and coinsurance.

Do supplement plans come with a monthly premium?

Each supplement plan will come with a monthly premium; consider this while planning and looking for what option is best for you and your wallet. Proper planning can help you cover the costs of your future. The last thing we want once we retire is to find out were unable to pay for Medicare.

Is Medicare a pay as you go policy?

Once you’re on Medicare, some costs may be a “pay as you go.” Just like many other health insurance policies, Medicare has deductibles and coinsurances. Medicare isn’t free, and Part B only pays 80% of outpatient expenses; so, you’re responsible for the remaining 20%.

1. Part A premiums

The component of Medicare called Part A primarily covers hospital stays and inpatient care (whereas Part B primarily covers services in health care providers’ offices).

3. Annual wellness visit

The purpose of the annual wellness visit available to Medicare recipients is to develop or update a personalized plan to help prevent disease and disability based on your health situation.

4. Vaccines

One influenza shot per flu season is covered when you have Medicare. The COVID-19 vaccine and booster are covered, too.

5. Cancer screenings

Medicare covers screenings for a variety of health conditions. They include various types of cancer:

6. Mental health screenings

When it comes to mental health, Medicare provides the following free screenings:

7. Other health screenings

Beyond cancer and mental health screenings, Medicare provides a number of free screenings for other health conditions. They include the following, most of which are free if you meet certain risk factors:

8. Counseling

The following types of counseling are among those by Medicare for people who meet eligibility requirements: