The Differences Between Plan G and Plan N:

- Plan G has only one out of pocket expense (Annual Part B deductible), then 100% coverage

- Plan N also has this expense, but then possible co-payments

- If you visit the doctor frequently Plan G might be a better option

- Plan N is best for people who visit the doctor infrequently but still want great coverage

Full Answer

What are the benefits of Medicare Plan G?

Jul 23, 2021 · Medicare Plan N has lower premiums than Plan G as well as lower annual rate increases. In exchange for lower premiums, Plan N has some additional out-of-pocket expenses that you could incur. Medicare Plan N vs G The Differences Between Plan G and Plan N: Plan G has only one out of pocket expense (Annual Part B deductible), then 100% coverage

What are the top 5 Medicare supplement plans?

Apr 29, 2021 · This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we’ll cover next.

What is Medicare Plan G coverage?

Sep 13, 2021 · The most significant difference is that Plan N requires a small copay, whereas Plan G waives any copayments for Medicare Part B services. Also, the new G plan is now a Guaranteed Issuance policy under Medicare. N policies are still fully underwritten once an individual is outside their Medicare open enrollment period. So, from a rate stability standpoint, …

How to pick the best Medicare supplement plan?

Jun 10, 2021 · Plan G is usually more expensive than Plan N. The reason G costs more is because it provides more coverage. Since Plan G typically has a more expensive premium, it actually may save you money in the long run.

Which plan is better g or n?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the difference between plan N and G?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.Apr 29, 2021

What is Medicare Part N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.Nov 23, 2021

Can I switch from Plan N to G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Does Plan N have a deductible?

Does Plan N have a deductible? Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, $233 in 2022.Jan 24, 2022

What is Plan G Medicare?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

What is Medicare Plan G deductible for 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.May 12, 2020

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Is Plan G going away?

Plan F covers the Plan B deductible, and Plan G does not, but Plan F was phased out as of Jan. 1, 2020. Plan F is now available only to those who were eligible for Medicare before that date. Plan G is a popular replacement because both offer identical benefits aside from the Plan B deductible coverage.

Does AARP plan n pay Medicare deductible?

Plan N also completely covers your Medicare Part A deductible, which is one of the more expensive deductibles in Medicare and repeats for each benefit period throughout the calendar year.

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Is Medicare Plan G Better Than Plan N?

Plan G provides more benefits compared to Plan N. However, N is typically priced lower than G. Which plan is best will depend on your coverage goal...

What Is Medicare Supplement Plan G?

Medicare Supplement Plan G is one of the 10 Medigap policies available to Medicare Supplement shoppers. It is the second most popular options behin...

What Is Medicare Supplement Plan N?

Medicare Supplement Plan N is one of the 10 Medigap policies available to Medicare beneficiaries. It is the third most popular plan behind plans G...

The Differences Between Plan G and Plan N

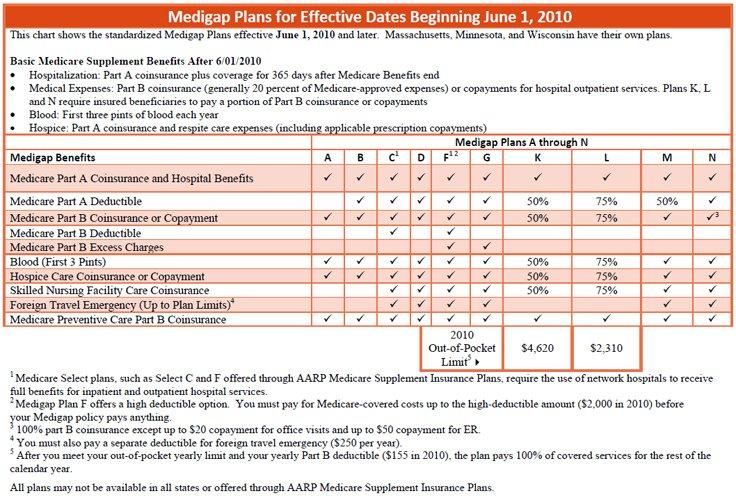

Please note: There’s a standardization of Medigap plans across the USA except for Wisconsin, Minnesota, and Massachusetts.

Medicare Plan G

Plan G offers better coverage than Plan N but at a higher monthly premium. Here are the areas that are covered by Plan G and not Plan N:

Items not covered by Medigap Plan N

These are quite rare, in fact, a recent study showed only 1% of providers even charge these.

What is Medicare assignment?

Medicare Assignment is basically a “fee schedule” or “agreement” between Medicare and a doctor. Accepting assignment by a doctor means that your doctor agrees to the payment terms set forth by Medicare.

How much does Medicare pay for doctor visits?

But, on the other hand, with Medicare Plan N benefits, you must pay a $20 copay for every doctor visit you go to. So, ultimately, if you are a person who visits the doctor frequently, this could definitely add up over a year.

Does Medicare Supplement Plan N cover Part B?

You may be wondering, does Medicare Supplement Plan N cover Part B deductible? Unfortunately, the simple answer is no. Both Plan N and Plan G do not cover the small annual Part B deductible of $203. This means when you go to the doctor the first time at the beginning of the year, you will have to pay this $203 deductible out of pocket with either of these plans.

Does Medicare Part B cover excess charges?

Medicare Part B Excess Charges. This is one of the most important coverage differences between the two plans that could cost you a lot more in medical bills than expected. So Plan N does not cover any excess charges, while Plan G does. So what this means if you choose Plan N, medical providers can send you a balance bill if ...

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is one of the 10 Medigap policies available to Medicare beneficiaries. It is the third most popular plan behind plans G and F. It's often considered the top "value" plan that's currently available.

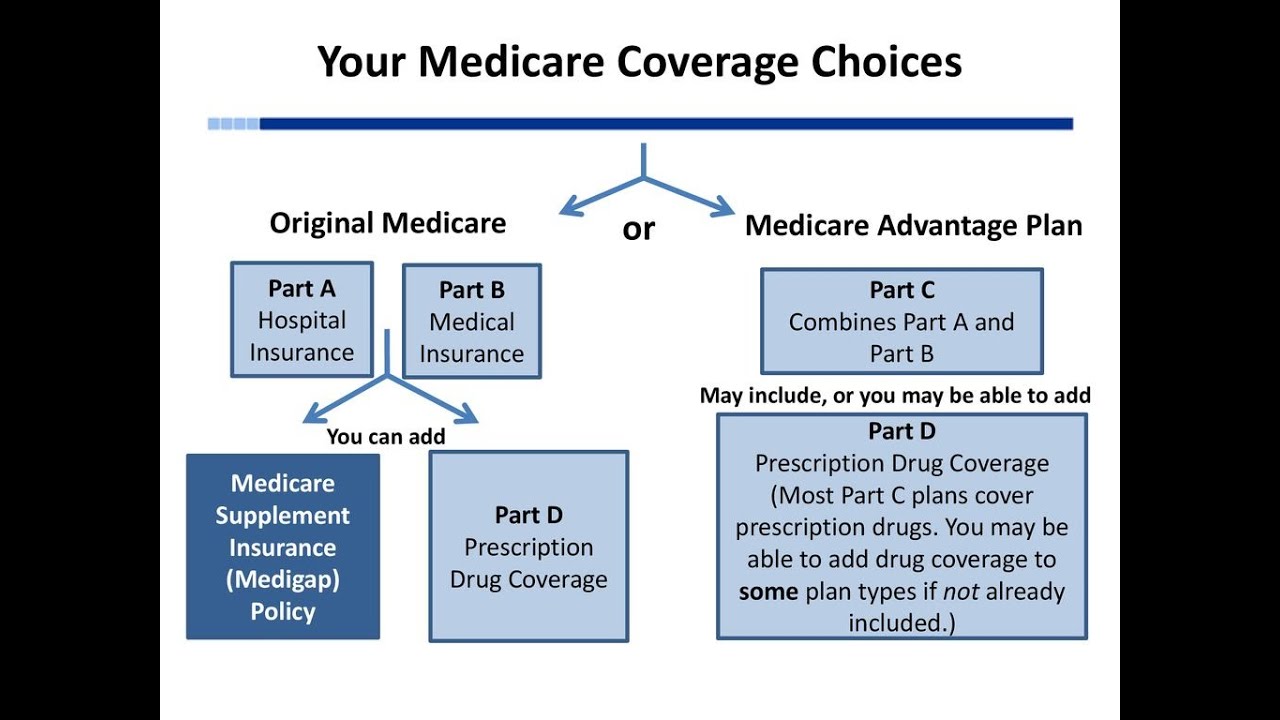

How many Medigap policies are there?

IMPORTANT: Medigap is standardized throughout the country (except in Minnesota, Massachusetts, and Wisconsin). There are 10 Medigap policies that are labeled with a specific letter. Currently, the available policies you may purchase are letters F, G, N, A, B, C, D, K, M and L.

Is Plan G better than Plan N?

For most of the country, Plan G will usually run about $20-25 more each month when comparing G vs N. When looking for the best value , it’s typically a better strategy to sign up for Plan N. It will often depend on your level of health even though N has a copay and you may be responsible for 15% in excess charges.

What is a plan G?

Plan G is a Medicare Supplement Plan that offers a lot of additional coverage. Like all Medicare Supplement Plans, Plan G covers most things left over by Original Medicare. It is one of the most comprehensive plans out there. Because it is so popular, you can usually find it for a competitive price.

How much does Medicare Supplement cost?

However, on average, you can expect to pay somewhere between $65 and $175 for Plan N. Keep in mind that prices in your area could be higher than this, sometimes significantly.

Who is Alex Wender?

Alex Wender. Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.

Is Plan G the same as Plan N?

Plan G is one of the most popular Medicare Supplement Plans out there, for good reason. While Plan N isn’t quite as popular, the plan covers a lot of the same costs as Plan G. Because of their similarity, it can be hard to figure out which plan is right for you. We’ll take you through all of the details here, so you can make an informed decision.

What is excess charge in Medicare?

Excess charges are fees that you may have to pay out of pocket if your doctor charges more than the Medicare allowed amount. If you know that your regular doctor doesn’t charge excess charges, and you don’t expect to have to change soon, then Plan N can be an excellent fit for you.

What does the asterisk mean on Medicare?

The asterisks indicate that you have the Medicare supplement Plan N copay. You will be required to pay up to a $20 co-pay for every doctor visit and a $50 copay for every emergency room visit unless you end up an inpatient in the hospital. Then the $50 copay is waved. The important qualifying words here are “up to”…$20.

How much is Medicare Part B deductible?

It is expected that the Medicare Part B annual deductible could increase up to $250 within the next five to seven years. As a side note: The two Medicare supplement plans that are being phased out in 2020 are the only two plans that paid this deductible. Medicare does not want any supplement to pay that deductible.

When does Medicare enrollment end?

Your Medicare initial enrollment period ends three months after your birthday month. Your Medicare supplement initial enrollment period ends six months after the day you start Medicare Part B. During that six months, you can change your mind about your Medicare supplement plan all you want. Every day even.

Does Medicare cover coinsurance?

Those doctors and hospitals will accept any Medicare supplement you have, from any insurance company. With Medicare supplement Plan N we see that it covers 100% “Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used up.).

What is the difference between Medicare Supplement Plan N and Supplement Plan G?

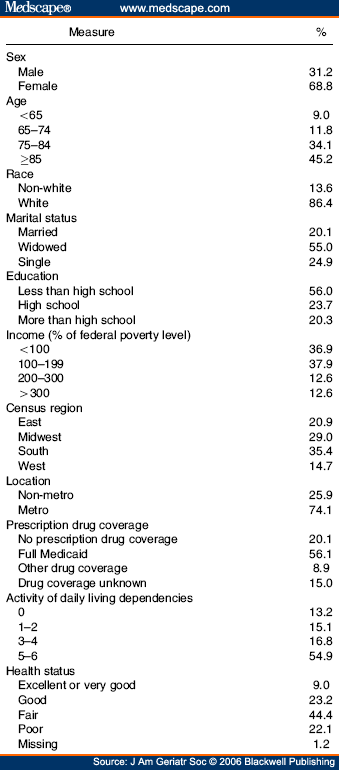

Medicare supplement Plan G, people that prefer the Medicare supplement Plan G to the Medicare supplement Plan N tend to be people who would rather pay a little extra each month and avoid having to do the extra work to avoid excess charges.

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare cover Plan G?

This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

What happens if you don't accept Medicare?

Health-care providers who don’t accept Medicare assignment may charge up to 15% more than the Medicare-approved amount for a service, if they’re legally allowed to do so.

Does Medicare Supplement Plan F cover out of pocket costs?

Medicare Supplement Plan F also pays 100% of your excess charges under Part B.

Is Plan F a high deductible?

There is also a high-deductible version of Plan F that might have a lower premium than the regular Plan F, because of its high deductible. It’s important to know that changes in Medicare law are phasing out plans that pay your Part B deductible, as of January 2020. Medicare Supplement Plan F is one of these plans.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is essentially the same as Plan F, except it does not cover your Part B deductible. You may still be able to buy Medicare Supplement Plan G in 2020. A Medicare Supplement high-deductible Plan G might become available in 2020.