What is the difference between a qualified health plan and Medicare?

Receive updates about Medicare Interactive and special discounts for MI Pro courses, webinars, and more. Qualified Health Plans (QHPs) are health insurance policies that meet protections and requirements set by the Affordable Care Act (ACA). They are typically not for people with Medicare.

What is a qualified health plan (QHP)?

Qualified Health Plans (QHPs) are health insurance policies that meet protections and requirements set by the Affordable Care Act (ACA). They are typically not for people with Medicare. QHPs must: Follow federally established cost-sharing limits

Do I need a QHP If I already have Medicare?

Remember, QHPs are typically not for people with Medicare. If you are already enrolled in Medicare, you do not need to change your health coverage and you do not receive coverage through the Marketplaces. No type of Medicare coverage is sold through the Marketplaces

What is the Qualified Medicare beneficiary program?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program. Billing Protections for QMBs

What is a qualified plan for Medicare?

Qualified Health Plans (QHPs) are health insurance policies that meet protections and requirements set by the Affordable Care Act (ACA). They are typically not for people with Medicare. QHPs must: Follow federally established cost-sharing limits. Provide essential health benefits.

Can I choose Obamacare instead of Medicare?

But there are some situations where you can choose Marketplace coverage instead of Medicare: You can choose Marketplace coverage if you're eligible for Medicare but haven't enrolled in it (because you would have to pay a Part A premium, or because you're not collecting Social Security benefits).

What is the difference between health insurance and Medicare?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

What is the highest rated Medicare plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Is ACA cheaper than Medicare?

The average Medicare Part D plan premium in 2021 is $47.59 per month. The average Medicare Supplement Insurance plan premium in 2019 was $125.93 per month. The average Obamacare benchmark premium in 2021 is $452 per month.

Is Obamacare good for seniors?

Free Preventive Services and Annual Wellness Visit These include flu shots, mammograms, and tobacco use cessation counseling, as well as no-cost screenings for cancer, diabetes, and other chronic diseases. Seniors can also get a free annual wellness visit, so they can talk to their doctor about any health concerns.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Do I need insurance if I have Medicare?

If you have Medicare. Medicare isn't part of the Health Insurance Marketplace®, so if you have Medicare coverage now you don't need to do anything. The Marketplace won't affect your Medicare choices or benefits.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

What is a qualified health plan?

A qualified health plan (QHP) is a health insurance plan that meets requirements established by Obamacare, which is also known as the Affordable Ca...

Do I have to go through the health insurance marketplace to get a qualified health plan?

No, QHP plans are available off exchange, such as through a broker or directly from the health plan. However, you can only qualify for the ACA’s pr...

Are all 'metal' plans qualified health plans?

Yes. All plans, regardless of the metal level, sold on the health insurance exchanges are qualified health plans. And, all QHPs must cover essentia...

Should I look for a qualified health plan if I have Medicare?

No, you should not buy a policy from a qualified health plan if you qualify for Medicare. Qualified health plans are specific to Obamacare/the ACA...

Is a non-qualified health plan lower quality?

While plans that are not a “qualified health plan” haven’t gone through a marketplace certification process, it doesn’t mean they don’t provide goo...

How does private health insurance work?

Copays for services rendered and/or coinsurance are also highly likely. With all of these payments, the health insurance company will pay for you and their enrollees when they are sick. Typically, those with health insurance are relatively healthy and will not undergo significant costs but the way health insurance companies work is that the money is gathered and distributed amongst those that need it at that specific time. The bulk of the money goes to the smaller percentage of individuals who do undergo cost-heavy treatments.

Is Medicare a private insurance?

For many seniors, a combination of Medicare and private insurance provides them with the most comprehensive coverage at the most affordable rate. Medicare is known to have many gaps in their coverage and if you are not aware of these gaps, out-of-pocket expenses can be quick to add up. However, there is one privatized insurance plan that is approved for sale by the government that can provide this combination for optimal coverage and costs.

Is Medicare a government program?

As mentioned, Medicare is a government health insurance program that provides hospital coverage (Medicare Part A), outpatient services (Medicare Part B) and prescription drug coverage (Medicare Part D). It is important to realize that Medicare is not a health insurance company in itself. It is a government program that contracts private healthcare providers to offer medical services to seniors (and qualifying individuals under the age of 65) for an affordable rate. And if you choose Medicare Advantage, you’ll be paying a Medicare-approved private health insurance company who follows the guidelines set by Medicare in order to obtain your benefits.

What happens if you apply for Medicare at any time?

If you apply at any time outside the window, there may be a lapse in coverage and penalties. If you are concerned about potential gaps in coverage between Medicare and private plans, Medicare has established options: Medicare Supplement plans and Medicare Advantage plans.

How long does it take to get Medicare?

There is a seven-month window during which you can apply for Medicare. The period begins three months before your 65th birthday, and ends three months later. If you apply at any time outside the window, there may be a lapse in coverage and penalties.

What is Medicare Supplemental Insurance?

Medigap: These are Medicare supplement policies offered by private insurance companies to cover gaps in coverage and out-of-pocket costs. Medicare Supplemental insurance is not part of Original Medicare, but isregulated by Medicare. Medicare Parts A and B do not have a max on out-of-pocket costs. This is something to consider as you evaluate ...

How much is Medicare deductible for 2021?

Medicare has a sizable deductible anytime you are admitted into the hospital. In 2021, the deductible is $1,484. This tends to increase each year. Hospital stays can be expensive over time. For days 1-60, there is $0 coinsurance. You will pay the deductible. For days 61-90, there is a $371 co-insurance per day.

How much is Part B insurance in 2021?

You can defer signing up for Part B if you are still working and have insurance through your job or spouse’s health plan. The monthly Part B premium in 2021 is $148.50, but can be higher if your income is over $87,000. You are also subject to an annual deductible, which is $203 for 2021.

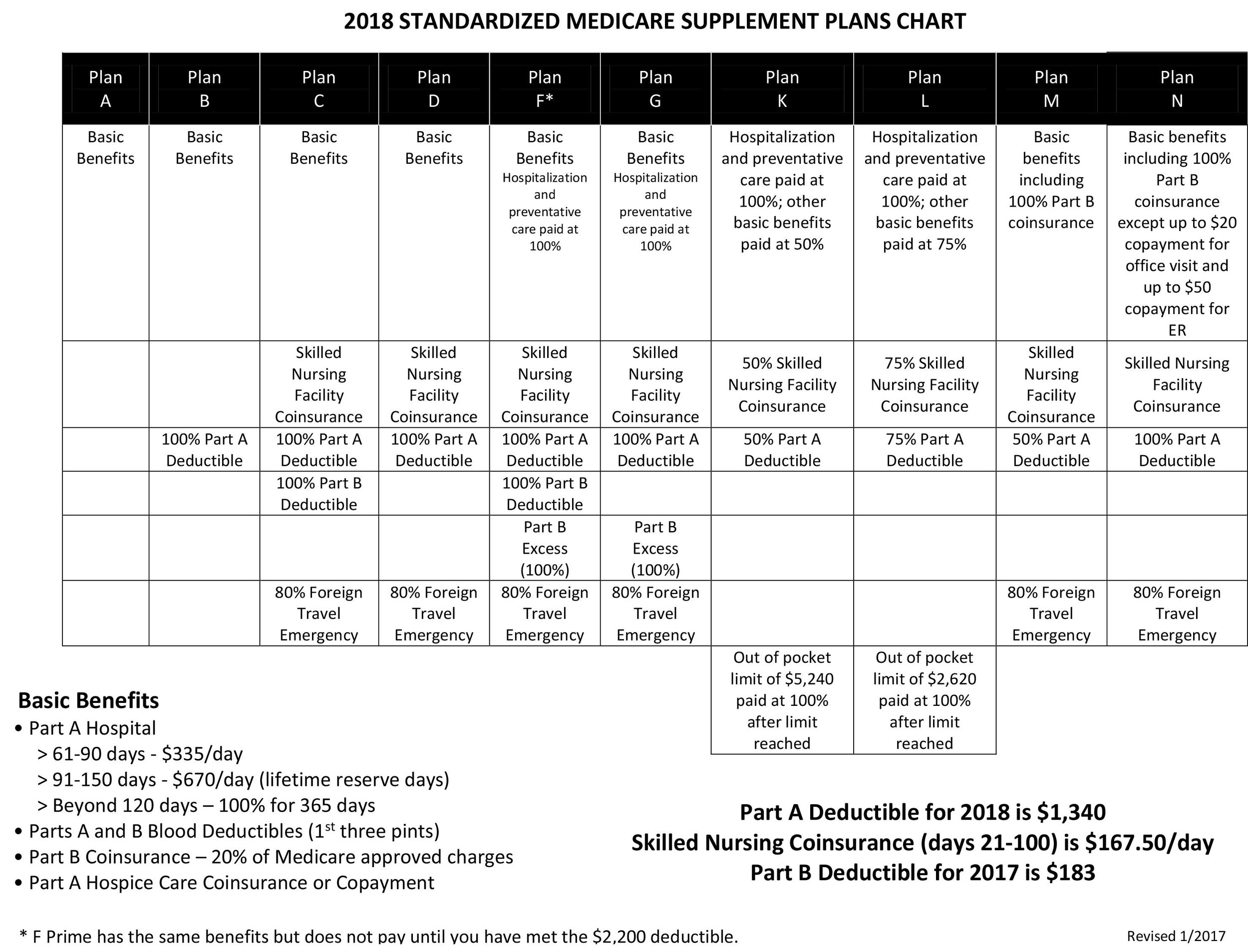

What is Plan A?

Plan A is the most basic plan. All other plans build off this coverage. Plan A covers Part A Medicare co-insurance, including an extra 365 days of hospital costs.Part B 20% co-insurance is covered, along with three pints of blood and Part A hospice care.

What are the different types of healthcare insurance?

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace: 1 Bronze Plans: Cover 60% of healthcare costs. 2 Silver Plans: Cover 70% of costs. 3 Gold Plans: Cover 80% of costs. 4 Platinum Plans: latcosts.

What is QHP categorized?

QHPs sold on the marketplace are categorized by metal levels. The metal levels make it easier for consumers to compare plans that have similar premiums and out of pocket costs. Plans are assigned to a metal level based on actuarial value.

What is a QHP?

A qualified health plan (QHP) is a health insurance plan that meets requirements established by Obamacare, which is also known as the Affordable Care Act (ACA). Some of the QHP rules include being licensed in the state where coverage is provided, covering pre-existing conditions, following cost-sharing limits, prohibiting annual ...

Can I buy a health insurance policy if I qualify for Medicare?

No, you should not buy a policy from a qualified health plan if you qualify for Medicare. Qualified health plans are specific to Obamacare/the ACA and apply to people who don’t have employer-provided coverage and who don’t meet eligibility requirements for Medicare or Medicaid.

Can I buy QHP insurance through the marketplace?

No, QHP plans are available off exchange, such as through a broker or directly from the health plan. However, you can only qualify for the ACA’s premium tax credits and/or cost-sharing subsidies if you buy a QHP policy through the federal or a state health insurance marketplace. The marketplace’s premium tax credits and cost-sharing subsidies are ...

When does Medicare kick in?

Medicare kicks in when you turn 65, and typically you need to sign up in the months right before or after this milestone birthday to avoid penalties later. But when you still have employer health coverage, you may have other options for when to enroll.

Does Medicare Advantage require Part B premium?

Comparing these expenses with the costs of employer plans can help determine if a switch makes sense. Medicare Advantage plans, which the questioner leans toward , usually require paying the Part B premium plus any Medicare Advantage premium.

What Is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are provided by private insurers and essentially replace Original Medicare as your primary insurance. They cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage.

What Are the Benefits of Medicare Advantage?

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

How Much Does Medicare Advantage Cost?

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: “If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 [or higher, depending on your income].”

What Is Medicare Supplement?

Medicare Supplement plans (commonly known as Medigap plans) are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

What Are the Benefits of a Medicare Supplement Plan?

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

How Much Does a Medicare Supplement Plan Cost?

The estimated average monthly premium (the amount you pay monthly) for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Sources

NORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...