The Extended Basic Medicare Supplement is the most comprehensive and the Basic Medicare Supplement is the least comprehensive. The Extended Basic Plan is a qualified Medicare supplement plan; the Basic plan is not qualified. Minnesota law also permits the purchase of additional riders with the Basic Plan.

Full Answer

What are qualified medical expenses (QME)?

Apr 23, 2022 · ShareTweetSharePin0 SharesMedicare supplemental health insurance is the health insurance taken in addition to the Medicare insurance. Supplemental refers to the add-on nature of the insurance; it supports the Medicare insurance by paying for costs that are not covered by Medicare. These include charges such as deductibles, copayments and coinsurance. Because …

Who is eligible for a Qualified Medicare beneficiary program in 2021?

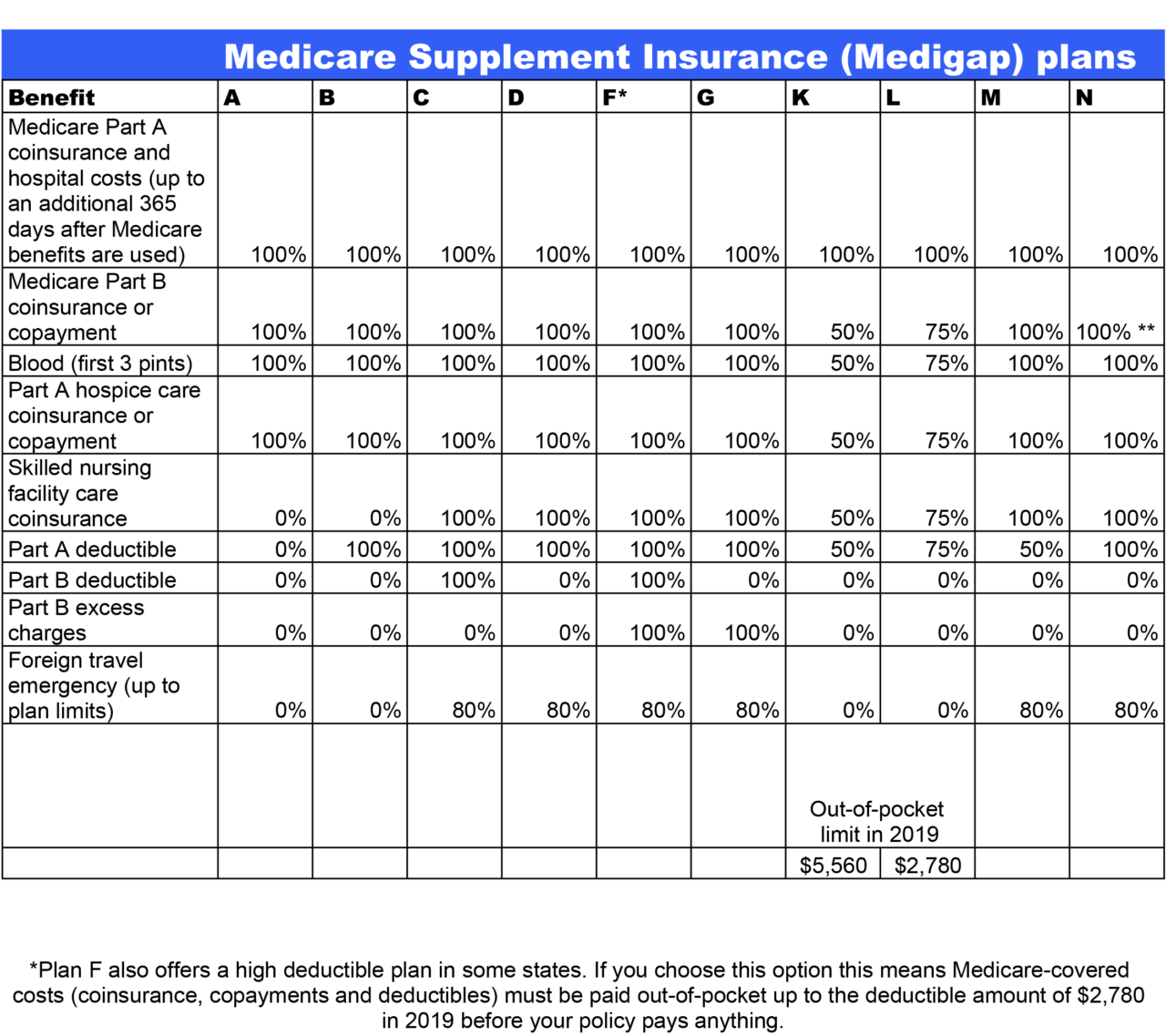

Apr 20, 2022 · Medicare Supplement Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

Are you eligible for Medicare extra help program?

Sep 15, 2021 · Medigap coverage isn’t necessary for anyone on the QMB program. This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

What are the ERISA rules for nonqualified retirement plans?

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified ...

What is a non standard Medicare supplement?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.Dec 1, 2021

Can I be denied a Medicare supplement plan?

Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

What are the criterias of a Medicare supplement plan?

You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which the Supplement Plan is offered at the time of application.Jan 28, 2022

What are the 2 types of Medicare plans?

What's a Medicare health plan? Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Why can you be denied Medicare?

Medicare can deny coverage if a person has exhausted their benefits or if they do not cover the item or service. When Medicare denies coverage, they will send a denial letter. A person can appeal the decision, and the denial letter usually includes details on how to file an appeal.Aug 20, 2020

Can I be turned down for Medicare Part D?

A. You cannot be refused Medicare prescription drug coverage because of the state of your health, no matter how many medications you take or have taken in the past, or how expensive they are.Dec 15, 2008

Which of the following is excluded under Medicare?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What are the 3 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

Does Medigap cover copays?

This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

What are qualified medical expenses?

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified Medical ...

Does Medicare cover dental and vision?

Services like dental and vision care are Qualified Medical Expenses, but aren't covered by Medicare. Qualified Medical Expenses could count toward your Medicare MSA Plan deductible only if the expenses are for Medicare-covered Part A and Part B services. Each year, you should get a 1099-SA form from your bank that includes all ...

What is a nonqualified retirement plan?

Nonqualified retirement plans are employer-sponsored retirement plans that aren’t subject to the rules laid out in the Employee Retirement Income Security Act of 1974 (ERISA). This law created minimum standards for plan participation, funding, and reporting, among other things.

What is a nonqualified deferred compensation plan?

A nonqualified deferred compensation plan, such as a Supplemental Executive Retirement Plan (SERP), is an employer-provided plan that gives the employee supplemental retirement income. The employee does not have to pay taxes on the income until they retire. Executive bonus plans. An employer takes out a life insurance policy in their employee's ...

What is executive bonus plan?

Executive bonus plans. An employer takes out a life insurance policy in their employee's name and pays the premiums, allowing executives to access the cash value of the policy when they retire. Split-dollar life insurance plans. The employer pays for a permanent life insurance policy on behalf of the employee, and the employee ...

What happens if a company goes bankrupt?

If a company goes bankrupt, it may have to draw upon the funds in their employees' nonqualified retirement plans to cover some of its debts. These plans may also have strict distribution schedules, which determine when you can withdraw funds from the account -- and you usually cannot withdraw funds before the date you and your employer originally ...

What happens if one household member switches to another?

If one member switches to a different plan, then neither member qualifies for the Household Savings Program and they both lose the applicable monthly savings. The subscriber will maintain coverage under the policy’s existing member ID number. The other household member will be transferred to his or her own coverage and be re-enrolled under a new member ID number.

Does Blue Shield have a six month guarantee?

No. The six-month rate guarantee applies to new members enrolled in a Blue Shield Medica re Supplement plan. The rate guarantee ensures that, for new members, rates are protected from a Blue Shield–imposed rate action for a specified period of time.

Does the SSI program expire?

No, this program does not expire. As long as both members continue their enrollment in the same plan and continue to reside in the same household and share the same residence and the same mailing and billing address, they qualify for this program.

Do you have to have the same ID for a subscriber?

Yes, both members will have the same subscriber ID number and share one policy. One member will be the subscriber and the other will be enrolled as the other household member.