What percentage of federal budget is spent on Medicare?

Mar 11, 2022 · If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16%...

How much does the US spend on Medicaid each year?

Jan 21, 2021 · Medicaid is the third largest mandatory program in the federal budget, accounting for 7 percent of federal spending in 2020, and represents a third of state budgets, on average. As such an important component of government spending and one of the largest payers of healthcare coverage, it has the unique opportunity to be a driver of change and innovation in …

How much does Medicare cost and what does it cover?

Jan 30, 2020 · The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018. State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027. Medicaid expenditures are projected …

What is the future of Medicare spending?

Sep 17, 2021 · Published by Jenny Yang , Sep 17, 2021. In 2020, the share of U.S. federal budget spent on Medicare was 12 percent, a four-times increase since 1970. If current laws stand, the share of federal ...

What percentage of federal budget is Medicare?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What percentage of the national budget goes to welfare?

Pie Chart of Federal Government Spending Health care, principally Medicare and Medicaid, takes a 28 percent share; pensions, principally Social Security, take a 23 percent share; defense, including foreign policy, veterans, and foreign aid, is 19 percent of spending; welfare takes 12 percent of spending.

How much did the government spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.Dec 15, 2021

What are the 5 largest federal expenses?

Major expenditure categories are healthcare, Social Security, and defense; income and payroll taxes are the primary revenue sources. The expenditures of the United States federal government as a percentage of GDP over time.

Which programs get funded the most by the budget?

Nearly 60 percent of mandatory spending in 2019 was for Social Security and other income support programs (figure 3). Most of the remainder paid for the two major government health programs, Medicare and Medicaid.

What percentage of the US budget is spent on pensions?

Pensions expenditure was 6.8 percent of GDP in 2015, 7.1 percent of GDP in 2020. In 2021 pensions spending is estimated at 6.65 percent GDP.

Is there a federal budget for 2021?

The United States federal budget for fiscal year 2021 ran from October 1, 2020 to September 30, 2021....2021 United States federal budget.Submitted byDonald TrumpSubmitted to116th CongressTotal revenue$4.046 trillion (actual) 18.1% of GDPTotal expenditures$6.818 trillion (actual) 30.5% of GDPDeficit$2.772 trillion (actual) 12.4% of GDP2 more rows

Is Medicare funded by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.Mar 23, 2022

What percentage of healthcare is paid by the government?

Contrary to the notion that the country's health care is primarily a privately funded system, 71 percent of health care expenditures in California are paid for with public funds, according to a new analysis by the UCLA Center for Health Policy Research.Aug 31, 2016

Is Medicare federal?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What percentage of Medicaid is children?

Even though children make up about 40 percent of Medicaid beneficiaries, they account for less than 20 percent of the program’s spending. Conversely, the elderly and people with disabilities make up one-quarter of beneficiaries but account for more than half of Medicaid spending.

What is Medicaid financed by?

Medicaid is a health insurance program targeted to lower-income recipients that is financed jointly by the federal government and the states . This budget explainer describes what Medicaid is, how it is funded, and who benefits from it.

What is the FMAP formula?

The formula that governs a majority of government funding is called the federal medical assistance percentage (FMAP), and takes into account differences in per capita income among the states. The FMAP ranges from a minimum of 50 percent in wealthier states such as Alaska to 78 percent in Mississippi. INTERACTIVE MAP.

Does Medicaid cover dental care?

Federal rules require state Medicaid programs to cover mandatory services such as hospital care and physician care , but states may also elect to cover optional services such as physical therapy and dental care. Medicaid services are designed to take into account the needs of its population of beneficiaries.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

Who is Roger Wohlner?

Roger Wohlner is a financial advisor and writer with 20 years of experience in the industry. He specializes in financial planning, investing, and retirement. Article Reviewed on October 29, 2020. Read The Balance's Financial Review Board. Roger Wohlner.

What is the federal budget?

The United States federal budget consists of mandatory expenditures (which includes Medicare and Social Security), discretionary spending for defense , Cabinet departments (e.g., Justice Department) and agencies (e.g., Securities & Exchange Commission ), and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

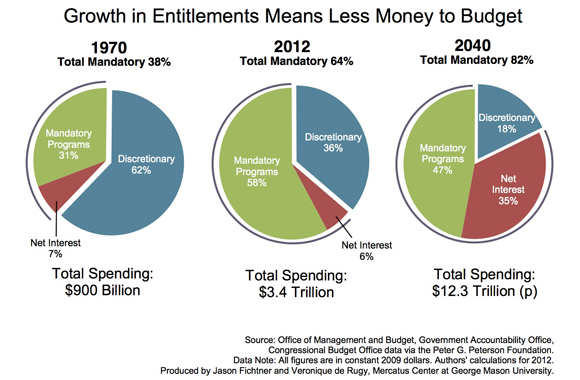

How much of the federal budget is mandatory?

Around two thirds of federal spending is for "mandatory" programs. CBO projects that mandatory program spending and interest costs will rise relative to GDP over the 2016–2026 period, while defense and other discretionary spending will decline relative to GDP.

What is mandatory spending?

Expenditures are classified as "mandatory", with payments required by specific laws to those meeting eligibility criteria (e.g ., Social Security and Medicare), or "discretionary", with payment amounts renewed annually as part of the budget process, such as defense. Around two thirds of federal spending is for "mandatory" programs.

How much will Social Security increase in 2035?

The Congressional Budget Office (CBO) estimates that Social Security spending will rise from 4.8% of GDP in 2009 to 6.2% of GDP by 2035, where it will stabilize. However, the CBO expects Medicare and Medicaid to continue growing, rising from 5.3% GDP in 2009 to 10.0% in 2035 and 19.0% by 2082.

What is the CBO 2020?

CBO: U.S. Federal spending and revenue components for fiscal year 2020. Major expenditure categories are healthcare, Social Security, and defense; income and payroll taxes are the primary revenue sources. The expenditures of the United States federal government as a percentage of GDP over time.

How much is Social Security spending?

Social Security ($845B or 24% of spending), Healthcare such as Medicare and Medicaid ($831B or 24%), other mandatory programs such as food stamps and unemployment compensation ($420B or 12%) and interest ($229B or 6.5%). As a share of federal budget, mandatory spending has increased over time.

What is discretionary spending?

Discretionary spending is typically set by the House and Senate Appropriations Committees and their various subcommittees.

How much of Medicare is funded by the government?

They financed 15 percent of Medicare’s overall costs in 2019, about the same share as in 1970. The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How many people are on Medicare in 2019?

The number of people enrolled in Medicare has tripled since 1970, climbing from 20 million in 1970 to 61 million in 2019, and it is projected to reach about 88 million in 30 years.

What is Medicare Advantage?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": Part A pays for hospital care; Part B provides medical insurance for doctor’s fees and other medical services; Part C is Medicare Advantage, which allows beneficiaries to enroll in private health ...

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

How much did the NHE increase in 2019?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

What percentage of the federal budget is Social Security?

As the chart below shows, three major areas of spending make up the majority of the budget: Social Security: In 2019, 23 percent of the budget, or $1 trillion, paid for Social Security, which provided monthly retirement benefits averaging $1,503 to 45 million retired workers in December 2019. Social Security also provided benefits ...

How much of the federal budget is interest on debt?

In 2019, these interest payments claimed $375 billion, or about 8 percent of the budget.

What is Medicare 570?

This category consists of the Medicare function (570), including benefits, administrative costs, and premiums, as well as the “Grants to States for Medicaid” account, the “Children’s health insurance fund” account, the “Refundable Premium Tax Credit and Cost Sharing Reductions,” and two other small accounts supporting the Affordable Care Act’s marketplace subsidies (all in function 550).

Why does the federal government collect taxes?

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

How much did the federal government spend in 2019?

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount ($984 billion) was financed by borrowing. As the chart below shows, three major areas of spending make up ...

What is the 601 income security?

The latter contains the Pension Benefit Guarantee Corporation and also covers programs that provide pension and disability benefits to certain small groups of private-sector workers.

What are the subcategories of education?

Education: The education subcategory combines three subfunctions of the education, training, employment, and social services function: elementary, secondary, and vocational education ; higher education; and research and general educational aids (subfunctions 501, 502, and 503, respectively).