How much does Medigap insurance cost on average?

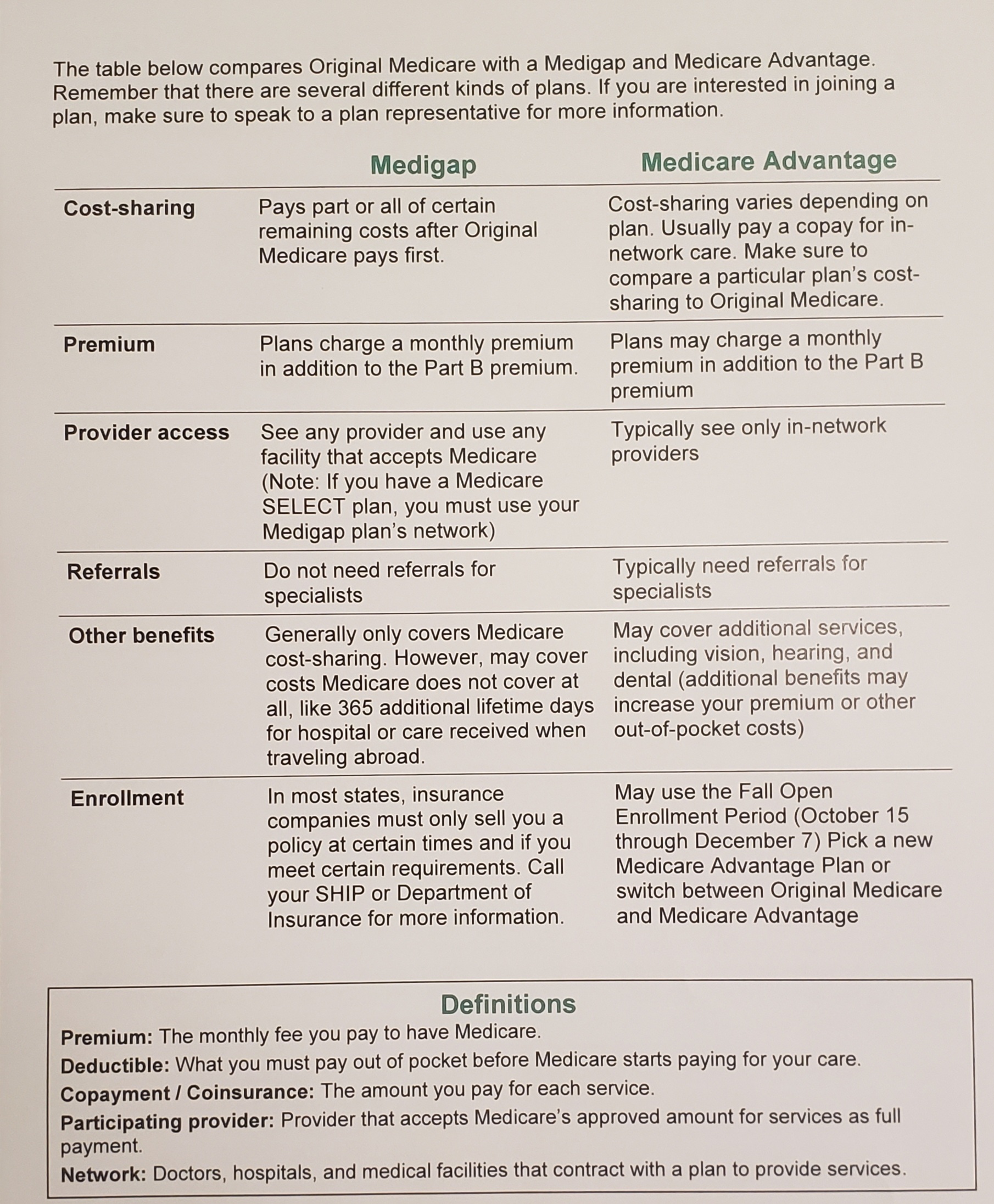

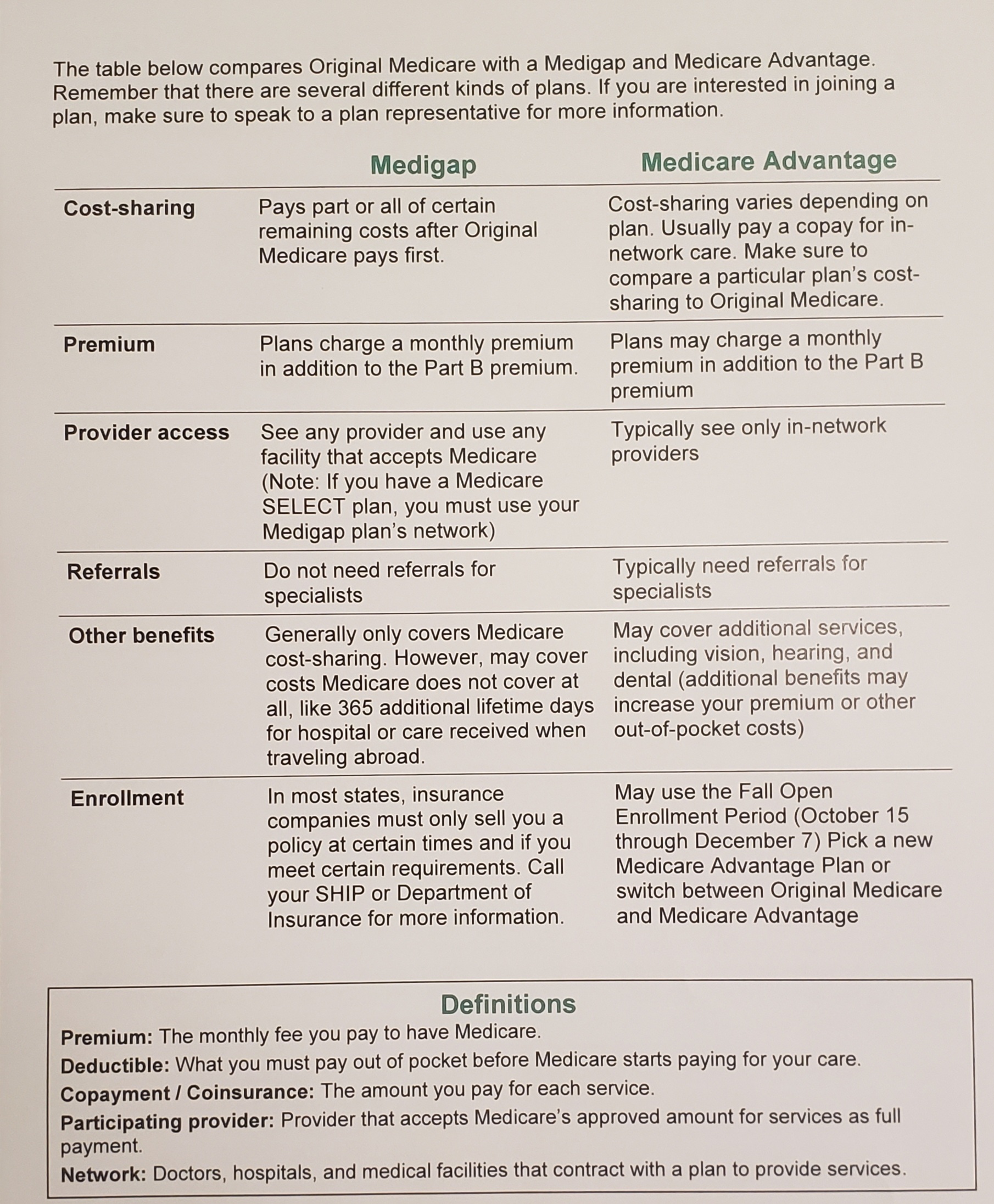

Jul 11, 2018 · A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles. Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days.

Who offers Medigap insurance?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Who needs Medigap insurance?

A Medigap policy (Medicare Supplement Health Insurance) is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Is it better to have Medicare Advantage or Medigap?

Jan 10, 2022 · Medigap is actually a Medicare Supplement policy. These plans cover the gaps of Medicare, which is why they are called “Medigap.” With Traditional Medicare, you’ll pay 20% of the cost of your medical bills, with no Maximum Out-of-Pocket. Plus, there are deductibles and other gaps in coverage.

What is Medigap and why would someone choose it?

Why do I need Medigap? Medigap policy supplements your Original Medicare coverage, covering more expenses. Medigap provides more choice and covers a larger network of healthcare providers than other options. If you travel or need coverage that Original Medicare doesn't provide, Medigap might be a good option for you.

What is the difference between Medigap and Medicare?

The biggest difference between Medicare Advantage and Medicare supplemental insurance (Medigap) is the way they work. Medigap is intended simply to cover some of the gaps (also known as cost-sharing) that Original Medicare doesn't pay for — coinsurance, copayments and deductibles, for instance.

What does a Medigap policy provide?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.Dec 1, 2021

Is Medigap and supplemental insurance the same thing?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Do Medigap plans have a deductible?

Summary: Medicare supplemental (Medigap) Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020.

Is Medigap the same as Part B?

The various Medigap plan types cover different amounts of your Medicare out-of-pocket costs. Note that Medigap Plan B is different from Original Medicare Part B, although their similar names may be confusingly similar. Medigap Plan B includes the following coverage: Medicare Part B copayments and coinsurance.

Do Medigap plans cover Part A deductible?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What does Medigap cover?

What Medigap Plans Can and Cannot Cover. A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles. Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs ...

When to enroll in Medigap?

How to Enroll in Medigap Plans. It is highly recommended that you buy a Medigap policy during your six-month Medigap open enrollment period which starts the month you turn 65 and are enrolled in Medicare Part B (Medical Insurance).

How to apply for Medicare Supplement?

You can apply for a Medicare Supplement plan insurance policy if you are: 1 A resident of a state where the policy is offered. 2 Enrolled in Medicare Parts A and B. 3 Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state).

What is the age limit for Medicare?

A resident of a state where the policy is offered. Enrolled in Medicare Parts A and B. Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state). Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work ...

What is Medicare Supplement Insurance?

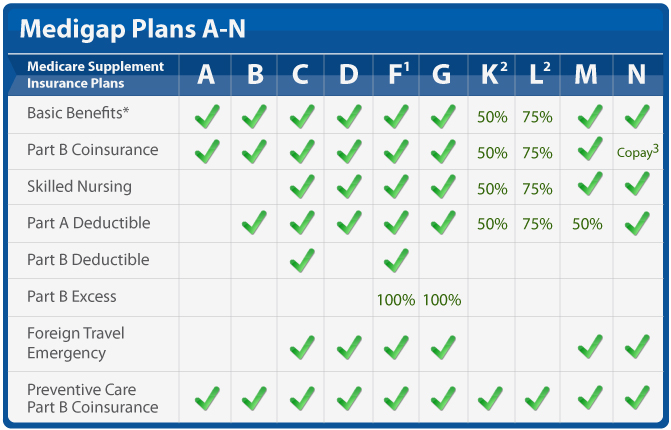

Each plan has different , yet standardized, benefits and coverage that must follow federal and state laws, and must be clearly identified as “Medicare Supplement Insurance.”. This means that no matter which insurer you buy from, the basic benefits of each plan type of the same letter will be the same. In Massachusetts, Minnesota, and Wisconsin, ...

Can you get a Medigap policy with Medicare Advantage?

Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work with Medicare Advantage Plans. You must have Original Medicare Parts A and B to get a Medigap policy.

Does Medigap cover out of pocket expenses?

Medigap can help pay out-of-pocket expenses that Original Medicare doesn’t cover. An Original Medicare plan paired with a Medigap policy can offer comprehensive coverage, which will likely result in lower out-of-pocket expenses.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

What is Medicare Supplemental?

What is Medigap (Medicare Supplemental) insurance? En español | Medigap is also sometimes referred to as a Medicare supplemental insurance. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) Original Medicare doesn’t cover, such as Medicare deductibles, coinsurance ...

Does Medigap cover Medicare Supplemental?

Then your Medigap policy pays its share of covered benefits. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as Medicare supplemental insurance. Insurance companies that sell Medigap can only sell you “standardized” Medigap policies, identified in most states by letters.

Does Medigap cover the same benefits?

Plans identified by the same letter cover the same benefits regardless of what company sells it. Note: In Massachusetts, Minnesota and Wisconsin, Medigap policies may be standardized in a different way. Note: Types of coverage that are NOT Medigap plans are Medicare Advantage plans, Medicare prescription drug plans, employer or union plans, ...

What is a Medigap policy?

Medigap coverage is a Medicare supplemental insurance policy. It is offered by private companies to assist in paying for healthcare expenses that are not covered by Original Medicare (Part A and Part B).

What is the purpose of the information shown on a Medigap policy?

The policy information shown is meant to give a general understanding of what the available Medigap policies may cover. Policies with varying degrees of coverage (which do exist) are not shown.

How long does it take to change a Medigap policy?

Under the Medicare SELECT policy, you will have the option to change your decision on purchasing a policy during the first 12 months of coverage. It also allows you to change policies to a standard Medigap policy during those first 12 months.

What happens if you don't have a Medigap policy?

Without a Medigap policy, you can incur costly medical bills, particularly from a catastrophic injury or illness. These uncovered original Medicare expenses also assist in deferring expenses for things such as: coinsurance, copayments and deductibles.

How many Medigap plans are there?

There are 10 Medigap policy plans, identified by the letters following your Medigap policy; i.e., Medigap A or B, C, D, F, G, K, L, M and N. These various plans carry varying degrees of additional coverage, in addition to your Original Medicare Part A and Part B coverage.

Can I buy Medigap insurance during my OEP?

You are able to buy any Medigap insurance plan that the insurance company offers, at the same price as people who are categorized as having “good health.”.

Does every insurance company have to offer a Medigap plan?

There are, however, some basic tenets for every insurance company that offers Medigap supplemental insurance policies: Every insurance company must offer Medigap Plan A in order to sell any Medigap policy or plan.

What is a Medigap plan?

A Medigap plan is a private insurance plan that helps cover costs that are not covered by original Medicare’s deductibles, coinsurance, and copayments. Medigap plans are offered by health insurance companies such as Aetna, Cigna, and Humana. Plans are identified by letter – for example, the “G” plan or the “N” plan.

What is the copayment for Medicare Supplemental Plan N?

Another copayment that you will be responsible for under the Medicare Supplemental Plan N is the $50 emergency room copayment (unless you are admitted into the hospital). Lastly, some doctors charge an excess amount that the Medigap Plan N doesn’t cover.

How much does Medicare Part B cost?

With the Medigap Plan N, you will pay the Medicare Part B deductible which is $203 per year. In addition, with Medigap Plan N, you will also pay a copay up to $20 each time you visit a doctor or outpatient center. This can get expensive if you are receiving any kind of outpatient treatment a few times a week.

What is Medicare Part A and B?

Typically, Medicare Part A and B covers about 80% of the cost of hospital care and doctor’s visits. A Medigap plan covers some of the costs that remain – it may even cover the full cost, so you may pay $0 out of pocket when you have surgery or another procedure. Medicare is your primary medical coverage.

Is Medigap Plan G the same as Plan G?

This means that every company selling Medigap Plan G is selling the same Plan G. So comparing Plan G’s across different companies is like comparing “apples to apples”. However, the cost of the same plan differs across companies. So a Medigap Plan G purchased from Company A can cost you more than the same plan from Company B.

Can you switch to another company for Medigap?

Only those who had purchased Medigap Plan F prior to January 1, 2020 could keep their plan or switch to another company for the same Plan F coverage. Another option you have when choosing a Medigap plan is the company you choose to purchase the plan from .

Is Medigap Plan G available in 2020?

Only 10% of the people purchase the other plans. Another important thing to know is that in 2020, Medigap Plan F is no longer available.

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.