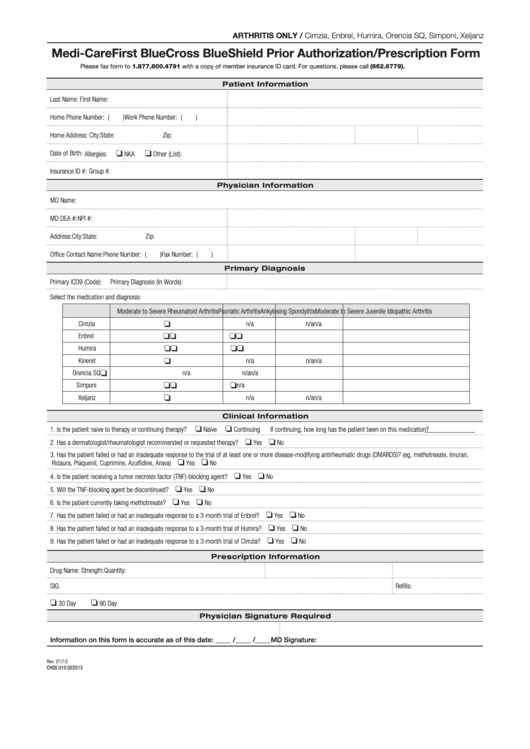

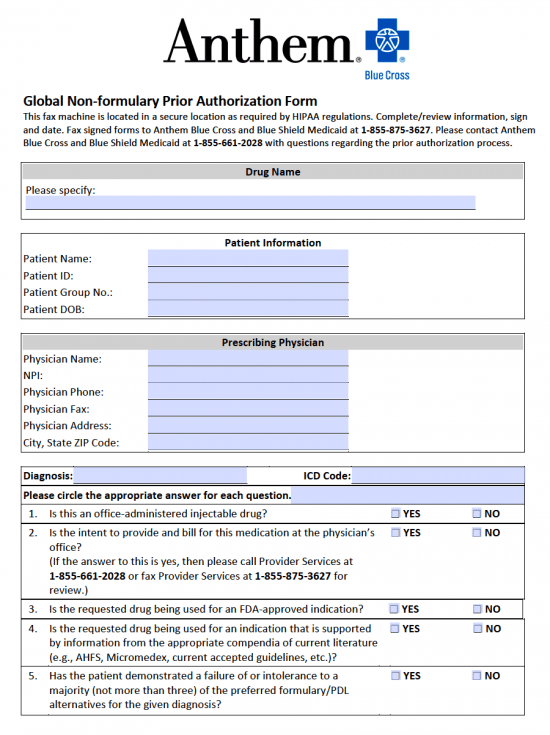

An Anthem (Blue Cross Blue Shield) prior authorization form is what physicians will use when requesting payment for a patient’s prescription cost.

Full Answer

What is the timely filing limit for Anthem Blue Cross?

Anthem’s New 90-day Timely Filing Requirement. Anthem has notified doctors and other providers that the timely filing window for professional claims is being shortened to 90 days. “Effective for all commercial and Medicare Advantage Professional Claims submitted to the plan on or after Oct. 1, 2019, your Anthem Blue Cross and Blue Shield (Anthem) Provider Agreement (s) will be amended to require the submission of all commercial and Medicare Advantage professional claims within ninety (90 ...

Which Anthem Blue Cross plan is the best?

- Highly competitive Plan F premium.

- Excellent financial strength.

- Over 25 years in the Medicare Supplements business.

- Offers the 5 most popular plans.

- No charge for writing the policy.

What is the customer service number for Anthem?

Visit Anthem Blue Cross for group health insurance plans in California. Anthem BlueCross of California. Close Window. Contact Us . Anthem Blue Cross . Member Services: (800) 967-3015 . Pre Certification: (800) 274-7767 . Coverage While Traveling: (800) 810-BLUE (2583) Transition Assistance: (800) 967-3015 ...

What is the cost of Anthem Blue Cross?

Anthem is waiving cost shares for COVID-19 treatment. If you’re diagnosed as having COVID-19, you won’t have any out-of-pocket costs to pay if you get treatment for COVID-19 from doctors, hospitals, and other health-care professionals in your plan’s network through May 31, 2020. This benefit is available to Anthem members in Fully Insured ...

Does Anthem Medicare supplement require prior authorization?

Anthem does not require prior authorization for treatment of emergency medical conditions. In the event of an emergency, members may access emergency services 24/7.

What is prior authorization in Anthem?

Prior authorizations Anthem makes determinations based on selected inpatient or outpatient medical services including surgeries, major diagnostic procedures, and referrals to validate medical necessity.

What is prior authorization in healthcare?

Prior authorization—sometimes called precertification or prior approval—is a health plan cost-control process by which physicians and other health care providers must obtain advance approval from a health plan before a specific service is delivered to the patient to qualify for payment coverage.

What are the benefits of prior authorization?

The prior authorization process can help you:Reduce the cost of expensive treatments and prescriptions by first requiring you to try a lower-cost alternative.Avoid potentially dangerous medication combinations.Avoid prescribed treatments and medications you may not need or those that could be addictive.

How long does it take for insurance to approve surgery Anthem?

5 business days for fully-insured and HMO/POS plans. 15 calendar days for self-funded plans (unless otherwise stated in your Evidence of Coverage or benefit booklet)

How can I check my availity authorization status?

How to access and use Availity Authorizations: Log in to Availity. Select Patient Registration menu option, choose Authorizations & Referrals, then Authorizations*

What happens if you don't get prior authorization?

If you're facing a prior-authorization requirement, also known as a pre-authorization requirement, you must get your health plan's permission before you receive the healthcare service or drug that requires it. If you don't get permission from your health plan, your health insurance won't pay for the service.

What is the difference between pre-authorization and prior authorization?

Sometimes they are called pre-approvals, or prior approvals, or prior authorizations, but they all mean the same thing. This practice is common in all types of insurance, even with government-sponsored coverage like Medicare, Medicaid, and Tricare.

What does prior authorization required mean?

What is a Prior Authorization? A prior authorization (PA), sometimes referred to as a “pre-authorization,” is a requirement from your health insurance company that your doctor obtain approval from your plan before it will cover the costs of a specific medicine, medical device or procedure.

How do I submit an authorization to Medicare?

To do so, you can print out and complete this Medicare Part D prior authorization form, known as a Coverage Determination Request Form, and mail or fax it to your plan's office. You should get assistance from your doctor when filling out the form, and be sure to get their required signature on the form.

What services typically require prior authorizations?

The other services that typically require pre-authorization are as follows:MRI/MRAs.CT/CTA scans.PET scans.Durable Medical Equipment (DME)Medications and so on.

How long is a prior authorization good for?

A PA for a health care service shall be valid for a period of time that is reasonable and customary for the specific service, but no less than 60 days from the date the health care provider receives the PA, subject to confirmation of continued coverage and eligibility and to policy changes validly delivered.

Prior authorization contact information for Anthem

Providers and staff can also contact Anthem for help with prior authorization via the following methods:

Behavioral health

Behavioral health services billed with the following revenue codes always require prior authorization:

Long-term services and supports (LTSS)

Services billed with the following revenue codes ALWAYS require prior authorization:

Related resources

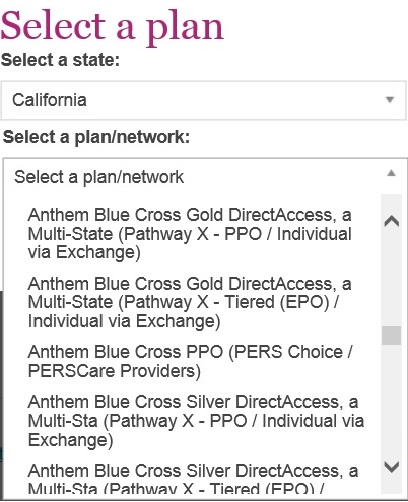

Anthem’s Prior Authorization Lookup Tool Online can assist with identifying services requiring prior authorization or determining a code’s prior authorization requirements.

Interested in becoming a provider in the Anthem network?

We look forward to working with you to provide quality services to our members.

What is an anthem PPO?

Anthem MediBlue PPO. Medicare Advantage plans bundle all the benefits of Medicare Part A and Medicare Part B into one convenient plan. Plus, these plans often have extras, such as coverage for prescription drugs, vision, dental, and hearing aids. A Medicare Advantage PPO plan is a Part C plan that works like a Preferred Provider Organization (PPO) ...

What is a MediBlue PPO?

Anthem MediBlue PPO is one type of Medicare Advantage plan that combines the benefits of a Medicare Advantage plan with the choice of a PPO. You receive all the benefits of the Medicare Advantage plan and can choose from our complete network of doctors and facilities. If you prefer to see someone out of network, you may pay a bit more.

What is the difference between a PPO and an HMO?

The main difference between a Medicare Advantage PPO and a Medicare Advantage HMO is that with an HMO you can only see doctors or specialists who are in network. Also, when you want to see a specialist in an HMO, you must get a referral from your primary care physician (PCP), which you do not need in a PPO.

What is a star rating in Medicare?

Star Ratings measure Medicare Advantage plans on a number of categories including customer service and quality of care. Medicare evaluates plans and assigns stars based on a 5-star rating system. Star Ratings are calculated each year and may change from one year to the next.

Is Anthem a Medicare Advantage Plan?

Anthem MediBlue PPO is a Medicare Advantage plan that gives you the flexibility to work with any doctor or specialist, in or out of network, no referrals needed. If you choose to see a provider outside your plan, your costs may be higher.

Is Anthem MediBlue a PPO?

An Anthem MediBlue PPO plan will have a list of providers you can choose from. These doctors, health care professionals, and other health care facilities have agreed to work with us. These are considered in- network providers.

Is Anthem MediBlue out of network?

Other doctors and health care provider s who have not agreed to work with us are considered out of network. When you choose an Anthem MediBlue PPO plan you can choose to visit an out-of-network provider.

Key Features

ICR is a free, electronic UM solution with a variety of features to simplify the prior authorization process. Benefits include:

Auto Authorizations

For some procedures, Interactive Care Reviewer can provide immediate decisions. Review the list of medical policies and clinical guidelines that may qualify below. This list will be updated as policies become eligible for auto authorization.

Available Training

We provide training to help you take advantage of this useful resource. Our live ICR Webinar provides an overview of the tool for new users and helpful tips for getting started. Additionally, our library of on-demand videos provides additional support and answers to common questions.

On-Demand Videos

Health care professionals can access Interactive Care Reviewer through Availity. This video is a high-level demonstration of how to get started using the Availity portal and navigate to ICR for authorizations. ( 3 minutes)