Full Answer

What is the true cost of Medicare administration?

Sanders said, "Private insurance companies in this country spend between 12 and 18 percent on administration costs. The cost of administering the Medicare program, a very popular program that works well for our seniors, is 2 percent. We can save approximately $500 billion a year just in administration costs."

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

What are administrative costs in health insurance?

Administrative costs are the expenses incurred by medical insurers that are not strictly medical, such as marketing, customer service, billing, claims review, quality assurance, information technology and profits. Is the gap between private and public health insurance providers’ administrative costs really that high?

How much does Medicare pay for home health care?

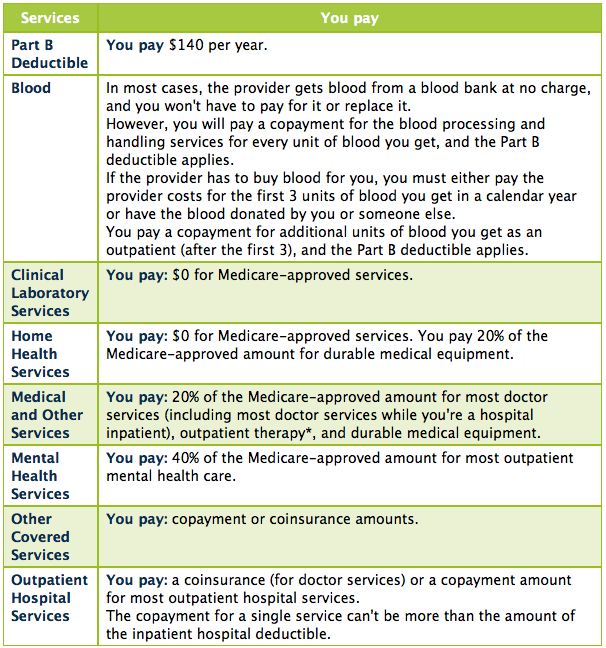

$0 for home health care services. 20% of the Medicare-approved amount for Durable medical equipment (DME) [Glossary] (DME). $0 for Hospice care. You may need to pay a Copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while you're at home.

What percentage of Medicare is administrative expenditure?

What is CMS in Medicare?

How much was Medicare's overhead in 2010?

About this website

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What medical equipment is ordered by your doctor for use in the home?

Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How are administrative costs calculated?

Administrative costs are calculated using faulty arithmetic. But most important, because Medicare patients are older, they are substantially sicker than the average insured patient — driving up the denominator of such calculations significantly.

Who wrote extensively about Medicare administrative costs?

UPDATE 2: Benjamin Zycher has also written extensively about Medicare's administrative costs, as exemplified by this paper for the Manhattan Institute.

What government agency is Medicare administered by?

First, other government agencies help administer the Medicare program. The Internal Revenue Service collects the taxes that fund the program; the Social Security Administration helps collect some of the premiums paid by beneficiaries (which are deducted from Social Security checks); the Department of Health and Human Services helps to manage accounting, auditing, and fraud issues and pays for marketing costs, building costs, and more. Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost. In addition, Medicare's massive size leads to economies of scale that private insurers could also achieve, if not exceed, were they equally large.

What are the government agencies that administer Medicare?

First, other government agencies help administer the Medicare program. The Internal Revenue Service collects the taxes that fund the program; the Social Security Administration helps collect some of the premiums paid by beneficiaries (which are deducted from Social Security checks); the Department of Health and Human Services helps to manage accounting, auditing, and fraud issues and pays for marketing costs, building costs, and more. Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost. In addition, Medicare's massive size leads to economies of scale that private insurers could also achieve, if not exceed, were they equally large.

Is Medicare tax exempt from state taxes?

Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost.

Is Medicare more efficient than private insurance?

Many people wrongly believe that Medicare is more efficient than private insurance; that view was often stated by champions of Obamacare during the debate preceding the law's enactment. These advocates argued that Medicare's administrative costs — the money it spends on expenses other than patient care — are just 3% of total costs, compared to 15% to 20% in the case of private, employer-sponsored insurance. But these figures are highly misleading, for several reasons.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How does Medicare pay for hospital insurance?

Medicare covers hospital insurance (HI), financed through the payroll tax in the same manner as old-age, survivors, and disability in- surance benefits are financed, and supplemen- tary medical insurance (SMI), jointly financed through general revenues and monthly premium payments deducted from the monthly benefit checks of the aged and by the premiums paid by persons aged 65 or over who are not entitled to social security benefits but who have enrolled voluntarily for SMI coverage. Until 1973, these payments bore a systematic relation to expected expenditures under SMI: the premium was set at one-half the cost of the program. In 1973 the method of financing SMI was amended. The future rate of increase in the beneficiary share of the premium will be limited to the rate of increase in the amount of old-age benefits. General rev- enues will pay the rest. Although the Federal Government is the in- surer under Medicare, the major portion of pro- gram administration is handled by the inter- mediaries for HI and carriers for SMI. The 82 intermediaries and 48 carriers are reimbursed for the reasonable costs they incur in performing administrative functions *for the Government. Intermediaries are selected by the Secretary of Health, Education, and Welfare on the basis of nominations from groups or associations of pro- viders. A member of a provider association, how- ever, may elect to be reimbursed by an interme- diary other than that nominated by his association or may elect to be reimbursed directly by the Social Security Administration. About 90 percent of all payments under HI currently are made by Blue Cross plans. Carriers, on the other hand, are selected directly by the Secretary of Health, Education, and Wel- fare. With the exception of the benefits for rail- road retirees (administered by the Travelers Insurance Company), carriers are assigned ad- ministrative responsibility for the services pro- vided in a geographic area. Thus, for example, beneficiaries who may be Pennsylvania residents visiting Florida are expected to submit claims to the Florida carrier for any medical expenses incurred in that State and to the Pennsylvania carrier for any medical expenses incurred in Pennsylvania. A patient may deal directly with the carrier, or he may assign his bill to the physician or other supplier for collection if he is willing to accept assignment from the patient. About two-thirds of all SMI bills were assigned in 1971. When there is no assignment the Medicare enrollee has to pay the difference between what the physician charges and what Medicare pays as an allowable charge. The percentage of assigned claims decreased in 1972 and 1973. Intermediaries make payments to hospitals, extended-care facilities (now called skilled-nurs- ing facilities), and home health - agencies for covered items and services on the basis of rea- sonable cost determinations. They also audit pro- vider accounts to det,ermine the accuracy of Medicare billing, make cost reports and checks for reasonableness of costs, conduct claims re- views to check the coverage of services billed, and monitor the appropriateness of medical treat- ment. Carriers determine allowed charges (based on the customary charge by the individual pro- vider for the specific service and based on pre- vailing charges in the locality for similar services) for bills submitted to them by physicians or other suppliers of services. They also pay 80 percent of the allowed charges after an annual deductible ($50 until January 1, 1973, $60 since that date) has been met. It is commonly acknowledged that the Medi- care program is more comprehensive and complex than much of the health insurance coverage pro- vided by commercial insurers and the Blue Cross- Blue Shield plans. An examination of some of the significant characteristics of Medicare and other plans may help to explain cost differences:

How much did Medicare cost in 1972?

ALL HEALTH INSURANCE expenditures, public and private, totaled $35.2 billion or 3 percent of gross national product in 1972-an indication of the magnitude of the health insur- ance third-party reimbursement sector. At the same time, it cost $5.1 billion to administer these health insurance programs. Though the Medicare program accounted for almost 30 percent of all health insurance benefits paid, its administrative expenses only amounted to 8.5 percent of total health insurance administrative c0sts.l Medicare is a large public program and large absolute sums are spent on the administration of the program. Furthermore, Medicare has been

What were the additional burdens added to the administrative system?

Additional burdens were added to the admin- istrative system by amendments on claims review, capital controls, and generally more paper work to justify the payment of bills and interim cost payments. These events led quite naturally to an acceleration in the increase in administrative costs and a deceleration in the rate of growth of benefit payments. Since percentage changes over

What is the cost of audit?

cost of the audit equals the marginal saving in preventing an unallowable cost. This indicates that the optimal amount of unallowable costs is not zero.

Is administrative cost per enrollee increasing?

base year, it is seen that administrative costs per enrollee have been growing at a more rapid rate than benefits per enrollee. Several factors account for the difference in growth rates. The lag benefit payments has already been mentioned. In addition, as rising benefit payments attracted closer congressional scrutiny and executive depart- ment interest in cost control, more emphasis was placed upon careful monitoring of provider bills, with a resultant drop the rate of increase benefit payments.

Is Medicare an established fawn?

b’ince Medicare is an established fawn of national health insurance for the aged, an analysis of the program’s administrative coat experience should yield valuable insight8 for discuseing administrative aspects of national health insurance. This article poids out the pitfall8 of Blindly using the com-

Is Medicare a publicly funded program?

Because the Federal Government’s role in Medicare is primarily that of a financier, enforcer of stand- ards, and gatherer of statistical information per- taining to the program, as it would be under any publicly financed program, regardless of the de- gree to which private contractors perform other services, the final sections of the article place major emphasis on the cost performance of the intermediaries and carriers.

How much does Medicare cost?

Advocates of a public plan assert that Medicare has administrative costs of 3 percent (or 6 to 8 percent if support from other government agencies is included), compared to 14 to 22 percent for private employer-sponsored health insurance (depending on which study is cited), or even more for individually purchased insurance.

Why is administrative cost lower in Medicare?

Expressing administrative costs as a percentage of total costs makes Medicare's administrative costs appear lower not because Medicare is necessarily more efficient but merely because its administrative costs are spread over a larger base of actual health care costs. Administrative Costs per Person.

What is Medicare beneficiary?

Medicare beneficiaries are by definition elderly, disabled, or patients with end-stage renal disease. Private insurance beneficiaries may include a small percentage of people in those categories, but they consist primarily of people are who under age 65 and not disabled.

Why is public health better than private health?

Many advocates of a public health plan--either a "single-payer" plan or a "public option"--claim that a public health plan will save money compared to private health insurance because "everyone knows" that the largest government health program, Medicare, has lower administrative costs than private insurance. Some even claim that switching every private insured American to Medicare or something like it could save the nation enough money to cover all currently uninsured Americans.

What are administrative costs?

Administrative costs can be divided broadly into three categories: 1 Some costs, such as setting rates and benefit policies, are incurred regardless of the number of beneficiaries or their level of health care utilization and may be regarded as "fixed costs." 2 Other costs, such as enrollment, record-keeping, and premium collection costs, depend on the number of beneficiaries, regardless of their level of medical utilization. 3 Claims processing depends primarily on the number of claims for benefits submitted.

How much higher was Medicare in 2005?

In the years from 2000 to 2005, Medicare's administrative costs per beneficiary were consistently higher than that for private insurance, ranging from 5 to 48 percent higher, depending on the year (see Table 1).

What percentage of health insurance premiums are administrative costs?

In recent years, these so-called "administrative costs" have accounted for 11.4--13.2 percent of total health insurance premiums. [7]

What is administrative cost?

Administrative costs are the expenses incurred by medical insurers that are not strictly medical, such as marketing, customer service, billing, claims review, quality assurance, information technology and profits. Is the gap between private and public health insurance providers’ administrative costs really that high?

How much did Medicare spend in 2016?

The trustees’ summary listed total Medicare expenditures of $678.7 billion for 2016, of which $9.2 billion was characterized as "administrative expenses." That works out to 1.4 percent, which is even lower than what Sanders stated.

What do private insurers do?

In addition, private insurers create provider networks, which is where they determine which doctors will offer which services under each plan and negotiate reimbursement rates. They also review which drugs will be most effective and affordable.

What is the federal cap on administrative costs?

Federal caps on administrative costs reflect this range. Group market insurers have a 15 percent cap and individual market insurers have a 20 percent cap. If exceeded, insurers have to pay a rebate to policyholders under the Affordable Care Act.

Why are administrative expenses higher in commercial markets?

Historically, administrative expenses were much higher in the commercial market because insurers did a lot of underwriting, or using the health status of individuals or groups to determine their premiums. The Affordable Care Act was designed to curb that spending.

How much money would be saved by converting to single payer?

Sanders cited Woolhandler and Himmelstein’s article estimating $504 billion in savings from converting to a single-payer system. But the article’s authors admitted that "any such estimate is imprecise" and cited other research placing the number closer to $383 billion.

What did Bernie Sanders say about Medicare?

Sen. Bernie Sanders, I-Vt., said that switching to a single-payer "Medicare for all" health system would save billions of dollars in administrative costs.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

What percentage of Medicare is administrative expenditure?

The latest trustees’ report indicates Medicare’s administrative expenditures are 1 percent of total Medicare spending, while the latest NHEA indicates the figure is 6 percent. The debate about Medicare’s administrative expenditures, which emerged several years ago, reflects widespread confusion about these data. Critics of Medicare argue that the official reports on Medicare’s overhead ignore or hide numerous types of administrative spending, such as the cost of collecting taxes and Part B premiums. Defenders of Medicare claim the official statistics are accurate. But participants on both sides of this debate fail to cite the official documents and do not analyze CMS’s methodology. This article examines controversy over the methodology CMS uses to calculate the trustees’ and NHEA’s measures and the sources of confusion and ignorance about them. It concludes with a discussion of how the two measures should be used.

What is CMS in Medicare?

The Centers for Medicare and Medicaid Services (CMS) annually publishes two measures of Medicare’s administrative expenditures. One of these appears in the reports of the Medicare Boards of Trustees and the other in the National Health Expenditure Accounts (NHEA).

How much was Medicare's overhead in 2010?

The latest NHEA, also prepared by OACT, is for 2010. According to it, Medicare’s overhead totaled $31 billion that year, far more than the $7 billion reported by the trustees for 2010. That $31 billion constituted 6 percent of total Medicare spending in 20102 — much higher than the 1 percent rate reported for that year by the trustees. The difference between the trustees’ measure of overhead and the NHEA measure is due almost entirely to the fact that the NHEA defines Medicare’s overhead to include not only the $7 billion in administrative expenditures reported by the trustees for 2010 but also the $24 billion in administrative expenditures incurred by the insurance companies that participate in Parts C and D.