What is the Medicare deductible and how does it work?

How Does the Medicare Deductible Work? Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses.

How much is the Medicare Part B deductible?

In 2020, you pay $198 ($203 in 2021) for your Part B Deductible. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for these: Clinical laboratory services: You pay $0 for Medicare-approved services. $0 for home health care services.

What is the Medicare Part D Donut Hole?

The donut hole, or coverage gap, is one of the most controversial parts of the Medicare Part D prescription drug benefit and of concern to many people who have joined a Part D drug plan. The good news is that it's steadily shrinking and by 2020, you'll pay the same 25 percent for drugs that you pay once you meet your deductible (if you have one).

What is the deductible for Medicare Part C and D?

Additionally, Part C and Part D have deductibles that will vary from year to year and plan to plan. Some are as low as $0, while others are a few hundred.

What is deductible for traditional Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

When did Medicare deduction start?

1966Medicare Taxes: The Basics Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What is the out of pocket cap on original Medicare expenses each year?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

What year did Medicare start charging premiums?

1966But it wasn't until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare's hospital and medical insurance benefits first took effect.

How has Medicare changed over the years?

Medicare has expanded several times since it was first signed into law in 1965. Today Medicare offers prescription drug plans and private Medicare Advantage plans to suit your needs and budget. Medicare costs rose for the 2021 plan year, but some additional coverage was also added.

Is your Medicare premium based on your income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

Are prescription drugs included in out-of-pocket maximum?

How does the out-of-pocket maximum work? The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums.

What is the Medicare lifetime maximum?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What is the Medicare deductible for 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021. Once the Part B deductible has been paid, Medicare generally pays 80% of the approved cost of care for services under Part B.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

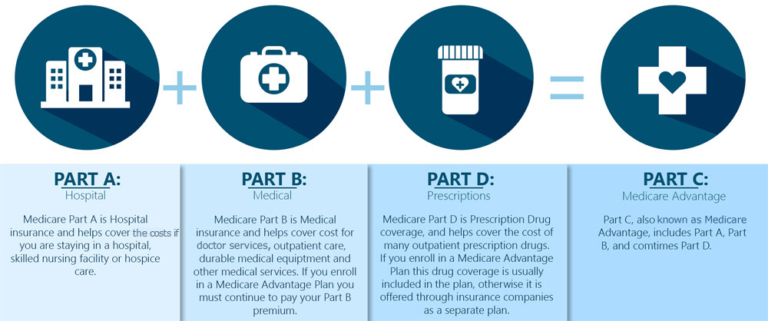

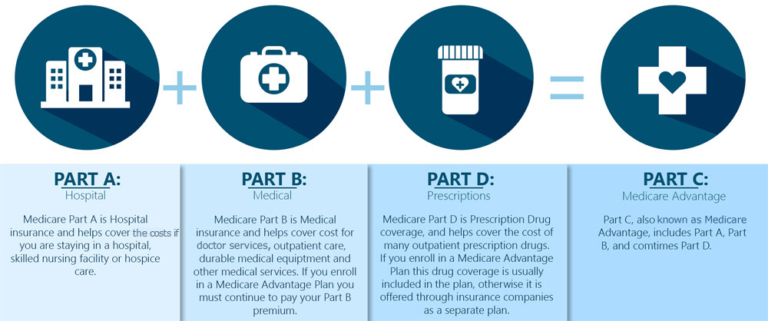

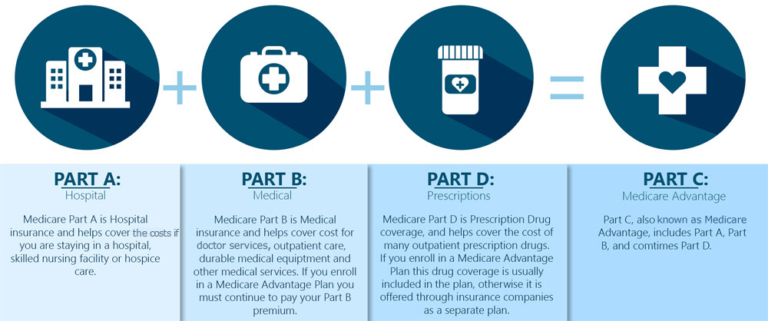

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

How much is deductible for Medicare?

Deductible: If you're enrolled in a Medicare prescription drug plan, you may have to pay up to the first $435 of your drug costs, depending on your plan. 5 This is known as the deductible. Some plans don't have a deductible, or have a smaller deductible, but no Part D plan can have a deductible in excess of this amount.

How much does Medicare pay for drugs?

If you're enrolled in a Medicare Part D plan, you now pay a maximum of 25% of the cost of your drugs once you meet your plan's deductible (if you have one). Some plans are designed with copays that amount to less than 25% of the cost of the medication, but after the deductible is met, Part D plans cannot impose cost-sharing that exceeds 25% ...

How much does Mary pay for her prescriptions?

This is what her prescription medications will cost in the plan she has selected: Mary will pay a deductible of $435.

What happened before the ACA closed the donut hole?

Before the ACA closed the donut hole, it caused some seniors to pay significantly higher costs for their medications after they had reached a certain level of spending on drugs during the year. Those higher costs would continue until the person reached another threshold, after which the costs would decrease again.

Can Part D Medicare be different from Part D?

It's important to understand that your Part D prescription drug plan may differ from the standard Medicare plan only if the plan offers you a better benefit. For example, your plan can eliminate or lower the amount of the deductible, or can set your costs in the initial coverage level at something less than 25% of the total cost of the drug.

When did Part D start?

When Part D plans first became available in 2006, beneficiaries paid 100% of their drug costs while they were in this spending window (known as the coverage gap, or more commonly, as the "donut hole").

Is the Medicare donut hole closed?

The good news is that the Affordable Care Act has closed the donut hole as of 2020, after several years of slowly shrinking it.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).