A Dozen Facts About Medicare Advantage in 2020

- Enrollment in Medicare Advantage has doubled over the past decade. ...

- The share of Medicare beneficiaries in Medicare Advantage plans, by State, ranges from 1% to over 40%. ...

- The share of Medicare beneficiaries in Medicare Advantage plans varies across counties from less than 1% to more than 70%. ...

Full Answer

What are the best Medicare Advantage plans?

Jan 13, 2021 · In 2020, Medicare Advantage enrollees’ average out-of-pocket limit for in-network services is $4,925 (HMOs and PPOs) and $8,828 for out-of-network services (PPOs). For HMO enrollees, the average...

What are the Medicare Advantage plans?

2020 Medicare Advantage Guide – What to Know. From 1999 to 2019, Medicare Advantage (Part C) enrollment almost doubled, as reported by Henry J. Kaiser Family Foundation (KFF), rising from 18% of Medicare beneficiaries to over 34% across this time period. The Congressional Budget Office (CBO) expects sign-ups to increase to about 47% by 2029, noting that Medicare …

How many Medicare Advantage plans are there?

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D).

What are the best Medicare Advantage programs?

Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research ... In 2020, the standard Part B premium amount is $144.60 (or higher depending on your income ...

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the difference between Medicare and Medicare Advantage plans?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What is Medicare Advantage in simple terms?

Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved. They are considered an alternative to Original Medicare and cover all the expenses incurred under Medicare. They include the same Part A hospital and Part B medical coverage, but not hospice care.

What is the point of Medicare Advantage?

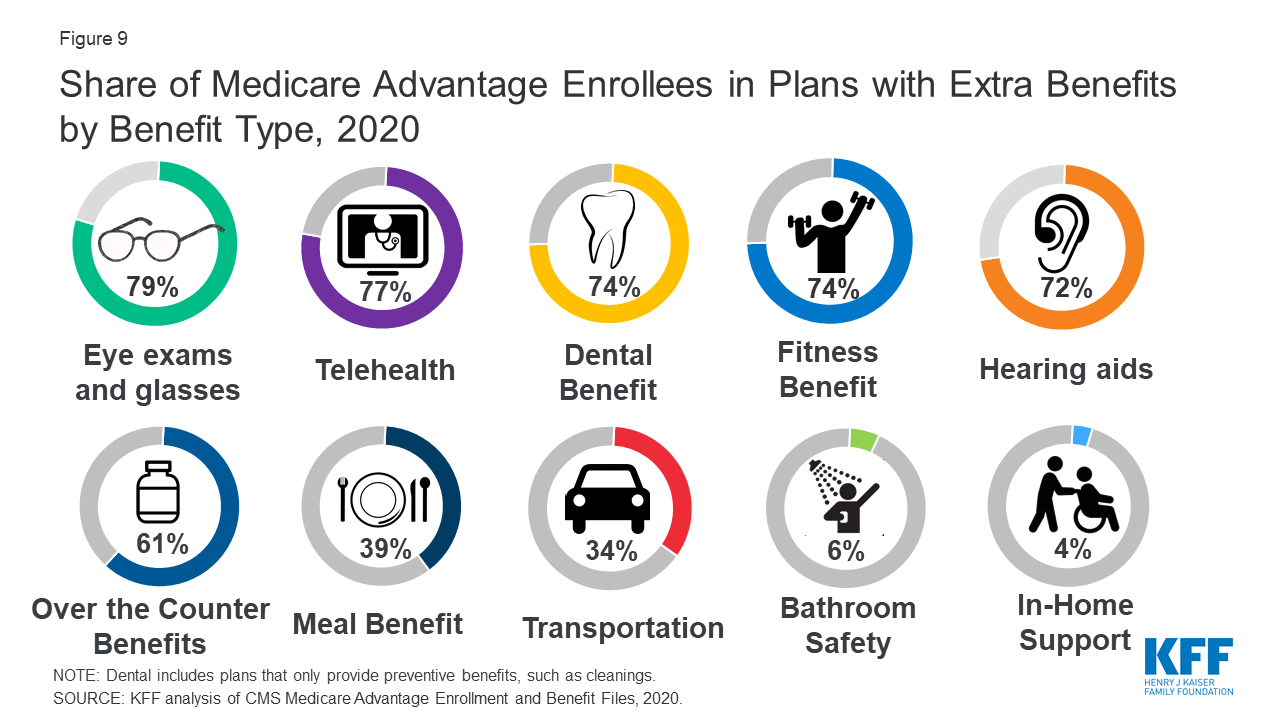

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the MA plan?

Benefits of MA Plans. Original Medicare, the healthcare program administered by the federal government for individuals 65 years of age or older or those under 65 with certain disabilities, leaves Medicare recipients with a level of exposure.

Does Medicare cover hospice care in MA?

An exception is hospice care, which is still covered by Original Medicare. Some MA Plans offer accessory coverage for vision, dental, hearing and even wellness programs like gym memberships.

Does Medicare Supplement include dental insurance?

It does not include any out-of-pocket maximums, prescription drug coverage, vision benefits or dental care. Some people opt to purchase supplemental insurance, called Medicare Supplement or Medigap plans, combined with Part D for prescriptions drugs to help cover some of those out-of-pocket costs.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Coverage in the Network

On finding you’ll know that there are HMO plans. These plans cover you within the network only. And, if you take any medical service outside the network, you’ll get no coverage for the same.

Coverage outside the Network

PPO Advantage plan is one that might surprise you. Similar to the HMO, it’ll cover you fully within the network. Apart from the coverage within the network, you can enjoy partial coverage outside the network as well.

What Cover does the Medicare Advantage Offer?

If you are thinking of what is the Medicare Advantage plan 2020 offering, we’ll help you find an answer. We’ll help you know what expenses Medicare Advantage will cover when you avail medical services.

Advantage Plan & Pricing

Seniors all over the country ask us about the cost of these advantage plans. People sometimes presume a high cost for these plans as they cover so much. But the opposite is true. Usually, these plans are quite cheaper than other available medical insurance plans.

Affordable & Cost-Effective

Instead of going with some supplement plans or other types of medical Insurance, the Advantage plans are capable of saving you more money. Certain advantage plans ask for a $0 monthly premium.

What is Medicare Advantage Part C?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies.

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

Does Medicare Advantage have a premium?

Both charge a premium for Part B benefits, and about 40% of Medicare Advantage enrollees with prescription drug benefits pay an additional premium. Medicare Advantage plans include an annual out-of-pocket spending limit, while Original Medicare does not and is usually supplemented with a "Medigap" plan.

Does Medicare Advantage cover out of pocket costs?

In addition Medicare Advantage plans may cover benefits in a different way. For example, plans that require higher out-of-pocket costs than Medicare Parts A or B for some benefits, such as skilled nursing facility care, might offer lower copayments for doctor visits to balance their benefits package.

Does Medicare pay for Part A and Part B?

By contrast, under so-called "Original Medicare", a Medicare beneficiary pays a monthly premium to the federal government and receives coverage for Part A and Part B services, but must purchase other coverage (e.g., for prescription drugs) separately.