Medicare Complement Plan (MCP) is a Point-of-Service (POS) or Preferred Provider Organization (PPO) plan designed for retirees of self-insured employer groups as a way to complement a member’s primary Medicare coverage. Providers must first bill Medicare for Medicare-covered services.

How do I pick a Medicare supplement plan?

“Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time. To buy a Medigap policy, it’s best to enroll during your Medigap Open Enrollment period, which lasts six months.

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Do I need to consider a Medicare supplement plan?

The purpose of Medicare Supplement Insurance is to cover the cost left by deductibles and coinsurance in Original Medicare, but as full Medicaid coverage should cover the majority of those costs, a Medicare Supplement Insurance policy isn’t necessary. 3 A number of factors influence your coverage eligibility and decisions.

How to pick a Medicare supplement plan?

- Your health – How many times a year do you visit a doctor, specialist, or hospital? ...

- Your budget – Do you want to pay less each month or pay less when you visit a doctor? ...

- Your doctor – Choosing an HMO plan means you have a PCP who works together with a team of specialists to help you stay healthy and get the care that ...

What is Complement Plan?

Complementary Plan means the national pension plans for French Employees and workers sponsored by the Association des Regimes de Retraite Complementaires ("ARRCO") and the Association Generale des Institutions de Retraite des Cadres ("AGIRC"), respectively.

What is the difference between Tufts Medicare complement and Tufts Medicare Preferred?

Members enrolled in the Tufts Health Plan Medicare Complement Plan may utilize any provider that accepts Medicare. Tufts Health Plan Medicare Preferred is an HMO plan with a Medicare contract. Enrollment in Tufts Health Plan Medicare Preferred depends on contract renewal.

What is Tufts Medicare Complement?

Tufts Medicare Complement (TMC), offered by Tufts Health Plan, is a health maintenance organization (HMO) option that is designed to enhance your Medicare coverage. To be eligible for TMC: • You must have – and maintain – Medicare coverage Parts A and B (please note that Medicare must be your primary coverage).

How much is Tufts preferred Medicare?

Costs for Tufts Medicare Advantage plans in Boston (Suffolk County)PlanMonthly premiumPrimary doctor copay, specialist copayTufts Medicare Preferred HMO Saver Rx (HMO)$0$10, $45Tufts Medicare Preferred HMO Value No Rx (HMO)$123$10, $25Tufts Medicare Preferred HMO Prime Rx Plus (HMO)$235$10, $15

Is Tufts Health Plan only in Massachusetts?

With headquarters in Massachusetts, Tufts Health Plan also serves members in Connecticut and Rhode Island.

Does Tufts have a Medicare supplement plan?

The Tufts Medicare Preferred Supplement Plan is offered to eligible individuals and employer groups for retirees who are enrolled in Medicare Parts A and B. As a Medigap policy, this plan covers some of the health care costs that Original Medicare does not cover.

Does Tufts have a Medigap plan?

Tufts Medigap plans are offered throughout the state of Massachusetts. Tufts offers Plan 1, Plan 1a, and Core Plan. If you became eligible for Medicare before January 1, 2020, you can purchase any of the three plans.

Does Tufts have a Medicare plan?

HMO Plans. Our Tufts Health Plan Medicare Preferred HMO plans are Medicare Advantage plans (also known as Medicare Part C) that offer comprehensive medical coverage beyond Original Medicare (Medicare Parts A & B).

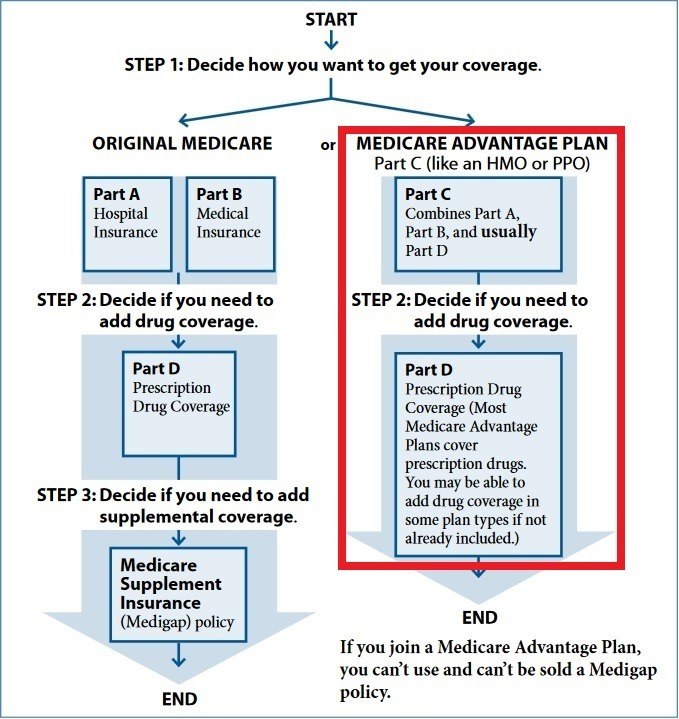

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is a TMC plan?

The Tufts Medicare Complement (TMC) plan is a managed care plan that complements a member's Medicare coverage. It is offered to Tufts Health Plan members in eligible employer groups who are enrolled in Medicare Parts A and B. The TMC plan requires members to choose a primary care physician (PCP) who is responsible for managing or providing the member’s care.

Does Tufts Health Plan reimburse Medicare?

Tufts Health Plan will reimburse 100% of the Medicare deductible and/or coinsurance, minus a copayment for any medically necessary services provided or authorized by the member’s PCP.