Medicare is the secondary payer to GHPs for the working aged where either a single employer of 20 or more full and/or part-time employees is the sponsor of the GHP or contributor to the GHP, or two or more employers are sponsors or contributors to a multi-employer/multiple employer plan, and a least one of the employers has 20 or more full and/or part -time employees.

What does GHP stand for in insurance?

Apr 04, 2022 · Information and instructions for the Medicare Secondary Payer (MSP) Group Health Plan (GHP) reporting requirements mandated by Section 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 (MMSEA) (P.L. 110-173) are documented in the MMSEA Section 111 MSP Mandatory Reporting GHP User Guide (GHP User Guide).

What does GHP stand for?

Group Health Plan (GHP) Group health plans (GHPs), also known as employer group health plans, are health insurance offered by an employer or employee organization (such as a union) for current or former employees and their families. This insurance may be primary or secondary to Medicare coverage depending on the size of the company and whether ...

What does LGHP stand for in Medicare?

Apr 04, 2022 · The Medicare Secondary Payer (MSP) provisions of the Social Security Act (found at 42 U.S.C. § 1395y(b)) require Group Health Plans (GHPs) to make payments before Medicare under certain circumstances. For additional information on this topic, please visit the Medicare Secondary Payer page. If Medicare paid primary when a GHP had primary payment …

What does no gap coverage mean Medicare?

GHP Medicare Abbreviation What is GHP meaning in Medicare? 1 meaning of GHP abbreviation related to Medicare: 1 GHP Group Health Plan Medical, Technology, Health Suggest to this list Share GHP Medicare Abbreviation page

What is GHP coverage?

A “Group Health Plan” (GHP) is health insurance offered by an employer, union or association to its members while they are still working. GHP coverage is based on current employment.Jun 1, 2021

What does coordination of benefits allow?

Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an ...Dec 1, 2021

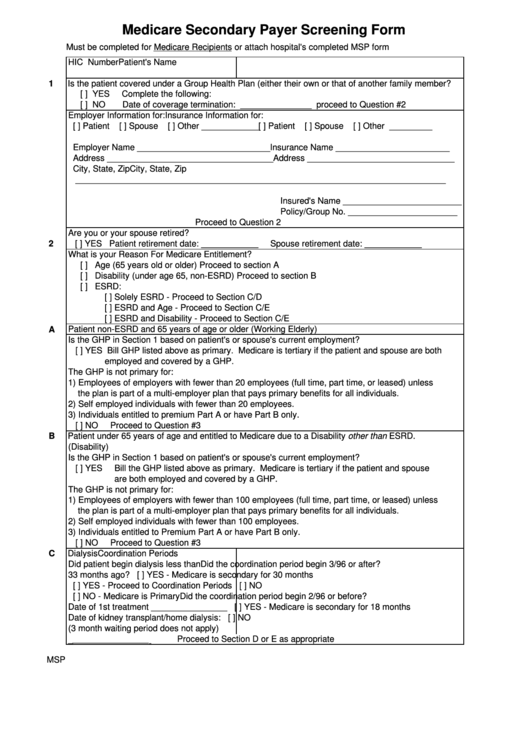

What is the Medicare Secondary Payer questionnaire?

CMS developed an MSP questionnaire for providers to use as a guide to help identify other payers that may be primary to Medicare. This questionnaire is a model of the type of questions you should ask to help identify MSP situations.

How do I know if Medicare is primary or secondary?

If the employer has 100 or more employees, then your family member's group health plan pays first, and Medicare pays second. If the employer has less than 100 employees, but is part of a multi-employer or multiple employer group health plan, your family member's group health plan pays first and Medicare pays second.

Is it good to be double covered for health insurance?

There are potential benefits to having more than one health plan. Having multiple health insurance policies may mean extra help with medical costs, since dual coverage lets people access two plans to cover healthcare costs.Jan 21, 2022

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

How Much Does Medicare pay as a secondary payer?

Medicare's secondary payment is $230, and the combined payment made by the primary payer and Medicare on behalf of the beneficiary is $680. The hospital may bill the beneficiary $70 (the $520 deductible minus the $450 primary payment).

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

Does Medicare Secondary cover primary copays?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

Does Medicare become primary at 65?

Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second. If this is your situation, it's important to enroll in both parts of Original Medicare when you are first eligible for coverage at age 65.Mar 1, 2020

Do I need supplemental insurance if I have Medicare and Medicaid?

Do You Need Medicare Supplement Insurance if You Qualify for Medicare and Medicaid? The short answer is no. If you have dual eligibility for Medicare and full Medicaid coverage, most of your health costs are likely covered.

Who is responsible for GHP recovery?

GHP recoveries are the responsibility of the Commercial Repayment Center (CRC). The only exception to this rule: MSP recovery demand letters issued by the claims processing contractors to providers, physicians, and other suppliers.

What is an MSP claim?

MSP laws expressly authorize Medicare to recover its mistaken primary payment (s) from the employer, insurer, TPA, GHP, or any other plan sponsor. Once new MSP situations are discovered, the CRC identifies claims Medicare mistakenly paid primary and initiates recovery activities.

What is GHP reporting?

GHP reporting is done on a quarterly basis in an electronic format. The Section 111 statutory language, Paperwork Reduction Act Federal Register Notice, and Supporting Statement can be found in the Downloads section below.

What is a Section 111 MSP response file?

Through this process, a monthly file will be sent to the participating RRE to notify them whenever another entity changes or deletes MSP information previously submitted by them . The file will contain information about the RRE’s prior submission and information regarding the data modifications that were applied, the reason for the change, and the source of the new information. While receipt of this file is optional, GHP RREs are encouraged to consider participation since it improves the overall accuracy of MSP information used and stored by Medicare, RREs, and employer GHP sponsors. More information on the benefits of the Unsolicited Response File and how to enroll in this process can be found in the GHP User Guide.

What is the section B of the CMS L564?

The information provided in Section B is the evidence of GHP or LGHP coverage. To view the Form CMS-L564, see HI 00805.340 .

What is a B policy?

B. Policy when the employer, GHP, or LGHP cannot provide evidence. When the employer, GHP or LGHP cannot provide all evidence of GHP or LGHP coverage based on current employment status, the applicant may submit other documents that reflect employment, GHP or LGHP coverage (in addition to or in lieu of the evidence listed in HI 00805.295A ...

Is a GHP an LGHP?

If the response is that the employer had at least 100 employees, then the GHP is an LGHP. When it is common knowledge (or the FO has established a precedent) that the GHP meets the definition of LGHP, prepare a Form SSA-5002 to document that the GHP is an LGHP.

Does HI 00805.295C apply to disabled?

The same requirements, in HI 00805.295C, apply to the disabled beneficiary covered under an LGHP, except that the evidence must show that the beneficiary currently has or had coverage under an LGHP based on current employment status.

Who Must Report

- A GHP organization that must report under Section 111 is an entity serving as an insurer or third party administrator (TPA) for a group health plan. In the case of a group health plan that is self-insured and self-administered, this would be the plan administrator or fiduciary. These organizations are referred to as Section 111 GHP responsible reporting entities, or RREs. GHP R…

Reporting

- The purpose of Section 111 reporting is to enable Medicare to correctly pay for the health insurance benefits of Medicare beneficiaries by determining primary versus secondary payer responsibility. Section 111 authorizes CMS and GHP RREs to electronically exchange health insurance benefit entitlement information. On a quarterly basis, an RRE must submit a file of inf…

Reporting Requirements - GHP User Guide and Alerts

- Reporting requirements are documented in the MMSEA Section 111 Medicare Secondary Payer (MSP) Mandatory Reporting GHP User Guide which is available for download on the GHP User Guide page. The GHP User Guide is the primary source for Section 111 reporting requirements. RREs must also be sure to refer to important information published on the GHP Al...

Registration and The Section 111 Coordination of Benefits Secure Website

- Section 111 RREs are required to register for Section 111 reporting and fully test the data exchange before submitting production files. The registration process provides notification to CMS of the RRE’s intent to report data to comply with the requirements of Section 111. GHP RREs must register on the Section 111 COB Secure Website (COBSW). This interactive Web portal ma…

Reporting Assistance

- After registration, you will be assigned an Electronic Data Interchange (EDI) Representative to assist you with the reporting process and answer related technical questions. CMS conducts GHP Town Hall Teleconferences to provide updated policy and technical information related to Section 111 reporting. Announcements for upcoming GHP Town Hall events are posted to the GHP Wha…

Unsolicited Response File

- Section 111 GHP RREs can elect to receive the GHP Unsolicited MSP Response File. Through this process, a monthly file will be sent to the participating RRE to notify them whenever another entity changes or deletes MSP information previously submitted by them. The file will contain information about the RRE’s prior submission and information regarding the data modifications t…

Compliance

- In addition to the provisions for GHP arrangements found at 42 U.S.C. 1395y(b)(7), please refer to the GHP User Guide and CMS Guidancepublished in the Downloads section below.