What does it mean to pay with LTC?

Long-term care insurance usually covers all or part of assisted living facilities and in-home care for people 65 or older or with a chronic condition that needs constant care. It is private insurance available to anyone who can afford to pay for it.

Is LTC worth the cost?

Consumer and financial experts generally agree that LTC insurance is a bad investment unless the monthly premium is 5% or less of your monthly income. When calculating this 5% figure for future years, bear in mind that your premiums are likely to rise, while your income will probably drop.

How does a LTC work?

Long-term care refers to a host of services to help with “activities of daily living,” such as bathing, eating and remembering to take medication. Regular health insurance and Medicare pay for medical expenses. But they don't pay for custodial care, which is the nonmedical help with routine activities.

Who pays the most for LTC?

Medicaid is by far the largest payer of Long-Term Care costs in the US today. Most people find out quickly when they need care that the government is not going to pay their way until they have spent most of their assets.

Are long-term care premiums tax deductible?

Long-term care insurance premiums can be costly. The IRS allows qualified taxpayers to deduct a portion of their long-term care insurance premiums on their tax return based on their age. Generally, you must itemize deductions and have expenses that exceed the AGI threshold to qualify.

Does Medicaid cover long-term care?

Medicaid, the largest public payer of long-term care services, not only covers ongoing and emergent medical care, like doctor visits or hospital costs but also provides coverage for: Long-term care services in nursing homes, including custodial care, for all eligible people age 21 and older.

What are 5 factors that you should consider when buying long-term care insurance?

5 Key Factors to Consider When Buying Long-Term Care InsuranceThe daily benefit amount.The amount of inflation protection.The length of benefit payments.The waiting period before benefits begin.Your current age.

Which of the following was a long-term care plan typically provide benefits for?

Which of the following will a Long Term Care plan typically provide benefits for? Home health care. (A Long Term Care policy will typically pay for home health care.

How do you qualify for benefits under the ADL trigger?

A person qualifies for benefits when they are unable to perform two or three ADLs, depending on the long-term care insurance policy. Make sure bathing and dressing are included on the list of ADL benefit triggers because these are usually the two that a person can't do.

What are the three types of long-term care insurance?

There are three types of long-term care insurance.traditional (i.e., stand-alone) policies;hybrid policies; and.policies as part of a Continuing Care Retirement Community package.

Does long-term health insurance cover assisted living?

While long-term care insurance does not usually offer comprehensive payment coverage for assisted living, the limited support that most policies include can reduce the expense of nonmedical long-term care.

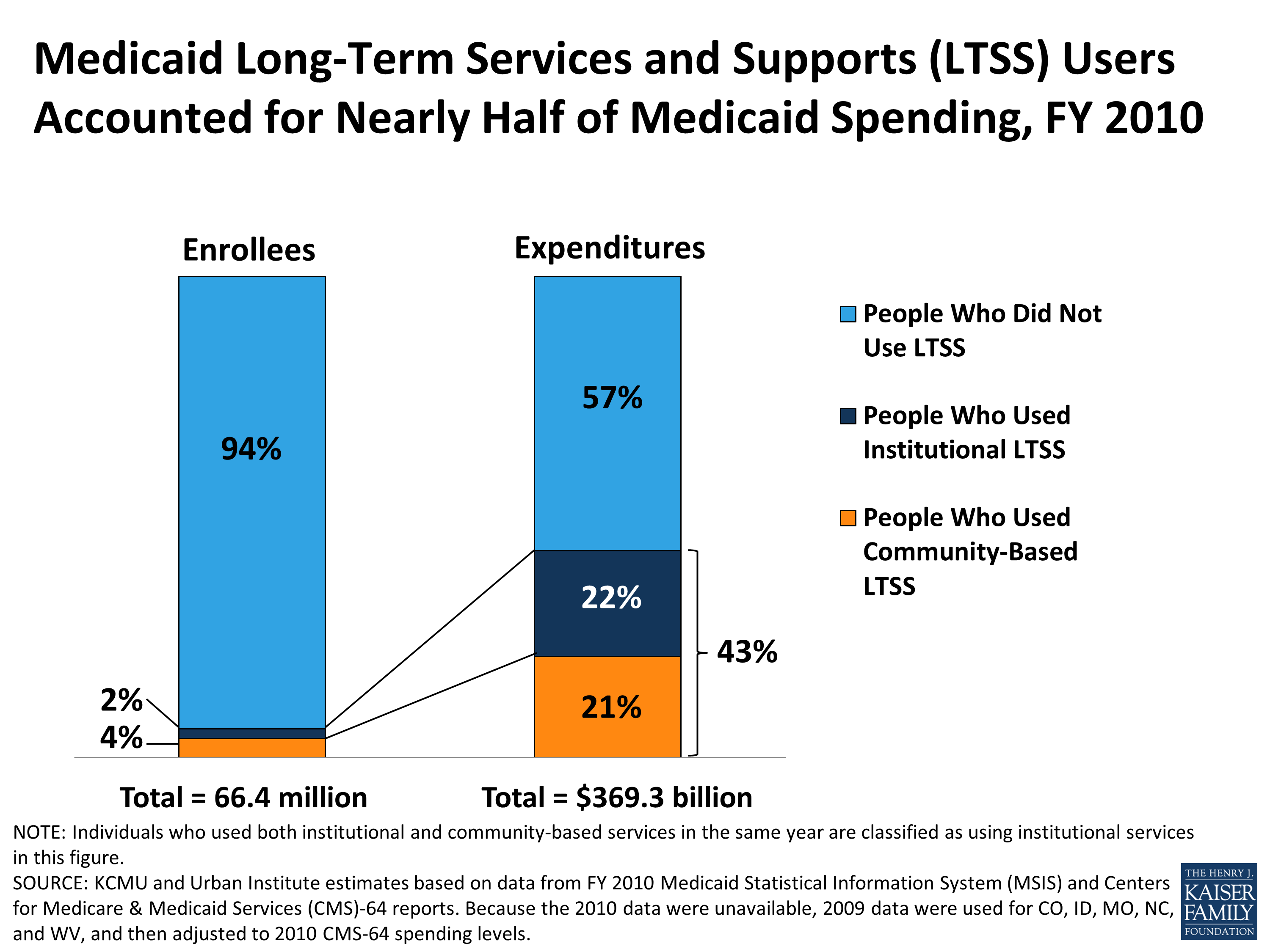

What is the largest payer of long-term care in the United States?

MedicaidMedicaid is the largest single payer of LTSS in the United States; in 2019, total Medicaid LTSS spending (combined federal and state) was $182.8 billion, which comprised 42.9% of all LTSS expenditures.