Is Aetna a good health provider?

We award Aetna 4.0 out of 5.0 stars. Aetna is one of the largest health insurers in the US, and is highly rated by AM Best and the BBB. The company offers a variety of health plans for employer groups, and a limited number of plans (Medicare supplements, dental plans) for individuals and families.26 fév. 2021

What insurances does Aetna offer?

Most of the U.S. Aetna does offer Life Insurance. However, on their website, Aetna states that the Life insurance coverage that they offer is available through employer-provided plans only. Their life insurance policies are not available to individuals for private sales. Aetna life insurance plans are called group term insurance or group coverage.

Is Aetna a private health insurance?

Aetna Inc. (/ ˈ ɛ t n ə /) is an American managed health care company that sells traditional and consumer directed health care insurance and related services, such as medical, pharmaceutical, dental, behavioral health, long-term care, and disability plans, primarily through employer-paid (fully or partly) insurance and benefit programs, and through Medicare.

Is WellCare the same as Aetna?

Wellcare sells Medicare Advantage and Medicare Part D plans in many parts of the country. However, the company does not sell Medigap. One big difference between Aetna and Wellcare is that Wellcare only sells Medicare insurance, while Aetna also sells other types of insurance, such as group insurance and standalone vision and dental plans.

What does a Medicare HMO cover?

A Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan's network (except emergency care, out-of-area urgent care, or out-of-area dialysis).

Is HMO same as Medicare?

Like all Medicare Advantage Plans, HMOs must provide you with the same benefits, rights, and protections as Original Medicare, but they may do so with different rules, restrictions, and costs. Some HMOs offer additional benefits, such as vision and hearing care. You must have both Parts A and B to join a Medicare HMO.

What is the difference between Medicare Advantage and HMO?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Is Aetna Medicare Advantage the same as Medicare?

Both terms refer to the same thing. Instead of Original Medicare from the federal government, you can choose a Medicare Advantage plan (Part C) offered by a private insurance company. These plans include all of the benefits and services of Parts A and B. They may include prescription drug coverage as part of the plan.

Do doctors prefer HMO or PPO?

PPOs Usually Win on Choice and Flexibility If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

What is an example of an HMO?

The medical-care foundation reimburses the physicians from the prepaid fees of subscribers. Examples of this type of HMO are the San Joaquin Foundation in California and the Physician Association of Clackamas County in Oregon.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Can you have Medicare and Medicare Advantage at the same time?

Can I combine Medicare Supplement with Medicare Advantage? If you already have Medicare Advantage plan, you can generally enroll in a Medicare Supplement insurance plan under one condition – your Medicare Advantage plan must end before your Medicare Supplement insurance plan goes into effect.

Is Aetna Medicare Part D?

Medicare prescription drug coverage (Part D) is offered through private insurance companies, like Aetna and SilverScript.

What type of insurance is Aetna Medicare?

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is a DSNP plan?

* Use of provider network is required by an HMO plan unless there’s an emergency. ** DSNP is a special type of a Medicare Advantage Prescription Drug plan.

What is Medicare HMO?

What is a Medicare HMO plan? A Health Maintenance Organization (HMO) plan requires you to receive medical treatment from specific hospitals and doctors within a certain network. HMO plans are required to provide you with Original Medicare benefits, just like any other Advantage plan.

What is an HMO POS plan?

There are also Health Maintenance Organization Point-of-Service (HMO-POS) plans that give you more flexibility in choosing a doctor or hospital, as they allow out of network options in certain circumstances.

Is Aetna a HMO?

An Aetna Medicare HMO plan may be exactly what you’re looking for. If that’s the case, call to see if you’re eligible to enroll now! There is value in understanding all of your options, though, and Medicare Advantage has plenty of choices. Some HMO, DSNP, and PPO plans are available with a $0 monthly premium, and each plan has its own specific ...

Can you get HMO out of network?

HMO plans are limited when it comes to out-of-network treatment, though that care is still available. In cases of emergency, you can visit an out-of-network doctor or hospital to take care of your health needs.

What is an Aetna Medicare Advantage HMO plan?

A health maintenance organization (HMO) plan lets you choose any doctor or hospital that is in the plan network. You’re typically required to receive care from an in-network provider, unless in the case of an emergency.

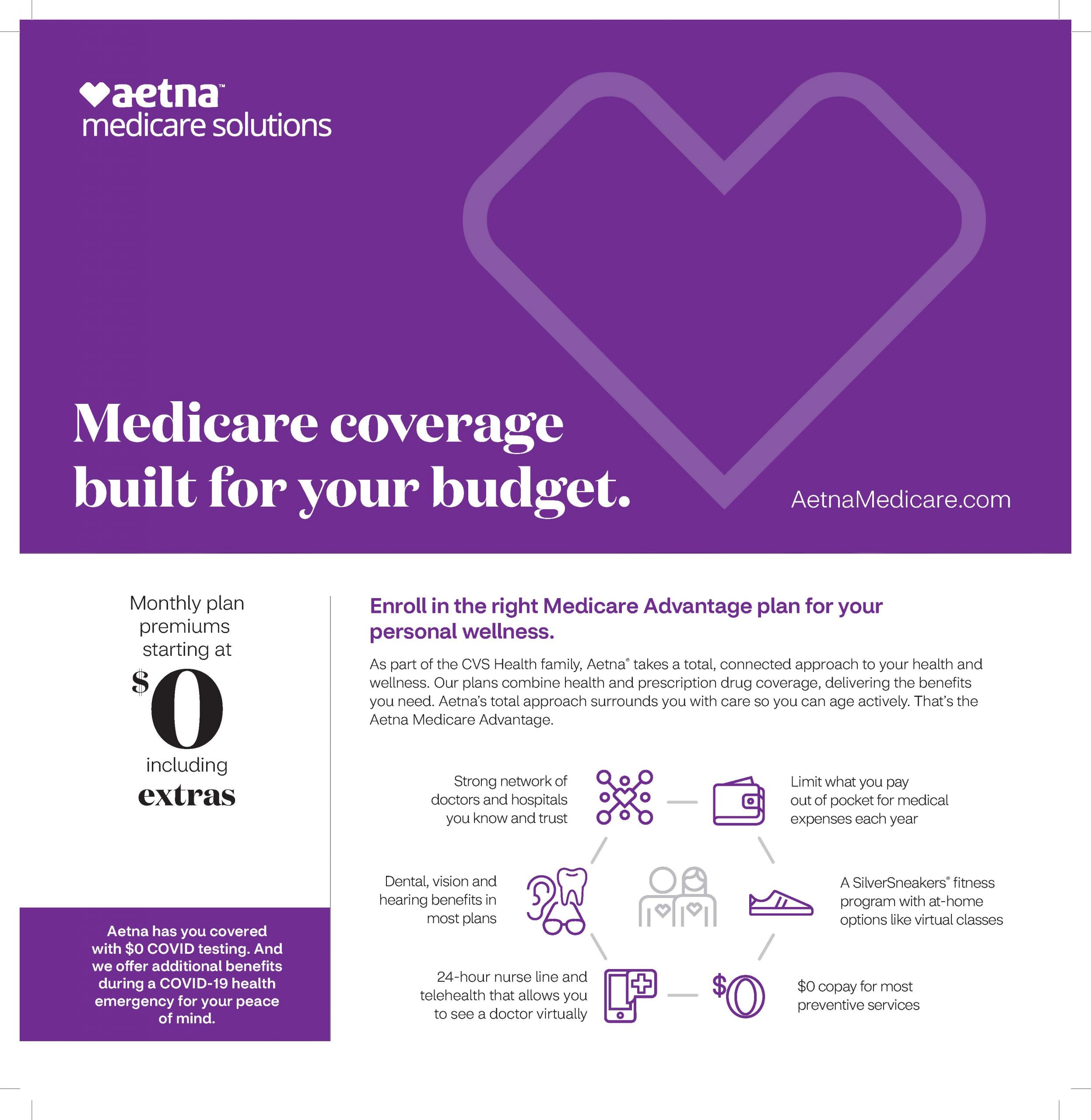

Additional Aetna Medicare Advantage HMO plan benefits

Many Aetna Medicare Advantage HMO plans offer a variety of benefits that go beyond what Original Medicare (Part A and Part B) covers.

How do I enroll in an Aetna Medicare Advantage HMO plan?

To learn more about your Aetna Medicare options or to enroll in a Medicare Advantage plan, speak with a licensed insurance agent. You can reach one by calling 1-877-890-1409 1-877-890-1409 TTY Users: 711 24 hours a day, 7 days a week.

What is HMO health care?

Our Health Maintenance Organization (HMO) benefits plans offer a nice choice of providers with the comfort of guided care to help members reach their best heath, at the best costs possible.

What is an HMO plan?

The HMO plan is ideal for employers in urban locations who want to offer simple, convenient care with fixed, predictable costs. Members must choose a PCP* to guide their treatment and coordinate all specialist care — which all takes place in a quality network to keep costs in check.

What is POS plan?

Point-of-service (POS) plans generally offer you more choice than traditional health maintenance organization (HMO) plans. While you choose an in-network primary care physician, you can also see providers for certain types of services out of network. However, you may pay more for out-of-network care you receive.

What is a D-SNP?

Our dual-eligible Special Needs Plan (D-SNP) is a type of Medicare Advantage plan, available to people who have both Medicare and Medicaid. We can help you find out if you qualify.

Does Aetna offer Medicare Advantage?

Medicare Advantage plans for every need. In addition to HMO-POS plans, Aetna offers you other Medicare Advantage plan options — some with a $0 monthly plan premium. We can help you find a plan that’s right for you.

Does Aetna offer meals at home?

Meals-at-home program. (meals delivered to your home after a hospital stay) Yes, in many plans. Yes, in many plans. Yes, in many plans. Aetna Medicare Advantage plans at a glance. Our HMO-POS plans. Requires you to use a provider network. Varies by plan.

Is there an OTC benefit for HMO?

Over-the-counter (OTC) benefit (get select OTC items at no charge) Yes. Meals-at-home program. (meals delivered to your home after a hospital stay) Yes, in many plans. Our HMO plans. Requires you to use a provider network.

Does seeing out of network providers cost more?

Varies by plan. Seeing out-of-network providers generally costs more. Yes, unless it's an emergency. No. But seeing out-of-network providers generally costs more. Requires you to have a primary care physician (PCP) Yes. Yes, in many plans. Usually no PCP required.

Does a dental plan have RX coverage?

Yes. Yes, if plan has Rx coverage . Yes, if plan has Rx coverage. Dental, vision and hearing coverage. Yes. Yes, in most plans. Yes, in many plans. ER and urgent care coverage worldwide. Yes.

What is HDHP with HSA?

HDHP with HSA: Offset out-of-pocket costs with a health savings account. A High Deductible Health Plan (HDHP) has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA) funded to cover some or all of your deductible.

What is an HMO plan?

HMO: A budget-friendly plan. A Health Maintenance Organization (HMO) plan is one of the cheapest types of health insurance. It has low premiums and deductibles, and fixed copays for doctor visits. HMOs require you to choose doctors within their network.

How old is Myron from HDHP?

People who are managing a health condition but can’t afford higher monthly premiums may find that an HDHP saves them money in the long run. Myron is a 60-year-old book editor in Philadelphia. He and his longtime boyfriend, Joseph, who maintain separate homes, love to travel.

Why does Gayle choose HMO?

When it’s time to enroll in one of her employer’s health plans, she chooses the HMO because it costs the least. This will help her keep expenses down and pay off her debt faster. Gayle doesn’t have any serious health problems ― just seasonal allergies and occasional migraines.

How long has Jenelle been married?

Jenelle, 38, of Jacksonville, FL, has been married for five years. The couple is having difficulty conceiving and has seen a number of fertility specialists. When her employer offered three choices for health plans, Jenelle picked the PPO.

What does HMO mean in insurance?

Health insurance companies use a lot of acronyms (HMO, PPO) and specialized terms like “deductible” and “copay.” You may be wondering if you’re the only one who’s confused: “Was I out sick the day that everyone else learned what this stuff means?”

Is a PPO a good plan?

But this plan allows you to see specialists and out-of-network doctors without a referral . Copays and coinsurance for in-network doctors are low. If you know you’ll need more health care in the coming year and you can afford higher premiums, a PPO is a good choice.