What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

Is Medicare Part B premiums tax-deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be "rewarded" with a tax break for choosing to pay this medical expense.

What is Plan B deductible?

The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible. How do Medicare deductibles work? A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs.

What is part B deductible?

- Medicare deductibles are reset each year and the dollar amount may be subject to change.

- Both Medicare Parts A and B have deductibles that must be met before Medicare starts paying.

- Medicare Advantage, Medigap and Part D plans are all sold by private insurance companies that set their own deductibles.

What was Medicare Part B deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the annual deductible for Medicare Part B in 2019?

$185 in 2019On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What was the Medicare Part B deductible for 2017?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

What is the 2016 deductible for Medicare Part B?

($166 in 2016)Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

How do I find out what my Medicare deductible is?

You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What is the deductible for Medicare Part B 2021?

$203.00 per yearPart B: (Medical Insurance) Premium You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

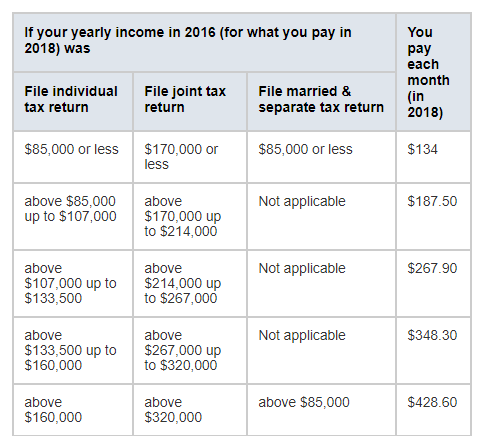

What is the Irmaa for 2018?

An upper-income household in 2018 will face an IRMAA surcharge of $294.60/month (which is $3,535/year) once income exceeds $160,000/year, yet even that still only the equivalent of “just” a 2.2% surtax on income.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Are Medicare premiums tax deductible in 2021?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

How much is the Part A deductible?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

What is the Medicare Part B deductible for 2018?

2018 Medicare Part B Deductible. CMS announced that the annual deductible for all Part B beneficiaries once again be $183, the same as in 2017.

How much is the 2018 Medicare Part D deductible?

The 2018 standard Part D plan deductible is $405, however the actual plan deductible can be anywhere from $0 to $405 . Use our 2018 Part D Plan Finder to see plan premiums, deductibles, and features in your state. use our 2017/2018 Part D plan comparison to see annual changes for each Medicare Part D plan.

What is Medicare Advantage 2018?

2018 Part C (Medicare Advantage) Monthly Premium & Deductible. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

How long can you get Medicare Part A if you are disabled?

(If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8 1/2 years after you return to work.) The chart below shows the annual Medicare Part A deductible and the Medicare Part A monthly premium for people who do not ...

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

Where to mail Medicare premiums?

You can mail your premium payments to the Medicare Premium Collection Center, P.O. Box 790355, St. Louis, Missouri 63179-0355. If you get a bill from the RRB, mail your premium payments to RRB, Medicare Premium Payments, P.O. Box 9024, St. Louis, Missouri 63197-9024.

How much is Medicare Part B premium?

The Social Security Administration announced a 2.2 percent cost-of-living adjustment (COLA) for 2018 Social Security benefits - which translates into about a $28 increase for the average Medicare Part B beneficiary.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

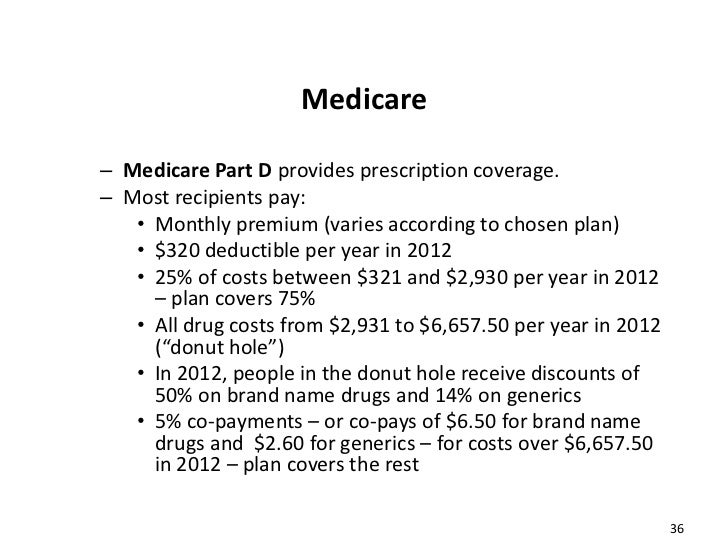

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Find Best Medicare Insurance Plan Coverage

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

What Does Part B Cover?

Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

How much is a knee injury deductible in July?

In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $150 for the appointment. You will be responsible for paying the first $65 of the $150 for the appointment out of your own pocket, because that is how much is left on your deductible. After the $65 is paid, ...

What is the deductible for Part B?

Part B includes a yearly deductible. This is the amount you must pay for most health care services before Part B starts to help. The federal government sets the deductible, and it may change from year to year, similar to the premium. In 2020, the deductible is $198 (up from $185 in 2019). 4 After you meet the deductible, ...

How much is Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted ...

What is Medicare Part B 2020?

Part B, which helps millions of Americans pay for medical care, requires certain costs, two of which are premiums and deductibles. The prices are set by federal law, but the exact amount you’ll pay varies depending on certain factors like your income. Read on for details about Part B premiums and ...

What percentage of Medicare deductible is coinsurance?

Coinsurance: This is a percentage that you pay for most services after you meet your deductible. For most services, your coinsurance is 20% of the Medicare-approved amount.

How much is the 2020 Medicare premium?

In 2020, that's $144.60 (up from $135.50 in 2019). 1. People who earn more than the standard premium threshold will pay higher premiums. This premium increase is called the Income-Related Monthly Adjusted Amount (IRMAA). 2. The table below outlines the 2020 premiums by income.

What is the standard Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted from your monthly benefit payment. Social Security.

Do you pay Part B deductible to Medicare?

How to pay your Part B deductible. You don’t pay your deductible to Medicare; you pay it to your health care providers directly. The doctor, specialist, or facility may ask for a deductible payment at the time they provide you care, or they may bill you later.