What is a Medicare supplement deductible?

Dec 14, 2021 · Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other …

What is the Medicare deductible in 2019?

In 2019, the Part A inpatient hospital deductible is $1364 and the Part B deductible is $185. Medigap plans can help offset these costs, making your healthcare more affordable and giving you more access to services you might otherwise be unable to afford. Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments.

What is the deductible amount for a health insurance plan?

Jan 20, 2022 · The deductible for Medicare Part B is $233 per year in 2022. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services. Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance.

What is a Medigap supplement plan?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and...

Do Medicare supplement plans have a deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.Aug 6, 2021

What is the deductible for Medicare supplement plan g?

$233Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

What is the Medicare standard plan annual deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is my annual deductible for Medicare?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Does Medigap cover Part A deductible?

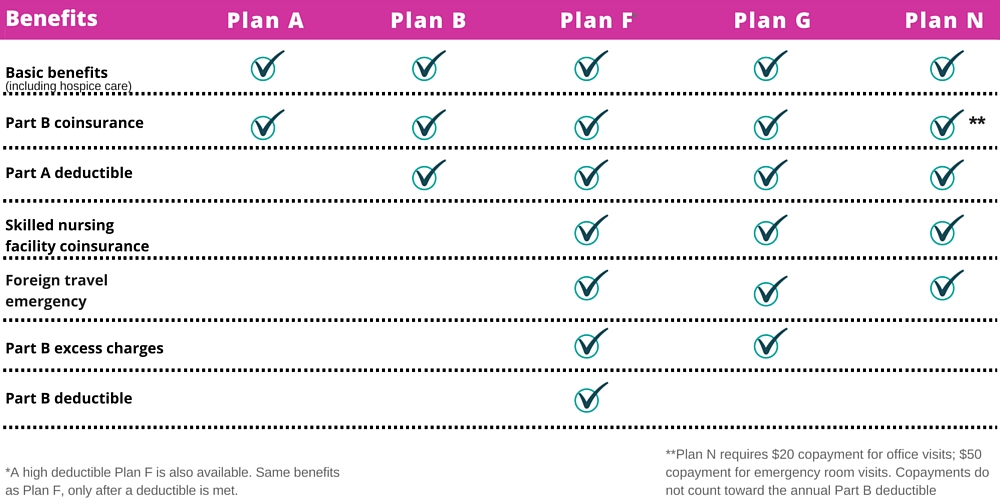

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

How old do you have to be to get Medicare?

You must be enrolled in Original Medicare Part A and Part B, and most plans require you to be 65 years of age or older. If you are under 65 years old and receive Medicare benefits, you can check the Medigap plans sold in your state to see if any are available for you.

Can you cancel Medicare Supplement?

Medicare Supplement policies cannot be canceled by the providing company. This means that as long as you continue to pay your premiums, the insurance company is not able to cancel your insurance plan regardless of your current state of health or the usage of your plan. Related articles: What is Medicare Parts A & B.

Does Medicare Supplement cover travel?

Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments. Some Medigap plans can also help cover the cost of medical care you receive while traveling abroad, so many Medicare recipients who spend time traveling outside of the United States find Medigap coverage appealing.

Does Medicare have a monthly premium?

While Original Medicare does offer coverage for an array of different medical services and supplies, the costs associated with them often include a monthly or annual premium and an annual deductible.

What is the Medicare deductible for 2021?

Medicare Part A. Medicare Part A has the most complex deductible. For 2021, the Medicare Part A deductible is $1,484. However, this is not a yearly deductible. Rather, it is a deductible for each benefit period. The benefit period begins the first day you enter a hospital or skilled nursing care facility for an inpatient stay.

How much is Medicare Part B deductible in 2021?

Medicare Part B. The deductible for Medicare Part B is $203 per year in 2021. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services.

Who is Christian Worstell?

Or call 1-800-995-4219 to speak with a licensed insurance agent. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Does Medicare Advantage have a deductible?

Medicare Advantage plans that offer prescription drug coverage may sometimes feature two different deductibles, with one being for medical costs and the other for prescription costs.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance. Part C plan deductible amounts will vary from one plan to the next. This is different from Medicare Part A and Part B (Original Medicare) where deductibles come at a fixed amount for everyone enrolled.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance plan, or “Medigap,” can provide coverage for Medicare Part A and Part B deductibles, among other out-of-pocket expenses. There are several Medigap plans that offer full coverage for the Medicare Part A deductible and some plans that offer partial coverage.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is a high deductible Medicare Supplement?

Two of these Medicare Supplement plans, Plan F and Plan G, have high-deductible options – often with lower premiums. A deductible is an amount you have to pay toward your covered medical costs before your Medicare Supplement insurance plan starts paying its share. So, if you have a high deductible, that means you pay more before plan benefits kick ...

What are the benefits of Medicare Supplement?

All Medicare Supplement insurance plans provide certain basic benefits. This means no matter what letter name your Medicare Supplement insurance plan has, it may pay all, or at least part, of your Medicare costs related to: 1 The Medicare Part A deductible 2 Hospice care copayment/coinsurance 3 Up to 365 additional hospital days after your Medicare benefits are used up 4 Medicare Part B coinsurance and copayments 5 The first 3 pints of blood if you need a transfusion

What is the difference between a F and G plan?

Here’s what to know about Plan F and Plan G: Each has a regular version, meaning you generally don’t have to wait for plan benefits to start. Each has a high-deductible version. The basic plan benefits are the same – for example, if you have Plan G, it generally pays your Medicare Part B coinsurance.

Do you have to have Medicare Part A and Part B?

You have to have Medicare Part A and Part B to get any Medicare Supplement insurance plan. This includes high-deductible plans. Note that the best time to buy Medicare Supplement Plan F or Plan G is usually during your Medicare Supplement Open Enrollment Period (OEP).

Does Medicare Supplement pay for coinsurance?

When you have a Medicare Supplement insurance plan, it generally helps pay your Medicare Part A and Part B coinsurance or copayments. Some plans may pay your Part A and/or Part B deductible, skilled nursing care coinsurance, hospice care coinsurance, and more.

What is the high deductible plan for Medicare Supplemental?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

What is the deductible for Medicare 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370.

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...