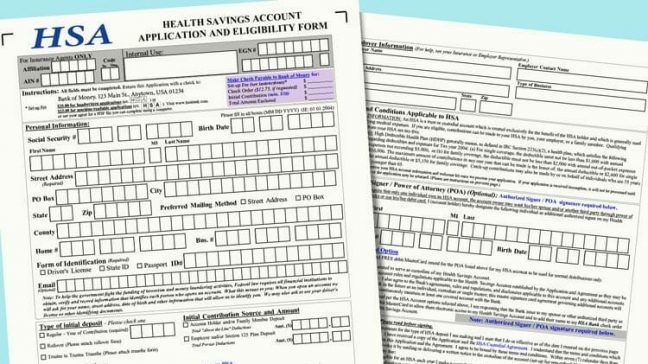

A Medicare Advantage MSA is an Archer MSA designated by Medicare to be used solely to pay the qualified medical expenses of the account holder who is eligible for Medicare. A Health Savings Account (HSA) is a tax-exempt trust or custodial account that you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur.

What is a Medicare Advantage MSA?

A Medicare Advantage MSA is an Archer MSA designed by Medicare to be used solely to pay the qualified medical expenses of the account holder who is enrolled in Medicare. Contributions can only be made by Medicare.

What is an Archer MSA or HSA?

The Archer MSA served as a model for the more recent and more broadly available health savings account (HSA). Archer MSAs and HSAs can be used only with high-deductible health plans (HDHPs). No federal income tax is owed on contributions to Archer MSAs and HSAs, account earnings, and distributions used for qualified medical expenses.

Can my employer contribute to my Archer MSA?

Generally, contributions you make to your Archer MSA are deductible. Employer contributions are excluded from your income and are not deductible by you. If your employer makes a contribution to one of your Archer MSAs, you cannot contribute to any Archer MSA for that year.

What happened to the Archer MSA?

Some Archer MSAs continue as active accounts. 1 As with an HSA, an Archer MSA was required to be accompanied by a high-deductible health plan. The Archer MSA was a pilot program that its promoters believed would help limit the overuse of healthcare services.

What does Medicare Advantage MSA mean?

Medicare Medical Savings AccountA Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account.

What is an Archer MSA plan?

An Archer MSA is a tax-exempt trust or custodial account set up with a financial institution such as a bank or an insurance company. Contributions you make to the account can be used to pay for health-care expenses not covered by your health insurance plan. Note: The Archer MSA program expired on December 31, 2007.

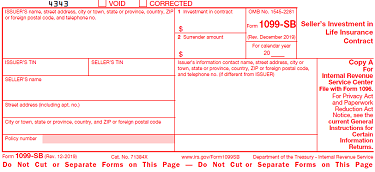

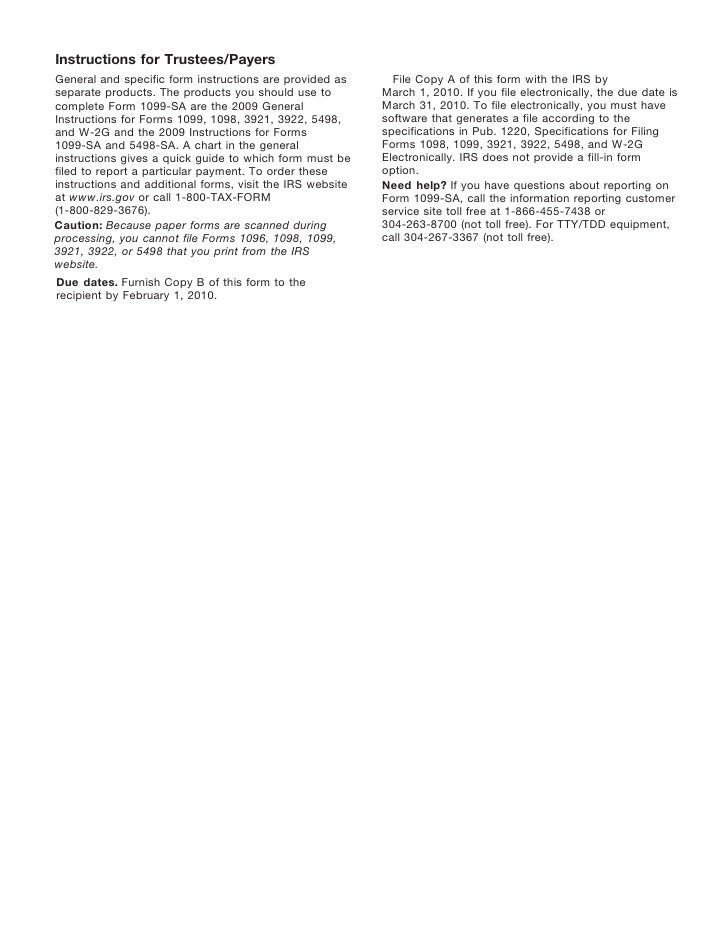

What is Archer MSA distributions?

Form 1099-SA, Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, is the Internal Revenue Service (IRS) form that you receive if you must include a distribution from a health savings account (HSA), an Archer medical savings account (MSA), or a Medicare Advantage (MA) MSA on your federal taxes.

What is difference between Archer MSA and HSA?

Medicare savings accounts (MSAs) and health savings accounts (HSAs) both give consumers tax-advantaged ways to fund the costs of healthcare. MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans.

Who is eligible for an Archer MSA?

The Archer MSA was available only to self-employed people and small businesses with 50 or fewer workers. 3 No new Archer MSAs can be established. By contrast, an HSA can be offered to employees by businesses of any size and can be created by both a self-employed and an unemployed individual.

Which is better MSA or HSA?

The choice between a MSA or HSA really boils down to this: If you are a relatively healthy individual who is covered by a high-deductible health plan and are looking for a tax-advantaged way to save for medical expenses, a health savings account is probably your best bet.

What is the maximum amount that can be contributed to an MSA?

How much can I contribute to an MSA? The annual limit to contributions are 65% of your insurance deductible if you have single coverage, or 75% if you have family coverage.

What is a MSA form?

A Master Services Agreement (MSA) is a contract that details the responsibilities and obligations of two parties to each other. This comprehensive contract generally includes detailed rates, services, and terms for each functional area of the partnership.

What is an archer MDA?

OUT OF MANY, ONE. This familiar phrase describes the Archer® approach to multi-discipline accounts, also known as MDAs or UMAs. Archer facilitates orders, allocation, reconciliation, and reporting for both stand-alone and MDA accounts.

How is an MSA different than other plans?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

What is an advantage of a medical savings account?

The main benefits of a high deductible medical plan with a health savings account (HSA) are tax savings, the ability to cover some expenses your insurance doesn't, the ability to have others contribute to your account, and the convenience of using the account to pay for healthcare expenses.

How does an MSA work?

MSA plans work with a high deductible health plan (HDHP) and a bank account. Your plan deposits funds for your medical expenses into the bank account, and you can then use these funds to pay for care. You will likely have high out-of-pocket costs for your care until you reach your deductible.

What Is a Medicare Advantage MSA?

A Medicare Medical Savings Account (MSA) Plan is a plan available to most people eligible for Medicare who live where these plans are offered. An MSA has two separate components: a medical savings account and a high-deductible Medicare Advantage plan (“Part C”).

How a Medicare Advantage MSA Plan Works

The first step to getting an MSA plan is to select a high-deductible MSA plan. You can do this when you first sign up for Medicare or during the annual open enrollment period between October 15 and December 7. You won't pay a monthly premium for your Medicare Advantage MSA, however, you must continue to pay your monthly Medicare Part B premium. 1

The Bottom Line

A Medicare Medical Savings Account (MSA) plan isn’t right for everyone. But it might be a good fit if you appreciate the flexibility of choosing any Medicare-approved provider, and if you can afford to pay a high deductible before your coverage kicks in.

How to contact Medicare Advantage MSA?

Special Needs Plan (SNP) To learn more about Medicare Advantage MSA plans, including which Medicare Advantage MSA plans may be available for sale near you and how you can enroll, speak with a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

How does a Medicare MSA work?

How Medicare Medical Savings Accounts (MSA) work. When you enroll in a Medicare Medical Savings Account, the Medicare MSA plan will designate an amount of money to be deposited into a savings account each year. You will then be able to use the money in this account to pay for covered health care services and products.

What is MSA plan?

MSA Plans combine a high deductible Medicare Advantage Plan and a trust or custodial savings account (as defined and/or approved by the IRS). The plan deposits money from Medicare into the account. You can use this money to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Does Medicare MSA have a deductible?

Medicare MSA plans include a deductible that is greater than the amount of money that the Medicare MSA plan deposits into the account. The money deposited into your account can be used toward the plan deductible before the plan’s additional coverage kicks in.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage MSA plans may also provide coverage for benefits not offered by Original Medicare. These additional benefits can include: MSA plans do not provide coverage for prescription drugs.

Does Medicare cover hearing?

Hearing. Long-term care not covered by Original Medicare 1. MSA plans do not provide coverage for prescription drugs. If you wish to enroll in Medicare prescription drug coverage, you may enroll in a Medicare Part D plan in addition to your Medicare Advantage MSA plan.

Does MSA account grow over time?

Any unused money in your account at the end of the year will remain in your account and will be combined with the deposited money of the upcoming year, so the account has the ability to grow over time. Money that is deposited into your Medicare Advantage MSA plan account that is used for qualified medical expenses through ...

What is Medicare MSA?

What's a Medicare MSA Plan? Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare.

What is MSA plan?

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs. A type of Medicare health plan offered by a private company that contracts with Medicare.

What is a medical savings account?

Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into your account. You can use money from this savings account to pay your health care costs before you meet the deductible.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does MSA cover extra?

In addition, some Medicare MSA plans may cover extra. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. Contact plans in your area for more information on what extra benefits they cover, if any.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . The plan will only begin to cover your costs once you meet a high yearly. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , which varies by plan.

Does Medicare cover MSA?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. If you join a Medicare MSA Plan and need drug coverage, you'll have to join a Medicare Prescription Drug Plan. To find available plans in your area, you can: Visit the Medicare Plan Finder. Call us at 1-800-MEDICARE (1-800-633-4227).

What is an Archer MSA?

An Archer MSA is a medical savings account (MSA) enacted in 1996 and named for former Texas Congressman Bill Archer, who sponsored the amendment that led to its establishment. As with the more recent health savings account (HAS), an Archer MSA offered the account holder a tax-advantaged way to save for medical expenses.

What is the maximum amount of deductible for Archer MSA 2020?

For an Archer MSA in 2020, the associated HDHP must have a minimum deductible of $2,350 and a maximum deductible of $3,550 for an individual , and a minimum of $4,750 and a maximum of $7,100 for a family. The ceiling on out-of-pocket expenses is $4,750 for an individual and $8,650 for a family.

What is the maximum HSA contribution for 2020?

For 2020, the HSA contribution limits are $3,550 for an individual and $7,100 for a family.

Can you use an Archer MSA for HSA?

The Archer MSA served as a model for the more recent and more broadly available health savings account (HSA). Archer MSAs and HSAs can be used only with high-deductible health plans (HDHPs). No federal income tax is owed on contributions to Archer MSAs and HSAs, account earnings, and distributions used for qualified medical expenses.

Is Archer MSA tax deductible?

Congress created the Archer MSA specifically for self-employed individuals and for employees of small businesses with fewer than 50 employees. Contributions to the account by the owner are tax-deductible. Contributions by an employer, or by an employee through payroll deductions, are excluded from the employee’s income.

Can an Archer MSA be established?

The Archer MSA was available only to self-employed people and small businesses with 50 or fewer workers. No new Archer MSAs can be established. By contrast, an HSA can be offered to employees by businesses of any size and can be created by both a self-employed and an unemployed individual.

What is Medicare Advantage MSA?

A Medicare Advantage MSA is an Archer MSA designed by Medicare to be used solely to pay the qualified medical expenses of the account holder who is enrolled in Medicare. Contributions can only be made by Medicare. The contributions are not included in your gross income, nor are they deductible.

How to enter MSA information?

To enter MSA information in the program: From within your TaxAct return ( Online or Desktop), click Federal. On smaller devices, click in the upper left-hand corner, then click Federal.

Is HSA deductible on taxes?

Health Savings Account (HSA) Generally, after-tax contributions you or someone other than your employer make to your HSA are deductible on your tax return. Employer contributions to your HSA may be excluded from your income and are not deductible by you.

Is an Archer MSA deductible?

Archer MSA. Generally, contributions you make to your Archer MSA are deductible. Employer contributions are excluded from your income and are not deductible by you. If your employer makes a contribution to one of your Archer MSAs, you cannot contribute to any Archer MSA for that year.

What is covered by Archer MSA?

Additional insurance coverage exceptions include: insurance that provides liability benefits, fixed amounts per day for hospitalization, or for a specific illness or disease. Coverage for accidents, dental and vision care, short- or long-term disability or long-term care also is permitted without affecting Archer MSA eligibility.

Can you deduct Archer MSA contributions?

If your employer made contributions to your Archer MSA, you’re not entitled to a deduction for your own contributions, though you’ll still complete Form 8853. Amounts paid from Archer MSA's in excess of qualifying medical expenses may be subject to an additional 20 percent tax, unless the amount meets a qualifying exception.

Does Archer MSA cover self employed?

Archer MSAs cover self-employed workers or those who work for a company with an average of 50 or fewer employees over either of the preceding two years. Your health plan must be a high-deductible plan, and you must have no other health coverage, although there are some exceptions to the rule.