Secure Horizons, now branded as AARP

AARP

AARP is a United States-based interest group whose stated mission is "to empower people to choose how they live as they age". According to the organization, it had more than 38 million members as of 2018. The magazine and bulletin it sends to its members are the two largest-circulat…

Full Answer

Does AARP follow Medicare guidelines?

Medicare Advantage Plans Must Follow CMS Guidelines In the United States, according to federal law, Part C providers must provide their beneficiaries with all services and supplies that Original Medicare Parts A and B cover.

What is Medicare complete with AARP?

- Various health insurance policies that meet your needs and your budget, now or in the future.

- Possibility of hiring a personal doctor without restricting the network under the condition that doctors accept patients as part of the AARP Medicare plan.

- Insurance is also available when you travel anywhere in the United States.

What is AARP MedicareComplete?

MedicareComplete

- Health maintenance organization. In an HMO, the insurance company covers the charges only for health care providers in the network; if you go out-of-network for service, those charges won't be ...

- Preferred provider organization. ...

- Point of service. ...

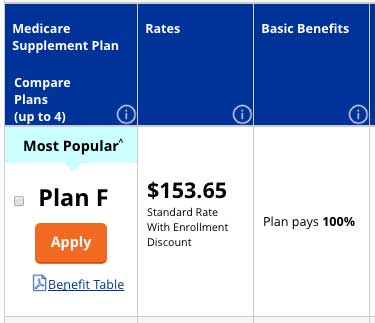

What is the AARP Medicare plan?

- Part A deductible

- Part B deductible

- Part B excess charges

- Preventative care Part B coinsurance

- Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted

- Part B coinsurance or co-payment

- First three pints of blood used in an approved medical procedure (annually)

- Part A hospice care co-payment or coinsurance

What is AARP Secure Horizons?

AARP Medicare Advantage SecureHorizons Plan 1 (HMO) is a HMO Medicare Advantage (Medicare Part C) plan offered by UnitedHealthcare. Plan ID: H0543-032. $89.00. Monthly Premium. AARP Medicare Advantage SecureHorizons Plan 1 (HMO) is a HMO Medicare Advantage (Medicare Part C) plan offered by UnitedHealthcare.

What does Secure Horizons cover?

This plan covers preventive care screenings and annual physical exams at 100% when you use in- network providers. $90 copay ($0 copay for worldwide coverage) per visit If you are admitted to the hospital within 24 hours, you pay the inpatient hospital copay instead of the Emergency copay.

Is Secure Horizons part of Medicare?

The Sharp® SecureHorizons® Plan by UnitedHealthcare® and the Sharp® Walgreens® by UnitedHealthcare® plans are Medicare Advantage Health Maintenance Organization (HMO) plans that include benefits in addition to those covered under Original Medicare, including Part D prescription drug coverage.

What is a AARP Medicare Complete plan?

AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs.

Is Secure Horizons still in business?

Q: Will the PacifiCare and Secure Horizons brands continue in each current market? A: Yes. PacifiCare and Secure Horizons are valued assets of the company and our intent is to utilize them in all of their current markets after the merger is approved.

What is the difference between AARP and UnitedHealthcare?

Although AARP is not an insurance company, it offers healthcare insurance plans through United Healthcare. The plans include Medicare Part D prescription drug coverage and Medigap. United Healthcare is a nationwide health insurance company, with reported 2019 revenue of $242.2 billion.

What plan is H5619?

Humana Gold Plus H5619-144 (HMO) is a HMO Medicare Advantage (Medicare Part C) plan offered by Humana Inc..

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Is Medicare Complete the same as Medicare Advantage?

MedicareComplete is the brand name for UnitedHealthcare's family of Medicare Advantage Plans, many of which also carry the AARP brand. At a minimum, they offer the same coverage as Medicare Parts A and B, and in some cases include a prescription drug component as well.

Does AARP Medicare Complete require referrals?

AARP HMO plans If you have to see a specialist, you'll usually need a referral from your primary care doctor. Most AARP Medicare Advantage plans have a few exceptions to this rule. If you need flu shots, vaccines, or preventive women's healthcare services, you may receive them from a specialist without a referral.

What is the GRP number for Medicare Supplement Plan?

Policy form No. GRP 79171 GPS-1 (G-36000-4). You must be an AARP member to enroll in an AARP Medicare Supplement Plan. In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Who pays royalty fees to AARP?

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

Does AARP pay royalty fees?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, ...

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

What is Secure Horizons?

Secure Horizons was a division of United Healthcare that offers Advantage plans, Medigap policies and Part D Drug plans in the Medicare market. Secure Horizons Medicare Advantage plans were popular because of the variety of plans offered and having plans that are affordable and benefit rich.

Is a PPO a network plan?

HMO, PPO and HMO-POS plans are all network based plans. The PPO plans will generally afford the member more freedom of choice. As a PPO member, you can choose to receive your services from either a network provider or go out-of-network to receive services. If you use a network provider you will generally have lower cost sharing co-pays and co-insurance if required.

Is Secure Horizons Medicare Advantage a secure Horizons plan?

Although MedicareComplete is still one of the most recognizable Medicare brands, it no longer branded as a Secure Horizons plan.

Is PFFS a Medicare plan?

PFFS plans with medical benefits only. The HMO, PPO and HMO-POS plans are branded as MedicareComplete plans. and the PFFS plans are branded as MedicareDirect plans. Not all plans are available in all service areas and some plans may not be renewed for the coming year.

What is Secure Horizons Medicare Advantage Plan?

A Secure Horizons Medicare Advantage Plan is another way to receive your Medicare benefits. The plan includes all Medicare Parts A and B benefits and often includes prescription drug coverage. You generally receive your care from a network of providers and pay premiums, deductibles, co-payments and coinsurance for services.

What is Secure Horizons Medicare?

Secure Horizons MedicareDirect Plans are Private Fee-For-service plans (PFFS) and members can receive care from any Medicare approved provider that accepts the plan’s payment terms and conditions. Many of these PFFS plans were discontinued leaving many service areas without a Secure Horizons Medicare plan option.

How does a Medigap supplement work?

A Medigap policy works differently than a Medicare Advantage Plan. A supplement fill the gaps in original Medicare by paying a portion of your costs. The amount the plan pays depends on the plan. There are 10 standardized plans some more comprehensive than others.

What is special needs plan?

Special Needs Plans are Medicare Advantage Plans for people with certain qualifying conditions or situations. There are chronic illness plans, plans for people living in a nursing home and plans for people enrolled in both Medicare and Medicaid otherwise known as dual-eligible individuals.

Why are Medicare Advantage plans so popular?

Medicare Advantage Plans are popular because you are able to get all your coverage from one plan and many plans include extra benefits such as dental . vision, hearing and Silver Sneakers gym memberships.

When does the open enrollment period for Horizon Medicare end?

The open enrollment period begins October 15th and ends December 7th.

Is Medicare based on age?

Rates are not based on gender, health condition or age, the exception being those people with End Stage Renal Disease (ESRD) who have other options through Medicare and are not eligible to join a Medicare Advantage Plan.

What is an HMO plan?

Health Maintenance Organization (HMO) plans have a defined network of contracted local physicians and hospitals to provide member care. Generally, members must use these care providers to receive benefits for covered services, except in emergencies. Some HMO plans do not need referrals for specialty care.

Do you need a referral for PPO?

Members do not need a referral for specialty care. PPO plans are available as either local PPO (certain counties within a state) or regional PPO (RPPO) offerings. RPPOs serve a larger geographic area - either a single state or a multi-state area.

Do POS plans require referrals?

Some POS plans do not require referrals for specialty care. Preferred Provider Organization (PPO) plans offer members access to a network of contracted physicians and hospitals, but also allow them the flexibility to seek covered services from outside of the contracted network, usually at a higher cost.

Already a Member?

Connect with UnitedHealthcare by calling the number on your member ID card, 8 a.m.–8 p.m., 7 days a week. Or sign into your member account to get information about your plan (s).

Contact UnitedHealthcare by Mail

Use the following address to send UnitedHealthcare correspondence or enrollment forms through the mail if you have a Medicare Advantage, Medicare prescription drug or Medicare Special Needs plan.

PROVIDERS ONLY

If you are a Provider and require assistance, you may contact UnitedHealthcare plans by calling the toll-free General Provider line. Please do not call the Customer Service number listed throughout this website. Providers are routed by their Tax ID.

Website Technical Support

UnitedHealthcare Customer Service advocates are available to assist you with password resets, enhancement requests and technical issues with the website.