Medicare Part D In 2018

| If you earned (single tax filing): | If you earned (joint tax return): | You’ll pay: |

| Up to $85,000 | Up to $170,000 | The plan premium |

| Over $85,000 to $107,000 | Over $170,000 to $214,000 | $13.30 + plan premium |

| Over $107,000 to $160,000 | Over $214,000 to $320,000 | $34.20 + plan premium |

| Over $160,000 to $214,000 | Over $320,000 to $428,000 | $55.20 + plan premium |

How much does Medicare cost at age 65?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

How much does Medicare cost per month?

6 rows · In 2018, however, average premiums for Medicare Advantage plans are expected to decrease ...

What is the monthly premium for Medicare Part B?

In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is …

How to pay for Medicare?

5 rows · Oct 12, 2018 · What You'll Pay for Medicare Premiums in 2018 What are Medicare premiums in 2018? The ...

What was the monthly cost of Medicare in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much did Medicare cost in 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

How much did Medicare premiums increase from 2019 to 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What was the monthly Medicare premium in 2019?

$135.50 per monthThe standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.Jan 3, 2019

What was Medicare Part B premium in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

How much did Medicare go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much does Medicare take out of Social Security in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much did joint filers pay in 2017?

For instance, in 2017, it took $428,000 in income for joint filers to have to pay the highest $428.60 per month amount.

How much is Medicare Part B deductible?

For instance, the annual deductible for 2018 remains at $183 per year, which represents the amount you have to pay for doctor visits or other outpatient services before Part B coverage kicks in.

How much is Medicare premium in 2018?

In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is $422, up $9 from last year. 2018 will also see higher deductibles and coinsurance payments for hospital coverage under Part A. You can see the increases in the table ...

How much does Medicare Part A cost?

However, if you don't qualify, then you can still get Part A coverage as long as you pay a monthly premium. In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is $422, up $9 from last year.

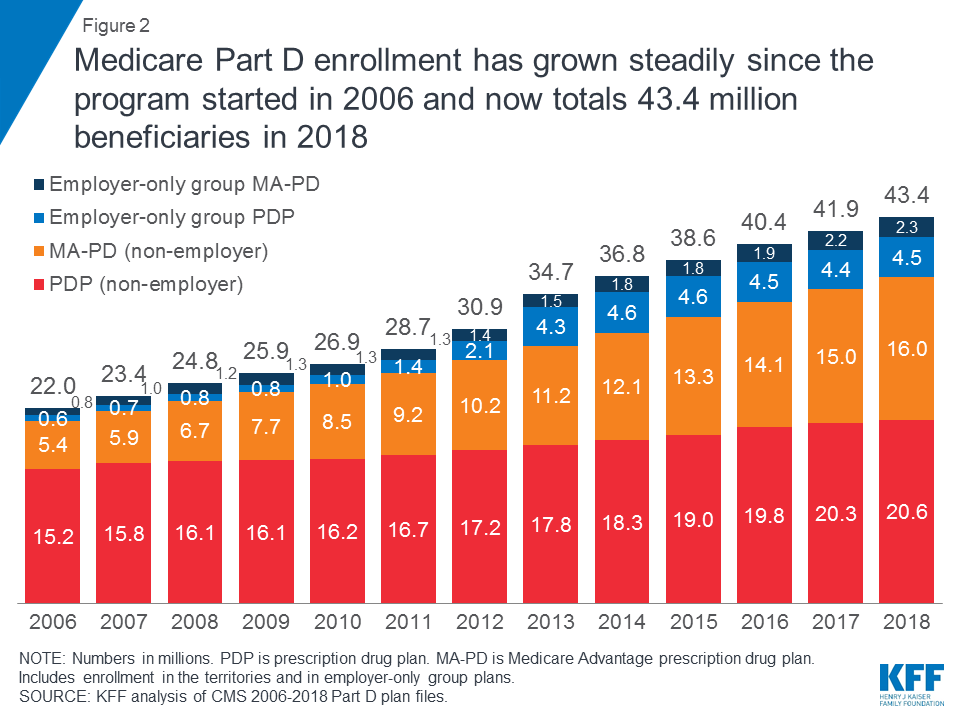

How many people get medicare?

About 58 million Americans get healthcare coverage through the Medicare program. Each year, healthcare costs tend to rise, and that typically results in increases in many of the costs Medicare recipients have to pay.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Is Medicare Part B flat?

It can be difficult for retirees to handle even small increases in living expenses, so the flat premiums for many Medicare Part B recipients are good news. Yet with the hold-harmless provision finally undoing its positive impacts over previous years, many retirees will nevertheless have to figure out how to deal with seeing more of their hard-earned money go toward Medicare in 2018.

Why is Medicare holding harmless?

The reason is rooted in the "hold harmless" provision, which prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits —if their premiums are automatically deducted from their Social Security checks. This applies to about 70% of Medicare enrollees.

How much will hold harmless pay for Medicare?

Another 28% of Part B enrollees who are covered by the hold-harmless provision will pay less than $134 because the 2% increase in their Social Security benefits will not be large enough to cover the full Part B premium increase. Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security ...

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

How much did people pay for hold harmless in 2017?

The cost-of-living adjustment for Social Security benefits for this year was so low (just 0.3%) that people covered by the hold-harmless provision paid about $109 per month, on average, for Medicare premiums in 2017. But Social Security benefits will be increasing by 2% in 2018, which will cover more of the increase for people protected by ...

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

How much is the Part B premium?

Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover the additional Part B premiums.

How much is Medicare premium in 2018?

The average basic premium for a Medicare prescription drug plan in 2018 is projected to decline to an estimated $33.50 per month.

What is the Medicare deductible for 2018?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017.

What is Medicare Part B premium?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. Some beneficiaries who were held harmless ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. ...

Will Part B premiums increase in 2018?

Some beneficiaries who were held harmless against Part B premium increases in prior years will have a Part B premium increase in 2018, but the premium increase will be offset by the increase in their Social Security benefits next year. “Medicare’s top priority is to ensure that beneficiaries have choices for affordable, ...

Is there more coverage for Medicare?

CMS recently released the benefit, premium, and Star Ratings information for Medicare health and drug plans which shows that there will be more health coverage choices, improved access to high-quality health choices, and decreased premiums in 2018.

What is the SSA 561 U2?

For those who have had some other type of “life-changing” circumstance that does not fit the specific list of choices on Form SSA-44, it’s also possible to file a more formal appealing on Form SSA-561-U2. Officially dubbed a “Request for Reconsideration”, Form SSA-561-U2 is used to appeal a number of Social Security retirement or disability scenarios – including the application of Medicare IRMAA surcharges, which are technically determined by the SSA.

What is Medicare Part B surcharge?

Since 2007, the Medicare Modernization Act of 2003 has required high-income Medicare enrollees to pay an “Income-Related Monthly Adjustment Amount ” (IRMAA) surcharge on their Medicare Part B premiums, which lifts the Medicare Part B premium from covering “just” 25% of costs up to as high as 80% of results, increasing Medicare Part B premiums by as much as 219% in 2017. And since 2011, a similar IRMAA surcharge has applied to Part D premiums, applying a flat dollar surcharge of as much as $914/year in 2017.

How are Medicare Part B and Part D paid?

For most, the Medicare Part B and Part D premiums are simply paid by being withheld from their monthly Social Security checks , though those who are delaying Social Security benefits but have already enrolled in Medicare must pay their premiums directly.

What is Medicare Modernization Act?

Medicare Modernization Act Introduces Income-Related Monthly Adjustment Amount (IRMAA) Rules. The Medicare Modernization Act of 2003, which introduced Medicare Part D prescription drug coverage for the first time, also made a shift to how Medicare Parts B and D are funded, by requiring “high-income” Medicare enrollees to pay a higher-than-25% ...

When was the MAGI threshold frozen?

The annual MAGI thresholds for IRMAA Medicare Premium surcharges are adjusted annually for inflation, although under the Affordable Care Act, the inflation adjustments to the MAGI thresholds were frozen in place from 2011 to 2019.

What is work reduction?

Work reduction (i.e., material reduction in work hours) Loss of income-producing property due to a disaster or similar circumstance. Loss of pension income (e.g., due to a pension default) Income for the year was due to a settlement with an employer for the employer’s bankruptcy or reorganization.

Is IRMAA a higher tier?

As a result, the impact of inflation on household incomes itself will cause at least some people to creep into a higher IRMAA tier, although overall the IRMAA surcharges are still projected to impact fewer than 5% of Medicare enrollees.

Hospital coverage through Part A

Medicare Part A provides hospital insurance coverage for Medicare participants. Most people don't pay a premium for their Part A coverage, because you can generally get free Part A if you or your spouse worked for 40 quarters at a job that charged Medicare payroll taxes.

Medical coverage through Part B

In contrast, many of the costs for medical care coverage under Medicare Part B will stay the same in 2018. For instance, the annual deductible for 2018 remains at $183 per year, which represents the amount you have to pay for doctor visits or other outpatient services before Part B coverage kicks in.

What is Medicare Advantage?

Medicare Advantage insurance bundles together Medicare Part A and Medicare Part B coverage, and it usually also includes coverage for healthcare services that are traditionally uncovered by Part A and Part B, such as hearing aids and drugs. In 2018, retirees have to pay the Part B insurance premium plus $30, on average, for their Medicare Advantage coverage. However, because these plans are sold by private insurers and each plan may provide slightly different coverage beyond the Part A and Part B requirements, their premiums can vary considerably.

Is Medicare Part A free for retirees?

A common misperception is that healthcare insurance is free for retirees. That's true of Medicare Part A for most Americans, but it's not true for Medicare Part B, Medicare Advantage, Medicare Part D, or Medigap plans.