Medicare Part B Deductible in 2022

- Home Health Services Deductible. Under Medicare Part B, you can receive home health care if you are homebound and need skilled care. ...

- Medical & Other Services Deductible. ...

- Outpatient Mental Health Services Deductible. ...

- Outpatient Hospital Services Deductible. ...

Full Answer

Does Medicaid pay the Part B deductible?

Medicare Part B Deductible – What It Is. Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B. Most people pay the standard Part B premium amount.

What is the maximum premium for Medicare Part B?

Feb 11, 2020 · The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How to collect a part B deductible?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the …

What are the rules for Medicare Part B?

Jan 21, 2022 · The Medicare Part B deductible increased from 2021 to 2022. The 2022 Part B deductible is $233 per year (up from $203 in 2021). This guide also explores the Part B deductible and some of the other 2022 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

How does the deductible work on Medicare Part B?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is the yearly Part B deductible?

Part B Annual Deductible: Before Medicare starts covering the costs of care, people with Medicare pay an amount called a deductible. In 2022, the Part B deductible is $233.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What is the deductible for Medicare Part B 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.Nov 8, 2019

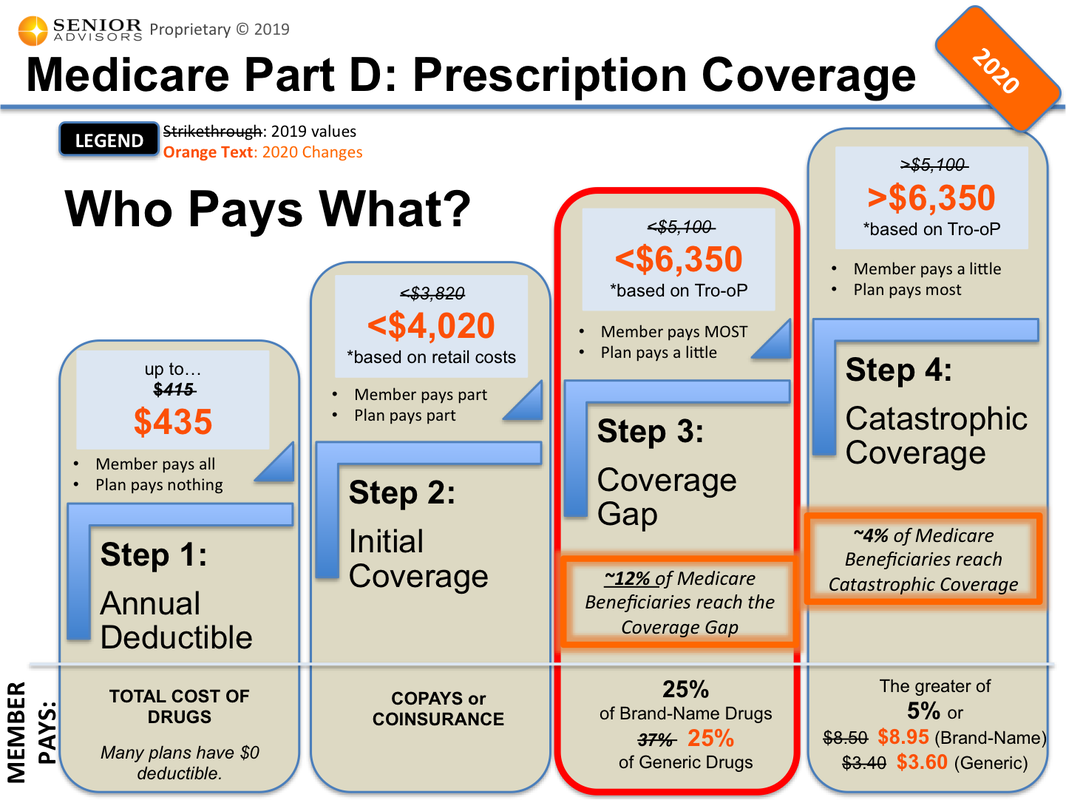

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

How can I increase my Social Security benefits after retirement?

Below are the nine ways to help boost Social Security benefits.Work for 35 Years. ... Wait Until at Least Full Retirement Age. ... Sign Up for Spousal Benefits. ... Receive a Dependent Benefit. ... Monitor Your Earnings. ... Avoid a Tax-Bracket Bump. ... Apply for Survivor Benefits. ... Check for Mistakes.More items...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

What does Medicare Part B cover?

Routine vision care. Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. Hearing aids. 24-hour home health care. Long-term care, such as you might get in a nursing home.

What is not covered by Medicare Part B?

What doesn’t Medicare Part B cover? 1 Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. 2 Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services. 3 Routine dental care 4 Routine vision care 5 Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. 6 Hearing aids 7 24-hour home health care 8 Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

Does Medicare cover custodial care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it. Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

How much is Medicare Part A deductible for 2021?

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

What is a benefit period for Medicare?

The benefit period begins the day you enter the hospital or facility and ends after you have not needed inpatient care for 60 days in a row. Source: Centers for Medicare & Medicaid Services.

What is the Medicare Advantage plan for 2021?

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs. Some Medicare Part D prescription drug plans don’t have a deductible. Those that do may not have a deductible ...

Does Medigap cover Part A?

Some of these plans may cover all or a portion of your Part A deductible. Medigap Plans C and F were the only two to cover the deductible for Medicare Part B. However, Plans C and F are available only to people who became eligible for Medicare before Jan. 1, 2020.

What is a Medigap plan?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

Does Medicare Advantage cover out of pocket expenses?

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary , all plans must set a limit on your maximum out-of-pocket (MOOP) expenses.

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Is Medicare Part B deductible higher in 2020?

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts.