Full Answer

What is an an an MSA?

An MSA is a settlement resulting from a workers’ compensation or personal injury claim. The settlement funds are ‘set aside’ in a special account to pay the claimants’ future costs for medical treatments and services.

What is a Medicare set aside account (MSA)?

A Medicare Set Aside account, also known as an MSA, is an important component of the workers’ compensation payment landscape. Here’s the essential information you need to know about who qualifies for them, how they work, approved expenses, etc.: What is an MSA?

Who can administer an MSA account?

MSA account administration may be performed by the injured person (self-administered) or by a professional administrator. The party who administers the MSA (individual or administrator) must keep accurate records of all disbursements from the account for CMS reporting. What are the Qualifications for an MSA?

What do I need to know about WCMSA?

A person can self-administer their WCMSA account, and they must ensure that their record-keeping is accurate and complete. Records should include evidence of the services and items covered by the account. A person should save their receipts, medical reports, appointment letters, and prescriptions.

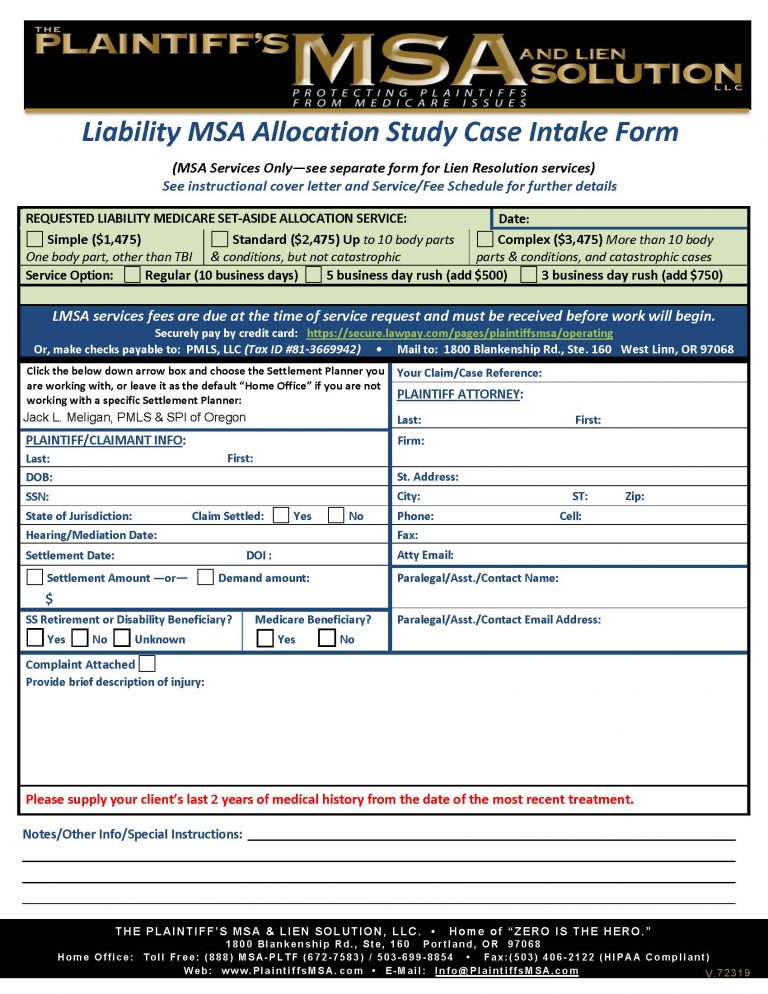

What is LMSA in Medicare?

For years, the Liability Medicare Set-Aside (LMSA) issue has been the source of much debate and frustration for liability claims payers. To date, there remain lingering questions on several fronts and the Centers for Medicare and Medicaid Services’ (CMS) attempts to clarify these issues that have been generally viewed as inadequate. As a result, liability claims payers have been left to navigate the uncertainties the best they can—while preparing for where CMS may be heading next.

When did CMS respond to LMSA?

CMS’ Town Hall statements raised concerns on many levels, prompting calls for further clarification. CMS responded with its much-anticipated September 30, 2011, “LMSA memorandum.” [5] There was guarded optimism this memo would provide better clarity and guidance; however, the release fell far short of both goals. Specifically, CMS simply outlined when it viewed an LMSA as unnecessary — situations where a claimant’s treating physician certifies in writing that treatment has concluded and no further treatment for the alleged injuries is required. [6] This memo, which remains in effect today, was widely criticized as too limited in scope and imposing a largely unrealistic evidentiary requirement.

When will CMS release NPRM?

In this regard, the Office of Information and Regulatory Affairs (OIRA) released an updated notice indicating that CMS plans on releasing a new NPRM in October 2021 aimed at addressing future medicals with said notice, stating as follows:

When will CMS release the next medical bill?

CMS is now expected to release its latest “future medicals” proposals in October 2021. Of note, CMS has previously slated release of these proposals for September 2019, October 2019, February 2020, August 2020, and most recently, for March 2021. These proposals were initially scheduled for release in September 2019, then delayed to October 2019, ...

When will the NFMSA process begin?

The RFP also states that the expanded LMSA and NFMSA process is not expected to begin before July 1, 2018. So at least the industry has some time to plan and prepare before the process actually begins. The draft SoW outlines a few items relating to “other” NGHP MSAs, in other words, LMSAs and NFMSAs.

How many numbers does Medicare see?

If the process is simple, easy, and involves a minimal amount of time at the desk level, then Medicare may see numbers closer to the 11,000 range ; however, if the process is confusing, complex, complicated, and time-consuming, then Medicare may only see numbers closer to the 800 range.

What does Medicare's note about proposed settlement amounts mean?

Medicare’s note about the “proposed” settlement amounts indicates that Medicare has likely considered certain amounts and that somehow there’s a correlation with the settlement amount and the type of review process involved, full or cursory.

Does Medicare recognize the LMSA?

Apparently, Medicare recognizes there will be mixed responses to a new LMSA/NFMSA process and states that the actual numbers will be influenced by the industry response. One would assume Medicare recognizes the industry response will likely be in direct relation to the particular process established by Medicare and its contractor.

Is Medicare still setting aside LMSA?

The dust is still swirling around the Liability Medicare Set-Aside (LMSA) issue, but a few areas clearly show Medicare’s plan and intended next steps. First, Medicare appears to have stopped or paused the official rulemaking process for LMSAs. Second, Medicare is still pursing the LMSA issue through other avenues—namely the expansion of the Workers’ Compensation MSA (WCMSA) contractor program. And finally, Medicare is obligating the soon-to-be-awarded WCMSA contractor with the task of creating and implementing the LMSA process. Medicare is also seeking to expand the set-aside program to include no-fault and self-insurance claims.

What is MSA in medical?

An MSA is a settlement resulting from a workers’ compensation or personal injury claim. The settlement funds are ‘set aside’ in a special account to pay the claimants’ future costs for medical treatments and services. Once the funds are exhausted, only then will Medicare begin paying for the injured person’s qualified medical expenses ...

Who administers MSA?

MSA account administration may be performed by the injured person (self-administered) or by a professional administrator. The party who administers the MSA (individual or administrator) must keep accurate records of all disbursements from the account for CMS reporting.

How does MSA fund work?

How Does the Injured Person Access MSA Funds? MSA funds are placed into an interest-bearing account. The account may have a linked debit card , or the account holder may withdraw funds for reimbursement for expenses related to the settlement. For any expense, the account holder must keep detailed records and receipts.

What happens when Medicare sets aside funds are exhausted?

Once all Medicare Set Aside account funds have been exhausted, a final audit is performed on expenditures. If the funds were used appropriately, then the injured person should receive Medicare benefits for medical expenses related to the claim.

What happens if you don't manage your MSA?

If account holders do not manage their MSA account properly, pay more than the approved amount for a service or treatment , or pay for non-allowable expenses from the account, they can face some serious repercussions, such as paying back the overages/improperly spent funds and jeopardizing future Medicare benefits.

What is MSA settlement money?

MSA settlement money is only for approved medical services and other costs directly related to the specific injury. MSA accounts must be interest-bearing and the interest must stay in the account to be used for medical expenses. Recipients should keep ALL records and receipts for every expense paid for from the account.

What is Medicare set aside account?

A Medicare Set Aside account, also known as an MSA, is an important component of the workers’ compensation payment landscape. Here’s the essential information you need to know about who qualifies for them, how they work, approved expenses, etc.: