- Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

- Additional Medicare Tax Withholding Rate. Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status.

- Wage Base Limits. ...

Is Medicare both paid by employees and employer?

Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax. If you are self-employed, you are required to pay both the employee and employer tax for Medicare.

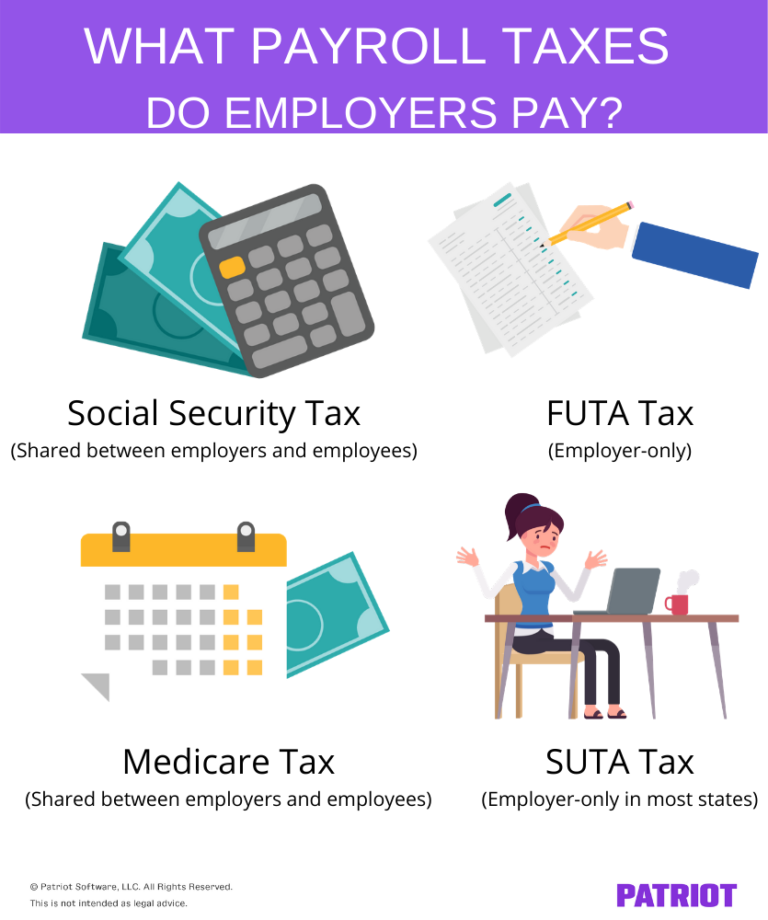

What tax is only paid by the employer?

Social Security Taxes are figured by your employer at 12.4% of your gross pay, and then split with you paying 6.2% of them and your employer paying 6.2% of them and forwarded to the IRS. Medicare Taxes are figured out again the same way, 2.9% of your gross wages and then split like SS and 1.45 is paid by you and 1.45% is paid by your employer.

What is the Medicare employee tax rate?

Your employer makes a matching contribution to the Medicare program. Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer. The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned.

How to ensure my employer has paid my taxes?

Working at a Job That Doesn't Take Out Taxes

- Self-Employment Tax. Working as a consultant or on a project basis where your employer does not take out taxes more than likely qualifies you as self-employed by the government.

- Quarterly Taxes. ...

- End of Year Taxes. ...

- Itemized Deductions. ...

/135309863-56a938963df78cf772a4e4a9.jpg)

Does employer pay Medicare tax?

Medicare wages There's no wage cap for Medicare tax, which means that all of an employee's annual wages are subject to this tax. Employees and employers must each contribute 1.45%.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

How is employer Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

Does the employer or employee pay Social Security tax and Medicare tax?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Do I get Medicare tax back?

No, you can not get the Social Security and Medicare taxes refunded.

Can I opt out of paying Medicare tax?

To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Why would Medicare tax increase on my paycheck?

All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income once the total amount exceeds the threshold for their filing status.

What is Medicare tax withheld on w2?

Box 6: Medicare Tax Withheld. This amount represents the total amount withheld from your paycheck for Medicare taxes. The Medicare tax rate is 1.45%, and a matching amount of 1.45% is paid by W&M. Once you earn $200,000 annually, there is an additional . 9% that the employee pays which makes a total of 2.35%.

How much tax should be taken out of my paycheck?

Overview of Federal TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

Why do I have to pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are Medicare taxes for?

Medicare is the federal government’s health insurance plan for Americans over the age of 65 and those with disabilities. It helps pay for essential medical services, including:

Who pays the Medicare tax?

Employers, employees and self-employed individuals are required to pay a tax for Medicare.

Basic Medicare tax rates

The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must:

Additional Medicare Tax rates

When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold.

Remitting the tax for Medicare

When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer (EFT).

Frequently asked questions about the Medicare tax

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act (FICA). FICA deductions help pay for both Medicare and Social Security programs.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

What Are Medicare Taxes for?

- Medicare is the federal government’s health insurance plan for Americans over the age of 65 and those with disabilities. It helps pay for essential medical services, including: 1. Inpatient hospital, skilled nursing, home health and hospice care (Medicare Part A) 2. Physician services, diagnostic tests and preventive screenings (Medicare Part B) The Medicare tax helps pay for these health c…

Who Pays The Medicare Tax?

- Employers, employees and self-employed individuals are required to pay a tax for Medicare. The government sets the tax as a percentage of gross earnings, so the more an employee makes, the more you have to withhold. As an employer, you must also match the employee’s contribution.

Basic Medicare Tax Rates

- The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must: 1. Withhold 1.45% of an employee’s gross wages 2. Contribute a matching 1.45% of an employee’s gross wages Example: The Medicare tax for an employee earning gross inc...

Additional Medicare Tax Rates

- When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold. The Medicare taxes for employees earning over $200,000 are as follows: 1. Earnings up to $200,000: 1.45% 2. Earnings exceeding $200,000: 2.35% (1.45% plus 0.9%) Emplo…

Calculating The Additional Medicare Tax on Earnings Over $200,000

- Employers must start deducting the Additional Medicare Tax in the pay periodin which an employee’s wages exceed $200,000. Continue applying this surtax in each subsequent pay period until the end of the calendar year. Example #1: An employee earning $30,000 per pay period makes a total of $180,000 in the first six pay periods of the year. The Additional Medicare Tax a…

Remitting The Tax For Medicare

- When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer(EFT). You can make the payment yourself or arrange for your tax professional, payroll service or a trusted third-party to make this deposit for you.

Frequently Asked Questions About The Medicare Tax

- Is the Medicare tax mandatory?

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act(FICA). FICA deductions help pay for both Medicare and Social Security programs. It’s important to know that penalties can apply to an employer who doesn’t w… - At what income level does the Medicare tax increase?

Once you pay an employee more than $200,000 in a calendar year, you must withhold the Additional Medicare Tax. However, things look different from an employee’s perspective. The tax may or may not apply to them depending on their tax filing statusand income thresholds. Individ…