Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2022 is $233.

Full Answer

What does Medicare supplement plan G cover?

This plan covers: What Does Medicare Supplement Plan G Cover? Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

What are Medigap supplement plans F and G?

Medicare Supplement Plans F and G are the only Medigap insurance plans that cover 100% of Medicare Part B “excess charges,” which are the costs a doctor can charge for a service or procedure, if they don’t accept assignment. Therefore, these plans will help protect you from additional out-of-pocket...

What is a Medicare supplement plan?

What is a Medicare Supplement plan? A Medicare Supplement (also known as Medigap) plan is a supplemental insurance plan sold by a private company. This kind of insurance helps cover the costs that Original Medicare doesn’t, like deductibles, copayments, or coinsurance. Request a quote in your area

What does Medicare Plan G cover in 2022?

Medicare plan G covers everything that original Medicare does not cover except the Part B deductible. While the part B deductible changes every year, in 2022 that is $233. This means, that other than the monthly payment for plan G, the only thing you will ever have to pay for healthcare is the Part B deductible.

What does supplemental plan G pay for?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is the difference between Plan G and select Plan G?

Plan G Select offers the same benefits as Plan G with the exception of national coverage. Plan G Select members use a local network of hospitals for inpatient services in exchange for lower premiums.

What is Type G Medicare supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What is the difference between Plan G and an Advantage plan?

Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

Does plan G have a deductible?

However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

Does Medicare Part G have a deductible?

What does Medicare Part G cover? Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end.

What are the advantages of a Medicare plan G?

The main benefit of Medicare Plan G is that it covers 100 percent of your Medicare Part A deductible, coinsurance, and copayments. In addition to that, Plan G also covers: 100 percent of Medicare Part B coinsurance, copayments, and excess charges. 100 percent of coinsurance at nursing facilities.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Can I switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

Is Medicare Part G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does AARP Offer plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year. This plan does not cover your Part B deductible.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

How to apply for Medicare Supplement?

This is an ideal time to apply for a Medicare supplement plan because during that Open Enrollment period, an insurance company is not allowed to use medical underwriting to decide whether to accept your application. This means that the insurance company can’t take certain actions based on any of your existing health conditions, including: 1 Not sell you a policy 2 Upcharge you for a Medigap policy as compared to someone else without your health conditions 3 Make you wait for coverage, aside from a few exceptions

What is Plan G?

Plan G is available to individuals who want comprehensive coverage and became newly eligible to Medicare after January 1, 2020. Ron Elledge. Medicare Consultant and Author. Ron Elledge. Medicare Consultant and Author.

Do you have to pay a monthly premium for Medicare?

All Medica re supplement plans require you to pay a monthly premium. Premiums are set by each state and each insurance provider. Because Medicare supplement plans are offered through private insurance companies, the companies will set their own premiums, so they will vary.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

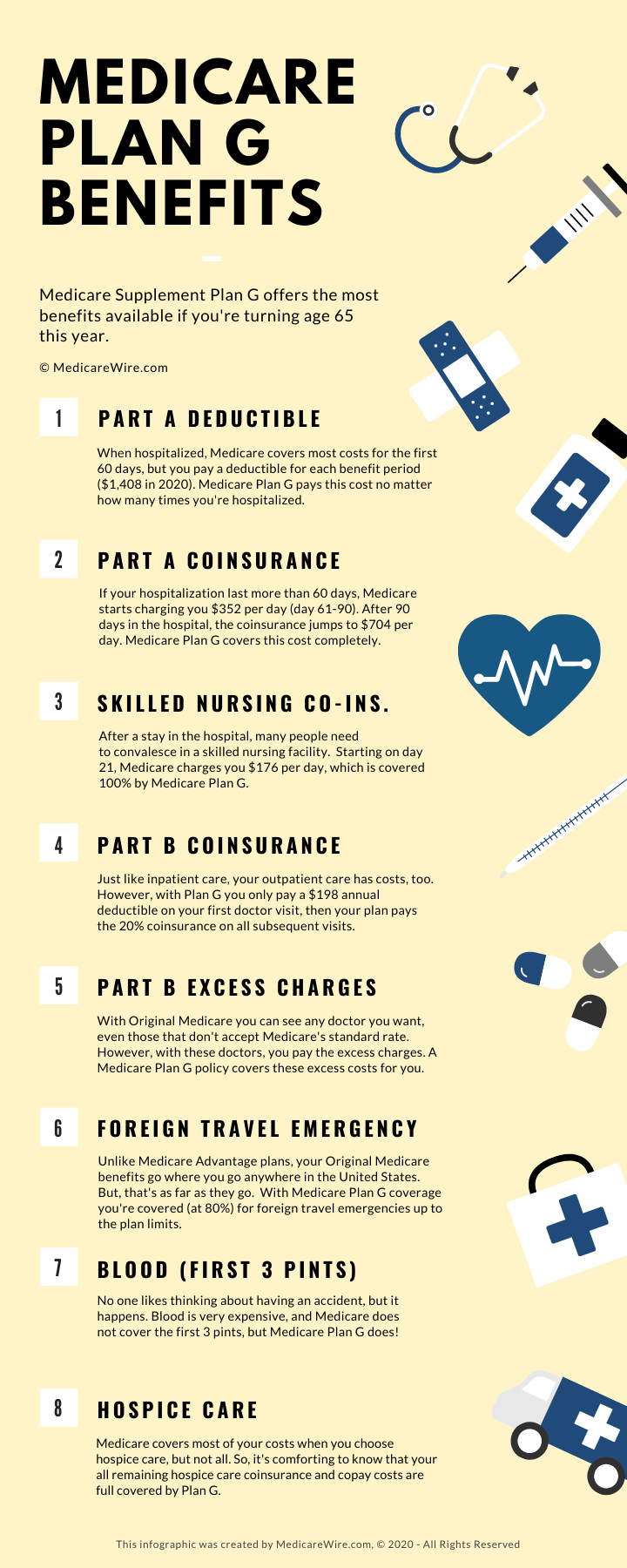

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What is Medicare Supplement?

A Medicare Supplement (also known as Medigap) plan is a supplemental insurance plan sold by a private company. This kind of insurance helps cover the costs that Original Medicare doesn’t, like deductibles, copayments, or coinsurance.

How long does Medicare cover hospitalization?

Medicare Part A will cover your first 60 days in a hospital, but only after you meet your not-so-small deductible in your benefit period ($1,408 in 2020). 2 A plan with this benefit covers your Part A deductible completely.

How long does it take to sign up for Medicare Part B?

Besides picking a plan that suits your needs best, timing is everything when purchasing a Medigap plan. For anyone 65 and over, within a six-month window of signing up for Medicare Part B, federal law guarantees the following protections:

How many pints of blood do you get with Medicare?

Under Original Medicare, you have to pay for every pint of blood you receive until you hit four pints in a calendar year. You’re covered for the first three pints you get in a year with this benefit.

Is Medicare Part A the same as Part D?

Keep in mind, they are not the same. Medicare Part A, Part B, Part C, and Part D are all sections of Medicare. Medicare Supplement Plans A, B, C, D, F, G, K, L, M, and N are Medigap policies that supplement your Original Medicare coverage. The plans supplement coverage for the parts.

When is Medicare due for 2019?

December 12, 2019. If you’re around 65, close to retiring, or already retired, chances are you’re researching Medicare. During your research, perhaps you’ve come to like what Original Medicare, or Medicare Part A and Part B, offers.

Does Medigap offer prescription coverage?

Medigap plans don’t offer prescription drug coverage. If you’re looking for drug coverage, you’ll want to check out Medicare Part D. If you want the benefits of Original Medicare, but you want additional coverage (perhaps vision, dental, or more), Medicare Part C is a great option as well.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.