What are the best Medicare Advantage plans?

A Medicare PPO Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. PPO Plans have network doctors, other health care providers, and hospitals. You pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network . You can also use out‑of‑network providers for

What are the advantages and disadvantages of PPO?

Nov 23, 2021 · What are the advantages of a Medicare PPO plan? A few reasons why some people might prefer a PPO plan over other types of Medicare Advantage plans include: Medicare PPOs typically offer the freedom and flexibility to seek health care services from providers outside of their plan network, though it will typically be at a higher out-of-pocket cost.

What are the requirements for Medicare Advantage plan?

A Medicare Advantage Preferred Provider Organization Plan, or PPO Plan, is one of the five different plan options you have when you enroll in a Medicare Part C, or Medicare Advantage Plan. A PPO Plan still provides a list of physicians and healthcare facilities that are in-network.

What exactly is the advantage of Medicare Advantage plans?

Feb 08, 2022 · A Medicare Preferred Provider Organization (PPO) plan is a type of Medicare Advantage Plan, an alternative to Original Medicare. A PPO provides you with access to your Medicare-covered services plus more benefits that Medicare doesn’t cover, such as dental, vision, and hearing.

What is the difference between a PPO and Medicare Advantage plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What does PPO stand for in a Medicare Advantage plan?

Preferred Provider Organizations• Health Maintenance Organizations. • Preferred Provider Organizations. • Private Fee-for-Service Plans. • Special Needs Plans. • Medicare Medical Savings Account Plans.

What is an advantage of a PPO health plan?

Advantages of PPO plans A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.Jul 1, 2019

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Is HMO or PPO better?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

What is the difference between a local PPO and a regional PPO?

A local PPO has a small service area, such as a county or part of a county, with approximately 2,000-5,000 providers in its network. A regional PPO has a contracted network that serves an entire region or regions and can include 16,000-17,000 providers in the network.Nov 28, 2018

What are the disadvantages of a PPO?

Disadvantages of PPO plans. Typically higher monthly premiums and out-of-pocket costs than for HMO plans. More responsibility for managing and coordinating your own care without a primary care doctor.Sep 5, 2020

Are PPO plans worth it?

A PPO gives you increased flexibility and allows you to bypass seeing a primary care physician, every time you need specialty care. So, if you are a heavy healthcare user or have a large family, the flexibility of a PPO plan may be worth it.Nov 17, 2020

What are the challenges of PPO?

PPO networks charge a monthly access fee to insureds for their access to the network. These fees can be anywhere from 1 to 3% of the cost of your monthly insurance bill. As expensive as monthly premiums are, those small percentages can add up quickly. PPOs are restrictive.Nov 18, 2020

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Which is better a Medigap policy or Medicare Advantage plan?

Is Medicare Advantage or Medigap Coverage Your Best Choice? Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

What is Medicare PPO?

by Christian Worstell. February 25, 2021. A Medicare PPO, or Preferred Provider Organization, is just one type of Medicare Advantage plan. What is a Medicare PPO plan, and could a PPO plan be a good fit for your health coverage needs? Learn more about Medicare Advantage PPO insurance plans ...

What is a PPO plan?

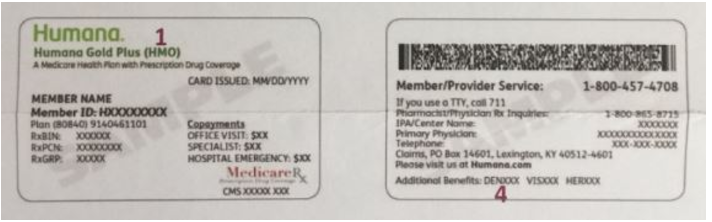

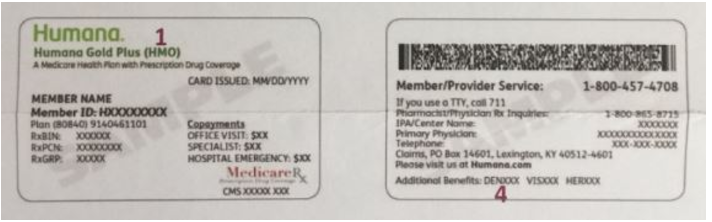

What is a Medicare PPO? A Medicare PPO plan consists of a network of preferred health care providers. These are doctors, facilities, pharmacists and other sources of health care services who have agreed to participate in the PPO plan network.

Do you need a referral for a PPO?

Unlike some other types of Medicare Advantage health plans, a PPO generally does not require you to utilize a primary care doctor, nor do you need a referral to visit a specialist.

Is out of network care covered by Medicare?

However, out-of-network care may still be covered to some extent.

What are the extra benefits of Medicare Advantage?

Where Medicare Advantage plans distinguish themselves is with the extra benefits they each may offer in addition to the required minimum coverage. Prescription drugs, dental, vision and hearing coverage are among the popular extra benefits that may be offered by some Medicare PPO plans.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the advantage of a PPO plan?

The most significant advantage that a Medicare PPO plan offers is the flexibility to choose providers based upon your own preferences rather than being restricted to the plan’s in-network selections. There is no need to select a Primary Care Physician (PCP). These plans also frequently have much larger networks then HMO managed care plans do.

What is a PPO plan?

Medicare PPO plans are one of several types of Medicare Advantage plans available to those who are eligible for original Medicare. Every Medicare PPO plan provides both Medicare Part A and Medicare Part B benefits and caps the out-of-pocket spending that is required, but in doing so it also provides enrollees the freedom to choose ...

What are special enrollment periods?

Special Enrollment Periods. There are special enrollment periods created for unique circumstances including:#N#Moving to a different service area while enrolled in another plan#N#Losing eligibility for a Special Needs plan#N#Losing eligibility for Medicare/Medicaid#N#Living in or recently leaving a nursing home 1 Moving to a different service area while enrolled in another plan 2 Losing eligibility for a Special Needs plan 3 Losing eligibility for Medicare/Medicaid 4 Living in or recently leaving a nursing home

What is Medicare expert?

As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies. Once you are eligible for Medicare and enroll in both Parts A and Parts B, you have the option of remaining with that basic coverage or arranging for additional benefits via either a Medicare Advantage plan that is available in your state ...

How old do you have to be to get medicare?

Eligibility for Medicare is linked to being either a U.S. citizen or a legal resident of the United States for a minimum of five years and who have turned 65 years old. Disabled individuals who are under the age of 65 are also eligible for Medicare and can enroll in the program once they have been receiving either Social Security disability ...

When does ICEP end?

But, if you delay enrollment in Part B, then your ICEP begins the three-month period before your Part B start date and ends the last day of the month before your Part B coverage starts. If you miss this enrollment period, then you’ll have to wait until the annual enrollment period to enroll in a Medicare Advantage plan.

What is Medicare Advantage?

Among the Medicare Advantage plans there are several different types and options, all of which are offered by private insurance companies. Medicare Preferred Provider Organizations, or PPO plans, are among the most popular of these options. PPO plans allow beneficiaries the flexibility of using their in-network physicians ...

What is a D-SNP?

Our dual-eligible Special Needs Plan (D-SNP) is a type of Medicare Advantage plan, available to people who have both Medicare and Medicaid. We can help you find out if you qualify.

Does Aetna offer Medicare Advantage?

Medicare Advantage plans for every need. In addition to PPO plans, Aetna offers you other Medicare Advantage plan options — many with a $0 monthly plan premium. We can help you find a plan that’s right for you.

Does Aetna require a PCP?

Aetna Medicare Advantage plans at a glance. Our PPO plans. Requires you to use a provider network. No. But seeing out-of-network providers generally costs more. Requires you to have a primary care physician (PCP) Usually no PCP required.

Do you need a referral for a PPO?

Preferred provider organization (PPO) plans let you choose any provider who accepts Medicare. You don’t need a referral from a primary care physician for specialist or hospital visits. However, using providers in your plan’s network may cost less.

What is a PPO plan?

Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you’ll pay more.

What is the difference between a PPO and an HMO?

What is the difference between PPO and HMO plans? Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers. When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services.

How much is Medicare Part B coinsurance?

Medicare Part B charges a 20 percent coinsurance that you will out pay out-of-pocket after your deductible has been met. This amount can add up quickly with a Medicare PPO plan if you are using out-of-network providers.

What is Medicare Part A?

Medicare Part A, which includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care. Medicare Part B, which includes medical insurance for the diagnosis, prevention, and treatment of health conditions. prescription drug coverage (offered by most Medicare Advantage PPO plans) ...

Do PPOs require referrals?

Unlike Medicare HMOs, Medicare PPOs don’t require a referral for specialist visits. In fact, if you seek services from a specialist in your plan’s network, you will save more money than if you visit a specialist out of the network.

Do Medicare Advantage plans charge a premium?

In addition, Medicare PPO plans can charge their own monthly premium, although some “ free ” plans don’ t charge a plan premium at all.