Who is Medicare Part A available to?

Is there a Medicare Part A?

Do patients pay for Medicare Part A?

What is Medicare Part A called?

Medicare Part A, a.k.a. Medicare hospital coverage, pays for care at a hospital, skilled nursing facility, or nursing home, and for home health services.

What is not covered by Medicare Part A?

What is the difference between Medicare Part A and B?

Does Medicare Part A cover 100 percent?

Is Medicare Part A and B free?

Do I have to pay for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

What is not covered by Medicare Parts A and B?

What are the 4 parts of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Is MA and Part C the same thing?

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

How long does Medicare Part A last?

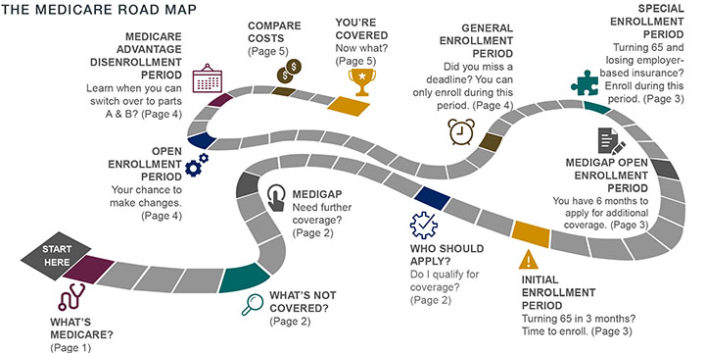

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What is hospice care?

Hospice care: May include doctor services, nursing care, durable medical equipment, medical supplies, and more if you are terminally ill and your doctor has determined that you have six months or less to live.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

When will Medicare Supplement Plan F be available?

Medicare Supplement Plan F and Plan C are not available for sale to Medicare beneficiaries who became eligible for Medicare on or after Jan. 1, 2020.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What are the parts of Medicare?

Medicare now features four major parts: Parts A and B (original Medicare) and optional add-ons Part C (Medicare Advantage, an alternative that bundles the parts together) and Part D (prescription drug coverage).

What are the two major parts of Medicare?

Here’s a shortcut to remembering Medicare’s major components: The two biggies are Parts A and B. The twin parts make up original Medicare, the government-run pillars that hold up the rest of the program. Hospital insurance (Part A) and medical insurance (Part B) were first on the scene when Medicare started. Lawmakers struggled for years after that to add lasting prescription drug coverage .

What is Medicare supplement insurance?

Medigap is the nickname for Medicare supplement insurance, which covers out-of-pocket costs for Medicare Parts A and B. There are 10 nationally standardized Medigap plans, and some share alphabetical names with the major Medicare parts.

What is Medicare Advantage plan MA?

MA plans package Medicare Parts A and B and, in most cases, a prescription drug benefit together in one private plan — often for a monthly cost of no more than the Part B premium. Medicare Advantage plans with or without an extra premium average $21 a month. There are 6 types of Medicare Advantage plans, and they comprise their own alphabet soup of names. Health maintenance organization (HMO) and preferred provider organization (PPO) plans are the most common types. But enrollment in special needs plans (SNPs) — for enrollees with low income or who have chronic medical conditions and need coordinated care — is growing.

What to do if you are Medicare eligible?

If you’re Medicare-eligible or take care of someone who is, you can contact the State Health Insurance Assistance Program, or SHIP, with questions on anything Medicare related . Its trained benefits counselors offer unbiased guidance for free.

What does Medicare Part B cover?

Medicare Part B covers the care you get outside the hospital. It also covers some drugs and vaccines that Part D doesn’t cover, such as:

When did Medicare start?

When Medicare became law in 1965 , it also started at the beginning of the alphabet with Parts A and B. Part A covered hospital and associated services, and Part B was insurance for doctor visits and outpatient services. Simple enough. But as the program grew, so did the number of parts — and letters — associated with it.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

What is a small group health plan?

Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan. If your employer’s insurance covers more than 20 employees, Medicare will pay secondary and call your work-related coverage a Group Health Plan (GHP).

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Is Medicare the primary or secondary payer?

The first thing you want to think about is whether Medicare will be the primary or secondary payer to your current insurance through your employer. If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs.

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Does Cobra pay for primary?

The only exception to this rule is if you have End-Stage Renal Disease and COBRA will pay primary. Your COBRA coverage typically ends once you enroll in Medicare. However, you could potentially get an extension of the COBRA if Medicare doesn’t cover everything the COBRA plan does like dental or vision insurance.

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

When is Medicare open enrollment?

Between Oct. 15 and Dec. 7, Medicare's Annual Open Enrollment Period, millions of Medicare beneficiaries have a chance to make changes to their coverage for the upcoming year.

How much is Medicare Advantage 2020?

You must continue to pay your Part B premium, which is $144.60 per month for most beneficiaries in 2020. Medicare Advantage plans are similar to individual health insurance policies you may have received through your employer or signed up for on your own through the individual insurance market, in that they have different monthly premiums, provider networks, copays, coinsurance and out-of-pocket limits. The trade-off for a lower premium (or $0 premium) could be higher copays or coinsurance.

What age do you have to be to get Medicare?

People usually qualify for Medicare at age 65 and may be automatically signed up if they're receiving Social Security payments, unless they take steps to opt out. Original Medicare comes in two parts: Part A and Part B. Part A covers a portion of hospitalization expenses, and Part B applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

Can Medicare Part D be enrolled in private insurance?

Medicare-eligible beneficiaries can enroll in a Medicare Part D Prescription Drug plan from a private insurance company . U.S. News provides a tool for Medicare-eligible beneficiaries to find the right Medicare plans for their needs. All plan information and star ratings come directly from the Center for Medicare and Medicaid Services (CMS) at Medicare.gov.