Is there still a donut hole in Medicare?

Aug 09, 2010 · A number of visitors to www.HealthCare.gov have told us they’d like to know more about the Medicare “donut hole” in the Part D program. If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have …

How to avoid the Medicare Part D Donut Hole?

Feb 10, 2022 · The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

Where did the donut hole really come from?

Oct 01, 2021 · The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2022, you’ll have to pay 25 percent OOP from the time you...

How much is a donut hole?

The donut hole is the coverage gap that occurs when you and your Medicare drug plan have reached a pre-determined spending limit for covered drugs. For example, in 2022, once you have spent $4,430 on covered drugs, you enter the coverage gap.

What is the Medicare donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

How do I get out of Medicare donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.Mar 4, 2020

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What happens when you reach the donut hole in Medicare?

How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Does the donut hole end at the end of the year?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Is there insurance to cover the donut hole?

There is no Donut Hole Insurance but there are ways to reduce your overall Part D spending. Insurance to cover the Donut Hole in Medicare Part D does not exist. There is no Donut Hole insurance policy that you can buy just to cover the higher expenses during the coverage gap.Aug 8, 2014

Has the donut hole been eliminated?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

What happens when you reach the donut hole?

You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year. Once you fall into the donut hole, you'll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit.

Is the donut hole the same for everyone?

No. Not everyone will enter the Medicare donut hole (coverage gap) stage. The Part D donut hole begins after you and your Medicare prescription drug plan have spent a certain amount for covered prescription drugs during the calendar year.

What is the donut hole amount for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.Oct 30, 2021

How does the donut hole work in 2022?

In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

What will the donut hole be in 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430. At this point, you will pay a percentage of medication costs (25% in 2022) while you're in the Medicare donut hole.Mar 28, 2022

The Medicare Donut Hole Is Now Closed

The Medicare donut hole closed completely in 2020. This has led to some confusion, however, since there is still a coverage gap phase under Medicare Part D.

The Part D Initial Coverage Phase

Once you meet your Medicare Part D annual deductible, you enter the initial coverage phase. Your out-of-pocket costs during this stage are 25 percent of your plan's negotiated costs for covered medications. You pay this in the form of copays or coinsurance at the time of purchase.

The Part D Coverage Gap Phase

During the coverage gap phase, you continue paying 25 percent of prescription costs. And this is where the confusion seems to strike. Many people assumed "closing the donut hole" meant the coverage gap was ending.

How Does Cost-Sharing Work in the Coverage Gap Phase?

During the initial coverage phase, you pay 25 percent of prescription drug costs and your Part D plan pays the other 75 percent. Once you enter the coverage gap, you continue paying 25 percent. But, your plan's share changes depending on whether it's brand-name drugs or generic.

The Catastrophic Coverage Phase

You enter the catastrophic coverage phase once your total out-of-pocket spending reaches $7,050 in 2022. This includes money you paid for covered prescriptions during the deductible phase. In addition, the manufacturer discount on brand-name prescription drugs counts toward your total out-of-pocket for Part D coverage (i.e.

Drug Costs That Don't Count Toward Your Total Out-of-Pocket

When figuring your total out-of-pocket Part D spend, exclude the following:

Does Everyone Enter the Donut Hole?

No, most Medicare beneficiaries never enter the coverage gap. Even fewer ever reach the catastrophic coverage stage. Fewer than 5 percent of Part D beneficiaries will reach the donut hole.

What is the Medicare donut hole?

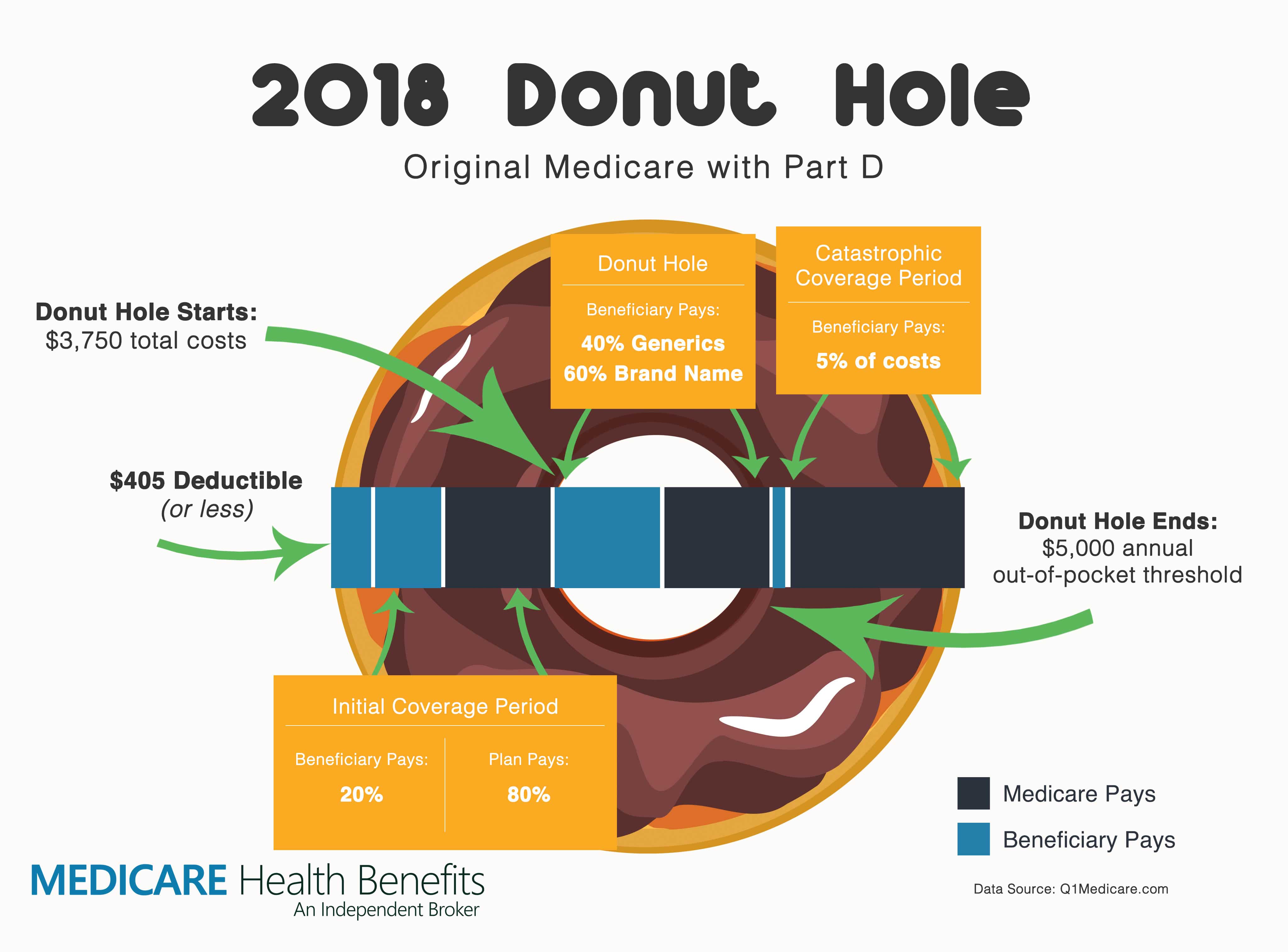

Back to the visual donut image. Picture a donut with a hole in the middle. Maybe it’s an old fashioned style, chocolate glazed, vanilla frosted with sprinkles, apple cider or any other flavor of your choice. Now that we’ve got your attention, let’s continue.

What is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

Did the Medicare donut hole go away in 2020?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Can I avoid the Medicare donut hole?

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,130 in 2021. Once you hit that amount, you enter the Medicare coverage gap.

Do Medicare Advantage plans cover the Medicare donut hole?

Some Medicare Advantage plans may offer extended gap coverage for enrollees in the Medicare donut hole, though you should check with your specific plan for more details.

Phase 1 – annual deductible

Some plans require you to pay a deductible, or 100% of the cost of prescription drugs, up to a certain limit before your plan starts to pay. The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445. Once you hit your deductible, your initial coverage kicks in.

Phase 2 – initial coverage

During this phase, your copayments and coinsurance come into play. You pay just your share of prescription costs and your plan pays the rest for covered drugs. For example, if your plan has a 25% copayment for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

Phase 3 – coverage gap

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs.

Phase 4 – catastrophic coverage

In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year.

Request a call

Our licensed Humana sales agents are available to help you select the coverage that best meets your needs.

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

Brand-name prescription drugs

Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. Some plans may offer you even lower costs in the coverage gap.

Generic drugs

Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

If you think you should get a discount

If you think you've reached the coverage gap and you don't get a discount when you pay for your brand-name prescription, review your next " Explanation of Benefits" (EOB). If the discount doesn't appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.