What does FFS mean in insurance terms?

Apr 01, 2010 · The Medicare FFS Approach. The purpose of this message is to clearly communicate the approach that Medicare Fee-For-Service (FFS) is taking to ensure compliance with the Health Insurance Portability and Accountability Act's (HIPAA's) new versions of the Accredited Standards Committee (ASC) X12 and the National Council for Prescription Drug …

What does FFS stand for in insurance?

Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis. Alternatives to fee-for-service programs include value-based or bundled payments, in which providers are paid …

What does it mean when someone says 'FFS'?

A Medicare PFFS Plan is a type of. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, with a few exclusions, for example, certain aspects of clinical trials which are covered by Original Medicare even though you’re still in the plan.

What does FFS mean in medical terms?

Oct 09, 2021 · Medicare Private Fee For Service (PFFS) Plan Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes.

What does Medicare FFS mean?

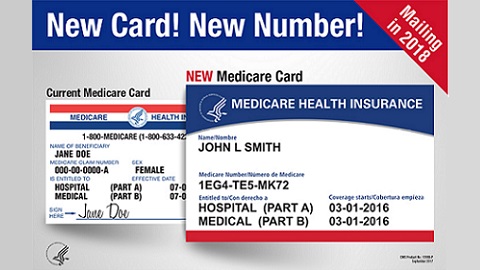

Fee-for-ServiceIt is sometimes called Traditional Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the government pays directly for the health care services you receive. You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country.

What is an FFS claim?

Fee for service (FFS) is the most traditional payment model of healthcare. In this model, the healthcare providers and physicians are reimbursed based on the number of services they provide or their procedures. Payments in an FFS model are not bundled.

How many people are on Medicare FFS?

With over 6.2 million, California was the state with the highest number of Medicare beneficiaries.Feb 16, 2022

What are the 4 types of Medicare?

What are the 4 parts of Medicare?Medicare Part A – hospital coverage.Medicare Part B – medical coverage.Medicare Part C – Medicare Advantage.Medicare Part D – prescription drug coverage.

Is Medicare Advantage an FFS?

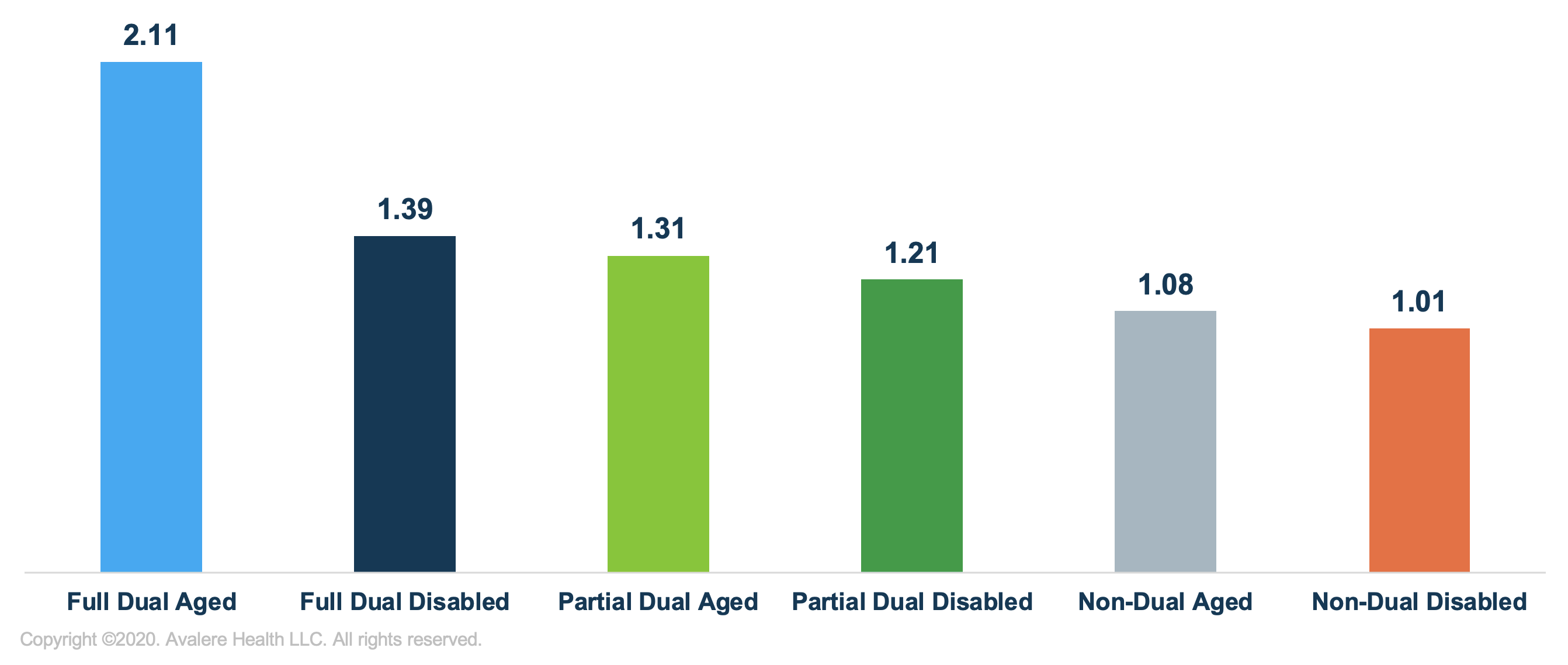

Almost one-third of the Medicare population, approximately 19 million beneficiaries, receive their benefits through a Medicare Advantage (MA) plan. MA plans are private plans that provide Medicare benefits as an alternative to traditional Medicare, also known as Medicare fee-for-service (FFS).

Is FFS the same as PPO?

Fee-for-Service (FFS) Plans with a Preferred Provider Organization (PPO) - An FFS option that allows you to see medical providers who reduce their charges to the plan; you pay less money out-of-pocket when you use a PPO provider. When you visit a PPO you usually won't have to file claims or paperwork.

What percentage of Medicare is Medicare Advantage?

In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).Jun 21, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

How much does health insurance cost per month in Michigan?

Marketplace premiums in Michigan are among the lowest in the country. The average benchmark premium in Michigan for 2021 is $347 a month compared to $452 for the U.S. average. The benchmark premium is based on the second-lowest-cost silver plan.

What are the 2 types of Medicare?

New to Medicare? Get the basics. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

Whats the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What are the two types of Medicare?

There are two types of Medicare: Original Medicare and Medicare Advantage. Here's how they differ. Original Medicare provides more choices of plans. You choose the doctors, hospitals, and healthcare providers and pay your own deductibles and coinsurance (the amount you pay after meeting your deductible).

What is fee for service?

Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis. Alternatives to fee-for-service programs include value-based ...

What are some alternatives to fee for service?

Alternatives to fee-for-service programs include value-based or bundled payments, in which providers are paid based on outcomes and efficiency, rather than for each separate procedure that they perform.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is coinsurance in insurance?

coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%). amount allowed by the plan for the type (s) of service you get at the time of the service.

What is a copayment?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Is PFFS the same as Medicare?

PFFS plans aren’t the same as. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

Can you get prescription drugs with PFFS?

Prescription drugs may be covered in PFFS Plans. If your PFFS Plan doesn't offer drug coverage, you can join a. These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. to get coverage.

What Is The Medicare Shared Savings Program

What Is A Medicare Private-Fee-For-Service Plan? Should You Join A Medicare PFFS Plan?

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003.

Provider Payment And Delivery Systems

States may offer Medicaid benefits on a fee-for-service basis, through managed care plans, or both. Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan.

Mma Initiatives For Private Plans 2006

The 2003 MMA legislation increased payments to private plans for 2004-2005. It also created a new type of private planthe regional PPOand created special payment arrangements for this type of plan and for local plans. The payment arrangements for both plans are based on a comparison of benchmark prices and bids by plans for Parts A and B coverage.

What Is The Purpose Of The Medical Review Program

Medical reviews identify errors through claims analysis and/or medical record review activities. Contractors use this information to help ensure they provide proper Medicare payments . Contractors also provide education to help ensure future compliance.

Competitive Pricing For Private Plans: 1995

Beginning in 1995, CMS began a series of demonstration projects centered on competitive pricing as a method for paying private health plans in Medicare. Instead of payments based on costs in FFS Medicare, private plans would be paid on the basis of bids in local market areas.

Fee For Service Vs Value Added Model

Ready to see the difference a private plan makes? Call now to talk to a licensed insurance agent about your options or click Compare Plans to see the Medicare options available where you live. Your coverage matters. Let us help you find the right plan.

What is Medicare Fee for Service Compliance?

The Medicare Fee-for-Service Compliance programs prevent, reduce, and measure improper payments in FFS Medicare through medical review. We provide a number of programs to educate and support Medicare providers in understanding and applying Medicare FFS policies while reducing provider burden.

Why is Medicare simplifying documentation requirements?

Medicare is simplifying documentation requirements so that you spend less time on paperwork, allowing you to focus more on your patients and less on confusing and time-consuming claims documentation. Learn about what we are doing.

What is a CBR in Medicare?

A CBR provides data on Medicare billing trends, allowing a health care provider to compare their billing practices to peers in the same state and across the nation. A CBR educates providers about Medicare’s coverage, coding, and billing rules and acts as a self-audit tool for providers.

How does ESMD work?

Using the esMD system decreases costs, increases efficiency, helps improve payment turnaround time, and reduces the administrative burden of medical documentation requests and responses. Learn more about esMD.

What is a provider compliance tip?

Provider Compliance Tips are quick reference fact sheets to educate and provide high-level guidance to providers about claim denial issues and provide claim submission and documentation guidance. The tips cover Part A, B, and DME services with high Medicare improper payment rates. Access these tips and more on the Medicare Learning Network.

What is EMDI in healthcare?

The primary focus of EMDI is Provider-to-Provider communications using standards similar to esMD. Learn more about EMDI.

What is a PEPPER?

PEPPER provides provider-specific Medicare data for services vulnerable to improper payments. It can be used as a guide for auditing and monitoring efforts to help providers identify and prevent payment errors. Learn more about PEPPER.

What is the main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans

The main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans is the latitude it may give Medicare beneficiaries and health-care providers.

What is a PFFS plan?

A Medicare Private Fee-For-Service (PFFS) plan is a type of Medicare Advantage health plan offered by a private insurance company under contract to the Medicare program. The PFFS plan, rather than Medicare, largely determines how much it will pay for covered health-care services ...

What to do if you don't know if your PFFS plan will pay for a service?

If you don’t know whether your PFFS plan will pay for a service, you can call your plan and ask for confirmation that the plan will cover the service. Note: You have the right to receive medically necessary emergency care anytime and anywhere in the United States without any prior approval from your PFFS plan.

How much does a PFFS plan charge?

Some PFFS plans may allow doctors and hospitals to charge you up to 15% over the plan’s payment amount for services. The plan will inform you if this is the case. Health-care providers: PFFS plans do not require you to select a primary care physician (PCP) to coordinate your care or to use a network of hospitals and doctors contracted with ...

Does PFFS charge a premium?

Costs: PFFS plans may charge you a premium amount above the Medicare Part B premium. (You typically pay your Part B premium no matter what type of Medicare Advantage plan you may have, as well as any plan premium.) PFFS plans may charge deductible, copayment and/or coinsurance amounts. PFFS plans may charge a premium for extra benefits like ...

Does PFFS cover dental?

Some PFFS plans may have extra benefits – for example, prescription drug coverage, routine dental care and/or routine vision care coverage. If you choose to enroll in a PFFS plan that does not offer Medicare Part D prescription drug coverage, you may be able to enroll in a stand-alone Medicare Part D Prescription Drug Plan offered ...

Does Medicare have a provider network?

Some Medicare PFFS plans have provider networks. Before enrolling in a PFFS plan, you may want to consider carefully the following features of this type of Medicare Advantage plan. Benefits: PFFS plans provides all medically necessary health care services covered by Medicare Part A (hospital care) and Part B (medical care).

What Is Medicaid FFS?

Medicaid FFS stands for Medicaid fee-for-service. Individual states administer Medicaid programs, and states deliver and pay for these Medicaid services through a fee-for-service system, which directly pays physicians, clinics, hospitals and other medical providers a fee for each service they provide their patients with Medicaid plans.

Other Payment Models

Medicaid FFS is a type of payment model for Medicaid service delivery. Within an FFS system, the individual state's Medicaid agency establishes fee levels for covered services, and it pays providers directly for each service they deliver to Medicaid beneficiaries.

More Information About Medicaid FFS

To find out more information about whether your state uses a Medicaid FFS system, consult your state's Medicaid resources. Medicaid programs vary widely by state, so it's important to consult resources specific to your location. Find out more by visiting Medicaid.gov or your state's Medicaid page.

What is fee for service health plan?

A fee-for-service health plan allows you to see any provider -- doctors, hospitals, and so forth -- you want to see. Either the health plan pays the provider directly for the care you get, or it reimburses you for paying. You are still responsible for any deductibles or cost-sharing.

Is FFS more expensive than HMO?

You are still responsible for any deductibles or cost-sharing. A FFS plan tends to be more expensive than managed care plans, like an HMO or PPO. In part, that's because HMO or PPO plans contract with providers to take a discounted fee for certain services.