Adjustments are amounts such as discounts, professional courtesy and other special items that are identified by the provider as those that need not be collected or collected at a lower rate.

What is Medicare premium adjustment?

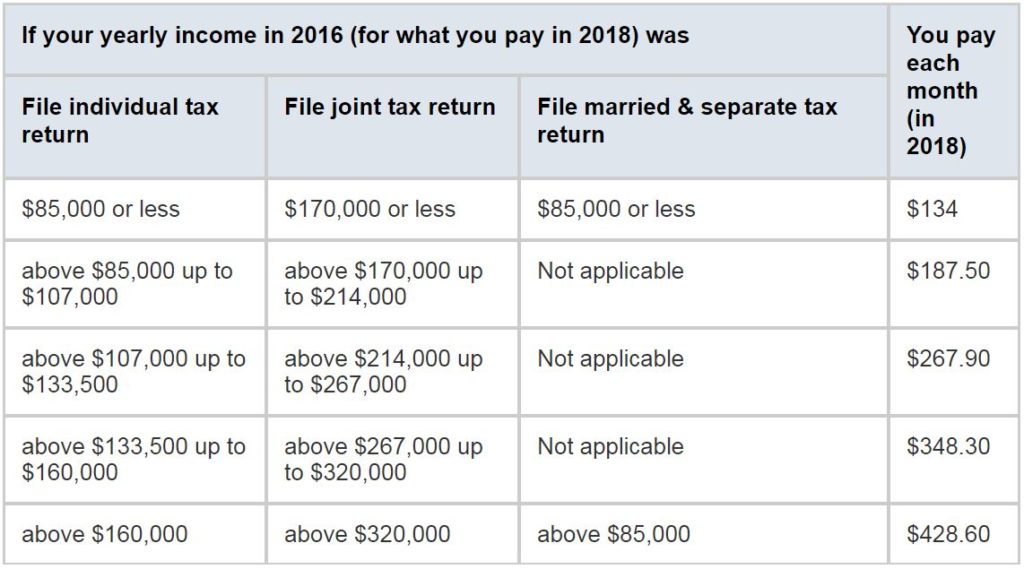

The Centers for Medicare & Medicaid services ... But you need to submit paperwork to have the premiums reconsidered and provide evidence of the eligible change. The IRMAA (income-related monthly adjustment amount) is based on your adjusted gross income ...

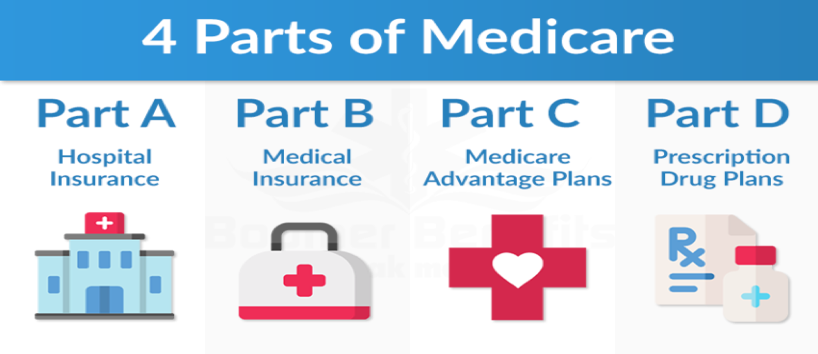

What are the advantages and disadvantages of Medicare?

What Are the Pros of a Medicare Advantage Plan?

- Additional Benefits. As mentioned above, Medicare Advantage plans can provide additional benefits that are not found in Original Medicare.

- Out-Of-Pocket Protection. ...

- Coordinated Care. ...

- Plan Selection. ...

- Customized Coverage. ...

What is modified adjusted gross income for Medicare?

What is modified adjusted gross income for Medicare? Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is MRA Medicare risk adjustment?

What is MRA? MRA – Medicare Risk Adjustment – was established in 2003 and phased in over a five year period. Risk adjusted reimbursement attempts to fund providers for the anticipated costs of care based on the patient's health status.

What is a payment adjustment?

Pay Adjustment Definition Term Definition. Pay adjustment is any change that the employer makes to an employee's pay rate. This change can be an increase or a decrease.

What is the Medicare incentive adjustment?

The Medicare Electronic Health Record (EHR) Incentive Program provides bonus payments to eligible professionals who demonstrate meaningful use (MU) of certified EHR technology. The cumulative payment amount depends on the year in which a professional begins participating in the program.

How often are Medicare premiums adjusted?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

What is Medicare sequestration adjustment?

Medicare FFS claims: 2% payment adjustment (sequestration) changes. The Protecting Medicare and American Farmers from Sequester Cuts Act impacts payments for all Medicare fee-for-service claims: No payment adjustment through March 31, 2022.

What is Medicare adjustment code 144?

CARC 144: "Incentive adjustment, e.g. preferred product/service" RARC N807: "Payment adjustment based on the Merit- based Incentive Payment System (MIPS)." Group Code: CO. This group code is used when a contractual agreement between the payer and payee, or a regulatory requirement, resulted in an adjustment.

Do I need to report MIPS?

The 2022 MIPS quality category has a full-year performance period ranging from January 1, 2022 – December 31, 2022. This year, physicians may choose to report data on quality measures at the individual, group, or Virtual Group level using one reporting mechanism.

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Why does Medicare have sequestration?

The sequestration is required by the Budget Control Act that was signed into law in August 2011. It was originally intended as an incentive for the so-called Super Committee convened that year to design an alternative package to achieve $1.2 trillion in budget savings. How will Medicare physician payments be affected?

What is the Medicare sequestration amount?

2%Dec. 20, 2021 Update: Congressional leaders announced agreement on a bipartisan deal to provide full relief from the 2% Medicare sequester cut for both participating providers and non-participating provider from January 1, 2022, through the end of March 2022.

What does Medicare sequestration apply to?

Q: How long is the 2% reduction to Medicare fee-for-service claim payments in effect? A: The sequestration order covers all payments for services with dates of service or dates of discharge (or a start date for rental equipment or multi-day supplies) on or after April 1, 2013.

How long will Medicare be cut?

Per the Budget Control Act, $1.2 trillion in federal spending cuts must be achieved over the period of nine years. Unless changes are made by Congress, Medicare Sequestration will limit federal spending until 2022. Only time will tell if the cuts made to Medicare reimbursement will continue until 2022.

What is Medicare sequestration?

Medicare sequestration is a penalty created during The Budget Control Act of 2011. Medicare sequestration was made to create savings and prevent further debt, but it had some negative repercussions on hospitals, physicians, and health care. Beneficiaries are not responsible for the price difference caused by the sequestration.

Why did Medicare fail to meet the deadline?

Some believe Medicare failed to meet the deadline because economists and financial analysts predicted Congress would step in and squash the Budget Control Act of 2011. When Congress didn’t step in, it gave little time for entities such as Medicare to outline a plan before the deadline.

What was the Medicare cut in 2013?

Under these budget cuts, any claim received by Medicare after April 1, 2013 was subject to a 2 percent payment cut. Any drugs that were administered as part of the claim were also reimbursed with a 2 percent cut implemented.

What was the budget control act?

The Budget Control Act required half of the budget savings must be acquired through defense spending cuts. Providers were limited to a 2 percent reduction in reimbursement. This meant that most money needed to meet budget needs had to be obtained through domestic discretionary programs.

Is Medicare 2 percent cut?

The 2 percent cut to Medicare payments is also not cumulative. This means is payments will not continually be reduced by 2 percent year after year. Instead, they will only be subject to the initial 2-percent reduction until 2022. The only way this reduction could be removed or changed is if Congress voted to change it.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

Does Medicare distribution increase adjusted gross income?

The amount distributed is added to your taxable income, so exercise caution when you’re receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Can realized capital losses reduce Medicare premiums?

As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums. The inverse is also true and now may be more applicable to you: realized capital losses can reduce your MAGI, and could potentially reduce your Medicare Part B and Part D premiums.

Will MAGI income be adjusted for inflation in 2020?

The year 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). Back to top.

Limitation on Recoupment (935) Overpayments

The limitation on recoupment (935), as required by Section 935 of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) changes the process by which CGS can recoup an overpayment resulting from a post payment adjustment, such as a denial or Medicare Secondary Payer (MSP) recovery.

Resources

Refer to the Claims Correction Menu (Chapter 5) of the Fiscal Intermediary Standard System (FISS) Guide for information about how to submit claim adjustments or cancellations using FISS.