What is the difference between a PPO and Medicare Advantage plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What does PPO stand for in a Medicare Advantage plan?

Medicare preferred provider organizationsMedicare preferred provider organizations (PPO) is one type of Medicare Advantage (Medicare Part C) plan. Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you'll pay more.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is HMO or PPO better?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

Why would a person choose a PPO over an HMO?

Advantages of PPO plans A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.Jul 1, 2019

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the highest rated Medicare Advantage plan?

The Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have earned the title of an AM Best A Rated Company.

Are EPO and PPO the same?

EPO or Exclusive Provider Organization Usually, the EPO network is the same as the PPO in terms of doctors and hospitals but you should still double-check your doctors/hospitals with the new Covered California plans since all bets are off when it comes to networks in the new world of health insurance.

What is out-of-pocket maximum vs deductible?

Essentially, a deductible is the cost a policyholder pays on health care before the insurance plan starts covering any expenses, whereas an out-of-pocket maximum is the amount a policyholder must spend on eligible healthcare expenses through copays, coinsurance, or deductibles before the insurance starts covering all ...May 7, 2020

What is out-of-pocket maximum?

The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits. The out-of-pocket limit doesn't include: Your monthly premiums.

What Is Covered By A Medicare Advantage PPO Plan?

Once you enroll in a Medicare Advantage PPO Plan, you receive all the Medicare coverage that an individual with Original Medicare would receive, plus extra benefits as well. Most Preferred Provider Organization Plans offer prescription drug coverage, and most of them also cover vision, dental, and hearing visits as well.

How Much Does A Medicare Advantage PPO Plan Cost?

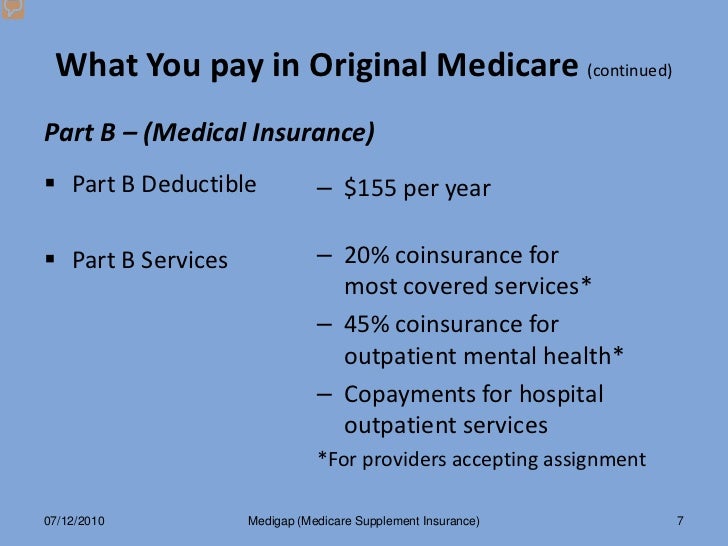

While it is true that using an out-of-network provider is more costly than using one in-network, Medicare Advantage PPO Plans also have basic, stable costs that accompany the plan as well. These types of costs include deductibles, copayments, and coinsurance.

What is Medicare PPO?

by Christian Worstell. February 25, 2021. A Medicare PPO, or Preferred Provider Organization, is just one type of Medicare Advantage plan. What is a Medicare PPO plan, and could a PPO plan be a good fit for your health coverage needs? Learn more about Medicare Advantage PPO insurance plans ...

Why do people choose PPO over Medicare?

A few reasons why some people might prefer a PPO plan over other types of Medicare Advantage plans include: Medicare PPOs typically offer the freedom and flexibility to seek health care services from providers outside of their plan network, though it will typically be at a higher out-of-pocket cost.

How to get information on Medicare PPO?

Get in touch with a licensed insurance agent who can provide information on Medicare PPO plans that may be available in your area . A licensed agent can also help you review the costs and benefits of each available plan where you live and help guide you through the enrollment process. Call. 1-800-557-6059.

What is a PPO plan?

What is a Medicare PPO? A Medicare PPO plan consists of a network of preferred health care providers. These are doctors, facilities, pharmacists and other sources of health care services who have agreed to participate in the PPO plan network.

How to contact a PPO insurance agent?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. Unlike some other types of Medicare Advantage health plans, a PPO generally does not require you to utilize a primary care doctor, nor do you need a referral to visit a specialist.

How many people are in a PPO plan in 2017?

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders. 2.

Is out of network care covered by Medicare?

However, out-of-network care may still be covered to some extent.

What is the difference between Medicare Advantage and PPO?

The only difference is that instead of your employer covering part of the insurance cost, the federal government does. Some Medicare Advantage PPO plans even offer benefits that aren’t typically included in non-Medi care PPO plans, such as dental care, eyeglasses, and wellness programs.

What is a PPO plan?

PPOs (and HMOs, for that matter) are common types of health plans offered by private insurance companies such as United Healthcare and Aetna. If you’re familiar with using a PPO plan outside of Medicare Advantage, you can rest easy. A Medicare Advantage PPO plan works much the same way.

What are the two most common types of Medicare Advantage plans?

The chart below gives an overview of the two most common types of Medicare Advantage plans, PPOs and HMOs. There are other types of Medicare Advantage plans, but they are far less common.

What is a provider in a PPO?

To start, a “provider” is any doctor or facility that provides you with medical care. When you have a PPO plan, you can choose to see any provider you like. PPO plans can be less restrictive than HMO plans, which have a set network of doctors and facilities you must use. However, not all providers are created equal when you have a PPO plan.

What does it mean to be preferred by health insurance?

Some are “preferred” by the health insurer, meaning you’ll pay less for your care if you choose them. (This is similar to choosing an “in-network” provider in other types of plans.) If you choose to receive care from a doctor or facility that is not inside the preferred network, you’ll pay more for your care.

Does Medicare Advantage PPO work?

A Medicare Advantage PPO plan may work well if you . . . Value freedom and flexibility. You don’ t need to work through a primary care physician or request referrals before seeing a specialist. Want access to more doctors and facilities.

What are the advantages of Medicare PPO?

The most significant advantage that a Medicare PPO plan offers is the flexibility to choose providers based upon your own preferences rather than being restricted to the plan’s in-network selections.

What is a PPO plan?

Medicare PPO plans are one of several types of Medicare Advantage plans available to those who are eligible for original Medicare. Every Medicare PPO plan provides both Medicare Part A and Medicare Part B benefits and caps the out-of-pocket spending that is required, but in doing so it also provides enrollees the freedom to choose ...

What is Medicare Advantage?

Among the Medicare Advantage plans there are several different types and options, all of which are offered by private insurance companies. Medicare Preferred Provider Organizations, or PPO plans, are among the most popular of these options. PPO plans allow beneficiaries the flexibility of using their in-network physicians ...

How long is the Medicare enrollment period?

The Initial Enrollment Period (IEP) and Initial Coverage Election Period (ICEP). When you become eligible for Medicare (by turning 65), there is a 7-month enrollment period that begins three months before you become eligible, includes the month that you become eligible, and ends three months after the month that you become eligible.

What is Medicare expert?

As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies. Once you are eligible for Medicare and enroll in both Parts A and Parts B, you have the option of remaining with that basic coverage or arranging for additional benefits via either a Medicare Advantage plan that is available in your state ...

How old do you have to be to get medicare?

Eligibility for Medicare is linked to being either a U.S. citizen or a legal resident of the United States for a minimum of five years and who have turned 65 years old. Disabled individuals who are under the age of 65 are also eligible for Medicare and can enroll in the program once they have been receiving either Social Security disability ...

Does Medicare PPO have copays?

There are also copays for hospital stays and services. Every Medicare PPO publishes a Summary of Benefits that provides details regarding the copay amounts for each of these services. Medicare PPO enrollees will pay higher costs for services from out-of-network providers and less for services from those who are in the plan’s network.

What is a Medicare Advantage PPO Plan?

A Medicare Advantage PPO Plan is an alternate way to receive your Medicare Part A (hospital insurance) and Part B (medical insurance) benefits. Medicare Parts A and B (also known as Original Medicare) cover many basic health needs, but they do not cover everything many seniors need.

Why Should You Choose a Medicare Advantage PPO Plan?

With a Medicare Advantage PPO plan, you can select from a network of doctors, hospitals, and other healthcare providers. When staying within your network, you’ll pay less for healthcare services than if you use doctors, hospitals, or providers outside the network ./p>

Who is Eligible for Medicare Advantage PPO Plans?

In order to be eligible, you must be enrolled in both Medicare Part A and B. Some states require that you are age 65 or older, even if you are eligible to enroll in Medicare at an earlier age.

What Do Medicare Advantage PPO Plans Cover?

These plans provide the same level of coverage as Medicare Part A and Part B, and more. A Medicare Advantage PPO plan might also cover things like:

What Are Some of the Cost Considerations When Using a Medicare Advantage PPO Plan?

A Medicare Advantage PPO plan is often less expensive than the same coverage you would get if you used Original Medicare.

What About Special Needs Plans?

Medicare Advantage PPOs include Medicare Special Needs Plans (SNPs). These are a type of Medicare Advantage plan that serves seniors with chronic or disabling conditions. These plans require that you obtain healthcare from doctors and hospitals in their approved Medicare SNP networks.

How Do You Sign Up for a Medicare Advantage PPO Plan?

In order to receive the benefits a Medicare Advantage PPO plan provides, you will contract with a private insurance company like United Healthcare, Blue Cross Blue Shield, AARP, or others.

Can I go to a doctor for a HMO?

#TAB#Health Maintenance Organization (HMO) plans—In most HMOs, you can only go to doctors, other health care providers, or hospitals in the plan’s network, except in an urgent or emergency situation. You may also need to get a referral from your primary care doctor for tests or to see other doctors or specialists.

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.

What is a PPO plan?

Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you’ll pay more.

What is the difference between a PPO and an HMO?

What is the difference between PPO and HMO plans? Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers. When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services.

How much is Medicare Part B coinsurance?

Medicare Part B charges a 20 percent coinsurance that you will out pay out-of-pocket after your deductible has been met. This amount can add up quickly with a Medicare PPO plan if you are using out-of-network providers.

How much is a PPO deductible?

Medicare PPO plans can charge a deductible amount for both the plan, as well as the prescription drug portion of the plan. Sometimes this amount is $0, but it depends entirely on the plan you choose.

What is Medicare Part A?

Medicare Part A, which includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care. Medicare Part B, which includes medical insurance for the diagnosis, prevention, and treatment of health conditions. prescription drug coverage (offered by most Medicare Advantage PPO plans) ...

Does Medicare Advantage have an out-of-network max?

All Medicare Advantage plans have an out-of-pocket maximum amount that you will pay before they cover 100 percent of your services. With a Medicare PPO plan, you will have both an in-network max and out-of-network max. Below is a comparison chart for what your costs may look like if you enroll in a Medicare Advantage PPO plan in a major U.S. city.

Do Medicare Advantage plans charge a premium?

In addition, Medicare PPO plans can charge their own monthly premium, although some “ free ” plans don’ t charge a plan premium at all.