What is covered by Medicare Part?

Medicare Part A is hospital insurance. It’s the part of the Medicare insurance plan that pays for hospital stays, skilled nursing facility (SNF) care, hospice care, and home health care. 1 If you have an illness or incident that results in hospitalization and need rehab afterward, this is the insurance that would cover it.

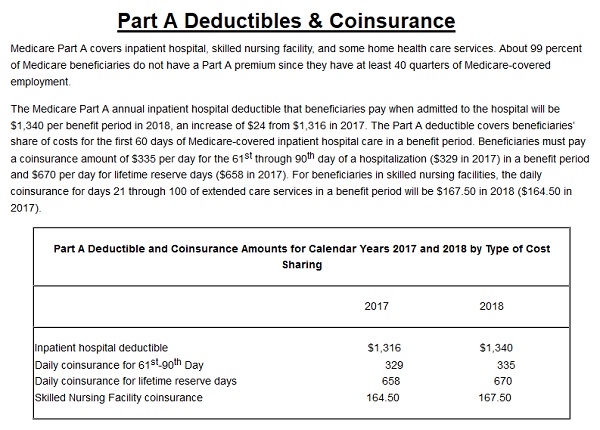

Does Medicare charge a deductible?

Some UnitedHealthcare Medicare Advantage plans have annual deductibles for certain services which you might pay each year. With Original Medicare, you have separate deductibles for Part A and Part B. Copayments. Many Medicare Advantage plans charge a copayment each time you see the doctor or get other health care services.

What is the premium for Medicare Part A?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

What are the four parts of Medicare?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.

What is the deductible for Medicare Part A in 2022?

$1,556Medicare Part A Premium and Deductible The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.

Is there a copay or deductible for Medicare Part A?

Medicare parts A, C, and D have copayments and may also have deductibles and coinsurance. Medicare Part B does not usually have a copayment. A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full.

What percentage does Medicare Part A cover?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

Does Part A have a deductible?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

What is the maximum out of pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Does Medicare Part A pay for hospital stay?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What Medicare Part A does not cover?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Does Medicare Part A cover surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What is Medicare Part A?

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What is deductible insurance?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

What Is the Maximum Cost of Medicare Part B?

Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

What is the Medicare deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period , and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs.

How much is Medicare Part A deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

How long after your Medicare benefits end do you have to go back to the hospital?

Should you enter the hospital again at least 60 days after your benefit period has ended, you will begin a new benefit period and will once again have to pay the first $1,556 of covered care.

Can you have multiple benefits in the same year?

You could experience multiple benefit periods within the same calendar year if you are in and out of the hospital multiple times, and you would be required to meet the full deductible cost in each new benefit period.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

How often is Medicare deductible charged?

Many homeowners and car insurance policies charge a deductible whenever you file a claim. A health insurance deductible is usually charged once for the plan year.

How much is the Medicare deductible for 2021?

She is in the hospital over 60 days this time, so she must also pay a co-pay for 5 days. For 2021, the Part A deductible is $1,484 and the daily copay is $371. Item. Amount. First Stay. Medicare Part A deductible. $1,484.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does it take to get a deductible back after a hospital stay?

If you go back into the hospital after 60 days, then a new benefit period starts, and the deductible happens again. You would be responsible for paying two deductibles in this case – one for each benefit period – even if you’re in the hospital both times for the same health problem.

How long does Medicare cover lifetime reserve days?

Part A Lifetime Reserve Days. Medicare Part A covers an unlimited number of benefit periods, and it helps pay for up to 90 days of care for each one. After 90 days, it’s possible to tap into lifetime reserve days. Lifetime reserve days are like a bank account of extra hospital days covered by Medicare.

When does Medicare kick in?

Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

How many days can you use for Medicare?

Lifetime reserve days are like a bank account of extra hospital days covered by Medicare. You have 60 extra covered days in your account that you can use over your entire life. Lifetime reserve days may be applied to more than one benefit period, but each day may be used only once.

What does Medicare Part A Cover?

Medicare Part A covers care you receive when you stay at the hospital as an inpatient or skilled nursing facility. This includes:

How much does Medicare pay for a month?

If you’re getting retirement benefits or are eligible for retirement benefits, Medicare Part A has a $0 monthly premium payment. The same rule applies if you’re under 65 years old and have been claiming federal disability benefits for at least 24 months, or if you’ve been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis, or ALS). Americans who are eligible for Medicare, but not other federal benefits, can still get coverage for a monthly premium up to $471.

How much is Medicare coinsurance for 2021?

Days 61-90 : $352 coinsurance per day ($371 in 2021) Day 91 and beyond : $704 coinsurance per day for each "lifetime reserve day" after the benefit period ($742 in 2021) You get 60 “lifetime reserve days” while on Medicare. These are extra days you can apply toward your qualified stay.

When do you enroll in Medicare Part A?

If you’re on federal retirement benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65. Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65.

Does Medicare cover inpatient hospital?

Medicare Part A covers the cost of an inpatient hospital stay, but fees charged by a doctor or specialist physician will be covered by Part B. Medicare Part A does not cover the following at any hospital or facility: A private room, unless medically necessary. In-room television and phone services. Personal items.

Does Medicare cover home health care?

Medicare can cover the cost of home health care — like intermittent skilled nursing care or home health aides — in specific circumstances. Primarily, you must have recently had prior inpatient hospitalization and be homebound (unable to leave your home for medical reasons).

Does Medicare cover nursing home care?

Medicare will cover your stay at the nursing facilities after your qualifying hospital stay and if you have a legitimate medical condition. Medicare will not cover a nursing home stay if it is simply for personal care, like bathing and getting dressed (sometimes called custodial care).