Can I Keep my Medicare Plan F?

According to congress.gov, starting in 2020, Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible ...

Can I Keep my Medicare supplement plan F after January 1 2020?

Jan 28, 2020 · Medigap plans can still cover the Part A Hospital deductible, but as of 2020, the plans can no longer cover the Part B deductible for new enrollees. Currently this annual deductible is $233 in 2022. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, is to make ...

Is Medicare Plan F being phased out?

Dec 08, 2021 · December 8, 2021. In many cases, your Medicare coverage will automatically renew. There are still some important steps you should take each year to plan for your coverage renewal. If you are enrolled in Medicare, you might not need to do anything for a renewal of your Medicare coverage. In many cases, your Medicare coverage will automatically renew each year.

Is Medigap plan F being discontinued?

Nov 07, 2019 · Starting in 2020, Medicare Supplement plans that cover the Part B deductible (Plan F and Plan C) are being gradually discontinued. If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how these …

Can I keep my plan F after 2020?

Is Plan F still available in 2022?

Is Medicare Plan F being discontinued?

Is Medicare Plan F being discontinued in 2020?

Why was Plan F discontinued?

Why is Plan F more expensive than Plan G?

Will Plan F be grandfathered?

What is Medicare Plan F being replaced with?

Can you switch from Plan F to Plan G in 2021?

Can I switch from Plan N to Plan F?

What is the most popular Medigap plan for 2021?

Are all Medigap Plan F policies the same?

When Is Plan F Going away?

Both Plan F and Plan C are going away in 2020. However, these Medicare changes in 2020 won’t affect everyone. Some people already on Medicare Plan...

Why Is Plan F Going away?

So what is happening with Plan F? Why is Medicare Plan F being phased out?Well, these changes to Medicare supplement plans are a result of the Medi...

Medicare Plan F 2020 Changes

So is Plan F going away? Yes, BUT only for new people starting in 2020. Here’s how it will go: 1. If you are are on Plan F already when 2020 rolls...

Will Plan F Rates Go Up Faster After 2020?

Some people are worried about this, and it’s certainly possible. Back in 2010, when Medicare discontinued Plans H, I and J, we did some price infla...

What Does 2020 Plan F Change Mean For You?

Here’s our advice about Medicare Plan F going away: 1. Make the best coverage decision for yourself right now. If Plan F feels best to you, it’s st...

When will Medicare Supplement Plan F be phased out?

These plans are being phased out, starting in 2021.

Does Medicare pay deductibles before Plan F?

With that plan, you generally have to pay an annual deductible before Plan F pays your Medicare out-of-pocket costs. Like all Medicare Supplement plans, Plan F is sold by private insurance companies.

What is Medicare Supplement Plan F?

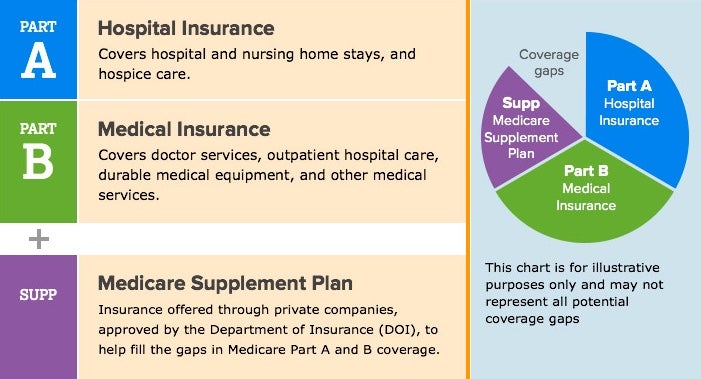

Medicare Supplement Plan F is a specific type of Medicare Supplement plan. Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. These costs might be coinsurance, copayments, or (in some cases) deductibles. Please note: Medicare Part A and Part B make up the federal government’s ...

Does Medicare Supplement pay for out of pocket expenses?

Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. These costs might be coinsurance, copayments, or (in some cases) deductibles. Please note: Medicare Part A and Part B make up the federal government’s Original Medicare program.

How many states have Medicare Supplement Plans?

In 47 states, there are up to 10 Medicare Supplement plans that are standardized with lettered names – for example, Medicare Supplement Plan F. Each standardized plan has the same set of basic benefits. Plan F, for example, has the same basic benefits whether you buy it in Vermont from one company, or in Washington from another.

Is there a high deductible for Medicare Supplement Plan F?

With that plan, you generally have to pay an annual deductible before Plan F pays your Medicare out-of-pocket costs. Like all Medicare Supplement plans, Plan F is sold by private insurance companies.

Will Medicare Part B deductible be sold in 2020?

Apparently so, for some people. According to congress.gov, starting in 2020, Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). If you already have Medicare Supplement Plan F (or Plan C, ...

Is Medigap Plan F going away?

Yes, it is – but not for everyone, so don’t panic. As of 2020, Plan F went away but not completely. Find out who can still get it. Medigap Plan F has been one of the most popular supplement plans on the market for decades. Millions of people will be affected, so Congress gave beneficiaries until 2020 to get ready for the change.

Is Plan F deductible phased out?

Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, is to make Medicare beneficiaries put a little more “skin in the game.”. You see, people with Plan F have what we call “first dollar” coverage. Right from the first day, Medicare covers 80% ...

Does Plan F pay for doctor visits?

So at the time of service, people currently on Plan F pay no copay for their Medicare-related doctor visits. No deductible either. Lawmakers fear that this lack of cost-sharing results in people running to the doctor for minor issues that may not really require medical care.

Is there a deductible for Medicare?

No deductible either. Lawmakers fear that this lack of cost-sharing results in people running to the doctor for minor issues that may not really require medical care. These changes mean that all Medicare beneficiaries will have least $203 in deductible spending out of your own pocket each year.

How much money do Medicare beneficiaries have to pay out of pocket?

These changes mean that all Medicare beneficiaries will have least $203 in deductible spending out of your own pocket each year.

Does Medigap cover Part A?

Medigap plans can still cover the Part A Hospital deductible, but as of 2020, the plans can no longer cover the Part B deductible for new enrollees. Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, ...

When is the Medicare enrollment period?

The Medicare Annual Enrollment Period (also known as the Fall Medicare Open Enrollment Period for Medicare Advantage plans) takes place each year from October 15 to December 7. During this time, you may join, leave or switch Medicare Advantage plans or Medicare Part D plans.

Can Medicare discontinue a low performing plan?

Medicare reserves the right to discontinue low-performing plans from being offered. If this happens, all members of the plan will receive a notice informing them of the decision, and they will be granted a Special Enrollment Period to sign up for a different Medicare plan. The plan stops serving your area.

Does Medicare automatically renew?

There are still some important steps you should take each year to plan for your coverage renewal. If you are enrolled in Medicare, you might not need to do anything for a renewal of your Medicare coverage. In many cases, your Medicare coverage will automatically renew each year.

Does Medicare carry over to the next year?

If you have Medicare Part A (hospital insurance) and/or Part B (medical insurance) and you are up to date on your Medicare premiums, your Medicare coverage will automatically carry over from one year to the next and there is nothing you need to do to re new your plan.

How many stars does Medicare give?

Medicare rates all Medicare Advantage plans and Part D plans each year using the Medicare Star Rating system. Each plan is given a rating of one to five stars, with five stars being the highest ranking. 1. If a plan receives fewer than three stars for three consecutive years, Medicare will flag the plan as low performing.

What happens if a Medicare plan stops serving your area?

If this happens, all members of the plan will receive a notice informing them of the decision, and they will be granted a Special Enrollment Period to sign up for a different Medicare plan. The plan stops serving your area.

Who sells Medicare Advantage plans?

Medicare Advantage plans, Medicare Part D plans and Medicare Supplement Insurance plans are sold by private insurance companies. The company that provides a plan may choose to no longer offer that specific plan. If this happens, plan members may be granted a Special Enrollment Period to enroll in a new Medicare plan.

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

Does Medicare Supplement Plan F have a high deductible?

Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan. Medicare Supplement Plan F also has a high-deductible version.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Which states have standardized Medicare Supplement Plans?

Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement plans. Medicare Supplement Plan F isn’t available in those states. Here’s an overview of what Medicare ...

Is Medicare Supplement Plan F still available?

But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.

When will Medicare Supplement Plan F change?

Changes to Medicare Supplement Plan F in 2020. If you enrolled in Medicare prior to January 1, 2020, you will remain eligible to apply for Medicare Supplement Plan F at any time in the future. On the other hand, those who became eligible for Medicare after January 1, 2020, will not be able to enroll in Medicare Supplement Plan F or Plan C.

Is Medicare Plan F available to everyone?

What You Need to Know. Medicare Plan F is the most comprehensive Medicare Supplement plan, but starting in 2020 the plan will not be available to everyone enrolled in Original Medicare. Everyday Health may earn a portion of revenue from purchases of featured products.

How much is Medicare Supplement 2020?

It’s $198 in 2020, a slight increase from $185 in 2019. While this means changes for individuals researching Medicare Supplement policies, Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center, shared her insight in an interview with AARP.

Does Medicare Supplement Plan G cover Part B?

It includes the same benefits as Plan F. The only difference is it doesn’t pay Part B deductibles.

Does Medicare cover medical expenses?

But even if you sign up for Original Medicare, this federal health insurance program doesn’t cover all medical expenses. With Original Medicare, you’re still responsible for copayments, deductibles, and coinsurance.

Why is Plan F going away?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees. But even if you’re unable to get a plan ...

Is Plan F going away?

Plan F is one Medigap option. Though there are changes to it in 2020, this popular plan is not going away for everyone. But some people will no longer be able to enroll in it. Continue reading to learn more. Share on Pinterest.

Is Plan F a standardized Medigap plan?

These policies are sold by private companies and are associated with an additional monthly premium. Plan F is one of the 10 standardized Medigap plans. In addition to the standard version, a high-deductible option is also available in some areas.

Is Medicare Supplement Insurance going away?

Medicare supplement insurance (Medigap) is a type of Medicare insurance policy that can help pay for some costs that original Medicare (parts A and B) doesn’t cover. Plan F is one Medigap option. Though there are changes to it in 2020, this popular plan is not going away for everyone. But some people will no longer be able to enroll in it.

Can you get Medicare Part B in 2020?

As of 2020, Medigap plans are no longer allowed to cover the Medicare Part B deductible. People who are new to Medicare in 2020 cannot enroll in Plan F; however, those who already have Plan F can keep it. Medicare supplement insurance (Medigap) is a type of Medicare insurance policy that can help pay for some costs that original Medicare ...

Can you keep Medigap if you are already enrolled?

People who are already enrolled in Plan F can keep it. Medigap policies are guaranteed renewable as long as you maintain enrollment and pay the monthly premium associated with your policy.

What is a plan F?

The takeaway. Plan F is one of the 10 types of Medigap plans. It covers a wide breadth of expenditures that original Medicare doesn’t pay for. Starting in 2020, new rules prohibit Medigap policies from covering the Medicare Part B deductible. Because of this, people who are new to Medicare in 2020 won’t be able to enroll in Plan F.

Is Medigap similar to Plan F?

Some Medigap plans offer coverage that’s very similar to Plan F , including Plan G, Plan D, and Plan N. If you’ll be enrolling in Medicare this year, comparing different Medigap policies offered in your area can help you find the best coverage for your needs.

What Is Medicare Supplement Plan F?

Many people ask, “What is Medicare Plan F?” It is one of the ten Medigap plans currently available. These plans provide supplemental health insurance covering various expenses, such as coinsurance, copayments, deductibles, and other costs.

What Does Medicare Plan F Cover?

Forbes refers to Medicare Plan F as the “Cadillac of Medigap plans” due to the coverage it offers. The plan covers:

Medicare Access and CHIP Reauthorization Act – The Reason Medicare Plan F Is Going Away

Congress passed the Medicare Access and CHIP Reauthorization Act in 2015. This act will stop the sale of Medigap plans that cover the deductible for Medicare Part B. Out of the ten Medigap plans offered, only Medicare Plan F and Medicare Plan C cover the deductible, so these are the only plans the government is phasing out.

Medicare Part G – An Alternative to Medicare Part F

Medicare Part F is being phased out, but there are other plans available. Many who cannot get Medicare Part F are expected to sign up for Medicare Part G. This plan covers everything that Medicare Part F does, except the Medicare Part B deductible.

Choosing Medigap Coverage

Medicare Plan F is going away, but that does not mean people lack coverage options. With eight Medigap plans available after Medicare Plan F is phased out, including the popular Medicare Plan G, interested parties can find a program that offers the coverage they need.

When will Medicare stop allowing you to buy Medigap?

If you became eligible for Medicare on or after January 1, 2020, a federal law will prevent you from purchasing Medigap Plan C and Plan F.

When will Medicare Part B be sold?

Plans F and C, which cover the Medicare Part B deductible, aren't sold to newly eligible beneficiaries starting in 2020, with the aim of helping to reduce total Medicare spending by the government.

What is the first dollar Medicare Supplement?

First-Dollar Medicare Supplement Insurance plans. Plan F and Plan C are both referred to as “first-dollar” coverage plans because they cover the annual Medicare Part B deductible. This benefit allows policyholders to get non-emergency medical care without having to pay an annual deductible. The Part B deductible is $198 per year in 2020.

How many Medicare plans are there in 2020?

Unless new plans are added, most newly eligible Medicare beneficiaries in 2020 will only have 8 Medigap plan options to choose from: Plans A, B, D, G, K, L, M, and N. If you're a new Medicare beneficiary starting in 2020, you will not be able to enroll in Plan F or Plan C and will not have coverage for the Medicare Part B deductible benefit.

Will Medicare Part B deductible increase in 2020?

If you use Medicare Part B services, you must pay the $198 annual deductible in 2020. The Part B deductible may increase in future years. Esposito thinks that it's possible that the Part B deductible will increase at a higher rate than we are used to seeing especially due to the recent increase.

Can you keep Medigap Plan C?

Current Medigap policyholders. If you are currently enrolled in Medigap Plan C or Plan F, you can keep your plan. However, you may still want to explore your options. “Plan F holders may want to make sure Plan F is the right plan for them and make changes while they are healthy and still able to qualify for a new plan,” he said.

Can you change Medigap plans at any time?

However, you may still want to explore your options. “Plan F holders may want to make sure Plan F is the right plan for them and make changes while they are healthy and still able to qualify for a new plan,” he said. Esposito said one of the best things about Medigap plans is that you can change plans at any time.

What is Plan F for Medicare?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted. 100% coverage of the first 3 pints of blood for a transfusion.

What is a plan F?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 1 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted 2 100% coverage of Part B outpatient coinsurances and copayments 3 100% coverage of the first 3 pints of blood for a transfusion. 4 100% coverage of Part A’s coinsurance or copayment for hospice care. 5 100% coverage of the coinsurance at a skilled nursing facility. 6 100% coverage of the Part A deductible 7 100% coverage of the Part B deductible 8 100% coverage of excess charges with Part B 9 80% coverage of medical care during a foreign travel emergency

Who is eligible for Medicare in 2020?

The change impacts newly eligible enrollees, which means anyone who turns 65 and first becomes eligible for Medicare in 2020. Medicare recipients who already have Medigap Plan F or who turned 65 prior to 2020 can use this plan.