What is a Medicare Set-Aside?

- A Deeper Definition. A Medicare Set-Aside is a portion of settlement proceeds set aside, called an “allocation,” to pay for future Medicare-covered services that must be exhausted prior to Medicare ...

- The Problem with MSAs. ...

- Medicare Set-Asides are an Unregulated New Frontier. ...

How long does it take to get Medicare set aside?

Jul 23, 2020 · A Medicare set-aside arrangement is an amount of money set aside to pay the medical costs for a specific injury or illness. The money in your Medicare set-aside arrangement comes from one of three...

Can I Cash Out my Medicare set aside?

Jun 30, 2020 · A Medicare Set-Aside is a trust or trust-like arrangement that is set up to hold settlement proceeds for future medical expenses. A specialized company evaluates your future medical needs, recommends an amount that should be set aside for future medical care, and the government approves the amount.

Can you spend your Medicare set aside money?

Oct 28, 2020 · A Medicare Set-Aside is a portion of settlement proceeds set aside, called an “allocation,” to pay for future Medicare-covered services that must be exhausted prior to Medicare paying for any future care related to the injury.

Does my client need Medicare set-aside?

A Medicare Set Aside account, also known as an MSA, is an important component of the workers’ compensation payment landscape. Here’s the essential information you need to know about who qualifies for them, how they work, approved expenses, etc.: What is an MSA? An MSA is a settlement resulting from a workers’ compensation or personal injury claim.

How does a Medicare set aside work?

A Medicare Set-Aside is a trust or trust-like arrangement that is set up to hold settlement proceeds for future medical expenses. A specialized company evaluates your future medical needs, recommends an amount that should be set aside for future medical care, and the government approves the amount.Jun 30, 2020

What happens to Medicare set aside?

The Centers for Medicare & Medicaid Services Self Administration Toolkit indicates that: If you have funds left over at the end of a year, they remain in the account and are carried forward to the next year. The following year, you will be able to use the annual deposit money as well as whatever was carried forward.

How do you calculate a Medicare set aside?

The professional hired to perform the allocation determines how much of the injury victim's future medical care is covered by Medicare and then multiplies that by the remaining life expectancy to determine the suggested amount of the set aside.

What is Medicare set aside MSA?

A Workers' Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers' compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare.

What is an MSA payment?

An MSA is a financial arrangement that allocates a portion of a settlement, judgment, award, or other payment to pay for future medical services.Sep 19, 2017

What is MSA seed money?

An initial deposit of “seed money” is used to fund the MSA. The amount of the seed deposit totals the first surgical procedure or replacement and two years of annual payments. The structured settlement then funds the MSA with annual deposits.

What is the largest Workmans Comp settlement?

Navigating Mental Health Challenges Through Law School To date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.Feb 11, 2021

What does self administered MSA mean?

Self-Administration. To self-administer an MSA, all the client needs to do is open an interest-bearing bank account and deposit the funds there. The client then alerts their provider regarding the existence of the MSA and pays for Medicare-covered, injury-related care out of the account they created.Jul 7, 2020

What is a non submit MSA?

By way of background, a “non-submit” is a prepared Medicare Set Aside (MSA) allocation which otherwise meets workload review thresholds[1] but isn't submitted to CMS / Workers' Compensation Review Contractor (WCRC) for review and approval.Jan 12, 2022

Is Medicare set aside taxable?

In most cases, the entire amount paid out in a personal physical injury settlement is non-taxable. So, your MSA funds, as part of that settlement are also not taxed upon receipt. The injured party is responsible for taxes on interest earned on their MSA funds.

What is the maximum workers compensation in California?

In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage. This is set by state law and also has a maximum allowable amount. In 2018, for example, the maximum allowable amount was $1,215.27 per week for a total disability. This amount is adjusted annually.

How do I set up an MSA?

How it worksJoin: Enroll in a qualifying high-deductible Medicare Advantage MSA Plan.Set up your MSA: Next, you'll select your health plan provider and the provider will open your account with Optum Bank®.Get your money: Medicare will deposit a certain amount of money each year for your health care.More items...

What is Medicare set aside?

What is a Medicare set-aside arrangement? A Medicare set-aside arrangement is an amount of money set aside to pay the medical costs for a specific injury or illness. The money in your Medicare set-aside arrangement comes from one of three sources: settlement of a worker’s compensation claim. settlement of a liability lawsuit.

What is a medical cost projection?

In some cases, you’ll need to do what’s called a medical cost projection. The medical cost projection will estima te the costs for future care related to your settlement.

Does Medicare cover medical equipment?

medical equipment. Expenses for healthcare needs that are not related to your injury will still be covered by Medicare. For example, if you’re receiving treatment for broken ribs and muscle damage you sustained at work, all the therapies and pain management would be paid out of your Medicare set-aside arrangement.

Is Medicare a secondary payer?

Medicare is always the secondary payer when another option, like a worker’s compensation or liability settlement, is available. This is because Medicare is taxpayer funded. Medicare doesn’t want to spend taxpayer money on your treatment if you’re already receiving money from a settlement to treat it.

What is settlement planner?

At Settlement Planners, Inc., we help attorneys and adjusters working with injured parties plan for the future by understanding how and when medical expenditures will be allocated. This can be used for financial planning and to set reserves from provider sources. We also assist with claim settlement negotiations in cases that involve MSA guidelines. We offer MSA services from the beginning to the end of the claims process.

Is Medicare a secondary payer?

When someone else is liable for an injury or illness, such as an employer and a workers’ compensation insurance company, Medicare becomes a secondary payer and requires the setup of an MSA under the Medicare Secondary Payer Act. Workers’ compensation claims are the most common type of claim requiring an MSA, but claims that fall under ...

Does Workers Comp cover Medicare?

When settling claims, Workers’ Compensation insurance companies are under a great deal of pressure to protect the interests of Medicare. Federal law even holds liable anyone who shifts the burden to Medicare to pay for future medical expenses related to an person’s personal injury or workers’ compensation accident or illness.

A Deeper Definition

A Medicare Set-Aside is a portion of settlement proceeds set aside, called an “allocation,” to pay for future Medicare-covered services that must be exhausted prior to Medicare paying for any future care related to the injury.

The Problem with MSAs

The problem is that MSAs are not required by a federal statute even in workers’ compensation cases where they are commonplace. There are no regulations, at this time, related to MSAs either. Instead, CMS has intricate “guidelines” and “FAQs” on their website for nearly every aspect of Set-Asides from submission to administration.

Medicare Set-Asides are an Unregulated New Frontier

All the foregoing considered, while there is no regulation or statute requiring anything be done when it comes to Set-Asides, ignoring the issue isn’t the answer.

What is Medicare set aside account?

A Medicare Set Aside account, also known as an MSA, is an important component of the workers’ compensation payment landscape. Here’s the essential information you need to know about who qualifies for them, how they work, approved expenses, etc.:

What happens when Medicare sets aside funds are exhausted?

Once all Medicare Set Aside account funds have been exhausted, a final audit is performed on expenditures. If the funds were used appropriately, then the injured person should receive Medicare benefits for medical expenses related to the claim.

What is MSA in medical?

An MSA is a settlement resulting from a workers’ compensation or personal injury claim. The settlement funds are ‘set aside’ in a special account to pay the claimants’ future costs for medical treatments and services. Once the funds are exhausted, only then will Medicare begin paying for the injured person’s qualified medical expenses ...

What happens if you don't manage your MSA?

If account holders do not manage their MSA account properly, pay more than the approved amount for a service or treatment , or pay for non-allowable expenses from the account, they can face some serious repercussions, such as paying back the overages/improperly spent funds and jeopardizing future Medicare benefits.

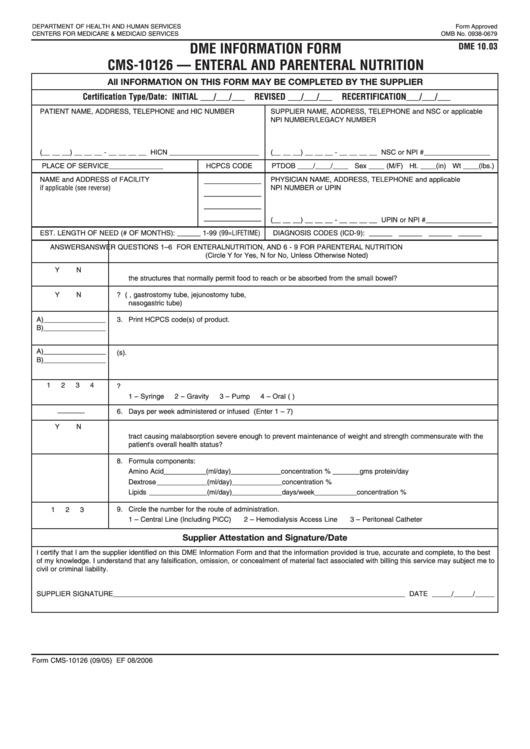

Who administers MSA?

MSA account administration may be performed by the injured person (self-administered) or by a professional administrator. The party who administers the MSA (individual or administrator) must keep accurate records of all disbursements from the account for CMS reporting.

Do you have to report Medicare set aside?

Medicare Set Aside account holders are required to report their expenditures on annual basis to the Centers for Medicare and Medicaid Services (CMS). They must hold on to all receipts in order to validate the expenses. As for qualified expenses, settlement funds can only be used to pay for treatments and prescriptions directly related to the injury. Plus, the claimant has to pay the approved Medicare rate for each service.

What is Medicare set aside?

What is a Medicare Set-Aside (MSA)? A Medicare set-aside (MSA for short) is a mechanism sometimes used in settlement when Medicare might have an interest in your workers’ compensation case. Generally, funds from settlement create the Medicare-set aside account. An injured worker then uses those funds after settlement to pay for medical treatment ...

Who is Jason Perkins?

Jason Perkins is an attorney who specializes in representing injured workers. He regularly blogs about Georgia’s workers’ compensation system and issues that are important to injured workers and their families. You can subscribe to his Georgia Workers Compensation channel on YouTube.

Does Medicare provide a safety net?

If the MSA is properly prepared and used and adequately considered Medicare’s interests, then Medicare should provide a safety net once the MSA is used up. This provides protection for injured workers when they settle their cases. But they have to make sure that they do everything right.

Is MSA self administered?

Sometimes, MSAs are self-administered. Other times, you or the insurance company hires a professional administrator to manage the money in the MSA. Whoever administers the MSA generally has responsibility for making sure they use the MSA funds properly. A failure to do so could result in penalties from Medicare.

What is a workers compensation set aside?

A Workers’ Compensation Medicare Set-aside Arrangement (WCMSA), often called “Medicare set-aside,” involves some of the money from a workers’ compensation settlement being allocated for future costs that Medicare would typically cover. Medicare has strict guidelines about how a person can use the funds in their set-aside account.

What is MSA in WCMSA?

When a person has an WCMSA, some money awarded in a workers’ compensation settlement is placed in a separate account, called an MSA, to cover future medical needs related to the illness or injury in the claim. A person needs to use this money for Medicare-approved services.

Does Medicare cover medical expenses?

Under Medicare Secondary Payer legislation, in some instances, Medicare does not have the primary responsibility to cover medical costs, and other available insurance is responsible for the coverage before Medicare.

Does Medicare cover prescription drug costs?

The costs must be among those that Medicare typically covers, including prescription drug expenses. Individuals may not use the funds for any services that Medicare does not cover. Individuals must keep copies of receipts and bills and report all of their WCMSA-related costs to the CMS each year.

Does Medicare cover MSA?

Medicare helps cover a range of healthcare costs for adults ages 65 and older, as well as for some younger adults with specific health conditions. If a person receives a settlement for a workers’ compensation claim, a portion of the money is put into a WCMSA account — called an MSA — for future medical care.

What is a Medicare Set Aside?

A Medicare set aside ( MSA) is simply an account or trust that holds settlement proceeds. Medicare recipients who receive greater than $25,000 for a personal injury settlement or reasonably expect to enroll in Medicare within 30 months of a settlement of more than $250,000 need to consider Medicare Set Aside.

Two broad types of MSAs

Commonly, MSAs get established for Workers’ Compensation claims (WCMSA). In addition, they are used for personal liability settlements (LMSA). The sources of the liabilities may differ, but accounts get established to ensure Medicare is the secondary payer of future claims.

How are MSA Allocations determined?

The crucial first step is to hire a qualified attorney for representation in a Workers’ Comp or personal liability claim. A personal injury professional with a track record in Medicare Set-Asides and secondary payer compliance is an absolute necessity. As a first step, one can look to the Special Needs Alliance.

What about for Workers Comp?

CMS maintains specific standards for creation and adherence to WCMSA guidelines and provides copious guides and instructions. However, as an administrator (could be self-administered) for allocated funds, whether lump sum or paid in an annuity structure, ongoing compliance is an ominous task. We’ll discuss this more later in the blog.

What about personal injury or liabilities?

CMS does not provide clear-cut guidelines, nor is there anything codified into law regarding personal injury or liabilities (LMSAs), making them more challenging to navigate. Attorneys and administrators may start with Workers’ Compensation rules.

Medicare set aside mistakes to avoid

Here are the most common Medicare set aside mistakes we have seen people make.

Stay on top of your financial health – not just Medicare benefits!

Avoiding Medicare set aside mistakes and optimizing your Medicare benefits are a few aspects of your overall financial health. The ins and outs of Medicare overall can be a challenge to grasp. The greatest Medicare mistake is to let annual enrollment go ignored.

How An MSA Works?

- Because federal law designates Medicare as a secondary payer, Medicare will not pay bills for an injury unless the primary source of payment from a workers’ comp or personal injury settlement has been exhausted. Because you receive money from an insurance provider to cover future medical costs, Medicare wants to ensure this money is spent on injury-related medical expense…

When Is An MSA Required?

- When someone else is liable for an injury or illness, such as an employer and a workers’ compensation insurance company, Medicare becomes a secondary payer and requires the setup of an MSA under the Medicare Secondary Payer Act. Workers’ compensation claims are the most common type of claim requiring an MSA, but claims that fall under the Federal Coal Mine Health …

Medicare Set Aside Services

- At Settlement Planners, Inc., we help attorneys and adjusters working with injured parties plan for the future by understanding how and when medical expenditures will be allocated. This can be used for financial planning and to set reserves from provider sources. We also assist with claim settlement negotiations in cases that involve MSA guidelines. We offer MSA services from the b…