What benefits are covered by Plan K?

| Benefit | Does Plan K cover? |

| Part A deductible | 50% |

| Part A coinsurance and hospital costs | yes |

| Part A coinsurance or copayment for hosp ... | 50% |

| Part A coinsurance for skilled nursing f ... | 50% |

What does Medicare supplement plan K cover?

- 100% coverage for Part A hospitalization coinsurance plus coverage for 365 days after Medicare benefits end

- 50% hospice coverage for Part A coinsurance

- 50% of Medicare-eligible expenses for the first 3 pints of blood

- 50% Part B coinsurance, except for preventive care services, which are covered 100%

What does Plan K cover?

What does Medicare Supplement Plan K cover?

- Medicare Part A coinsurance and hospital costs. ...

- Medicare Part B coinsurance or copayment. ...

- First three pints of blood. ...

- Part A hospice care coinsurance or copayment. ...

- Skilled nursing facility care coinsurance. ...

- Medicare Part A deductible. ...

What is the best Medicare coverage plan?

- Best Medicare Advantage Plan Providers

- Compare Medicare Advantage Plans

- What is a Medicare Advantage Plan

- Medicare Law and Medicare Advantage Plans

- Best Medicare Insurance Providers 1. ...

- Pros + Cons of Medicare Advantage Plans Advantages of Medicare Part C Disadvantages of Medicare Part C

- How to Compare Medicare Advantage Plans

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

What does Medigap K cover?

Medigap Plan K covers the following, according to Medicare.gov: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part A deductible (50%). Part A hospice care coinsurance or copayment (50%).

What is Medigap plan K?

Plan K offers benefits to help pay for a variety of Medicare out-of-pocket costs and services. Unlike most of the Medigap plan types, Medigap Plan K includes an out-of-pocket yearly spending limit of $6,220 in 2021 for Medicare-covered services.

What does plan K mean?

Plan K is one of the Medicare supplement insurance plans also known as Medigap. It has a yearly out-of-pocket limit. Costs include premiums and deductibles. Medigap plans help fill the gaps in healthcare costs not covered by original Medicare (Part A and Part B).

How much does Medigap plan K cost?

How much does Medicare Plan K cost? Plan K's monthly premiums are cheaper than many of the other Medigap policies, averaging between $62 and $135 a month in 2020, rates determined by location, current health status, age and gender.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do planes L and K differ other plans?

Plan L is similar to Plan K, but offers a little more protection. Like Plan K, Plan L pays 100% of the Part A coinsurance and hospital costs and does not cover the Part B deductible, Part B excess charges, or foreign travel emergency costs.

Does Medigap cover drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

Is Humana a supplement to Medicare?

Like all other Medicare Supplement insurance plans, Humana's Plan B provides basic benefits for hospitalization and medical expenses, and adds a little bit more coverage for hospitalization compared to Plan A.

Do Medicare Supplement premiums increase with age?

Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes, it may be helpful to consider how your age could affect your Medigap premium costs over time.

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Are Medigap premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the out-of-pocket limit for Medicare Supplement Plan K?

Medicare Supplement Plan K and Plan L are the two Medigap plans that include a yearly out-of-pocket limit. Plan K out-of-pocket limit: $6,220 in 2021. Plan L out-of-pocket limit: $3,110 in 2021. For both plans, after you meet your yearly Part B deductible and your out-of-pocket yearly limit, 100 percent of covered services for the rest ...

What is a Medigap plan?

Medicare supplemental insurance, or a Medigap, helps cover some of the healthcare costs that are often leftover from Medicare parts A and B. Medicare Supplement Plan K is one of two Medicare supplement plans that offer a yearly out-of-pocket limit. Keep reading to learn more about this plan, what it covers, ...

Is there a cap on Medicare?

There’s no cap on your annual healthcare costs with original Medicare. People who purchase a Medigap plan typically do so to limit the amount of money spent on healthcare during the course of a year. This can be important to people who: have a chronic health condition with high costs for ongoing medical care.

Does Medicare Supplement Plan K cover coinsurance?

Medicare Supplement Plan K coverage includes: 100% coverage of Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. 50% coverage of:

Do I have to have Medicare to get a Medigap plan?

For a Medigap plan, you must: have original Medicare, which is Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) have your own Medigap policy (only one person per policy) pay a monthly premium in addition to your Medicare premiums. Medigap policies are sold by private insurance companies.

What is Medicare Supplement Plan K ?

Medicare Plan K is one of the 10 Medicare supplemental insurance plans that you can buy to help cover your medical costs after Medicare pays its share. You can only buy these plans with Original Medicare, not Medicare Advantage plans.

Medicare Supplement Plan K Coverage

After Medicare pays its share of your Part A and Part B — also known as Original Medicare — claims, you still have some costs left to cover on your own. This is where Medigap plans come in.

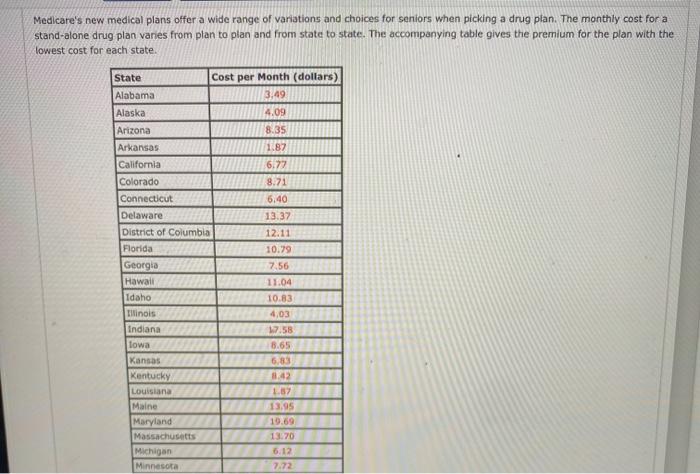

Medicare Plan K Costs

The monthly premium for Medigap plans can vary widely from one insurance company to the next.

Medicare Plan K vs Plan L

Plan K and Plan L are similar in terms of what they cover and the fact that they both offer annual out-of-pocket limits. The difference between the two is how much is covered for the cost of the plan.

When to Buy Plan K

Certain periods of time are ideal for signing up for Plan K — or any other Medigap plan for that matter. While you can try and purchase a Medigap plan at any point during the calendar year, there is no guarantee that an insurance company will sell you a plan.

FAQs

You can buy any Medigap plan that is offered in your area that matches your needs and budget if you are enrolled in Parts A and B of Original Medicare.

How Plan K works

Medicare Plan K is one of 10 Medicare supplement policies labeled A through N in most states. All of these Medicare Supplement plans differ in terms of reimbursement rates, monthly premiums and levels of coverage.

How much does Medicare Plan K cost?

Plan K’s monthly premiums are cheaper than many of the other Medigap policies, averaging between $62 and $135 a month in 2020, rates determined by location, current health status, age and gender.

When and where to buy Medigap Plan K

Medicare Supplement plans, including Plan K, can be purchased during the open enrollment period each year (Oct. 15–Dec. 7). Additionally, you can purchase Plan K during your initial enrollment period. The initial period starts three months before you turn 65 and is a total of seven months.

Does Medicare supplement Plan K cover SilverSneakers?

Some Plan K plans may also cover the SilverSneakers program, which encourages older adults to participate in physical activities that promote a healthier lifestyle. With this arrangement, your insurer pays for a basic membership at any gym in the SilverSneakers network.

Plan K vs. Plan L

Medicare Plan K is sometimes compared to Medicare Plan L, and the two plans share some commonalities. Both plans, for example, pay a percentage of certain services, and both have annual out-of-pocket limits. Like Plan K, Plan L does not cover the Medicare Part B deductible, foreign travel emergencies or Medicare excess charges.

Find a plan

The coverage, prices, and features of Medigap plans differ, so people may wish to compare all of the options before selecting one. This chart shows the coverage of all 10 plans for easy comparison.

When toenroll

It is best to sign up for Plan K or another Medigap plan during the Open Enrollment Period. This time window spans 6 months, starting in the month a person turns 65 and becomes eligible for Medicare.

What is Medicare Plan K?

Medicare Plan K is the Medicare Supplement that covers the Part A hospital deductible while also covering about 50% of the other gaps in Medicare. Enrollment in Plan K increased by 28% from 2014 to 2015, according to a report by AHIP’s Center for Policy and Research. This is likely because consumers are beginning to be more interested in plans ...

What is Medicare Supplement Plan K?

Medicare Supplement Plan K offers you the same basic benefits as other Supplements, but with lower premiums. For example, this plan will still cover preventive care services and give you an extra year in the hospital. However, you split the cost-sharing with the insurance carrier on certain items like the Part A deductible.

What is the maximum out of pocket Medicare Supplement Plan K?

Medicare Supplement Plan K – Maximum Out-of-Pocket. Medigap Plan K’s cap is $6,220 in 2021, so that is the maximum you would spend in any calendar year. This cap works very similar to the out-of- pocket maximums that you have had in the past on employer group health insurance plans.

Is Plan K easy to find?

Finding Plan K quotes is not always easy for consumers because not every Medigap insurance carrier offers it. At Boomer Benefits, we know which carriers in your state offer this policy. We can easily pull rates for you, so that you don’t have to hunt through 30 carriers to find the 2 or 3 that might be selling this particular option.

What Are Medicare Supplement Insurance Plans?

Because they help fill gaps in coverage left by Original Medicare, these supplemental plans are often called “Medigap” plans.

Frequently Asked Questions

Medicare Supplement Plan K covers services similar to other Medigap plans, but instead of paying all your costs, the plan pays a percentage. The key benefit of Plan K is that there is an annual limit on your out-of-pocket costs, which can be a lifesaver if you have a serious illness or injury.

Conclusion

We hope you found this overview helpful! If you have a question we did not cover, however, don’t hesitate to leave a comment or send us an email at [email protected]. We’ll be sure to get back to you within 24 hours.

How much would Medicare pay if you had Plan K?

For example, if you had Plan K and received a Medicare-approved outpatient bill for $100: Original Medicare would pay $80, leaving $20 left to pay. You would pay $10. Without a Medicare Supplement plan, you would pay the full $20 out-of-pocket charge, with no cap on the amount you might be charged during the year.

Which has more members, Plan K or Plan L?

Plan K has more members than Plan L in most states, but both are typically close in size to one another. But if you like Plan L and are most concerned about the maximum out-of-pocket limit, then know that Plan L caps your maximum yearly expense at half of what Plan K has.

How much is Medicare Supplement deductible?

It’s not doctor’s bills but hospital bills that worry many people. When you enter the hospital with Original Medicare, you have an immediate deductible of $1,408, out of your pocket. 1 You could pay that deductible up to five times each calendar year (though five hospital visits in a single year would be rare, and would need to be at least 60 days apart). Without Medicare Supplement coverage, your costs could be much greater. You’d be covered for a 60-day stay, but days 61-90 would require daily coinsurance of $352, and day 91 and beyond would require $704 coinsurance per each “lifetime reserve day” you use. You only have 60 such days to use over your lifetime. After that, you’d pay all the costs.

How much is a hospital deductible in 2020?

50% or 25% of the hospital deductible per benefit period ($1,408 in 2020) 50% or 25% of the cost of the first three pints of blood. 50% or 25% of your hospice care and 50% or 25% of your skilled nursing facility (SNF) copayments (already largely covered by Medicare Part A)

How much is Medicare Advantage 2020?

For 2020, it is $5,880 with Plan K and $2,940 with Plan L. The yearly maximum out-of-pocket costs of Medicare Advantage plans are federally required not to exceed $6,700, but the limit is around $5,000 on average. Interested?

How much is the 2020 deductible for Plan K?

Rather than worry about paying that $1,408 deductible (in 2020) by yourself, know that Plan K would pay half of it for you and Plan L would pay 75 percent, as many times as necessary.

Is Part B excess covered by Medicare?

Foreign travel emergencies, the annual Part B deductible, and Part B excess charges are not covered. As for the services that are covered by Plan K or L, once you reach your out-of-pocket limit on them, they’re covered. These plans do not replace Original Medicare, which will also continue to pay its share of charges.